Summary:

- Microsoft is the largest publicly traded company with a market capitalization of $3 trillion.

- The company’s financial performance and valuation make it a fine long-term investment.

- The Intelligent Cloud and Productivity and Business Processes segments are driving growth for Microsoft, and that growth is likely to continue.

lcva2

With a market capitalization of about $3 trillion, Microsoft (NASDAQ:MSFT) is undeniably the largest publicly traded company on the planet. Although the firm has had many bumps in the road during its lifetime, the overall trend has been positive thanks to strong fundamental growth. The company is incredibly healthy and generates a tremendous amount of cash each year. And there does not appear to be any expectation that this trend will change anytime soon. Of course, any high-quality company like this deserves to trade at a premium. But even with that premium, I would say that the firm makes for a decent long-term play. This is based not only on recent fundamental performance and valuation, but also on the parts of the company that are performing the best.

A quality firm at a premium price

Back in January of this year, I wrote an article that took a rather bullish stance on Microsoft. I likened the company to a phoenix rising from the ashes. This was based on attractive growth in some key areas, particularly the firm’s Intelligent Cloud and Productivity and Business Processes segments. Even though I recognized that the stock was not the cheapest on the market, it made sense to me as a long-term play. But it’s also important to keep in mind that long-term plays do often take a good deal of time to play out. You can’t expect the picture to work in your favor overnight. That’s why I’m not bothered by the fact that shares are up only 0.6% since the publication of that article, which pales in comparison to the 5.4% increase seen by the broader market.

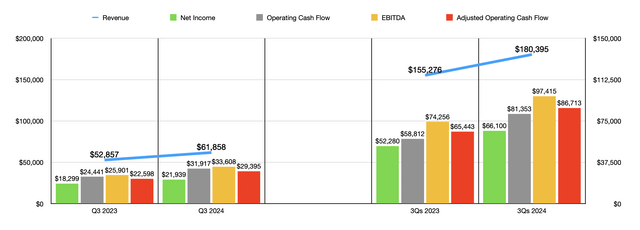

We have had some additional data come out since that article. And based on my own review of it, there is no reason to be anything other than bullish about the company in the long run. Take financial results for the third quarter of the 2024 fiscal year as an example. Revenue for that time totaled $61.86 billion. That’s 17% above the $52.86 billion generated the same time one year earlier. As the chart above illustrates, bottom line results for the business have also come in strong. Net income jumped from $18.30 billion to $21.94 billion. Operating cash flow expanded from $24.44 billion to $31.92 billion, while the adjusted figure for this that ignores changes in working capital grew from $22.60 billion to $29.40 billion. Meanwhile, EBITDA for the enterprise managed to grow from $25.90 billion to $33.61 billion.

The results experienced during the latest quarter were not simply a blip on the radar. They are part of a larger trend. Results for the first nine months of 2024 relative to the same time of 2023 have been really robust. Revenue growth year over year was 15.8%. Every other metric of significance also showed a year-over-year improvement. This includes net income, operating cash flow, adjusted operating cash flow, and EBITDA. In spite of the fact that the company allocated $9.16 billion to repurchase roughly 25 million shares in the first nine months of the 2024 fiscal year, the management team at Microsoft has made clear to make sure that cash exceeds debt in the amount of $14.58 billion.

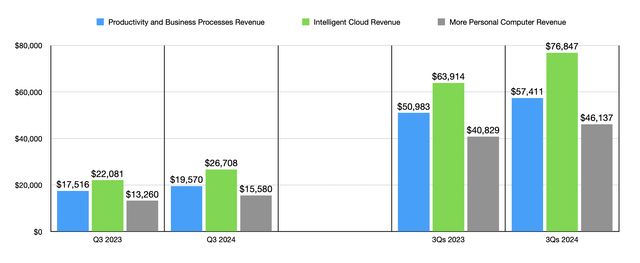

The biggest source of growth for the company as of late has been the Intelligent Cloud assignment. This includes, amongst other things, server products and cloud services revenue, with Azure being the most prominent example. In just the most recent quarter on its own, revenue for that segment totaled $26.71 billion. That’s 21% above the $22.08 billion generated the same time one year earlier. Azure and other cloud services revenue led the way here with a 31% growth rate thanks to increased consumption-based services. But this has not been the only source of expansion for the company. The Productivity and Business Processes segment reported a year-over-year rise of 11.7% from $17.52 billion to $19.57 billion. This is the part of the company that includes many of the Office products the company has, as well as other offerings like LinkedIn. Even the More Personal Computing segment that includes Windows, the devices the company sells, its gaming technologies and services, and more, saw growth of 17.5% from $13.26 billion to $15.58 billion.

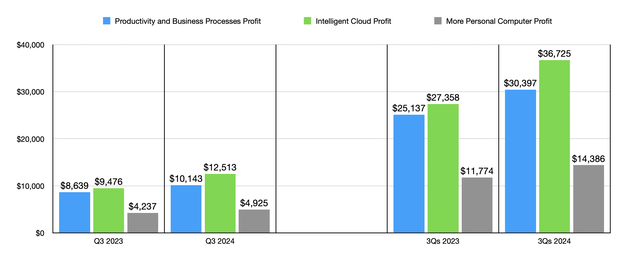

With all major aspects of the company expanding, the pictures looking good. But it’s more than just an expansion of revenue that matters. It’s also imperative that we look at other factors as well. Profitability is also incredibly important. But the good news is that the company is benefiting on that side as well. For the most recent quarter on its own, the Intelligent Cloud segment reported profits of $12.51 billion. That’s an astounding 32% above the $9.48 billion generated the same time of the 2023 fiscal year. The beautiful thing about this part of the business is that Microsoft is one of the two largest players in the cloud computing market. The other big player is Amazon (AMZN) with AWS. In a distant third place, as I have written before, is Google parent Alphabet (GOOG) (GOOGL).

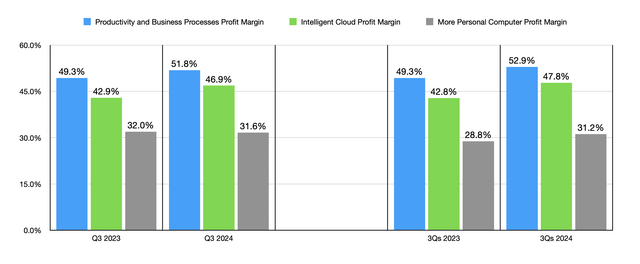

When you have only two or three companies account for the largest segment of a large, fast-growing, and already profitable, market, even a little bit of upside growth can lead to significant improvements in profitability. In just the third quarter on its own, this segment saw its gross margin shoot up by $3.1 billion. The end result here was a rise in profit margin of 46.9% from the 42.9% reported one year earlier. The More Personal Computer segment saw a small decrease in profit margin from 32% to 31.6%. However, the Productivity and Business Processes unit reported an increase from 49.3% to 51.8%.

As I detailed in my last article on Microsoft, the margin expansion involving the Intelligent Cloud segment has been part of a new trend. From 2021 through 2023, the segment saw its profit margin remain in a fairly narrow range of between 43.1% and 44.3%. The More Personal Computer segment was even worse off, posting a downtrend from 35.1% to 30.1%. Only the Productivity and Business Processes unit reported growth, with an increase from 45.2% to 49.4%. But now, as the data shows, all three of these segments are reporting increases when looking at the first nine months of the 2024 fiscal year compared to the same nine months of 2023. This is most certainly encouraging. Furthermore, the data on a forward-looking basis is very promising.

When it comes to the final quarter of the 2024 fiscal year, management expects revenue, at the midpoint, of about $64 billion. Using the data provided, we get net income of about $22.92 billion. That’s up from the $20.08 billion reported for the same time of 2023. That should bring net income for this year up to $89.02 billion, which would be a nice increase over the $72.36 billion reported last year. If we assume that estimates are correct and that other profitability metrics rise at a similar rate, we should anticipate adjusted operating cash flow for 2024 of $119.21 billion and EBITDA of $135.09 billion.

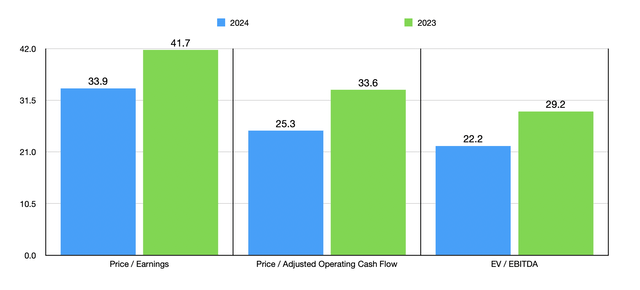

Using these results, I was able to value the company as shown in the chart above. If it were most companies that we were looking at, I would say that shares are overpriced. But again, we are talking about a large, fast-growing, and quality cash cow that has negative net debt and that is buying back billions of dollars’ worth of stock each quarter while paying out a distribution. Obviously, even a company like this, however, can only justify these kinds of multiples if we are forecasting continued growth in the long run. But the good news is that, at least for 2025, management seems quite optimistic. They expect revenue to climb at a double-digit rate. The same is true of operating income, even though operating margins are expected to be down by about one point. Unfortunately, we don’t have any real range of what to expect. But I would say that it’s safe to say that revenue and profit should climb by at least 10% to 20% year over year next year.

Takeaway

Fundamentally speaking, I believe that my description of Microsoft as a phoenix rising from the ashes is appropriate. The company spent years with mixed financial performance from a margin perspective. But today, that picture has changed, and margin expansion is occurring more or less across the board. Add on top of this fast revenue growth and the cash flow the company is putting to use in the form of growth initiatives, share buybacks, dividends, and more, and it’s hard not to be optimistic about the long run. I don’t think that this is the kind of opportunity that will make investors rich. Seeing shares double in a year or two would be extremely unlikely. However, I do imagine that the business will outperform the broader market for the foreseeable future. So even though the market has so far disagreed with me in that assessment, I believe that a ‘buy’ rating makes sense.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!