Summary:

- Pfizer’s stock has experienced significant fluctuations in the past 4 years, with opportunities for investors to buy low and sell high.

- The market has driven Pfizer’s price to a 10-year low.

- Pfizer’s focus on oncology and its strong pipeline of new products position the company for future growth, although debt obligations may limit dividend increases in the short term.

ekapol/iStock via Getty Images

Written by Sam Kovacs.

Introduction

Everyone says they want to buy low and sell high, but for some reason they forget to do so.

Pfizer Inc. (NYSE:PFE) stock has been on a wild ride these past 4 years.

Had you had the foresight to bet on Pfizer in 2020 during the first few months of the pandemic, you would have enjoyed 50% returns within a year or so.

The only caveat is that you would have had to have sold your shares at the top, or close enough to the top to have held on to those gains, as Pfizer now trades at prices lower than its pre-pandemic levels.

If only someone had told you to buy low and sell high! Well, to set the record straight, that’s precisely what we did. After saying in May 2020 that with or without a vaccine, PFE was a great play, and in August 2020, that PFE was the best vaccine bet, we changed our minds once PFE’s stock price shot above $50.

We didn’t exit at the top, but at $54, having started exiting in December 2021 and having fully exited by February 2022. But when we suggested selling at the time, this was not well received by many readers. Here are copies of a comment we received on that article, on Christmas day 2021:

- Selling PFE right now would be foolish – a superb company firing on all cylinders, with plenty of room left to run in its boom

- same here and agree

- share same sentiment as both of you…Especially, when PFE is on the run with such a strong performance…

Well, the pendulum always swings. I know I say that far too much, but it is because it does!

As the market realized that the mass vaccinations of 2021 would not be replicated in subsequent years, Pfizer’s stock started a severe descent, one which would take it all the way down to the mid $20s.

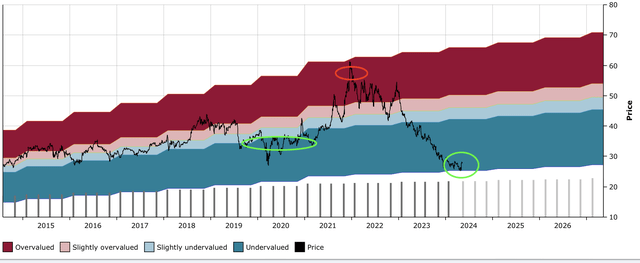

PFE DFT Chart (Dividend Freedom Tribe)

The DFT chart above, shows more or less our interest in Pfizer (with green being buy, red being sell)

As you can tell from the second green circle, we’ve been buying Pfizer again this year. We wrote a first article signalling this in January. The stock is up 2.5% since then, nothing worth getting excited about.

But the company has reported its first quarter earnings, which makes it a good time to review Pfizer, and see how it stacks up against my January thesis.

The Covid paradox

My thesis regarding Pfizer was that the market is wrongly punishing it for the loss of Comirnaty and Paxlovid revenues (its Covid platform).

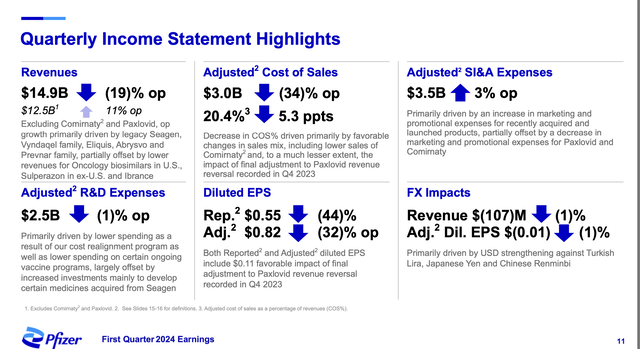

And sure, it’s frustrating to have to look at quarter after quarter of results, and see revenues down double digits every time because that’s what is happening. This quarter, Pfizer’s revenues declined by 19% YoY, although excluding Comirnaty and Paxlovid, revenues would have been up a solid 11%.

Now, answer this simple question for me: would Pfizer as a company have been better off if it had never developed any Covid vaccines or treatments?

Of course not. It is clear that the company has benefitted. Any pharma company which can sell $36.8bn worth of a product in a single year (by far the best performing drug ever) will benefit from being able to reinvest those profits into their pipeline and acquisitions.

Yet, the stock price is below its pre-Covid levels. So as far as market perception goes, it seems it would have been better if PFE never had its Covid products. To me, this is lunacy, but it is classic market behavior of looking at relatives rather than absolutes.

What is more is that it is not like Comirnaty revenues were going to zero. It’s tough to say where they will stabilize, but it isn’t zero. As the CFO, David Denton, pointed out in the latest earnings call (emphasis added):

As you know, our business continues to be negatively impacted by a declining COVID environment on a global basis. To that end, we expect our COVID products will continue to have an outsized effect on both our top-line and our bottom-line throughout this year. However, I do want to point out that we expect our COVID products will continue to be significant contributors to revenues and cashflows for the foreseeable future.

Reasonable investors might realize that this lapse in collective perception is causing the pendulum to swing too far to the other extreme.

Pfizer moving forward

Once you get over the fact that Pfizer is not a $100bn revenue company, but a $60bn revenue company, you can start seeing some things clearly. The company has set its priorities for 2024, after having acquired Seagen in December 2023.

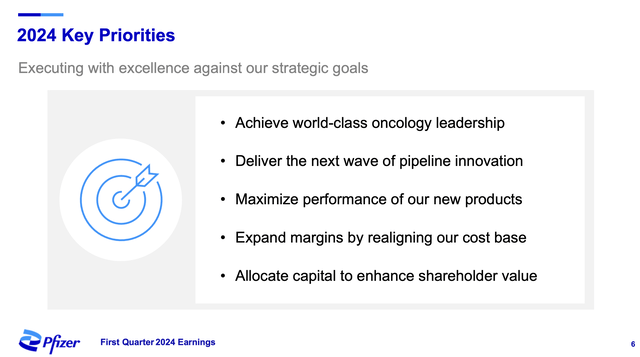

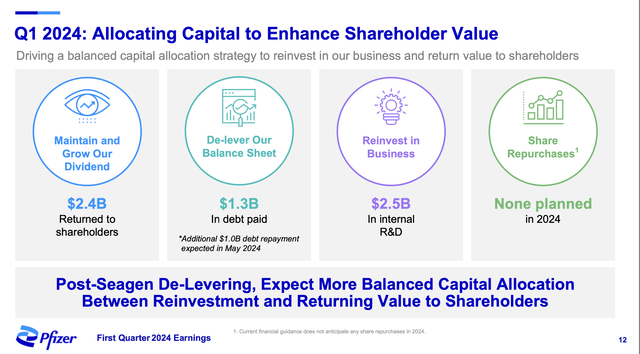

The goals presented above include shifting the focus to the oncology platform, keeping the pipeline of upcoming products well stuffed, growing revenues, and returning cash to shareholders and debt holders alike.

Pfizer has stressed for years that oncology would be the big new frontier for the company, with cancer cases growing year by year, with 2 million cases annually in the U.S. alone.

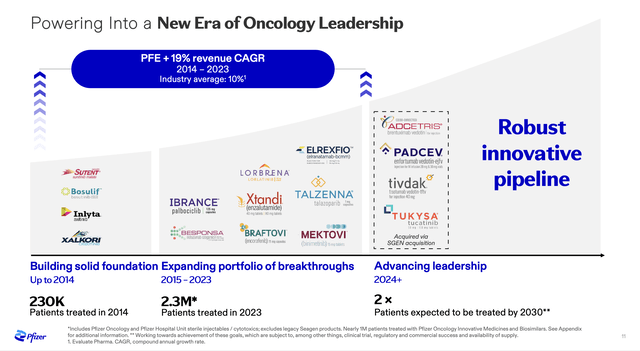

The oncology segment has grown at an impressive 19% for PFE during the past two decades, which compares extremely favorably to the industry’s average 10% CAGR.

This quarter again, oncology revenues grew 19% YoY, in part thanks to the acquisition of Seagen’s portfolio. The company plans to double the number of patients treated by 2030.

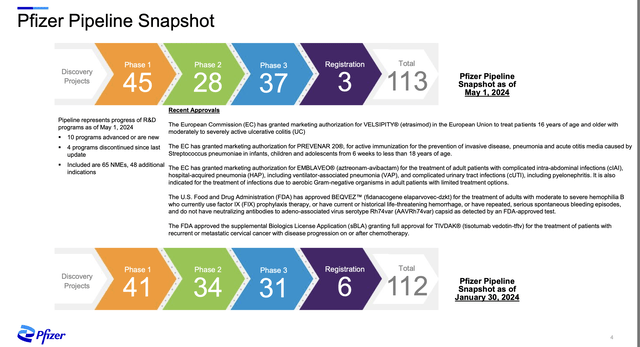

Pfizer’s pipeline is as stuffed as any company, and as you can see, the numbers are moving nicely through the phases in the first 5 months of 2024.

Pfizer has been one of those Pharma companies with an impressive ability to replace revenues with new products consistently throughout the years. I’m confident in management’s ability to continue doing this.

The Seagen acquisition added a considerable amount of debt, bringing debt to EBITDA to about 6x, well above the 3.25x objectives.

Let’s say they need to cut debt in half, to go back to where they were at the beginning of 2023, at around $30bn. If they continue paying down debt at a $6bn per year pace (my estimate of this year’s pace), it could take 5 years. Of course, they could likely accelerate this as they plan to do selling their $10bn or so stake in Haleon, which would free up cash.

The consequence is that, let’s say for at least the next 2–3 years, debt holders will be the masters.

You might recall from Matthew 6:24

No one can serve two masters. Either you will hate the one and love the other, or you will be devoted to the one and despise the other.

In corporate America, this is the same. You can either have shareholders as your master or debt holders. Whoever is bigger is the master.

This means that it is unlikely we will see much in terms of dividend increases. This year, Pfizer increased by 2.4%, moving the quarterly dividend from $0.41 to $0.42.

I expect more of these token increases for a couple of years, until the debt load gets closer to objectives, and at which point the dividend will be able to increase again. At 80% of earnings at midpoint, we’re likely not going to see much growth there until that number gets more under control.

CEO Albert Bourla does remind us that:

I just want to reiterate that our number one priority from a capital allocation perspective is both supporting and growing our dividend over time, and that is not at risk.

Ok Albert, This has been true since 2010, and you’ve been CEO since 2018, so you get the benefit of the doubt.

Conclusion

Pfizer trades at 15x 2024 earnings, yields 6%, and has a brilliant portfolio of drugs. Yes, after its $85bn buying spree it is left with a bit more debt than one would have liked, but this is not unusual that we see a digestion period after big acquisitions where the debt load comes back down to normal.

I believe that the market is wrong in discounting Pfizer so much, and that it is an incredibly well run business which should return to historical valuations within two or three years.

It might not be overnight, but when you’re getting paid 6% to wait for the capital gains to arise, it’s easier to sleep well at night. Buy low, sell high, get paid to wait.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to Buy Low, Sell High & Get Paid to wait…

The first thing you want to do is hit the orange “follow” button, so we can let you know when we write more dividend related articles.

But if you want the best experience, join the Dividend Freedom Tribe!

Our model portfolios are ahead of the market, and our community of nearly 900 members is always discussing latest developments in dividend stocks.

Our model portfolios are ahead of the market, and our community of nearly 900 members is always discussing latest developments in dividend stocks.