Summary:

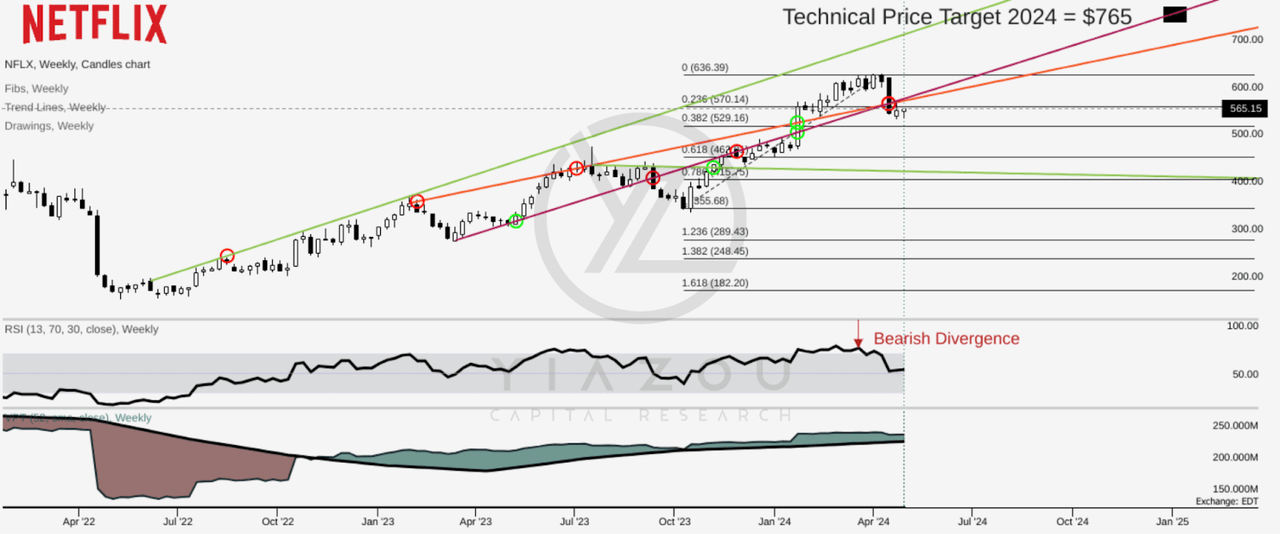

- Netflix, Inc. could reach $765 by the end of 2024, driven by solid price momentum and market sentiment.

- Strategic initiatives to convert over 100 million non-paying viewers have significantly increased Netflix’s revenue and subscriber base.

- Despite market share erosion, Netflix’s strategic innovations, such as ad-tiers and live-streaming, position it as a leader in the streaming industry.

- Introducing an ad tier and diverse content expansion have enhanced subscriber engagement and broadened revenue sources.

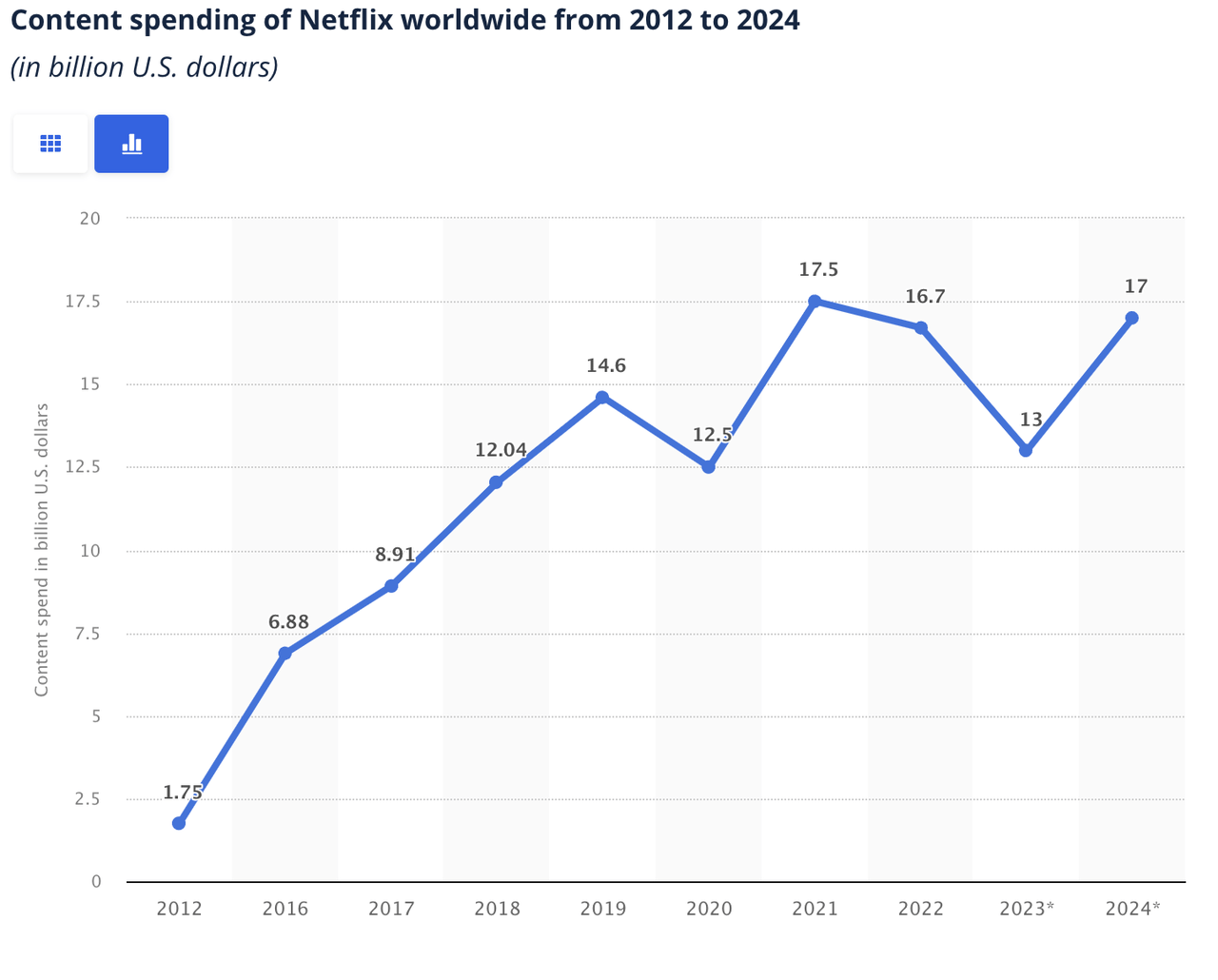

- Netflix plans to boost its content investment to $17 billion by 2024, aiming to enrich its library and strengthen subscriber attraction and retention.

wellesenterprises/iStock Editorial via Getty Images

Investment Thesis

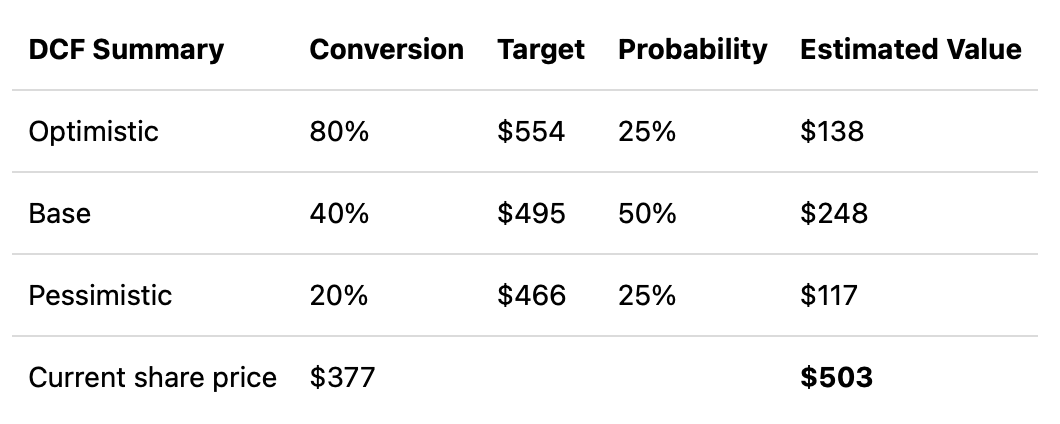

In our previous analysis, dated October 2023, we confidently issued a buy rating for Netflix, Inc. (NASDAQ:NFLX), anticipating significant value unlocking from its initiative to crack down on password sharing. Seven months ago, we projected a fair price of $503 when trading at $372, based on a thorough discounted cash flow, or DCF, model and probabilistic outcomes of Netflix’s strategic changes.

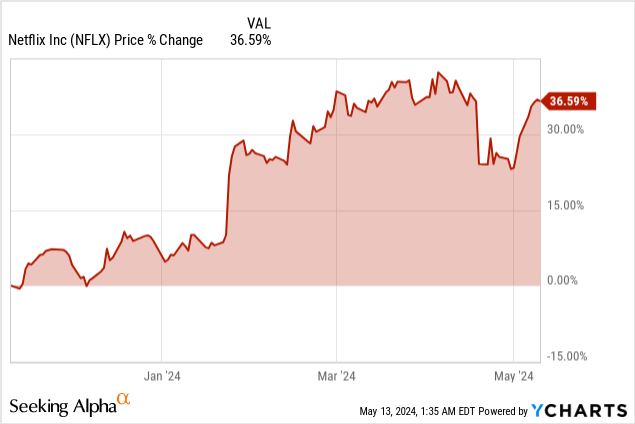

NFLX has outperformed our initial forecasts, surpassing the optimistic scenario’s target, indicating a highly promising financial trajectory. Given this strong momentum, we are now turning to technical analysis to predict the price movements further and capitalize on the ongoing market dynamics.

DCF (Author)

Currently, with robust price momentum, our technical analysis suggests that NFLX could climb to $765 by the end of 2024, buoyed by a bullish shift in market sentiments. Even our conservative estimates see it no lower than $700.

The company’s strategic move to convert over 100 million non-paying viewers into subscribers is already reshaping its revenue dynamics, promising to elevate its subscriber count. With new initiatives like an advertising tier and content diversification, Netflix is leading and revolutionizing the streaming industry.

Hence, investors should consider Netflix’s ongoing momentum and strategic advancements as pivotal elements driving the stock towards and potentially beyond our revised target range.

Aiming for $765 in 2024 Amid Bullish Momentum

Based on current price momentum, Netflix’s stock price may hit $765 by the end of 2024. The price target is derived from the prevailing trend line, which signifies a change in polarity over the short term.

More pessimistic measures (red trend line) suggest a price target of $700 based on short-term price swings. On the downside, based on the Fibonacci retracement, the stock price may take support at $529 and $462, vital 0.382 and 0.618 levels, respectively.

Looking at the Relative Strength Index (RSI), 54, the stock price is moving in a neutral state. As at the recent highs, the indicator experienced a bearish divergence, so there are possibilities for a further downside price movement. However, the stock price has taken multiple support near RSI at 50 over the last 12 months.

Any RSI line movement towards 70 indicates solid upside movement for the stock. Moreover, the volume price trend (VPT) signifies ongoing bullish momentum. Hence, this signals more upside for the stock price 2024, as bullish sentiment still prevails.

Q1 Surge in Subscribers and Revenue Validates Password Crackdown

Our previous analysis from October 2023 projected that Netflix’s crackdown on password sharing would catalyze an increase in paid subscriptions and overall financial health. The data from Q1 2024 confirms these forecasts with considerable accuracy. Netflix reported a significant 15% year-over-year increase in revenue, accompanied by an impressive 54% increase in operating income, pushing the operating margin up by seven percentage points to 28%.

These figures are improvements and validations of the strategic initiatives we believed would transform the company’s financial landscape. Specifically, the addition of 9.33 million subscribers in the first quarter starkly contrasts with the 1.8 million in Q1 2023, underscoring the successful implementation of measures against password sharing and the resultant spike in genuine subscriber count.

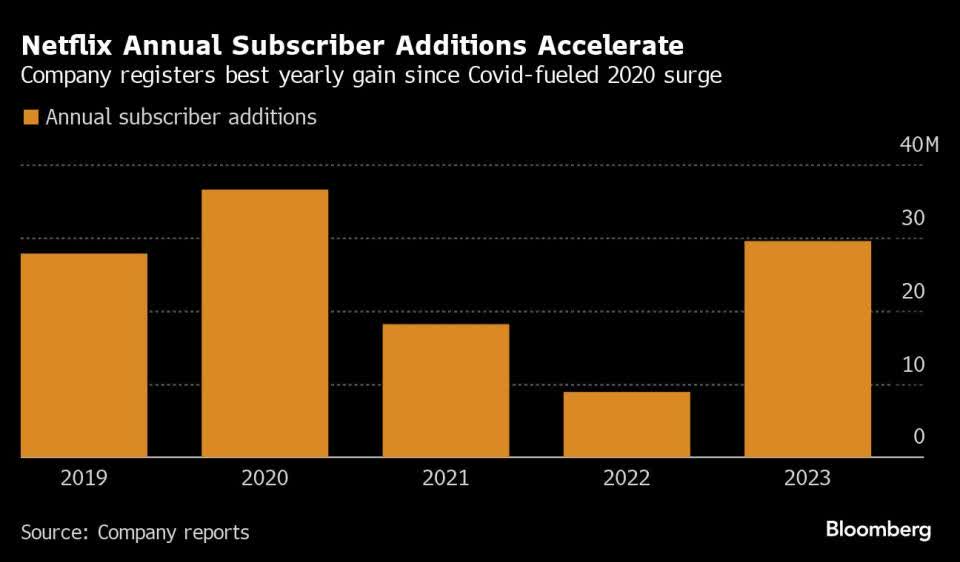

Netflix’s subscriber growth has been pretty good since COVID, and its customer count has been running ahead of expectations in the early quarters of 2024. The second half of 2023 saw the beginning of Netflix’s direct crackdown on password-sharing practices with non-paying subscribers, which number around 100 million. This campaign starts, and the full effect is anticipated within 1–2 years.

Bloomberg

Further expanding on our previous forecasts, Netflix’s move to diversify its revenue through ad-supported tiers and increased content investment has also begun to show promising results. The company’s ad membership grew by 65% quarter over quarter, continuing strong growth from the previous two quarters.

This growth in the ad-supported segment helps tap new customer segments and stabilizes revenue streams, balancing the investment in high-quality, diverse content that has been a significant draw for subscribers. Netflix’s strategic focus is on maintaining and actively enhancing the variety and quality of its entertainment offerings, including TV shows, movies, games, and live programming, which are aimed at sustaining and boosting subscriber engagement and satisfaction, which are crucial for long-term retention and revenue growth.

Boosting Original Content to Regain Dominance

Even though it once dominated streaming at the start of the game, Netflix has seen its share almost halved from its high point of 48% in 2019, and the company has around 28% market share. Market share erosion is coming at a very competitive time, with competitors like Disney (DIS) Plus and Amazon (AMZN) Prime, which have significantly expanded their content offerings.

Additionally, Netflix has been ramping up original content spending, moving to close to $13 billion on its library in 2020 and setting the target for close to $17 billion by 2024. This strategic investment in content development, whereby it creates material that will not only win new subscribers but keep existing ones by diversifying and refreshing the offers that attracted them to the platform in the first place, has paid handsomely with an explosion in new subscribers.

Looking forward, Netflix’s management has raised its FY24 operating margin forecast to 25%, up from the previously projected 24%, indicating confidence in continued operational efficiency and profitability. The company’s emphasis on innovative marketing and product development is designed to fuel further growth in fandom and engagement, which are critical drivers for sustaining competitive advantage in the streaming industry.

Finally, Netflix’s performance in Q1 2024 not only aligns with our earlier projections but also sets a solid foundation for future growth. The strategic measures to convert non-paying viewers into paying subscribers through account management enhancements and tier diversification have proven effective. Thus, as these strategies continue to unfold, along with expanded content offerings and innovative marketing tactics, Netflix is well-positioned to maintain its lead in the competitive streaming landscape, driving subscriber growth and financial health.

Strategic Innovations: Ad-Tiers and Live Streaming Adjusting to Market Demand

This agility and adaptability are evident in Netflix’s strategic innovations, which fit consumer preferences and market dynamics. Netflix’s $6.99 ad-tier plan for the price-sensitive viewer has quickly accounted for around 30% of new sign-ups, thus pointing to a successful penetration into the previously untapped market.

Netflix’s future now lies in groundbreaking strategies to balance growth with profitability and, further, in advertising and live-streaming. When used with advanced analytics to understand and forecast customer behavior, it can revolutionize content personalization with much better user engagement and satisfaction.

More than that, there is new growth potential in discovering international markets with localized content for regional markets. All these forward strategies, supported by continuous investments in content and technology, will ensure Netflix’s leadership and relevance in the digital streaming landscape.

Takeaway

The key takeaway for investors is that Netflix is not only reacting to the challenges of the streaming market but is now leading those changes. The company’s ability to beat financial expectations, paired with solid trends in subscriber growth, underlines its potential going forward.

Investors should closely monitor Netflix’s strategic initiatives and market performance, as these factors will likely drive further gains and offer attractive opportunities in a competitive landscape. With a revised target price indicating a substantial upside, Netflix represents a robust investment proposition in the evolving world of digital entertainment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.