Summary:

- Energy Transfer is one of the core holdings within my portfolio.

- The MLP’s volumes grew in the first quarter, propelling adjusted EBITDA and DCF sharply higher for the period.

- Energy Transfer moderately hiked its adjusted EBITDA guidance, which bodes well for the investment-grade balance sheet.

- My fair value estimate suggests that units could still be priced at a 14% discount.

- Energy Transfer combines a safe and rising 7.8% distribution yield with the potential for moderate growth and valuation upside.

A new pipeline under construction.

fotokostic/iStock via Getty Images

Readers who have followed me from the beginning are probably aware that my investing strategy has shifted in recent years. In the past, I was too oriented toward income investing (for being in my mid-20s, anyway) to the detriment of total returns. Now, I’m striking more of a balance in my investing strategy.

I’m buying great companies with newly initiated dividends and tons of growth potential. Think Alphabet (GOOGL).

I’m also adding more established dividend growers with generous growth. Think Automatic Data Processing (ADP).

Finally, I’m also leaning into higher-yielding dividend growers with more modest income growth potential. Think Enbridge (ENB).

Today, I’m going to be focusing on the third category. Besides ENB, another company that I think fits neatly into this category is its midstream counterpart, Energy Transfer (NYSE:ET). The MLP comprises 1.1% of my portfolio and is the 33rd-biggest holding in my 100 stock portfolio (and soon-to-be sub-100 holding portfolio, eventually sub-90).

When I last covered ET in February with a strong buy rating, there was quite a bit that I liked about it. The company upped the quarterly distribution per unit again, adjusted EBITDA and DCF kept growing, the balance sheet showed more progress, and units were substantially undervalued.

When the company released its first-quarter financial results after the markets closed yesterday (May 8), I remained impressed. As this article unfolds, I’ll dive into more of the details.

Briefly, however, ET’s topline beat was healthy. This drove the company’s adjusted EBITDA guidance for 2024 even higher. Key growth projects remain on track to be completed soon. The company’s leverage ratio looks poised to remain comfortably within its targeted range in 2024.

The only major development since my last article that slightly diminishes the bull case is the 11% rally. This was well over double the 4% return posted by the S&P 500 (SP500) in that time. Since then, my fair value estimate has climbed, but not by as much as the unit price. This is why I think units aren’t quite a strong buy anymore, but I do believe they’re still a buy.

Onward And Upward Q1 Operational Results For Energy Transfer

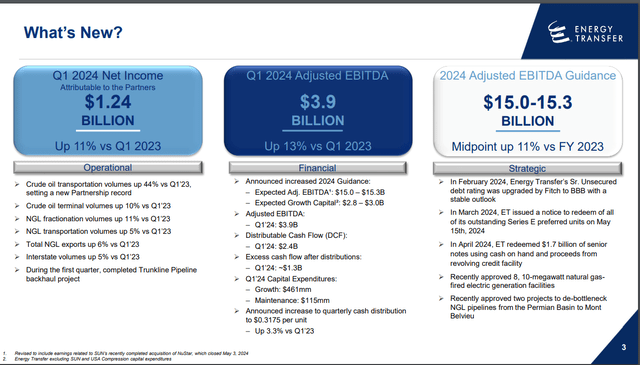

Energy Transfer Q1 2024 Earnings Presentation

ET posted exceptional results in the first quarter ended March 31. The midstream operator’s total revenue surged 13.9% higher year-over-year to $21.6 billion during the quarter. This was $720 million greater than the analyst consensus, according to Seeking Alpha.

What was behind ET’s sizable topline beat for the quarter? The quick answer is that results throughout the business were enviable. Operationally, there wasn’t a single aspect of the business that didn’t grow in the quarter.

Crude oil transportation volumes soared 44% over the year-ago period to 6.1 million barrels per day during the first quarter. For more context, that set a new partnership record per Co-CEO Tom Long’s opening remarks during the Q1 2024 Earnings Call. These results were driven by strength in the core business and the acquisitions of Lotus and Crestwood assets last May and November, respectively. Crude oil terminal volumes also climbed 10% higher for the quarter.

In the NGL and Refined Products segment, NGL fractionation volumes grew by 11% to 1.1 million barrels per day in the first quarter. Total NGL export volumes also edged 6% higher during the quarter on international demand and record LPG exports out of the Nederland Terminal in March. The company’s share of worldwide NGL exports for the quarter remained robust at roughly 20% per Long. NGL transportation volumes were also 5% more than in the year-ago period.

Finally, interstate natural gas transportation volumes were also 5% greater year-over-year in the first quarter. More demand and higher utilization of the company’s pipeline systems like Tiger and Trunkline were to be credited for this growth.

Thanks to admirable results across the board, the company’s adjusted EBITDA climbed 13% over the year-ago period to nearly $3.9 billion during the first quarter. ET’s DCF attributable to unitholders also rose by 17.3% year-over-year to almost $2.4 billion in the quarter. The 8.8% higher unit count from M&A was more than offset by growth in adjusted EBITDA and DCF. That is a great sign because it means ET knows exactly what it is doing with measured and methodical dealmaking as opposed to blind empire-building.

ET upped its adjusted EBITDA guidance for 2024 from the previous midpoint of just shy of $14.7 billion to a new midpoint of roughly $15.2 billion. Given the momentum of it businesses and the completion of the Trunkline Pipeline backhaul project (adding 400 MMf/d of southward flow capacity), I think this makes sense. For perspective, the midpoint would be an approximately 11% growth rate over 2023’s base of $13.7 billion. Even with more outstanding units, unitholders’ slice of the adjusted EBITDA pie is steadily growing.

Additionally, the $65 billion current and long-term debt load as of March 31 looks to be quite manageable. This is because, assuming the debt load remains stable (or immediate acquisitions are at least neutral), the leverage ratio will be 4.3 in 2024 – – in the targeted range of between 4 and 4.5x.

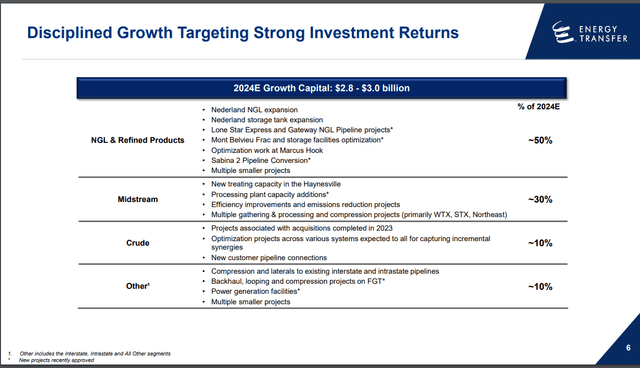

Energy Transfer Q1 2024 Earnings Presentation

Beyond just this year, ET is investing in various growth projects. A total of $2.9 billion in midpoint growth capital spending is anticipated for 2024. One of the more notable growth projects in development is the Nederland Terminal expansion. This project remains on schedule to be placed into service in mid-2025. It will add 250,000 barrels per day to NGL export capacity. That should help ET to remain a leader within the growing global NGL export market.

Not to mention that the company is also building new refrigerated storage at Nederland, which will up butane storage capacity by 33% and double propane storage capacity. According to Long, this will enhance the company’s ability to keep customer ships loaded on time (unless otherwise noted or hyperlinked, all details in this subhead were sourced from ET’s Q1 2024 Earnings Press Release and ET’s Q1 2024 Earnings Presentation).

There’s Plenty More Distribution Growth Ahead

Last month, ET announced that it was increasing its quarterly distribution per unit by 0.8% to $0.3175. Since restoring the distribution to pre-COVID levels in 2023, the company has committed to growing the distribution by 3% to 5% annually. So far, it has delivered. The current distribution is 3.3% higher than in the year-ago period.

Better yet, ET has the financial ability to do so. As I indicated in my previous article, the company posted $3.6 billion in retained DCF in 2023. Including the $2.3 billion in capital expenditures, ET still had over $1 billion in excess DCF that year.

For 2024, that should remain the case. This is because the ~$2.4 billion in first quarter DCF against the $1.1 billion in distributions left it with $1.3 billion in excess DCF. Including $576 million of growth/maintenance capex for the quarter, $709 million of excess DCF was left after paying distributions and funding all its projects (info according to ET’s Q1 2024 Earnings Press Release). Simply put, ET remains a cash flow machine.

Units Remain Discounted By A Double-Digit Percentage

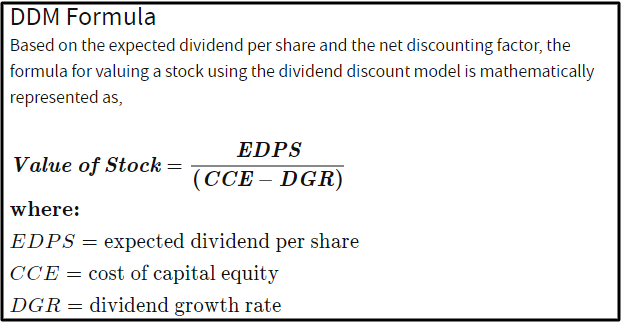

Investopedia

As I did last time, I will be using the dividend/distribution discount model to value units of ET. This is because for a midstream like ET, most total returns are typically generated through distributions. That is why I believe distributions are an appropriate way to value such a business.

The first input into the DDM is the expected distribution per unit or annualized distribution per unit. That’s now $1.27 for ET.

The next input for the DDM is the cost of capital equity, which is the annual total return rate an investor desires. I shoot for 10% annual total returns, so that’s what I’ll be using for this input.

The third input into the DDM is the annual distribution growth rate. Due to the strength of ET’s business, I’m comfortable increasing this from 3% to 3.25%. That’s still well below the 4% midpoint of its targeted range, which provides a nice cushion.

These assumptions give me a fair value of $18.81 a unit. Relative to the $16.24 unit price (as of May 9, 2024), this is nearly a 14% discount to fair value. Put another way, ignoring distributions and business growth, ET’s units could appreciate almost another 16% before I believe they would be fully valued.

Risks To Consider

ET is a top-notch business. Like any business, though, its profile and risks aren’t for everyone. The risks remain largely unchanged since my last article, so I’ll just be highlighting a few items for consideration.

First off, those who aren’t interested in dealing with the added tax complexities that stem from the K-1 tax forms issued by MLPs may not want to own ET.

Just like my prior article, ET’s growth projects could be met with opposition from environment groups and regulators. If this happens on larger projects, resulting cost overruns and in-service delays/project cancellations could harm the company’s growth potential.

ET’s adjusted EBITDA stream is very reliable, with 90% being fee-based and the other 10% being spread or commodity-based (slide 7 of 14 of ET’s Q1 2024 Earnings Presentation). However, this comes with a caveat. ET will only keep receiving payments from customers so long as they are solvent. If a major industry downturn like 2015/2016 happened again, the company could incur counterparty risk. This could weigh on operating results.

Summary: Energy Transfer Could Still Make Sense To Buy

Over the six-plus years that I have owned ET, the ride has been bumpy at times. That being said, it is an investment holding that I’m especially pleased to own. Every conceivable metric shows this company to be trending in the right direction.

Growing DCF/EBITDA. Yep. Investment-grade credit ratings. Indeed. Rising distributions. Check. The valuation isn’t quite as compelling as it was months ago, but with the fundamentals, it’s more than enough for me to rate units a buy yet.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET, GOOGL, ADP, ENB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.