Summary:

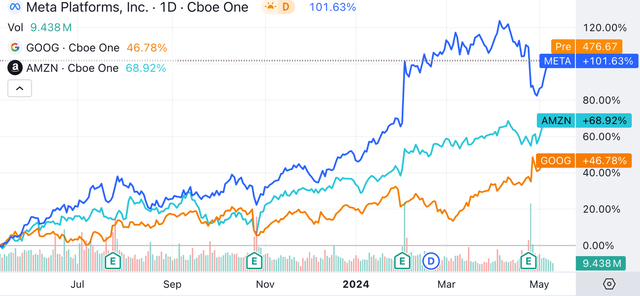

- Meta Platforms’ stock got battered post-earnings, whereas rivals Google and Amazon saw their stocks rallying, despite all three tech companies guiding that they will be engaging in heavy AI-related capex.

- The top three advertising platforms are in a tight race to offer new, powerful generative AI features to capture future ad dollars.

- Meta holds a particular advantage over its key rivals that it is now leveraging to win in the era of AI.

COM & O/iStock Editorial via Getty Images

Meta Platforms’ (NASDAQ:META) stock had plummeted by over 13% following its Q1 2024 earnings report in late April, whereas rivals Google and Amazon saw their stocks rallying post-earnings, despite all three tech companies guiding that they will be engaging in heavy AI-related capex over the next year. Meta’s less positive revenue outlook relative to Google (GOOG) and Amazon’s (AMZN) core businesses indeed made investors wary. While the three tech giants run different kinds of businesses, they all have enormous advertising revenue segments, and will be competing ferociously for future ad dollars in the new era of AI.

In the previous article, I had downgraded Meta stock to a ‘hold’, given the regulatory and legal headwinds facing the company. Amid the child exploitation issues on Meta Platforms, the company could potentially be banned from monetizing the user data of young teens and children, threatening revenue growth potential going forward.

In this article, we will be delving into how Meta is evolving its business messaging feature in the era of generative AI to drive returns for shareholders. Amid the tightening competition between the top three advertising platforms, Meta holds a particular advantage as generative AI-powered chatbots become increasingly prevalent in facilitating various forms of commercial activities. Though I am still maintaining a ‘hold’ rating on the stock, and META could potentially underperform relative to its main rivals over the next year.

Generative AI transforming tech platforms

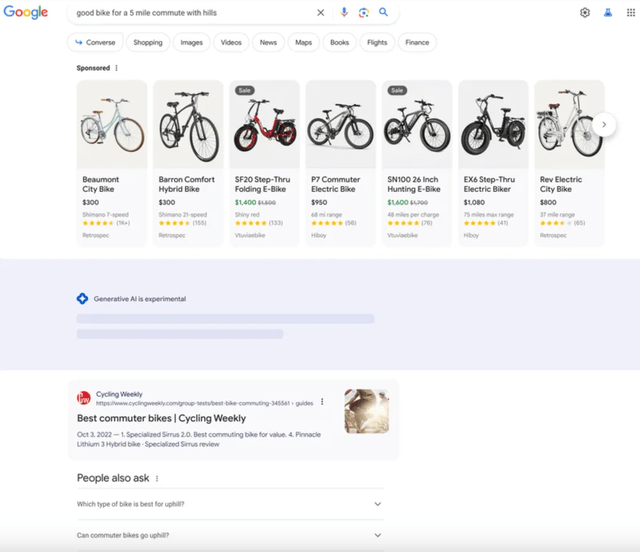

With the generative AI revolution in full swing following the rise of ChatGPT, all three major advertising giants, Meta, Google and Amazon, are striving to transform the consumer experiences on their platforms through chatbot-based search and discovery features. This includes the Meta AI assistant, Google’s Gemini and Search Generative Experience [SGE], and Amazon’s Rufus.

Google and Amazon have been sharing examples of how they intend to show ads in their chatbot-based services, in order to convince shareholders that their search-based advertising businesses can be sustained amid the AI revolution.

Google SGE ad example (Google)

Meta’s executives, on the other hand, have not yet felt the need to offer details into how they will show ads in the Meta AI assistant, given that Meta’s platforms like Instagram and Facebook are more discovery-oriented as opposed to search-oriented. The market considers generative AI to be less disruptive to the social media giant than Alphabet’s Search business, while Amazon is still trying to catch up against Meta and Google in the AI model race. These factors have been partly responsible for why the META stock price has outperformed GOOG and AMZN over the past year.

Meta’s business messaging advantage

For several years now, Meta has been leveraging the popularity of its communication apps like WhatsApp and Messenger to also facilitate business messaging through ‘Click to message’ ads, whereby shoppers can directly contact merchants to learn more about products of interest.

Enabling advertisers to directly communicate with prospective customers enables businesses to better understand shoppers’ needs, and also gives merchants an opportunity to cross-sell more products. In fact, a study by Forrester Research in 2022 had revealed that:

At the composite organizations, orders resulting from a Meta Business Messaging interaction have values 20% higher than their average order values.

Such positive business outcomes indeed benefit Meta investors in the form of higher demand for Meta’s advertising solutions, increasing revenue and profits for shareholders.

However, until now, such business messaging features have been more widely adopted in countries with low labor costs like India, where businesses can afford to hire staff to respond to online messages from potential customers. It has not been as popularly adopted by merchants in North American countries, where the cost of labor is higher.

Meta is automating business messaging

Now amid the generative AI revolution, Meta has been experimenting with automated business chatbots, powered by its own ‘Llama 3′ Large Language Model [LLM], that can respond to consumers’ queries and encourage them to buy various products on behalf of the merchants. Meta’s executives refer to these chatbots as “Business AIs”.

In fact, on the Q1 2024 Meta Platforms earnings call, when discussing the AI opportunities ahead, CEO Mark Zuckerberg proclaimed that:

The thing that I actually think is probably the biggest clear opportunity is all the work around business messaging.

If Meta succeeds at effectively automating chat-based interactions between merchants and shoppers, it could be conducive to greater demand for Meta’s ad solutions and translate to higher advertising revenue for shareholders.

This differs from Google and Amazon’s current deployment of LLMs on their platforms, whether that’s Google’s SGE or Amazon’s Rufus, which strives to connect shoppers and merchants through a single, universal chatbot. So when shoppers tell the chatbots what they are looking for, Google/ Amazon will try to show relevant product ads within or around the results. The market is still cautiously observing whether these new ad formats will be as profitable as the traditional ad solutions.

Now, to be clear, Meta will likely have to take a similar approach with its Meta AI assistant if consumers decide to start their product searches through this universal conversational AI feature.

However, Meta’s real advantage lies in its ability to facilitate direct conversations between consumers and a merchant’s customized AI chatbot, or “business AIs”. Such conversational features would be specifically trained using a merchant’s data to sell products/ services from that business when shoppers initiate a conversation via ‘click to message’ ads upon discovering traditional image/ video ads appearing on Instagram/ Facebook feeds.

So while Google and Amazon experiment with ad formats for their universal chatbot services, I believe Meta’s customized chatbot-based sales solutions for each individual merchant could potentially offer greater value for advertisers. Although that being said, we don’t know whether/ how much Meta would charge businesses for training and deploying their own tailored chatbots, which would indeed also play a role in businesses’ willingness to adopt these new generative AI solutions.

At present, Meta is still far from deploying automated business messaging features across its platform, as CFO Susan Li shared on the earnings call (emphasis added):

The longer-term piece here is around business AIs. We have been testing the ability for businesses to set up AIs for business messaging that represent them in chats with customers starting by supporting shopping use cases such as responding to people asking for more information on a product or its availability…we’re hearing good feedback with businesses saying that the AIs have saved them significant time while customer — consumers noted more timely response times. And we’re also learning a lot from these tests to make these AIs more performant over time as well. So we’ll be expanding these tests over the coming months and we’ll continue to take our time here to get it right before we make it more broadly available.

Hence, while the ad revenue opportunities from these generative AI-powered, customized business AIs are promising, Susan Li’s remarks suggest that

there is substantial iterative work to be done before these business AIs can be fully deployed and monetized. Hence, AI-driven revenue streams from these initiatives will be gradual and take time to realize.

Nonetheless, one of Meta’s key strategies to stand out from competition is to make its series of Llama models open source, while Google’s Gemini and Amazon’s Titan models remain closed source. Making the Llama code open-source should enable the social media giant to benefit from third-party developers innovating around the large language models. This should not only allow for faster additions of new functionalities to Meta’s chat-based services, but should also help uncover new ways of running its AI models more cost-efficiently, as CEO Mark Zuckerberg mentioned on the last earnings call (emphasis added):

The 8B and 70B parameter models that we released are best-in-class for their scale. The 400+B parameter model that we’re still training seems on track to be industry-leading on several benchmarks. And I expect that our models are just going to improve further from open source contributions.

We’re also going to continue to be very focused on efficiency as we scale Meta AI and other AI services. Some of this will come from improving how we train and run models. Some improvements will come from the open source community — where improving cost efficiency is one of the main areas I expect that open sourcing will help us improve, similar to what we saw with Open Compute.

Running the AI models more, and more cost efficiently is not just essential to improving profitability for shareholders, but will also play a key role in making Meta’s AI tools affordable for merchants and advertisers to adopt, conducive to top-line revenue growth as well as META investors.

Furthermore, aside from the innovative contributions from the third-party developer community, Meta’s own developers have also been impressively advancing the capabilities of Llama 3, as Mark Zuckerberg shared on the earnings call:

Now in addition to answering more complex queries, a few other notable and unique features from this release. Meta AI now creates animations from still images and now generates high quality images so fast that it can create and update them as you are typing, which is pretty awesome. I’ve seen a lot of people commenting about that experience online and how they’ve never seen or experienced anything like it before.

The reason such incredible functionalities are worth highlighting is that these capabilities offer great commercial value. For instance, it should enable business AIs to better and more swiftly understand what the consumer is looking for, allowing merchants to better grasp customers’ tastes/preferences, and potentially improving customer satisfaction rates. If Meta can better connect and facilitate richer conversations between merchants and shoppers than its rivals, then it could indeed lead to more ad dollars flowing towards its platforms, resulting in higher advertising revenue and profits for shareholders.

Could Google and Amazon also offer automated business messaging?

Now with Google and Amazon embracing chat-based services on their respective platforms amid the generative AI revolution, these competitors could also potentially offer automated communication services between consumers and merchants/ advertisers directly, to stay competitive against Meta. Although, simply introducing similar capabilities may not necessarily warrant a competitive threat.

Take Amazon as an example. The e-commerce giant had introduced its Rufus chatbot in beta mode to U.S. mobile app users on 1st February 2024, right before the Q4 2023 Amazon earnings call. And on that call, they had spent a notable amount of time talking about how they see Rufus enhancing shopping experiences on the platform.

However, on the Q1 2024 Amazon earnings call last month, there was not a single mention of Rufus. Amazon did not offer any details into how many people used the new shopping chatbot feature or the type of feedback they are getting. This raises questions about consumer usage volumes and/or usage experiences with Amazon Rufus.

If they had something positive to share for this feature, they indeed would have done so, given the company’s eagerness to convince markets that they are not falling behind in the AI race.

The absence of insights provided for this new generative AI feature suggests problems/ poor user experiences that need addressing before they have something positive to share with shareholders.

This indeed can be considered testament to Meta’s prowess in the AI race, which has been offering insights into users’ experiences with the Meta AI assistant, as well as proudly proclaiming the advancements of Llama 3. On the other hand, Amazon hasn’t even disclosed which AI model powers its Rufus chatbot.

Therefore, even if rival Amazon decided to start offering direct business messaging features for its shoppers using generative AI, it may not be an immediate threat to Meta. We would also need to consider the underlying models powering the tech giants’ respective chat features, as not all models are made equal. The more superior AI model would be able to facilitate richer user experiences.

Currently, Meta seems to be in a better position than Amazon when it comes to AI models, though it is worth keeping in mind that Amazon is developing a 2-trillion parameter LLM code-named ‘Olympus’ to try and catch up against rivals.

Google, on the other hand, already offers click-to-message ad solutions to merchants on its platform as well since 2016. However, unlike Meta Platforms, Google has not discussed the popularity of this feature on its earnings calls. Whereas on the Q3 2023 Meta earnings call, CEO Mark Zuckerberg had shared that:

Business messaging also continues to grow across our services and I believe will be the next major pillar of our business. There are more than 600 million conversations between people and businesses every day on our platforms.

Nonetheless, Alphabet is already competitively challenging Meta with its multimodal AI model ‘Gemini’. The search giant has not yet disclosed any ambitions to facilitate automated business messaging between consumers and merchants directly. Although, Google’s ability to challenge Meta here should not be underestimated.

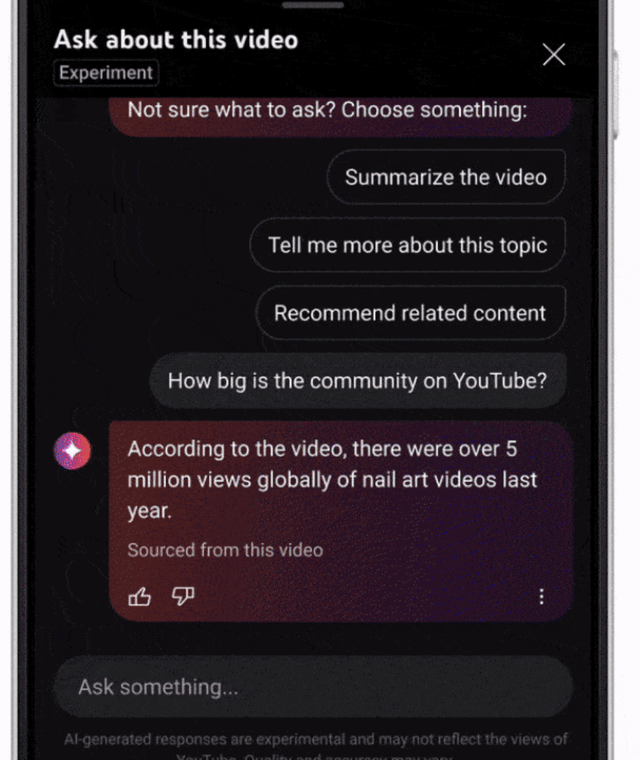

In fact, in November 2023, YouTube introduced an experimental, generative AI-powered chatbot for U.S.-based Premium subscribers. The conversational AI tool appears below videos and can be used to ask questions about the content, or even ask it to recommend similar content.

Similar to Instagram and Facebook, YouTube has also been evolving into a social commerce platform, with brands partnering with YouTube creators for endorsement deals and live shopping events. Therefore, there is certainly the potential for YouTube, and Google more broadly, to also leverage the power of its LLMs to facilitate automated business messaging between shoppers and brands, which would pose a challenge to Meta.

Although that being said, it could be difficult for Alphabet to challenge Meta in this space given that Zuckerberg’s social media giant already offers the most popular messaging apps in the world, Messenger and WhatsApp. Both of these apps are already widely and habitually used for friends and family to communicate with each other. So it becomes a natural transition to also start messaging businesses within these apps.

Google, on the other hand, does not offer any meaningful competitor chat-based service for people to communicate with each other. In fact, YouTube had introduced a chat service back in 2017 for users to communicate with each other and share videos, but was shortly shut down in 2019, testament to Meta’s dominance in the social communication services space.

Nevertheless, Alphabet also boasts certain advantages of its own. As a search engine, Google is naturally a convenient tool to use to start searches for businesses, particularly in the services industry like health care clinics or real estate agents. And these search experiences are further augmented by the integration with Google Maps when people need to search for businesses near their location. Though it remains to be seen how the recent addition of Google Search results within the Meta AI assistant will impact user behavior for both companies.

Risks facing Meta Platforms

Google is potentially ahead of Meta in building AI agents: the generative AI revolution has enabled significant advancements for augmenting the performance capabilities of automated chatbots. However, this is clearly only the beginning, with Meta CEO Mark Zuckerberg sharing on the latest earnings call that these chatbots will evolve into more intelligent agents as the next step:

I think that the next phase for a lot of these things are handling more complex tasks and becoming more like agents rather than just chat bots, right? So when I say chat bot, what I mean is, you send it a message and it replies to your message, right? So it’s almost like almost a one to one correspondence. Whereas what an agent is going to do is you give it an intent or a goal, then it goes off and probably actually performs many queries on its own in the background in order to help accomplish your goal, whether that goal is researching something online or eventually finding the right thing that you’re looking to buy.

Now this is certainly a promising growth avenue for Meta, whereby users could not only use the Meta AI assistant for shopping and finding products, but also for more multistep tasks like planning/booking a vacation or organizing a dinner party which would involve steps like ordering groceries and sending invites. This would beautifully open up more targeted advertising opportunities as users tell the assistant about what their preferences are at multiple stages of completing a task, conducive to ad revenue growth for shareholders.

However, Google is very likely to also be working on its own AI agent to help users with more multistep tasks, competing directly against Meta for ad revenue. To enable a powerful agent to effectively facilitate various commercial activities, it is key to have the chatbot/agent integrated with popular third-party apps. Last year, Google had revealed numerous third-party API integrations with its Bard chatbot (now called Gemini), including, TripAdvisor, Uber Eats and Walmart. Such integrations make it easier for Gemini to help users do things like plan vacations through TripAdvisor and plan dinner parties using seamless delivery app integrations like Uber Eats.

On the other hand, Meta has not yet announced any third-party app integrations with its Meta AI assistant.

If Meta delays such integrations for too long, or does not offer similar integrations at all, there is a risk of consumers becoming habitually attached to using Gemini for such complicated, multistep commercial activities, making it more difficult for Meta to induce consumers to use its own agent. This would undermine ad revenue growth potential for Meta stockholders.

Amazon and Google’s core businesses are performing strongly: Recent earnings reports and analyst conference calls from Amazon and Google revealed how each of their core businesses are performing robustly.

Amazon’s e-commerce business is seeing continuous profitability improvement amid the company driving efficiencies in its delivery fulfilment network. Amazon’s overall operating profit grew 221% Year-over-Year (YoY) to $15.3 billion in Q1 2024. More notably, CEO Andy Jassy assured analysts on the company’s Q1 2024 earnings call that there are many more levers Amazon can pull in terms of driving greater efficiencies in its fulfilment network, implying greater scope for profitability improvement ahead, allowing it to re-invest more profits into AI-related capex.

And at the beginning of this AI revolution, the market’s perception was that Google’s monopolistic search business would be disrupted by AI chatbots easily giving people the answers to their queries. Although on the Q1 2024 Alphabet earnings call the company somewhat alleviated these concerns with CEO Sundar Pichai mentioning that:

Most notably, based on our testing, we are encouraged that we are seeing an increase in Search usage among people who use the new AI overviews as well as increased user satisfaction with the results.

Such positive usage patterns enable investors to be confident that Google will be able to continue generating ad revenue and profits from its search business. In Q1 2024, Google Services revenue grew by 14% YoY, and Google Services operating profit grew by 28% YoY to $27.9 billion.

Now coming back to Meta, the social media behemoth also delivered strong growth over the last quarter, with Family of Apps revenue growing by around 26-27% and operating profit growth of 57.5% in Q1 2024.

However, Meta is warning of potential displacement of existing revenue sources as they encourage users to use new AI-powered services like Meta AI assistant, which are not yet being monetized. This will result in less time being spent on features that the company is actually able to monetize, as CEO Mark Zuckerberg explained on the earnings call (emphasis added):

And I think we’ve seen that with reels and with stories and with the shift to mobile and all these things where basically we build out the inventory first for a period of time and then we monetize it. And during that time when it’s scaling, sometimes it’s not just the case that we’re not making money from that thing. It can often actually be the case that it displaces other revenue from other things. So like you saw with reels, it scaled and there was a period where it was not profitable for us as it was scaling before it became profitable.

This is concerning, particularly when compared to the encouraging performance outlooks for both Amazon’s and Google’s core businesses. It is of no surprise then that Meta’s stock got pummeled following announcements that it will need to spend heavily on AI infrastructure buildouts, whereas Google and Amazon’s stocks rallied post-earnings despite similar capex guidance.

Hence, there is the risk of META potentially underperforming GOOG and AMZN stock prices, at least during this phase of AI infrastructure buildouts.

Regulatory headwinds: Meta Platforms faces regulatory scrutiny from various government bodies around the world on a regular basis. One of the most prominent cases it is dealing with is the investigation by the Federal Trade Commission, which has alleged that the social media giant misled parents over child safety and security features on its apps, though Meta is denying such claims. The stakes are high because if the FTC wins this case, it would put a ban on Meta’s ability to monetize the data of users aged below 18 in the U.S., with the risk of other governments following suit, threatening ad revenue growth potential going forward for shareholders. Such ongoing issues like children and teen’s mental health concerns and questions whether it is doing enough to completely eradicate child sex exploitation cases on its social media apps is one of the key reasons I don’t own the stock.

META Financial Performance and Valuation

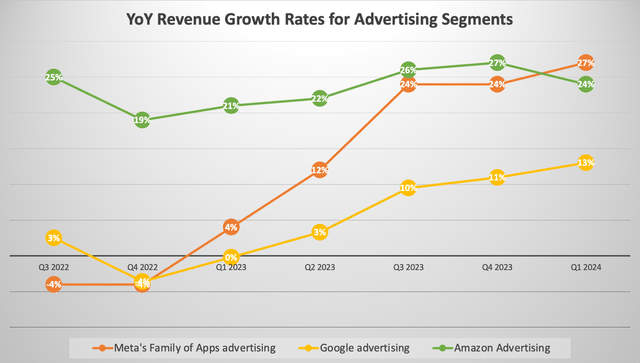

Broadly across the company, Meta Platforms delivered robust revenue growth of around 25-26% in Q1 2024, driven indeed by Family of Apps ad revenue growth of about 26-27%.

The chart below compares YoY growth rates of Meta’s Family of Apps ad revenue to those of Google advertising revenue and Amazon advertising revenue.

Nexus Research, data compiled from company filings

It is unsurprising for the ‘Amazon Advertising’ segment to witness such high growth rates given that it is the smallest of the big three advertising platforms, generating nearly $12 billion last quarter. Keeping this in mind, it is impressive that Meta’s key advertising segment, which generated $35.6 billion in Q1 2024, grew at an even faster pace than Amazon’s advertising segment last quarter, and had been growing almost just as fast in the preceding two quarters.

This robust revenue growth is partly attributable to Meta finding solutions around Apple’s iOS app tracking policy changes in 2022, enabling stronger YoY growth in 2023 after the revenue declines in 2022. Rising Chinese e-commerce companies Temu and Shein spending heavily on Meta’s ad solutions has also helped boost the social media giant’s ad revenue over the past several quarters.

Although looking forward, Meta’s revenue growth may not be as impressive amid its portfolio of social media applications going through AI-led transformations.

We talked about how Meta’s new generative AI features like the Meta AI assistant could displace existing revenue sources. But CEO Mark Zuckerberg also warned that:

As we’re scaling CapEx and energy expenses for AI, we’ll continue focusing on operating the rest of our company efficiently, but realistically, even with shifting many of our existing resources to focus on AI, we’ll still grow our investment envelope meaningfully before we make much revenue from some of these new products.

The company guided that they expect Q2 2024 total revenue to be between $36.5 billion and $39 billion, which would imply YoY revenue growth of between 14% and 22%. Even if it delivers around the top of its range, a 22% growth rate would mark a slowdown from the last two quarters.

Furthermore, Zuckerberg also repeatedly signaled high capex ahead to be able to optimally capitalize on the AI revolution. Over the near-term, this will inevitably deter the company’s profitability.

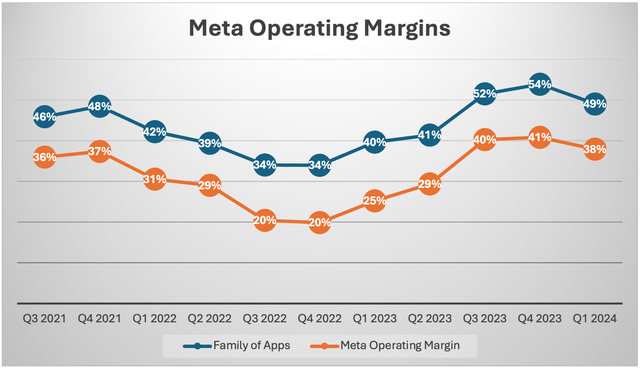

The company-wide operating margin already fell sequentially from last quarter to 38%, as the operating loss in the Reality Labs segment widened, and the operating margin of the Family of Apps segment (making up 98.9% of total revenue) fell to 49%.

Nexus Research, data compiled from company filings

The decline in operating margin comes as Meta significantly increases its expenditure on building out AI infrastructure, and CFO Susan Li guided on the call that:

We anticipate our full year 2024 capital expenditures will be in the range of $35 billion to $40 billion, increased from our prior range of $30 billion to $37 billion as we continue to accelerate our infrastructure investments to support our AI roadmap. While we are not providing guidance for years beyond 2024, we expect CapEx will continue to increase next year as we invest aggressively to support our ambitious AI research and product development efforts.

The step-up in capex will translate to higher depreciation costs in the subsequent years, depending on the expected useful lives of the assets purchased, leading to further operating margin compression.

Now, as mentioned earlier, rivals Google and Amazon will also be boosting their own AI-related capex, though the strength of their core businesses help cushion the impact on their operating margins.

On the other hand, Meta CEO Mark Zuckerberg cautioned investors that the company may not see return on investments for several years during the investment phase:

I think it’s worth calling that out that we’ve historically seen a lot of volatility in our stock during this phase of our product playbook where we’re investing in scaling a new product, but aren’t yet monetizing it. We saw this with reels, stories as newsfeed transitioned to mobile and more and I also expect to see a multi-year investment cycle before we fully scaled Meta AI, business AIs and more into the profitable services I expect as well.

Zuckerberg’s analogy with previous investment and product cycles aims to assure investors that Meta will see strong returns on investments over time. And he’s certainly not wrong given Meta’s unique positioning with new generative AI features like automated business messaging, which offer lucrative growth prospects.

Though when compared to competitors’ forward-looking guidance, whereby neither Google nor Amazon warned of risks of revenue displacements as they introduce new AI features, Meta’s stock could struggle to outperform its peers, at least over the next year.

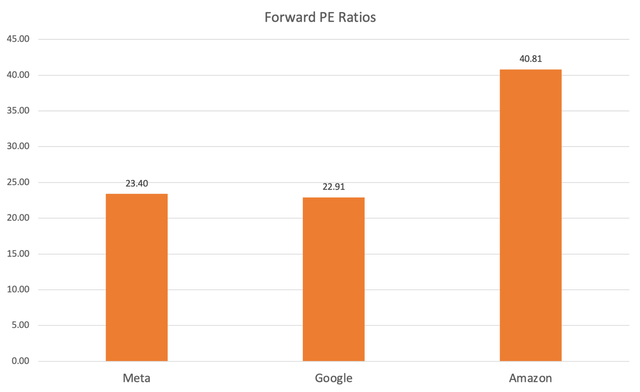

In terms of stock valuations, Meta and Google stock trade at more reasonable valuations of 23x forward earnings. For context, this is in line with META’s 5-year average forward PE of 23x.

Data compiled from Seeking Alpha

Although the Forward PE ratio does not take into consideration the anticipated future growth rates of a company’s earnings, which plays an important role in an investor’s decision-making. That is why the Forward Price-Earnings-Growth (Forward PEG) ratio offers a better assessment of a stock’s valuation, as it adjusts the Forward PE by the projected EPS growth rate going forward.

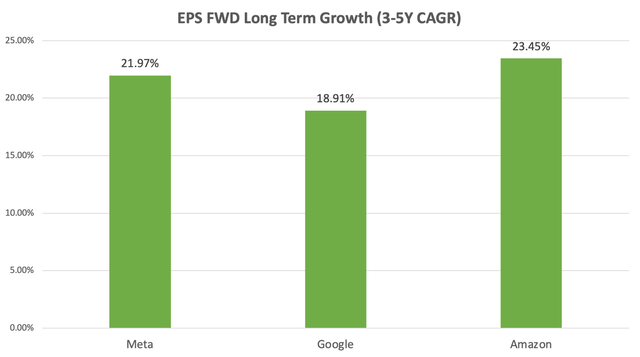

As per Seeking Alpha’s growth rate projection data, the EPS FWD Long-Term Growth (3-5Y CAGR) for Meta, Google and Amazon are as follows:

Data compiled from Seeking Alpha

Meta offers the second highest EPS growth potential among the three tech giants, and not too far from Amazon’s estimated EPS growth projections, making Meta’s forward PE ratio of 23.40x even more appealing.

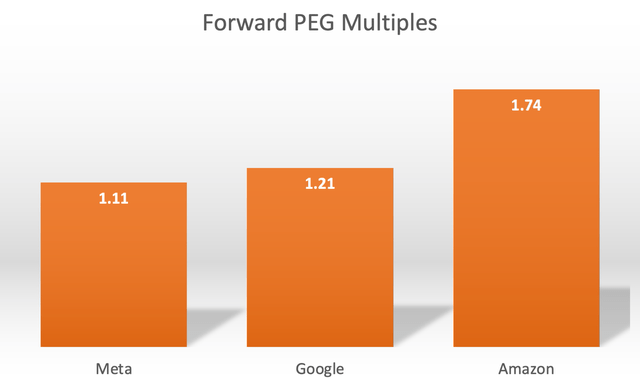

Now taking these growth projections to determine the Forward PEG ratios of these stocks, the multiples are as follows:

Data compiled from Seeking Alpha

A forward PEG of 1 would imply that the stock is trading at fair value relative to future growth potential. Though highly popular, tech stocks tend to trade at a premium to fair value. Nonetheless, the closer the Forward PEG is to 1, the more appealing the stock’s valuation is as an investment opportunity.

Meta has the lowest Forward PEG multiple out of the three tech titans at 1.11, and well below its 5-year average Forward PEG of 1.52. From this perspective, META appears as an attractive investment opportunity.

Although, we must also consider why the market would be willing to assign higher valuation multiples to Google and Amazon. We already covered earlier how unlike Meta which is cautioning investors over revenue displacements amid the rollout of new generative AI features, its two key advertising rivals are pleasing investors with relatively more appealing outlooks for their respective core businesses.

In addition, aside from having large advertising revenue segments, both Amazon and Google are also leading cloud providers. The cloud computing industry is considered one of the early beneficiaries of the AI revolution as enterprises across the corporate world seek to transform their business processes. This includes aggregating corporate data and testing & deploying various AI models, all of which require immense cloud computing instances.

For context, in Q1 2024, Amazon’s cloud unit AWS made up 17% of the company’s total revenue, and Google Cloud contributed 12% to Alphabet’s revenue base.

On the other hand, there are rumors of Meta building out additional data center infrastructure to rent out computing power to third-party enterprises at some point in the future, which could potentially create an additional revenue source for the tech behemoth. But for now, the company remains in the heavy capex phase while Google and Amazon are already enjoying cloud services revenue.

Meta’s other massive bet on the future, the Metaverse, remains deeply loss-making, with an operating loss of almost $4 billion last quarter. The segment has yet to prove to investors that it can yield commensurable returns on investments, with many investors still skeptic over how many people will want to spend time in a virtual world.

For now, rivals Google and Amazon offer investors exposure to better business segments in addition to advertising, which can immediately capitalize on the AI revolution. Therefore, it makes sense for META to be assigned a lower valuation multiple than its two key rivals and could potentially underperform GOOG and AMZN over the next year.

Therefore, I maintain a ‘hold’ rating on Meta stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.