Summary:

- Qualcomm reports slight revenue beat and surpasses earnings-per-share estimates in second quarter FY 2024 earnings.

- I discuss the company’s automotive business and other opportunities.

- Qualcomm benefits from partnerships with Samsung and Chinese smartphone manufacturers.

JHVEPhoto

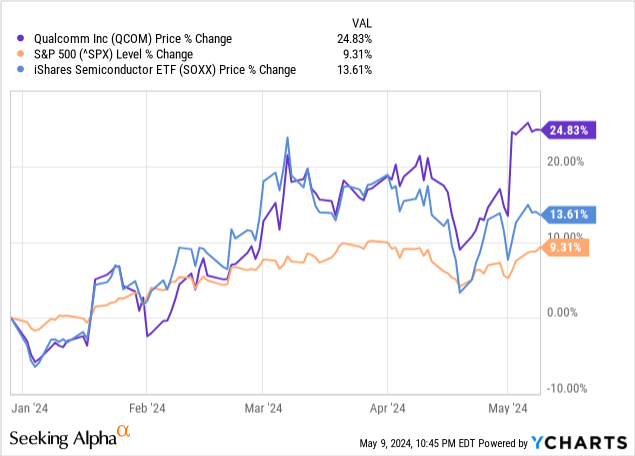

Qualcomm Incorporated (QCOM) reported its second quarter 2024 earnings on May 1, 2024. The company delivered a passable quarter, considering the primary end markets for its chips, smartphones, and consumer electronics are still emerging from a severe downturn. The company delivered a slight beat of $39.41 million on $9.39 billion in revenue. Its continued margin expansion led to Qualcomm recording an earnings-per-share (“EPS”) of $2.44, beating consensus analyst estimates by $0.12. The stock rose 9.7% the day after the company released its earnings. As of May 10, it is beating the S&P 500 Index (SPX) returns and iShares Semiconductor ETF (SOXX) in 2024.

My last article on the company highlighted how investors were waking up to Qualcomm being a huge beneficiary of Artificial Intelligence (“AI”), moving to local devices as an investing thesis. However, there are other reasons to invest in the company, including the signs of a potential rebound in smartphones and personal computers (“PCs”), its emerging leadership position in providing chips for the auto industry, and its expanding margins.

This article will discuss the potential rebound in smartphones and consumer electronics devices like PCs, and why Qualcomm may have a significant revenue opportunity in the automotive business. It will also discuss its second quarter fiscal year (“FY”) 2024 results, review its valuation and a few risks, and explain why growth investors should consider dollar cost averaging into the stock at the current price.

Potential rebound in smartphones and consumer electronics

On March 28, Counterpoint Research projected that global smartphone shipments in 2024 would increase by 3%. According to IDC, in the first quarter of 2024, the global smartphone market increased by 7.8% over the previous year’s comparable quarter, aided by a rebound in the Chinese market. Since smartphones are still Qualcomm’s largest revenue source, the smartphone industry’s return to growth is a positive development. Chief Executive Officer (“CEO”) Cristiano Amon said the following about smartphones in the second quarter of the fiscal year FY 2024 earnings call (emphasis added):

So what moves the market for us is it’s a premium and high tier and I think what we’re seeing in the China market is that the mix it’s improving, as the market has stabilized it when in return to some form of normality what we really liked is that within that market premium and high tier as a percentage continue to increase and that’s actually what’s driving the results and we are seeing the very first instances of on-device AI and GenAI being launched in premium devices and that has been resonating well to consumers, so it’s a positive trend that we like. The other color I’d like to add is we have not seen signs of weakness in the Android premium market in China especially with our OEMs so a lot of the strength really coming from premium devices from Xiaomi, Honor, OPPO, OnePlus, Vivo. And I think Huawei entering that market actually increased the overall term of premium Android.

When the CEO refers to premium and high-tier, he is referring to premium Chinese manufacturers as well as Samsung (OTCPK:SSNLF), which recently signed a new multi-year agreement with Qualcomm to use Snapdragon chipsets despite having its own proprietary chipset. This deal is on top of Qualcomm’s agreement with Samsung in 2022 to extend its licensing agreement for seven years. CEO Amon also said:

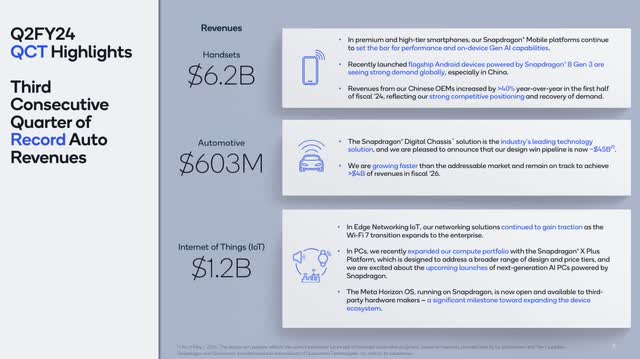

In premium and high-tier smartphones, our Snapdragon mobile platforms continue to set the bar for performance in on-device GenAI capabilities. Recently launched flagship Android devices powered by Snapdragon 8 Gen 3 are seeing strong demand globally, especially in China. We are extending the most sought after 8 series capabilities, including on-device AI, to a broader range of flagship and high-tier smartphones with the new Snapdragon 8S Gen 3 and Snapdragon 7 Plus Gen 3 mobile platforms launching in the second half of 2024.

Qualcomm’s Snapdragon 7 plus Gen 3 is a hardware chip designed for running AI algorithms on mid-range phones, and the Snapdragon 8S Gen 3 is a cheaper and slightly less capable version of the Snapdragon 8 Gen 3, its premium mobile AI chip that powers Samsung’s Galaxy S24 Series. Manufacturers that want to make a high-end power device above mid-tier devices but are trying to keep costs down use Snapdragon 8S Gen 3. The 8S Gen 3 chips will likely wind up in phones manufactured by Chinese companies like Xiaomi, Honor, iQOO, and Realme. All of the above chips could drive Qualcomm’s average selling price (“ASP”) higher, boosting margins during what looks like a potential upcycle in smartphones. Qualcomm Chief Financial Officer (“CFO”) Akash Palkhiwala said on the fourth quarter FY 2023 earnings call on November 01, 2023 (emphasis added):

From an ASP perspective, because of all the factors we discussed earlier in the call with the chips becoming way more capable, especially with GenAI [generative AI], we think we are on a good trajectory to continue to expand our ASP consistent with the last three-year trend. So, if you look at our last three-year trend, we’ve added approximately 10% increase in any tier of chipset every year. And we think as we look forward, we have the opportunity to do that, going forward.

In addition to the mobile phone market looking like it has bottomed, PCs look like they are also recovering from a downturn. At the end of 2023, some analysts predicted that PCs would rebound in 2024 due to a consumer refresh cycle. It looks like that rebound has started. IDC reported that the PC market grew by 1.5% in the first quarter of 2024. Also, the addition of AI functionality to PCs should also boost growth. The new AI functionalities use specialized accelerated hardware to run AI algorithms locally on the PC for services such as voice recognition, power/battery management, improved video editing, generative AI art, and more. Additionally, one of the most significant advantages of using AI locally on the PC rather than cloud-based AI is reduced latency and increased privacy and security.

Qualcomm plans to ship its specialized accelerated chipset Snapdragon X Elite and X Plus platforms for next-generation AI PCs in the second half of 2024. These AI chips should start becoming material to revenue in FY 2025. Since it never had much of a presence in PCs before, these AI chipsets have the potential to be a massive hit for Qualcomm, especially since, according to Tom’s Guide, testing shows Snapdragon X Elite is faster than Apple’s (AAPL) M3 chip.

It has a fantastic opportunity in autos

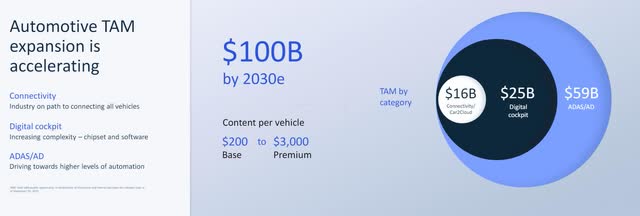

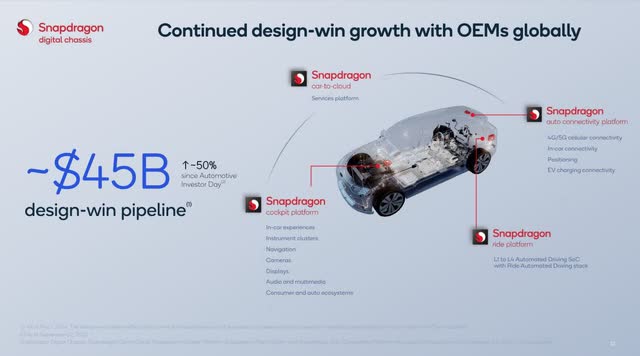

The image below shows that Qualcomm focuses on three functionalities in an auto where manufacturers require powerful chips: connectivity, a digital cockpit, and ADAS (Advanced Driver Assistance Systems). The company has built a $45 billion design win pipeline in those specific areas.

Qualcomm Second Quarter 2024 Investor Presentation.

One reason I wanted to show the above image is to show that the company addresses multiple functionalities within an auto with its chips, which differentiates it from some of its competitors like Mobileye Global (MBLY), which focuses primarily on self-driving car technology or Skyworks Solutions (SWKS), which mainly focuses on auto communications solutions like 5G cellular, Bluetooth, Wi-Fi, ultra-wideband, NFC (Near Field Communication), and CV2X (Cellular Vehicle-to-Everything).

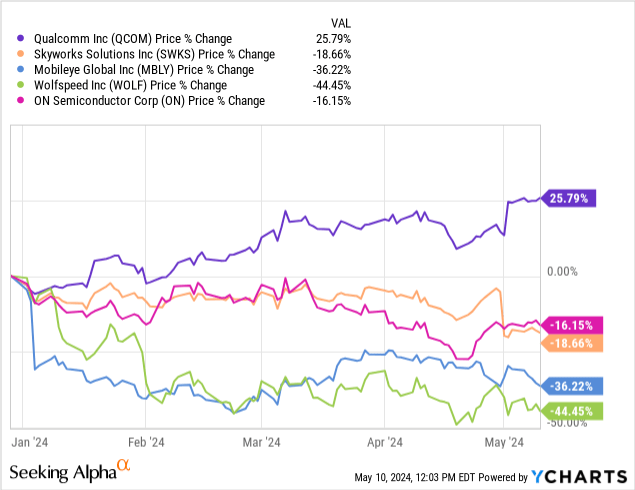

Mobileye and Skyworks didn’t fare very well when each reported earnings. When Skyworks reported its latest results on April 30, 2024, Chief Executive Officer (“CEO”) Liam Griffin said, “Automotive and industrial markets remain under pressure as they continue to undergo a steep inventory correction.” Mobileye reported an earnings miss when it reported results, and Morgan Stanley downgraded the stock due to electric vehicle adoption slowing down. Other auto chip companies that are reliant on Electrical Vehicles (“EV”) adoption, like Wolfspeed (WOLF) and ON Semiconductor (ON), which makes power chips based on Silicon Carbide, crucial for EV drivetrains, have struggled recently. Qualcomm doesn’t participate in manufacturing power chips used primarily for EV motors, so it has avoided slowing EV demand.

With so many auto chip suppliers suffering, some investors may not have expected much from Qualcomm’s auto segment when it reported earnings. Yet, its auto business continues to outperform. CFO Akash Palkhiwala said (emphasis added) on the company’s second quarter 2024 earnings call, “Following our record performance in the second fiscal quarter, we expect QCT automotive revenues to grow by low double-digit percentage quarter-over-quarter as the increase in our design win pipeline continues to materialize into revenue.” The company increased quarterly revenue by 35% year-over-year to $603 million in the second quarter.

Qualcomm’s outperformance over chip companies that rely on EV adoption is understandable, as the company never relied on EV adoption and is drivetrain agnostic. Senior Vice President (“SVP”) & General Manager, Automotive & Cloud Computing Nakul Duggal said during at the Deutsche Bank AutoTech Conference on November 9, 2023:

One advantage that we do have is we are really not affected by combustion engine or EV powertrains. We are also, I think, benefiting from a large amount of digital transformation that’s going on across all of these vehicle architectures regardless of what type of powertrain there is.

Although Qualcomm doesn’t directly benefit from EV adoption, its low-power solutions give it an advantage over NVIDIA’s (NVDA) auto solutions. An article on global market research company Counterpoint’s website stated the following (emphasis added):

We believe that extreme low-power high computations with a very scalable architecture for battery-powered devices is Qualcomm’s biggest advantage over NVIDIA which has helped the company attract a design win pipeline almost triple of NVIDIA, as power efficiency for future EV-based vehicles is going to be the key.

Qualcomm also benefits from manufacturers increasing interest in software development for autos. As digital transformation for autos ramped up around the time of the pandemic, the industry ran into a chip shortage wall, which started in mid-2020. Management responded to this digital transformation setback by using the few chips they could acquire in high-end vehicle models to get the most bang for the buck. Now that the chip shortage has receded, manufacturers want to use the same platform and chipsets developed for high-end models across multiple vehicle types and models, instead of using a different platform with different chipsets in each vehicle category. Differing chipsets may require slightly different software, and as manufacturers focus on software development for vehicles, for efficiency and cost-saving purposes, they prefer to develop software that they can use in all the cars they manufacture instead of creating different software for each vehicle type and model. Qualcomm has built a platform that works with any manufacturer, vehicle category, or model, from high-end luxury to budget-friendly. As a result, vehicle manufacturers can develop software that works across all their vehicles when using Qualcomm’s solutions. That is essentially what SVP Nakul Duggal says in the following more industry-speak quote:

The other piece that actually helps quite a bit is because there is so much of focus on software and in-sourcing of software and driving a lot of performance out of the SKU, automakers have started to consolidate how many different tiers of semiconductors they want and that has helped us quite a bit as well. So we tend to see automakers pick higher-end semiconductor peers and then would like to reuse that same platform as much as possible across as many tiers as possible.

As a result, Qualcomm is one of the fastest-growing chip manufacturers in the auto space. The company’s 2022 estimate was that the market for chips in autos would reach a total addressable market (“TAM”) of $100 billion by 2030. The company’s Chief Executive Officer (“CEO”) Cristiano Amon said on the second quarter earnings call:

In automotive, the Snapdragon Digital Chassis is the industry’s leading technology solution, and we’re pleased to announce that our design win pipeline has increased to approximately $45 billion. We’re growing faster than the addressable market and remain on track to achieve more than $4 billion of automotive revenue in fiscal ’26.

Suppose Qualcomm does reach $4 billion of automotive revenue by 2026; the company will have penetrated only 4% of its projected 2030 TAM. So, the company’s opportunity in autos is still very early. There is little question that automotive has significant potential upside for Qualcomm.

An excellent quarter

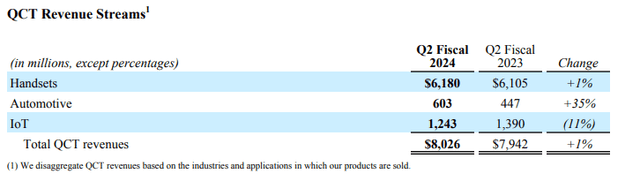

Qualcomm Second Quarter FY 2024 Earnings Presentation.

Qualcomm reports revenue in two segments: QCT (Qualcomm CDMA Technologies) and QTL (Qualcomm Technology Licensing). Since 85% of its revenue comes from the QCT segment, much of the reason the stock rose post earnings is the positive sentiment for the prospects for QCT revenue streams. I have not mentioned the Internet of Things (“IoT”) revenue stream until now. Management also didn’t talk much about IoT during the earnings call, most likely because the IoT market is still at the bottom of a cyclical downturn, as shown by the 11% year-over-year loss in the above table.

While IoT is down, the company is positioning itself for a leadership position in the numerous revenue streams that it reports as IoT revenue. The only revenue stream that reports under IoT that I talked about so far in this article was PCs, which are already on the rebound. Other revenue streams under IoT include Edge Networking, Industrial applications of IoT, and XR [extended reality], which are things like virtual reality, augmented reality, and mixed reality. During the second quarter earnings call, CEO Cristiano Amon said, “We’re very pleased with the continued progress on our growth and diversification strategy. Beyond handsets, we have established leadership positions across automotive, XR, and networking, and we are well-positioned to do the same in PCs, industrial, and Edge AI.” Some analysts believe that the IoT market is due to rebound in 2024. Analysts at IOT Analytics forecasts the IoT market to grow at a CAGR of 17% until 2030. I will discuss IoT more in future articles on Qualcomm, as I expect this area to diversify the company away from smartphone (handset) revenue over time and become a significant source of growth.

Handsets are currently Qualcomm’s largest revenue source. In the second quarter of FY 2023, handset revenue declined 17% year-over-year. The prospects for handsets have bottomed, and it looks like they are coming out of a cyclical downturn. Second quarter FY 2024 handset revenue grew 1%, boosted by 40% growth in the Chinese market. Although its handset revenue growth in the second quarter of FY 2024 isn’t blazing hot, it represents hope that smartphones are starting a new upcycle. Automotive is Qualcomm’s fastest-growing revenue stream at 35% in the second quarter, and investors are beginning to notice as the company continues gaining market share. Total second quarter FY 2024 QCT revenue was up 1% year-over-year, compared to being down 17% in the second quarter of 2023.

Qualcomm Second Quarter FY 2024 Earnings Presentation

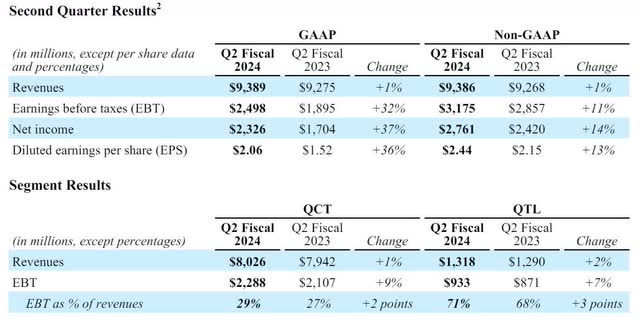

Qualcomm’s annual revenue has only grown by 9.6% CAGR over the last five years, and analysts project revenue growth of 7.6% over the next three years. Its revenue growth slowdown over the last several years is partially due to a cyclical downturn in its main handset business, and partially because the handset business has matured. These days, Qualcomm is more of an earnings growth story than a revenue growth story.

Qualcomm Second Quarter FY 2024 Earnings Presentation

The above table shows a metric called EBT (earnings before taxes), which the company uses because it operates in many different tax jurisdictions. EBT shows the company’s core profitability before the effect of taxes, making profitability numbers comparable across various periods. The table shows the company grew EBT in the second quarter of FY 2024 by 32% year-over-year, substantially better than in the second quarter of 2023 when EBT dropped 45% to $1,895. In the second quarter of FY 2024, the EBT margin was 29%, a gain of 200 basis points from the previous year’s comparable quarter. Qualcomm produced non-GAAP diluted EPS of $2.44, above the company’s guidance of $2.20 – $2.40. Next, let’s look at guidance.

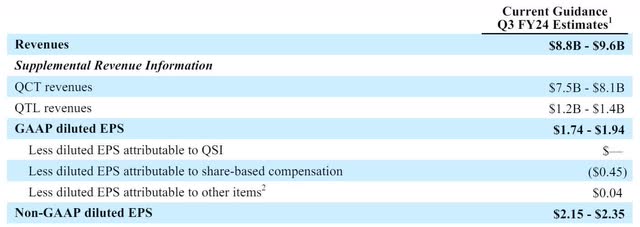

Qualcomm Second Quarter FY 2024 Earnings Release

The company guided for revenue in the range of $8.8 billion to $9.6 billion ($9.2 billion at the mid-point) and non-GAAP diluted EPS in the range of $2.15 to $2.35 ($2.25 at the mid-point). This guidance beat consensus analyst expectations for revenue of $9.1 billion and EPS of $2.17. The better-than-expected earnings beat in the second quarter and guidance above analysts’ expectations were likely one of the primary reasons investors bid the stock up post-earnings.

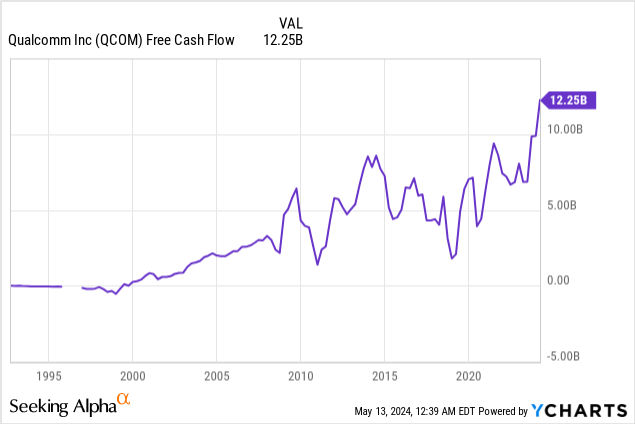

Qualcomm exited the second quarter with $13,851 in cash and short-term investments and $14,543 in long-term debt. Its net debt to EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is 0.52, which tells an investor that Qualcomm can pay down its current and long-term debts. The company has an interest coverage of 13.60, meaning it is in a solid position to pay down the interest on its debt. The chart below shows the company generated $12.25 billion in trailing 12-month (“TTM”) free cash flow (“FCF”).

Qualcomm used some of that rapidly expanding FCF to repurchase $731 million in stock and pay shareholders $895 million in dividends in the second quarter. The company also raised quarterly dividends from $0.80 to $0.85 per share.

Risks

One significant risk for Qualcomm is that the U.S. or Chinese government will restrict its business in China. For example, on May 8, 2024, it lost its export license to supply Chinese company Huawei with mobile phone chips. Restrictions on business with other Chinese mobile phone or consumer electronics manufacturers could hurt the company’s revenue and earnings growth.

Another risk is that some of its customers are starting to vertically integrate their operations, meaning they are building or acquiring capabilities to manufacture chips for their devices, removing the need for Qualcomm chips. Apple is one example of a company slowly removing Qualcomm from its supply chain. Another example is Samsung, which is starting to use its own Exynos chips on its latest smartphones. The Exynos line of chips is competitive with Snapdragon chips. If other customers decide to integrate vertically, its business could face problems. This risk of existing smartphone customers vertically integrating makes it imperative for Qualcomm’s efforts to diversify into autos and IoT to succeed.

Last but not least, Qualcomm is a magnet for regulators who have investigated its licensing practices in the past, and some regulators still don’t like its business practices. The company also gets its share of lawsuits from other companies, with the most famous example being Apple’s lawsuit. Most recently, Qualcomm got into fisticuffs with Arm Holdings (ARM) in the courtroom. While Apple and Qualcomm agreed to settle, its dispute with ARM holdings remains ongoing.

Valuation

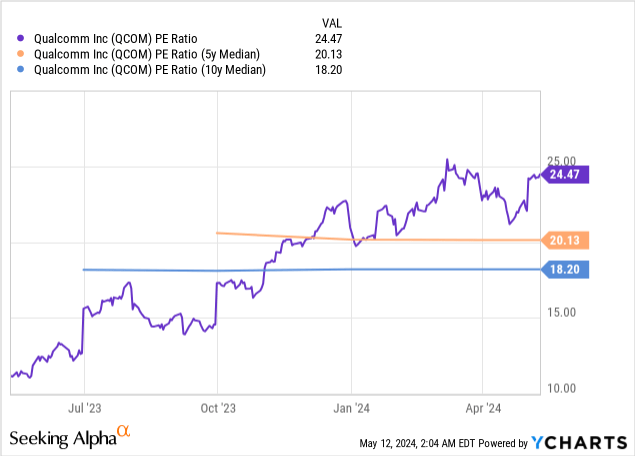

Qualcomm’s valuation is somewhat mixed. Depending on which valuation metrics a person uses and how a person interprets them, you can argue that the market is overvaluing or undervaluing the stock. The chart below shows that the company sells at a GAAP (Generally Accepted Accounting Principles) TTM price-to-earnings (P/E) ratio of 24.47, above its five- and ten-year median P/E ratio, suggesting overvaluation. However, according to Seeking Alpha Quant, it is trading below the Information Technology sector P/E GAAP TTM median of 29.69, suggesting undervaluation relative to its sector.

The following table shows that Qualcomm’s forward P/E is above its projected year-over-year growth rate for this fiscal year and next fiscal year, suggesting investors may overvalue the stock’s projected growth. However, analysts have continued to revise these estimates up since August 2023, and the actual EPS growth rates for fiscal 2024 and 2025 may be higher than the consensus analyst estimates and the forward P/E. The market may undervalue the stock if the actual growth rates turn out to be higher than the current forward P/E. For instance, suppose Qualcomm hits the high EPS estimate of $12.71 for fiscal 2025; earnings would grow around 28% over fiscal 2024 earnings. If Qualcomm traded at a 2025 forward P/E equal to a growth rate of 28%, the stock’s fair value would be $355.88, which is 95.50% above the company’s May 10 closing price of $182.08. In that case, the market would undervalue Qualcomm’s potential future earnings. So, this company is an earnings growth company. If you believe the company can generate significant future earnings above analysts’ consensus earnings expectations, the stock has substantial potential upside over the next several years. The more investors see earnings surprise to the upside and management’s EPS guidance rise, the higher this stock will go. I believe the stock’s fair value aligns with a 2025 forward P/E of 28 or $355.88.

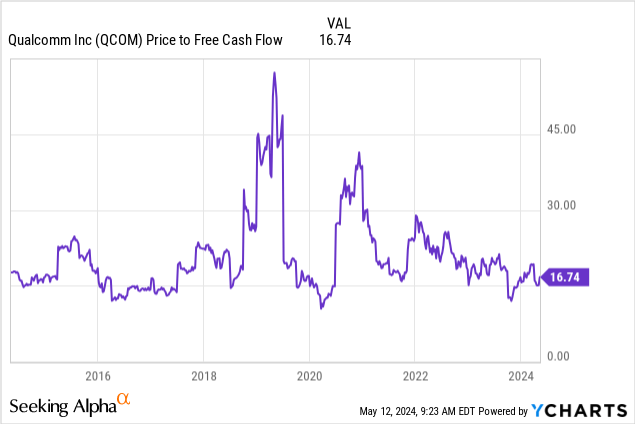

Qualcomm sells at a price-to-FCF of 16.74, near the bottom of where it has traded over the last ten years. Its ten-year median is 18.04. I use the median instead of the average, as the median is less sensitive to extreme highs or lows in value. For instance, using the ten-year median reduces the influence of Qualcomm’s P/FCF spiking in 2019 due to the start of commercialization of 5G and spiking around 2021 due to regaining chip content within Apple’s iPhone series, both one-time events. Qualcomm trading below its ten-year P/FCF median suggests that the market may undervalue the stock at current prices.

Let’s look at what the current price implies regarding Qualcomm’s FCF growth over the next ten years using a reverse discounted cash flow (“DCF”) analysis. When I did my last reverse DCF on Qualcomm, I assumed a terminal growth rate of 3%, the long-term average of U.S. Gross Domestic Product (“GDP”).

Reverse DCF

|

The first quarter of FY 2025 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$9877 |

| Terminal growth rate | 3% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 6.5% |

| Stock Price (March 26, 2024, closing price) | $169.30 |

| Terminal FCF value | $19.097 billion |

| Discounted Terminal Value | $105.180 billion |

| FCF margin | 27.24% |

However, in my first Qualcomm reverse DCF in my previous article, I underestimated the company’s potential long-term FCF growth in my first article. I think AI usage is only at the beginning of a secular trend. Qualcomm’s positioning to become a leading AI player on local devices, including smartphones and PCs, means it has an excellent chance to grow faster than the average GDP growth rate in perpetuity. Therefore, the following reverse DCF assumes a terminal growth rate of 5%.

Reverse DCF

|

The second quarter of FY 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$12,253 |

| Terminal growth rate | 5% |

| Discount Rate | 10% |

| Years 1–10 growth rate | 2.0% |

| Stock Price (May 10, 2024, closing price) | $182.08 |

| Terminal FCF value | $15.683 billion |

| Discounted Terminal Value | $120.931 billion |

| FCF margin | 33.64% |

Using the assumptions in the table above, Qualcomm only needs to grow FCF by 2.0% over the next ten years. Analysts estimate EPS will grow at a CAGR of around 16% over the next five years. I think the company can translate enough of its EPS growth to achieve FCF growth of more than 2% over the next ten years, easily justifying today’s stock price.

The stock remains a buy

If you are a growth investor looking to benefit from the auto industry’s ongoing digital transformation and a potential rebound in the smartphone, PC, and IoT device markets, consider investing in this potentially undervalued stock. Qualcomm should also be a massive beneficiary of generative AI applications moving to local devices. I reiterate my Buy recommendation for Qualcomm.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SWKS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.