Summary:

- I believe that PayPal’s consistent stock buybacks will eventually lead to a supply shortage, especially as PYPL’s growth rates return to more stable levels.

- The new management at PayPal is effectively executing its strategies, and the turnaround seems to be in its early stages.

- PayPal’s financials show widening margins and a return to growth, making it an attractive investment amid undervaluation.

- My bullish stance is supported by technical analysis, which suggests that we are only at the beginning of the reversal from the multi-month downtrend.

- PYPL is still a “Buy”.

Stockernumber2

Intro & Thesis

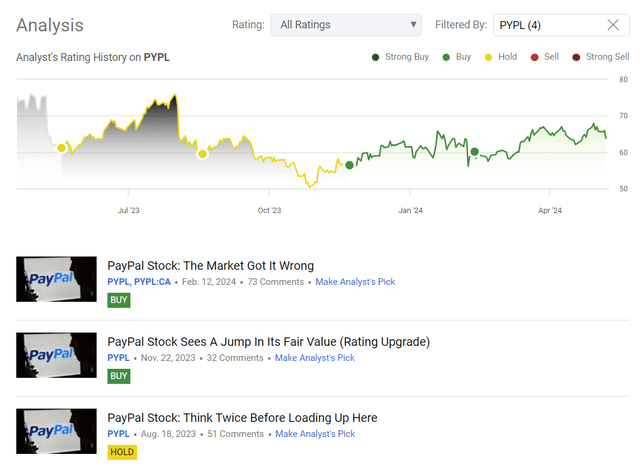

I initiated coverage of PayPal Holdings, Inc. (NASDAQ:PYPL) stock in May 2023 and have since authored 4 articles. The first 2 articles were published with a “Hold” rating but already in November 2023, I upgraded my rating to “Buy” after analyzing the company’s financials (as well as turnaround plans) at the time and observing an increase in its fair value. Following that update, the stock’s performance roughly tracked the broader market trends. However, after my most recent update in February 2024, PayPal’s stock has outperformed the market, surpassing the S&P 500 (SP500) (SPY) index’s return by more than 2x.

Seeking Alpha, my coverage of PayPal stock

My bullish view on PayPal stock remains unbroken today. Looking at the latest quarterly financials and operating metrics, I have the impression that the new management is effectively executing its strategies – the turnaround seems to be in its early innings.

Why Do I Think So?

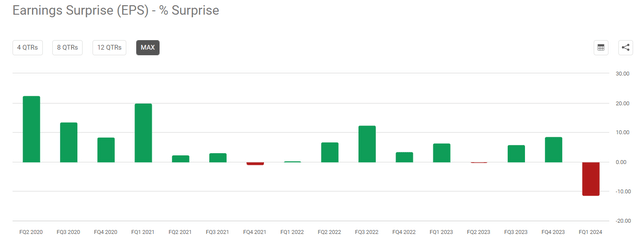

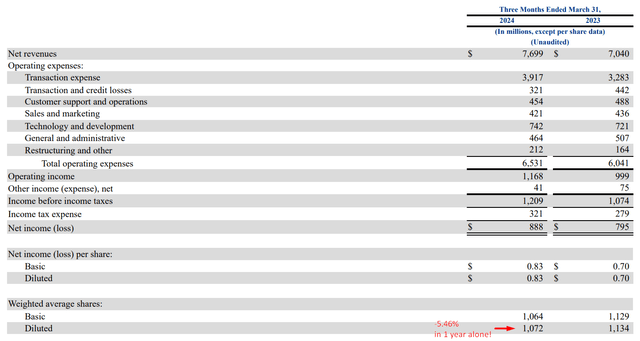

First off, I think we should dive into the most recent financial results which were published on April 30, 2024. For Q1 FY2024, PayPal reported revenue of $7.70 billion, surpassing Wall Street’s consensus estimate by ~$183 million, according to Seeking Alpha. This revenue marked a 9.4% YoY increase, outperforming the anticipated 7% growth outlined in the previous guidance. Total payment volume (TPV) also exceeded expectations, growing by 14% YoY (FX neutral), while branded volume exhibited robust growth, increasing by 7% YoY. PayPal had ~427 million active accounts as of March 31, down from 433 million the prior year; however, the number of payment transactions rose 11% to 6.5 billion, while transaction margin dollars saw a 4% YoY increase. Also important to note here is that PYPL’s monthly active users grew by 2% year-over-year and reached 220 million. Non-transaction expenses decreased by 2% YoY. As a result, the operating leverage of PYPL helped it to make $0.83 in non-adjusted EPS (+18.5% YoY), which was unfortunately below the consensus estimate by $0.14 or ~14% (the miss was quite serious compared to what we saw in previous quarters):

Seeking Alpha, PYPL

The company’s engagement metrics remained strong, with transactions per account (excluding PayPal PSP) up 7% YoY, in line with the previous quarter’s growth rate. During the earnings call, management stated that it is expanding package tracking and offering more options for instant use of the Venmo debit card – these efforts aim to increase engagement and drive transaction revenue growth. Incidentally, Venmo reported 60 million monthly active users and 90 million annual active users and plans to improve inflow monetization and enhance the user experience. In terms of product updates, PayPal’s Fastlane alpha tests have shown promising results: Merchants have seen an 80% conversion rate and a significant increase in guest checkout conversions. Now the company plans to make Fastlane generally available in the U.S. in 2H 2024. I think this move should be one of the most important for PYPL to boost sales again, as the end market seems to be huge. In addition, the availability of the PayPal Commerce Platform (“PPCP”) has been expanded to 34 markets, with 7% of sales from small and medium-sized enterprises already being processed via the platform. Given the company’s strategic direction and its focus on new fintech market areas, I can’t see any significant missteps by the new management. It’s evident to me that the company is keen to maintain its strong presence in established markets while actively seeking growth opportunities in new territories. This dual approach is critical to maintaining the company’s status as a fast-growing company, especially after a period of stagnation (starting in 2022) as it strives to reclaim its position as a frontrunner in the industry.

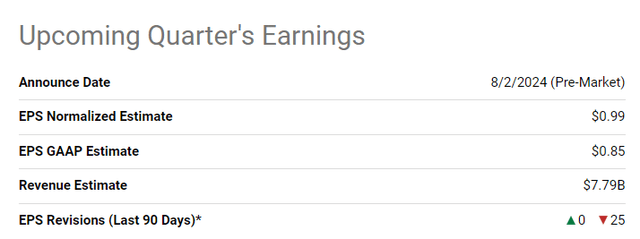

In my opinion, the negative reaction of PYPL’s stock price after the first quarter release indicates that the market’s expectations of the new management’s performance were too high and perhaps premature. This “market’s disappointment” is reflected in the numerous revisions to net sales and EPS estimates for the coming quarter.

Seeking Alpha, PYPL

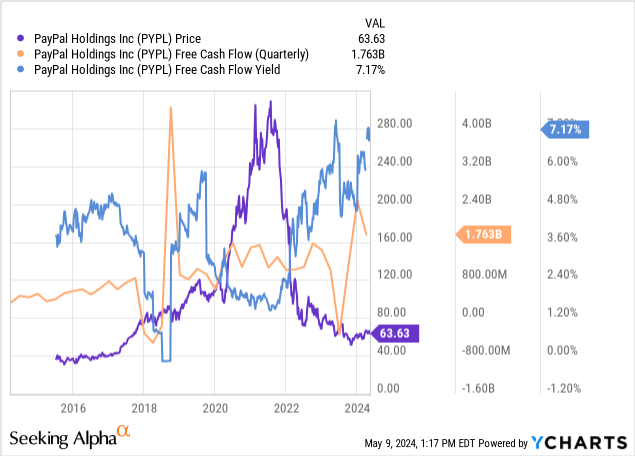

However, it can be assumed that the new management didn’t have sufficient opportunity to turn around the company comprehensively and restore the previous growth rates due to time pressure. Nonetheless, recent corporate events lead me to believe that the efforts to achieve a turnaround will continue and persist. While we await the final outcomes of these efforts, our confidence as investors in stability becomes increasingly important. In this regard, PayPal is performing commendably, in my view. First, we’ve witnessed its strong profitability, extensive market presence, and robust customer retention. While the number of active accounts is slightly declining, this is no cause for concern as PayPal seems to be a reliable “cash cow” in the tech industry. Second, in terms of FCF generation, PYPL has no obvious problems. Recent data from YChart shows that PayPal generated >$1.7 billion in the last quarter alone. Although FCF generation is clearly getting stronger, the stock is not reflecting this positive change, leaving the FCF yield at over 7% – that’s a historically high level, with the exception of a short period of time in 2023.

I remember the heated discussions surrounding Apple’s massive buyback plan recently, which drove up the stock price significantly. However, it’s puzzling to me that the market hasn’t reacted similarly to PayPal, which has reduced its share count by over 5% in just one year.

PYPL’s Q1 2024 report, author’s notes

PYPL’s buyback program is remarkable. But what’s also remarkable is that the company’s financials show widening margins and a return to growth, albeit not as fast as in the past.

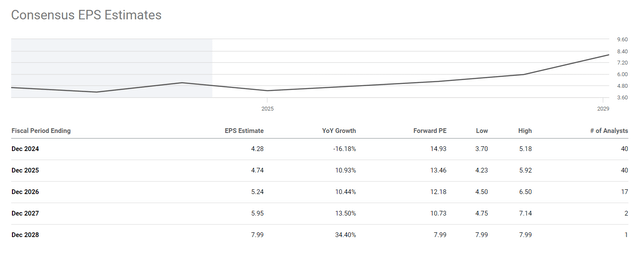

In recent months, there has been considerable discussion about the company’s supposed undervaluation. We can examine various ratios to confirm or refute this view. A classic indicator is the P/E ratio, a term you are no doubt familiar with. The market is assuming that the company will trade at 15.5 times earnings next year, an increase of 22% on the current multiple of 12.7x. This adjustment is due to the projected ~16% decline in earnings per share for FY2024.

Seeking Alpha Premium’s data

As mentioned above, the market has expressed dissatisfaction with the slow recovery of PayPal’s business growth. However, let’s assume that the market’s assessment is correct and PayPal’s EPS actually declines by 16% in FY2024. In this case, PayPal stock would trade at 15 times net earnings. But what happens then? The market assumes that the company’s EPS will grow at a CAGR of almost 14% from 2025 to 2028. At the end of FY2028, the implied P/E ratio would fall to 8x, as earnings per share are expected to grow by 34% in that year. While this forecast for last year comes from a single analyst, even if we revise it to 10-15%, PayPal’s undervaluation seems obvious to me given its growth prospects for the next 4-5 years.

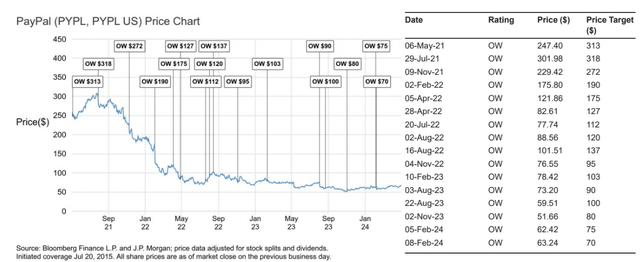

I’m glad to see that many colleagues from the sell-side agree with me. J.P. Morgan analysts (proprietary source) set a price target of $77 for PayPal by December 2024, up from $70 previously. The valuation is based on a 17x P/E ratio applied to the updated non-GAAP EPS estimate for FY2025, taking into account stock-based compensation (SBC). They also include the FCF yield mentioned above into their analysis and note that PYPL’s 7% is far higher than Fiserv’s (FI) 4%, which is mainly explained by the risks of investing in PYPL, but still the discount here is huge.

In addition to the fundamental reasons to buy PYPL today, I also see a technical setup. Although I am not an outstanding expert in technical analysis, I do know one golden rule: buy above the 200-day moving average. This long-term SMA is a kind of support and resistance for the stock price in the long term – using PYPL as an example, we can see that this has indeed been the case since the beginning of its decline a few years ago. The SMA 200 did not allow the stock price to go higher. Recently, however, PYPL has started to use the SMA 200 as support, marking “higher lows” and “higher highs” in the process, which is bullish:

TrendSpider Software, author’s notes

The combination of the above reasons in favor of buying PYPL compels me to reaffirm my previous “Buy” rating today.

Where Can I Be Wrong?

First, I have to admit that I may have been wrong about the expected turnaround in the company’s business under the new management. Despite the insignificant tenure of the new leadership, the results in some areas may not be as remarkable as expected. Perhaps I’m wrong in granting them a longer period of time to win the market’s favor, so to speak.

In my opinion, the main risk of investing in PayPal lies in the strong competition the company faces in the payment market. Established brands such as ApplePay, Visa’s Checkout, MasterCard’s MasterPass and American Express’s Later Pay, as well as digital products from Meta (META) and Google (GOOG), represent major competition. Customers have several payment options available to them at the point of sale, and PayPal must compete on the basis of convenience and transaction pricing.

I also cite the valuation findings from the J.P. Morgan report as an example. However, it’s important to recognize that their track record in calling PYPL a “Buy” is quite weak – PayPal’s performance has left much to be desired, and JPM’s “Overweight” rating may not result in a positive outcome this time around as well.

J.P. Morgan (proprietary source)

The Verdict

Despite the numerous risks that the company is currently facing, I remain convinced that the anticipated business turnaround that many, including myself, have been counting on is only just beginning to materialize. Among the positives, the company has quickly moved up into the “value” category while experiencing a gradual return to “growth” recently. Most importantly, PayPal has achieved robust free cash flow generation, enabling strong buybacks in the market – I believe that consistent stock buybacks will eventually lead to a supply shortage, especially as PYPL’s growth rate return to more stable levels. In that case, PayPal stock should experience significant upward momentum. This view is supported by technical analysis, which suggests that we are only at the beginning of the reversal form the multi-month downtrend.

Considering all these factors, I conclude that PayPal stock is still an attractive “Buy” for investors.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PYPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!