Summary:

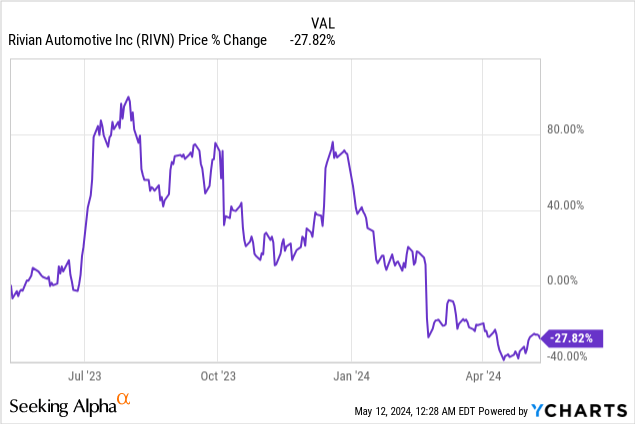

- Electric vehicle companies, including Rivian, have seen a slowdown in demand lately, resulting in valuation pressure.

- Rivian, however, reported 82% revenue growth for Q1’24 and unit economics improved Q/Q.

- Despite the risk of waning EV demand, Rivian remains a strong value in the large-cap EV sector after Q1’24.

hapabapa

Electric vehicle companies have rotated out of favor with investors lately due to weaker demand for EVs and concerns over a potential Fisker bankruptcy.

Many electric vehicle companies, including Rivian Automotive (NASDAQ:RIVN), Lucid Group (LCID) and even Tesla (TSLA) have seen signs of a growth slowdown, resulting in a significant amount of value destruction in the last year. Rivian just reported first fiscal quarter earnings that also fell short of Wall Street’s earnings estimates. However, Rivian stuck to its FY 2024 delivery target of 57,000 electric vehicles and the electric vehicle maker is still seeing considerable revenue momentum as well improving unit economics. While it may take longer than expected for the EV company to turn a profit, I believe the risk profile for long-term investors remains widely skewed to the upside!

Previous rating

I rated shares of Rivian a strong buy in February, after the electric vehicle company disclosed all-time record production of 17,541 electric vehicles in the fourth-quarter: Soon A Single-Digit Stock, What To Do Now? Although the setup for electric vehicle companies remains challenging in a lower-demand world and persistent inflation, I believe Rivian is on a good track, especially with its delivery forecast for FY 2024 confirmed. The valuation is what makes Rivian especially attractive in my opinion, as Rivian’s shares are trading in the single digits.

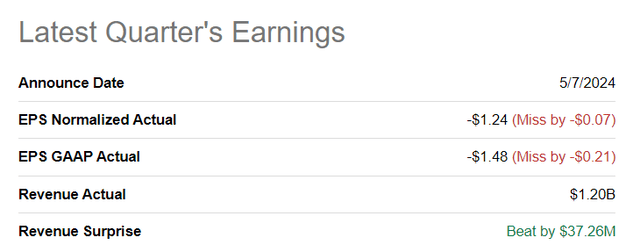

Rivian falls short of Wall Street estimates

Rivian failed to beat bottom line estimates for the first-quarter despite a strong production ramp for the R1S and R1T. Rivian reported adjusted earnings of $(1.24) per-share on revenues of $1.2B. However, the electric vehicle company did beat top line expectations by $37M due to continual revenue momentum.

Seeking Alpha

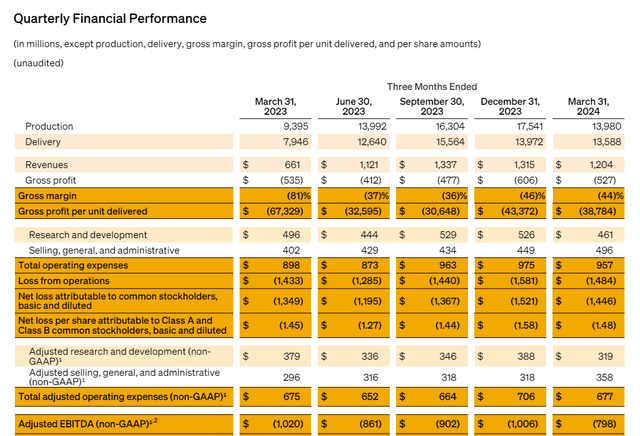

Solid revenue momentum, improving unit economics

The main take-away from Rivian’s Q1’24 earnings sheet was that the company continues to see a ton of revenue momentum (driven by production growth), but the EV maker is still losing a ton of money. Revenues in the first fiscal quarter were $1.2B, showing 82% year-over-year growth.

The loss from operations in Q1’24 was $1.48B, which narrowed from $1.58B in the previous quarter. Most importantly, the company’s unit economics continued to improve again (due to a higher factory output volume): Rivian lost $38.8k for each vehicle produced, which was down from $43.4k in the previous quarter.

With losses narrowing, especially losses sustained per-unit sold, I believe Rivian is overall on a good track to improve its financial profile in the coming quarters, especially now that the company confirmed its FY 2024 delivery target of 57,000 electric vehicles.

Rivian

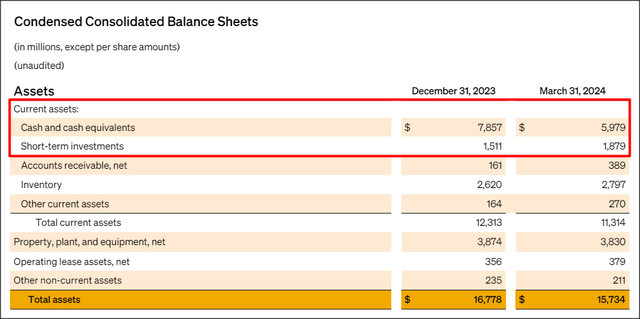

While it is almost certain that it will take a couple more years for Rivian to become profitable, the EV company still has one of the best-capitalized balance sheets in the electric vehicle industry.

The EV maker had $7.9B in total liquidity (including short-term investments) on its balance sheet at the end of March quarter… which marked a decline of 16% quarter over quarter. Rivian spent approximately $1.8B of its cash on its operations and CapEx in the first-quarter, so the company currently has enough liquidity to sustain its operations at least for another year.

I consider it highly likely that Rivian will offer additional senior convertibles notes in the second half of the year. Currently, Rivian carries $4.4B in long-term debt on its balance sheet, so the EV maker can clearly take on more financial obligations to extend its liquidity runway.

Rivian

Rivian’s valuation

Rivian continues to represent one of the best values in the large-cap EV sector, in my opinion, as the electric vehicle company continues to grow its revenues very quickly. The EV maker is expected to grow its annual

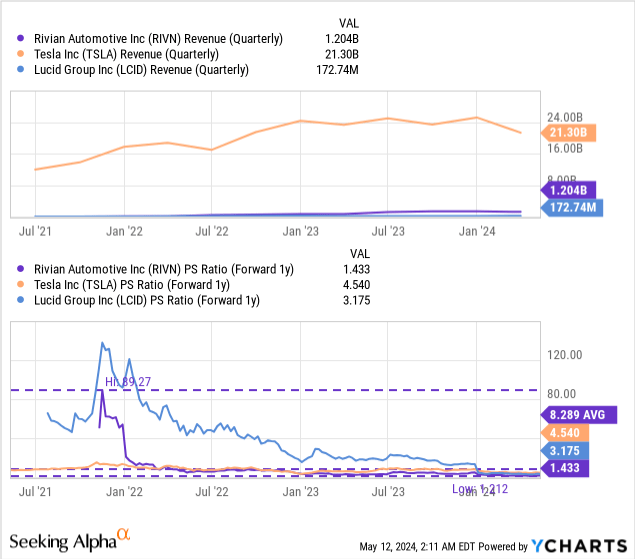

Rivian still has the lowest price-to-revenue ratio in the large-cap U.S. EV sector and is much cheaper than Lucid, as an example, which is delivering less electric vehicles and has a much smaller annual revenue volume than Rivian as well. Tesla is a bit of an outlier, obviously, as the company produces and delivers millions of cars globally and is already widely profitable on an earnings as well as free cash flow basis. Rivian is currently trading at only 1.4X FY 2025 revenues, which is a massive 83% below the 3-year average P/S ratio of 8.2X.

In my last work on Rivian, I said that Rivian could revalue to $22 per-share, under the assumption that the company could narrow its losses, improve its unit economics and maintain top line momentum (this fair value estimate was based on an industry group P/E average of 2.4X). I still believe that this is a very reasonable fair value estimates, especially in light of Rivian confirming its 57k production target for FY 2024.

Risks with Rivian

The biggest risk for Rivian, as I see it, is waning EV demand, which may mean that the company’s implied revenue potential may not get realized. This in turn would likely significantly increase pressure on the company’s valuation factor and potentially negatively affect Rivian’s gross-profit-per-unit trajectory. What would change my mind about Rivian is if the company saw a reversal in its gross profit per-unit trend or if the EV maker were to cut its 57k delivery target later this year.

Final thoughts

Rivian submitted a reasonably strong earnings sheet for its first fiscal quarter that saw a massive 82% Y/Y surge in revenues, as well as narrowing losses on a gross profit (per-unit) and operating income basis. Strong top line growth as well as Rivian’s resilient outlook for FY 2024 provide fundamental support for Rivian’s strong buy case, in my opinion. Additionally, I would name Rivian’s low valuation (shares are trading in the single digits) as a key reason to buy into the EV maker at this point. From a valuation point of view, I believe Rivian continues to represent the best value for investors in the large-cap U.S. EV market!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.