Summary:

- AWS is expanding rapidly and experiencing significant growth, driven by an improved customer experience and the demand for generative AI.

- Despite the growth of AWS, Azure, and Google Cloud, over 85% of global IT spend is still on-premises.

- AWS aims to make things easier for builders by providing primitive services that can be weaved together, leading to immense growth potential.

krblokhin

Introduction

Per my March article, Amazon (NASDAQ:AMZN) continues looking forward as they keep improving the customer experience. We now have new information from April such as the 2023 letter and the 1Q24 results. These new details show AWS is expanding rapidly and much of this is driven by an improved customer experience. My thesis is that AWS will continue growing prodigiously, largely because of generative AI (“GenAI”).

Despite the large size of AWS, Azure (MSFT) and Google Cloud (GOOG) (GOOGL), 85% or more of the global IT spend is still on-premises. These hyperscale cloud companies are advantaged over other offerings and they would have continued to grow nicely even before we saw explosive demand for AI.

In the 2023 letter, CEO Andy Jassy says if people ask him about Amazon’s next pillar at this time, he’ll lead with GenAI. The letter says customers want to run their GenAI on hyperscale cloud providers like AWS in part because of security concerns (emphasis added):

By the way, don’t underestimate the importance of security in GenAI. Customers’ AI models contain some of their most sensitive data. AWS and its partners offer the strongest security capabilities and track record in the world; and as a result, more and more customers want to run their GenAI on AWS.

The Numbers

We have to understand the background of AWS in order to appreciate the way it will continue growing. A book called The Everything War by Dana Mattioli explains the way AWS rose to its enormous size from humble beginnings. CEO Jassy started working for Amazon in a different role before their IPO. In the early 2000s, then technical Advisor Jassy and others saw developers wasting two to three months on storage, database and compute solutions (emphasis added):

Allan Vermeulen, the company’s chief technology officer during this period, describes the problem this way: “If you’re building a house nowadays, you buy a furnace that’s all built and you buy PVC pipe for your plumbing and all that stuff. And at the time, you couldn’t buy those pieces. You have to build them for each individual project,” he recalls. “So, if the first thing engineers do is spend six months figuring out how to build a furnace, [it] takes a long time to build a house.”

[ The Everything War kindle book location: 1,086]

In 2006, then Technical Advisor Jassy realized Amazon wasn’t alone in having engineers spending 70% of their time coming up with storage and computing solutions. He put together a presentation for then CEO Jeff Bezos saying Amazon should provide the building blocks of web infrastructure for other companies. The 2023 letter talks about what happened when this went into place (emphasis added):

When we launched Amazon Elastic Compute Cloud (“EC2”) in August 2006 and Amazon SimpleDB in 2007, people realized we were building a set of primitive infrastructure services that would allow them to build anything they could imagine, much faster, more cost-effectively, and without having to manage or lay out capital upfront for the datacenter or hardware.

The word “primitive” above is repeated throughout the 2023 letter and it is important in terms of understanding the growth potential for AWS. The goal of AWS is to make things easier for builders by giving them primitive services which are building blocks that can be weaved together.

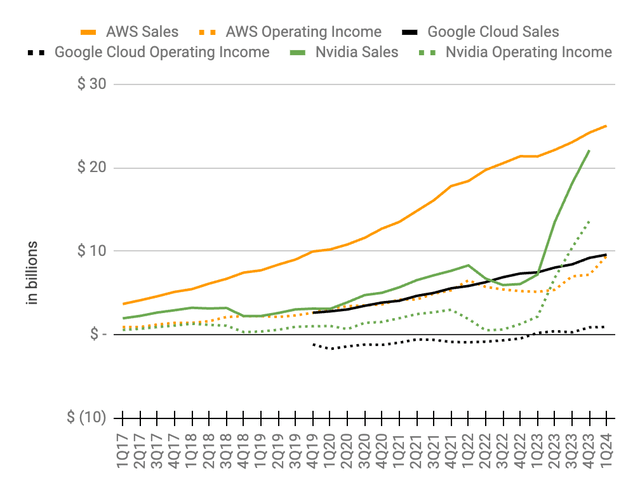

Given the factors above, AWS has grown immensely since inception. AWS is approaching quarterly operating income of $10 billion and this should climb significantly higher in the years ahead seeing as 85% or more of the global IT spend is on-premises. Additionally, Nvidia (NVDA) sales are starting to skyrocket as the world invests in AI. Companies want to run their GenAI on hyperscalers like AWS so growth for Amazon should not be slowing down anytime soon:

AWS revenue (Author’s spreadsheet)

*Fiscal quarters for Nvidia end about 1 month late. For example, Nvidia’s fiscal 4Q24 quarter ended January 28, 2024 and we put those numbers in the 4Q23 calendar period above.

Bottom Layer Of The GenAI Stack

The bottom layer of the GenAI stack is for foundation models (“FMs”). Leading FMs have been trained on Nvidia chips but AWS also has their own Trainium chips. Additionally, AWS has their own inference chips named Inferentia. Anthropic, Airbnb, Hugging Face, Qualtrics, Ricoh, and Snap (SNAP) use AWS AI chips. Per the 1Q24 call, AWS customers in the bottom layer of the GenAI stack are well served with both third-party Nvidia hardware and first-party training and inference chips from AWS:

We have the broadest selection of NVIDIA compute instances around, but demand for our custom silicon, training, and inference is quite high, given its favorable price performance benefits relative to available alternatives.

Amazon built SageMaker to make it easier for developers to deploy models at scale. Per the 1Q24 results, Audi is using SageMaker to reduce search time:

Audi used Amazon SageMaker and Amazon OpenSearch Service to build a generative AI chatbot to improve its enterprise search experience and help employees find and navigate internal documentation, reducing search time from hours to a few seconds and improving productivity.

Middle Layer Of The GenAI Stack

Per the 2023 letter, Amazon Bedrock is a key part of the middle layer:

The middle layer is for customers seeking to leverage an existing FM, customize it with their own data, and leverage a leading cloud provider’s security and features to build a GenAI application—all as a managed service. Amazon Bedrock invented this layer and provides customers with the easiest way to build and scale GenAI applications with the broadest selection of first- and third-party FMs, as well as leading ease-of-use capabilities that allow GenAI builders to get higher quality model outputs more quickly.

Per the 1Q24 results, tens of thousands of organizations are using Bedrock. The 2023 letter says Bedrock customers include ADP, Amdocs, Bridgewater Associates, Broadridge, Clariant, Dana-Farber Cancer Institute, Delta Air Lines, Druva, Genesys, Genomics England, GoDaddy, Intuit, KT, Lonely Planet, LexisNexis, Netsmart, Perplexity AI, Pfizer, PGA TOUR, Ricoh, Rocket Companies, and Siemens.

Top Layer Of The GenAI Stack

Tesla (TSLA) CEO Elon Musk knows a great deal about AI and cloud computing. He recently said “his hat is off” when referencing Amazon’s AWS accomplishments:

The post from CEO Jassy above went on to say Amazon Q is an enormous addition to the top layer at AWS. Thankfully developers are no longer wasting 70% of their time worrying about infrastructure but now they are spending 70% of their time on tedious code-related tasks. Amazon Q will help generate and debug code:

Developers are telling us that they’re spending roughly 70% of their time on repetitive and tedious tasks and code. Today, we’re launching the general availability of Amazon Q, the world’s most capable GenAI-powered assistant for accelerating software development and leveraging companies’ internal data – and that aims to remove much of the muck of repetitive and tedious coding and data tasks for developers and employees at large. On the software development side, Q doesn’t just generate code, it also tests code, debugs coding conflicts, and transforms code from one form to another.

More GenAI Thoughts

In the same way that AWS democratized high end computing, they are doing the same for AI and this will inevitably lead to more growth:

While we’re building a substantial number of GenAI applications ourselves, the vast majority will ultimately be built by other companies. However, what we’re building in AWS is not just a compelling app or foundation model. These AWS services, at all three layers of the stack, comprise a set of primitives that democratize this next seminal phase of AI, and will empower internal and external builders to transform virtually every customer experience that we know (and invent altogether new ones as well).

Valuation

1Q24 AWS operating income was $9,421 million for a run rate of nearly $37.7 billion. There are many unknowns here so my valuation multiple is wide – 20 to 30x seems right at this time such that the AWS segment could be worth $755 to $1,130 billion when rounding to the nearest $5 billion.

I think the non-AWS part of Amazon is worth two to two and a quarter as much as Walmart (WMT). The 10-K for Walmart through January 31st shows 8,058,048,674 shares as of March 13th. As such, their market cap is a little over $482 billion based on the May 6th share price of $59.87. As such, my range for the non-AWS portion of Amazon is $965 to $1,085 billion when rounded to the nearest $5 billion.

My sum of the parts valuation is as follows:

$965 to $1,085 billion non-AWS

$755 to $1,130 billion AWS

——————————————–

$1,720 to $2,215 billion total

Per the 1Q24 10-Q, there were 10,406,627,415 shares outstanding as of April 24th. Multiplying by the May 6th stock price of $188.70, the market cap is $1,964 billion. The market cap is within my valuation range and I think the stock is a hold.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, AAPL, ASML, BABA, GOOG, GOOGL, META, MSFT, NVDA, TCEHY, TSLA, TSM, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.