Summary:

- Amazon’s first quarter results exceeded expectations, driven by strong performance in AWS and double-digit sales growth in eCommerce.

- AWS reached a $100 billion sales run rate in 1Q24 and accounted for 62% of Amazon’s operating income.

- Despite a less optimistic outlook for the second quarter, Amazon’s operating income growth and potential in AWS suggest room for stock price growth.

4kodiak/iStock Unreleased via Getty Images

First quarter results of Amazon (NASDAQ:AMZN) were released on April 30, 2024, and crushed the Street’s expectations. The retail giant’s outlook for the second quarter was not particularly strong, but Amazon is doing a bang-up job in AWS which is now having a $100 billion sales run-rate and which delivered good results, including 17% YoY sales growth. Amazon’s eCommerce business is also showing considerable promise, with sales growing at double digits.

I think, even though I was bullish on Amazon, I underestimated how positive Amazon’s risk/reward relationship is, and I see a lot of room for the stock to run in 2024, particularly if the company can sustain its AWS operating income momentum.

Previous Rating

After Amazon presented an upbeat outlook for its first quarter, I suggested Amazon was selling for a compelling earnings multiple when taking into account the company’s ramping momentum in both eCommerce and AWS.

To me, Amazon’s stock was a steal, and the retailer’s business is not showing any signs of slowing down. AWS in particular continued to shine brightly in 1Q24 and is set to account for a larger operating income share moving forward as well, meaning AWS is only going to become more important in the future, not less. Amazon’s operating income is also growing exceptionally quickly, creating continued upside for the stock.

Amazon Leaves Profit Estimates In The Dust On Strong AWS Performance

Amazon handsomely beat the Street’s profit expectations for the first quarter last week. The retail giant’s books showed $0.98 per share in profits, compared to a $0.84 Street estimate. It was the fifth consecutive profit beat for Amazon in 1Q24.

Robust AWS Performance Driving Amazon’s Sales

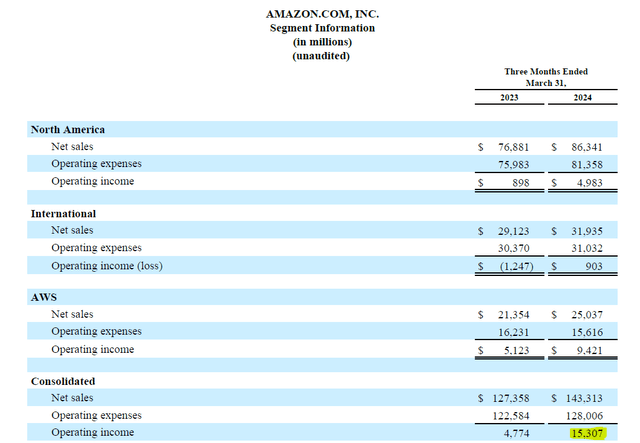

Amazon’s first quarter was defined by ongoing strength in its North American eCommerce segment, which produced 12% sales growth YoY and total net sales of $86.3 billion in 1Q24.

International eCommerce did only slightly worse, growing 10% YoY. This segment could profit from continual momentum in 2024 on the back of moderating inflation, which in turn would likely boost consumer spending. With consumers having more money in their pockets, moderating inflation could lead them to spend more money on Amazon’s shopping website, further fueling the company’s operating income growth.

One risk that exists here is that Amazon remains overly exposed to the U.S. eCommerce market, which accounts for 61% of all net sales. Since all segments, including International eCommerce, are now solidly profitable on an operating income basis, I think that an investment actually has very low risks.

AWS, Amazon’s cloud business, grew at a considerably faster rate of 17% YoY in the first quarter, which was driven primarily by increasing adoption of Amazon’s cloud services in the enterprise market.

Besides AWS sales growing 17% YoY, Amazon’s 1Q24 earnings release had two other insights regarding its cloud segment:

- AWS sales hit a $100 billion sales run-rate in 1Q24 for the first time;

- AWS’s segment operating income surged 84% to $9.4 billion.

AWS produced only 17% of Amazon’s net sales in the first quarter, but it was responsible for 62% of operating income, highlighting just how important the business has become for Amazon. All things considered, including a fundamental recovery in eCommerce, Amazon’s operating income skyrocketed 221% YoY to $15.3 billion.

Moving forward, AWS adoption, including tailored AI offers, have the potential to fuel the segment’s net sales and operating income growth. With these tailwinds being intact, I think that Amazon has considerable potential for a re-rating in 2024, and we are likely to see the stock reach new highs as a result.

Segment Information (Amazon)

Amazon is expecting $144.0 billion to $149.0 billion in net sales for the second quarter, reflecting between 7-11% YoY growth. This means that Amazon anticipates a QoQ drop in net sales growth, which is what dragged Amazon’s down shortly after earnings.

The company also anticipates between $10 billion and $14 billion in operating income in 2Q24 and the outlook highlights just how profitable Amazon, led by AWS, has become.

Considering Amazon’s present momentum, particularly in AWS, I think that the company and its investors are set to see positive surprises in 2024, and I would not be surprised to see Amazon exceed its 2Q24 guidance in this respect.

A strong U.S. economy obviously provides plenty of support for the retailer right now as well. With AWS being a $100 billion run-rate sales business, AWS is also going to make a bigger impact on Amazon’s group operating income.

Amazon’s Earnings Multiple Leaves Room For Expansion

Amazon is anticipated to see a big jump in profitability this year, as AWS is driving substantial sales and operating income growth for the internet giant.

In the present year, 2024, Amazon is expected to grow its profits to $4.15 per share, reflecting a 43% YoY growth rate. In 2025, Amazon’s profit growth is anticipated to moderate a bit, but 27% growth is still pretty impressive.

Presently, Amazon’s stock is selling for 32x leading profits, which is not an excessive multiple, in my view. I think Amazon could re-rate to 40x leading earnings in 2024, when considering that AWS is doing the heavy lifting for Amazon and responsible for serious operating income growth.

A 40x earnings multiple also seems defensible considering how quickly Amazon’s profits are anticipated to ramp up: With an almost 50% expected profit growth rate just this year, I think Amazon is definitely deserving of a premium multiple and Amazon could re-rate higher as the company scales its AWS footprint. Considering how much progress Amazon has made, particularly considering the operating income strength of AWS, I am raising my intrinsic value estimate from $185 to $211.

If this train continues in the same direction for the remainder of 2024, possibly supported by strong growth in the U.S. economy, I think that Amazon could be good for a number of positive surprises, particularly as far as its operating income trajectory is concerned.

Why The Investment Thesis Might Not Pan Out

Amazon is very much dependent on growth in its eCommerce business (its biggest sales source) and, particularly, its North American eCommerce operations.

AWS is crushing it right now, but a recession in the U.S. paired with a downturn in the enterprise market could be a double-edged sword that might lead to a considerably lower earnings multiple moving forward.

A reacceleration of inflation, which we have seen at the start of the year, could also cool down consumer spending, thereby posing a challenge to Amazon’s eCommerce segment.

My Conclusion

Amazon’s first quarter reflected ongoing business strength in both main businesses, eCommerce and AWS. The first one, eCommerce is reliably chugging along and could profit from a gradual moderation of inflation.

The real value, in my view, is represented by AWS, which is now a $100 billion annual sales business (on run-rate 1Q24 net sales basis) and the segment’s profitability is surging.

Furthermore, AWS still accounts for a relative small portion of Amazon’s sales while being responsible for about 2/3rds of the company’s operating income.

Amazon’s 32x earnings multiple may not look like a steal, but the increasing operating income growth is worth it, in my view. In the first quarter, AWS added a whopping $4.3 billion to Amazon’s operating income compared to the year ago period and I don’t see this growth stopping, particularly with the enterprise market being hot for cloud-based AI offers.

I think that Amazon will remain a compelling growth story in 2024, and I am not willing to give up a single share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.