Summary:

- Robust economic moat upholds Starbucks’ dominance amid market challenges and fierce competition, particularly in China.

- Its economic moat supports Starbucks amid a 4% global same-store sales decline and intensified competition in China.

- The management adjusted 2024 revenue projections to low single-digit growth due to prevailing market conditions and operational challenges.

- Implementing a turnaround plan focused on service efficiency and digital enhancements to regain and boost market traction.

monticelllo

Investment Thesis

Despite challenges, including a downturn in same-store sales and increased competition, particularly in China, Starbucks Corporation (NASDAQ:SBUX) maintains its market strength through a solid economic moat. The company’s global presence ensures consistent customer experiences, fostering brand loyalty. Initiatives in digital transformation and sustainability also support preserving its competitive edge.

The recent financial setbacks have undoubtedly led Starbucks to adjust its 2024 revenue outlook to low single-digit growth. In response, a turnaround plan focuses on enhancing service efficiency, improving digital engagements, and extending operating hours.

Finally, Starbucks’ strategic efforts aim to effectively navigate current market challenges, positioning it for long-term success. An economic moat is also a critical defense mechanism for Starbucks, ensuring its market position, safeguarding margins, and expanding its stronghold amid fierce competition in key markets like China.

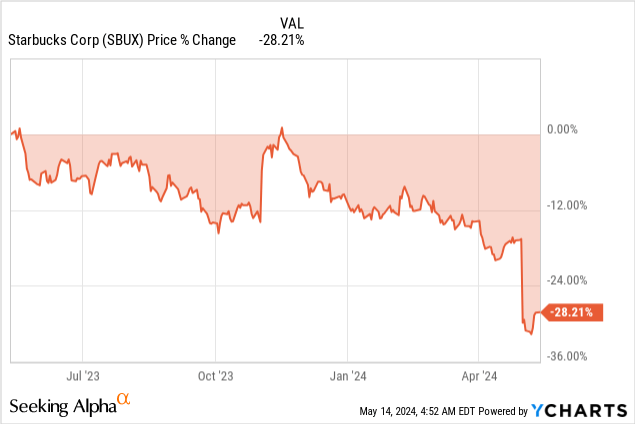

With SBUX now trading around its 52-week highs and the stock has already taken a beating, I’ve taken a small position in the company to play the durability of its strong brand moat. Starbucks’s long-term, entrenched market position, strong global brand recognition, and consistent customer experience suggest it is poised to continue delivering superior results compared to most of its rivals. Lastly, as the market fluctuates, I plan to capitalize on price dips to increase my stake incrementally.

Sustaining Global Dominance Through Strategic Innovation and Market Adaptation

Starbucks is one of the firms that has never relented in trying to show the public a uniform and supreme experience, hence defending and honoring its position in the market share.

Having thus far focused on details with a great sense of strictness when it comes to operational standards, a visit to any of Starbucks’ cafes worldwide will guarantee uniformity with the Starbucks brand. This inculcates intense brand loyalty and repeat customers in the defense of the competitive advantage and defense of market share that Starbucks has managed to fend off over competitors.

Further, the company plays a further part in creating such a market position through its pioneering strategic initiatives such as digital transformation and sustainability. It keeps Starbucks relevant with technology and a step ahead in light of an emerging consumer trend toward eco-friendly, socially responsible brands, which becomes attractive to a broader potential customer base.

Preserving Margins

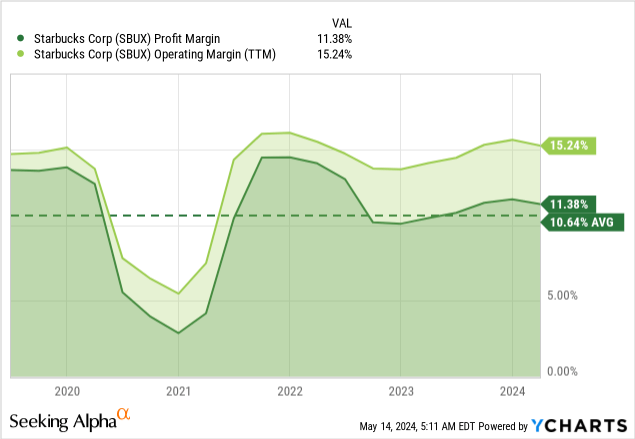

Given the growing competition and dynamism in the market, margin protection has become a very important issue for Starbucks. In such a situation, the company’s economic moat plays out, and Starbucks can command premium pricing over the products and services of its competitors. An emphasis on quality, innovation, and premiumization that drives Starbucks means that consumers pay a premium for a Starbucks experience, hence protecting margins in the face of competitive pressures.

In fact, Starbucks embraces the business model for a vertically integrated supply chain, with direct sourcing of coffee beans and proprietary roasting techniques that provide further cost efficiencies and quality control measures to help preserve the company’s margins. Hence, Starbucks has massive control over a large part of the supply chain, externalizing risks and maintaining stable margins despite market volatility.

Strengthens Its Grip on China’s Market

So, while China is a growth market for Starbucks, it is also a hub of competition for local and international players alike. However, Starbucks has enough economic moat to keep competition at bay and maintain its strong position in China.

With localization, product adaptation, and strategic alliances, Starbucks deepens its foothold further in the market, making it more difficult for other players to challenge its leading position. The continuous focus on understanding and adapting to local consumer preferences, coupled with the brand cachet and operational excellence, reasserts Starbucks as the preferred Chinese brand.

Lastly, its digital prowess and spending on technology-centric solutions, such as its mobile order and payment system, drive customer engagement with the brand and encourage loyalty, further cementing its positioning in the Chinese market.

Starbucks Faces Headwinds but Remains Resolute in Strategy

Those results set a pessimistic tone for the company’s second-quarter earnings report. Specifically, the same-store sales fell by 4%, and traffic to its cafe stores declined by 6%. In contrast, Wall Street was looking for growth in same-store sales to be 1%. Similarly, in the US, same-store sales were off 3%, hurt by a 7% decline in traffic into the store, setting up the second quarter in which the company floundered in the home market. In the international market, same-store sales were down by 6%, and same-store sales in China dropped by 11%, fueled by an 8% decline in average ticket prices.

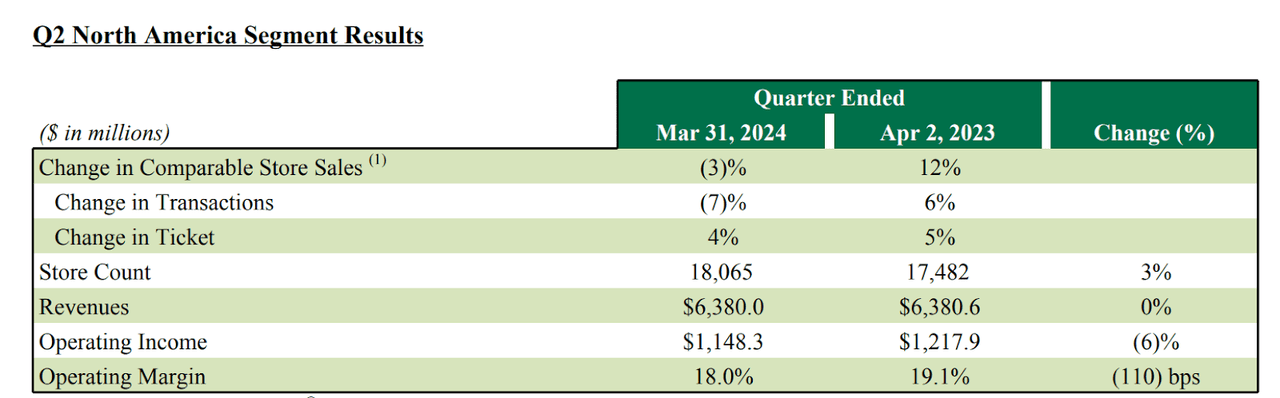

In a quarter when most other retailers reported a general decline in same-store sales, Starbucks posted $8.56 billion, down 2% year over year, missing consensus estimates of $9.13 billion. This was the first time since 2020 that the company had posted a decline in sales. However, net revenues in North America remained flat at $6.4 billion, even as comparable transactions fell 7%. Operating income in North America dropped to $1.1 billion from $1.2 billion a year ago, as operating margins shrunk from 19.1% to 18%.

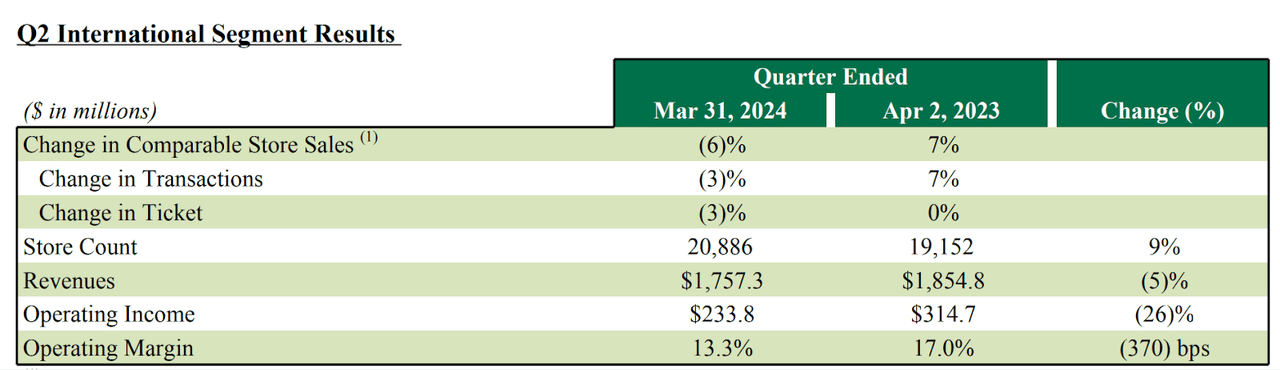

Additionally, in the international segment, China again led the revenues down by 5% to $1.8 billion, reflecting a 5% unfavorable impact from foreign currency translation. Operating income in the segment was $233.8 million, compared with $314.7 million a year ago.

On the other hand, the non-GAAP earnings per share were down 8% from a year earlier and came in at $0.68 per share; however, the EPS missed the analysts’ consensus estimate of $0.79 per share by a big margin. Net income in the quarter dropped to $772 million from $908 million reported in the same quarter last year. The decline in operating margin was by 240 basis points to 12.8%, which happened to be under the backdrop of incremental investments in store partner wages and stepped-up promotional activities.

Gloomy 2024 Outlook

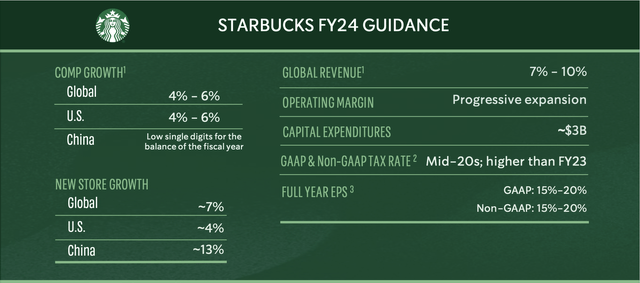

A challenging microenvironment combined with headwinds in China has forced Starbucks to lower its revenue outlook for the full year. The company now expects revenue to grow in the low single digits, compared to the previously estimated growth of 7% and 10%.

The company also expects it US same-store sales to grow by the low single digits to flat, from a previous forecast of between 4% and 6%. Its struggles in China should persist, with the company expecting same-store sales to decline by the single digits from the last single-digit growth. Earnings per share are expected to remain flat for the year or grow to low single digits, down from a previously anticipated climb of between 15% and 20%.

Starbucks Revamps Strategy to Boost Customer Experience and Drive Growth

Faced with deteriorating financial results, management has confirmed they are working on a turnaround plan aimed at reinvigorating the company’s growth metrics. Part of the strategy entails speeding up service during the morning when they receive the most customers. By enhancing customer service, Starbucks hopes to retain its loyal customers and attract more customers amid stiff competition.

In recent months, Starbucks has been hit with customers abandoning their orders because of long wait times and unavailability of menu items. In a bid to address the issue, the company is fine-tuning its apps to allow customers to order without necessarily being loyal customers. The move should incentivize more occasional customers to return to the outlet more often and take advantage of the rewards always on offer. Offering occasional customers the ability to share their experiences with friends and family is also expected to drive in more customers and retention rates.

Starbucks is also exploring ways of meeting its overnight demand between 5PM and 5AM, having already conducted a pilot test. Extending the time outlets are open ensures Starbucks serves as many customers as possible, addressing the 7% decline in transactions in the recent quarter.

The company hopes to improve supply chain issues and ensure customers can always access hot food and beverages using the app. It plans to push personalized promotions for customers visiting stores to entice them to purchase more. It’s also ramping up supply chain investments to ensure the most popular products end up in customers’ hands promptly, without any delays.

Finally, Starbucks employs various information technology instruments to oversee its supply chain operations. For instance, it uses enterprise resource planning (ERP) to monitor and control inventory levels. The business also uses cutting-edge analytics tools to track customer demand and performance. Finally, Starbucks intends to roll out new food and beverage options to strengthen its competitive edge. Hence, part of the plan entails introducing an energy drink and one tapioca-style pearl to entice customers back to the stores, especially in the afternoon after a long day of work.

Starbucks Navigates Rising Competition in China’s Evolving Market

The 11% decline in sales in China can be attributed to stiff competition, which remains the most significant risk for the giant coffee chain. In addition, foot traffic in Chinese stores is declining, dropping by 8% in fiscal Q2 as the average ticket size fell by 4%.

The decline in foot traffic and sales is due to the number of branded coffee shops ballooning by 58% in just one year, all piling pressure on Starbucks. A decline in sales in China comes from rivals stepping up efforts through promotions and aggressive pricing strategies to try and undercut Starbucks.

Luckin Coffee (OTCPK:LKNCY), a formidable rival of Starbucks, has dramatically increased its presence by doubling its outlets across China. Similarly, ChaPanda, a local powerhouse with 8,000 shops, is intensifying the competition for Starbucks. Moreover, international chains like KFC, owned by Yum China (YUMC), and McDonald’s (MCD), are capitalizing on China’s growing coffee market, adding to Starbucks’ competitive pressures.

Therefore, the fierce competition in China has been exacerbated by customers grappling with a harsh economic environment. The Chinese economy has struggled to bounce back following the COVID-19 pandemic, making it difficult for Starbucks to push products into the market. Nevertheless, Starbucks is offering more beverages tailored for the Chinese market to counter the pitfalls of stiff competition in China.

Bottom Line

Starbucks’ latest earnings results underline a company facing challenges in a highly competitive marketplace amid deteriorating macro conditions. Nevertheless, the company has embarked on a turnaround plan to reinvigorate traffic levels in its café stores. The giant is also fine-tuning its app and offering more deals in the US to attract more customers. In China, it is working on tailoring its offerings to the market. Even though the strategic efforts could take some time to have an impact, the company is still on the right track and remains a solid long-term play.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SBUX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.