Summary:

- With customers forecasting modest growth, Nvidia Corporation’s Q1 ’25 earnings release is crucial for the market’s direction, with the potential to drive the bull market or trigger a bear market.

- Nvidia intends to ramp up production of Spectrum-X in Q1 ’25 and H200 in Q2 ’25, both potentially driving significant revenue growth across their hyperscaler customers.

- Despite a challenging macroeconomic environment, I expect demand for GenAI applications to drive growth for Nvidia as businesses seek to optimize ops through automation.

Just_Super

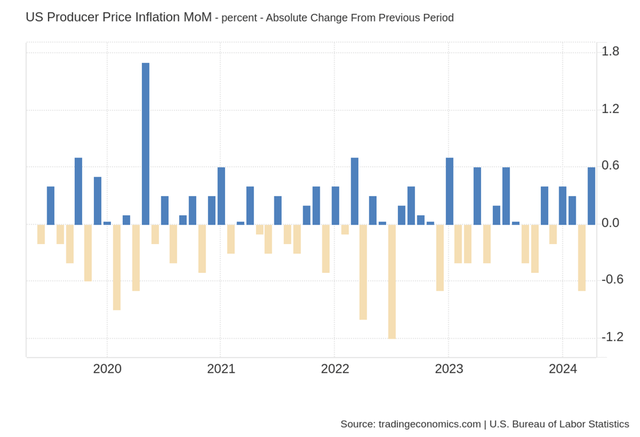

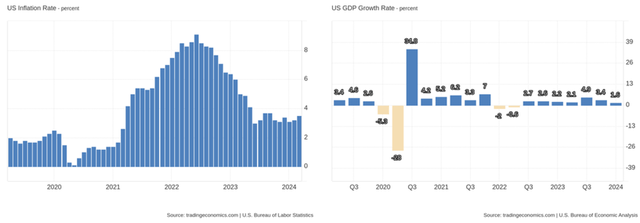

Nvidia Corporation’s (NASDAQ:NVDA) upcoming (expected post-market May 22nd) Q1 ’25 earnings release may be the most important data release this year and may be the leading driver to the continued bull market or result in the next bear market. With inflation readings coming in hotter than expected and Super Micro Computer (SMCI) reporting a less than spectacular forecast in their fiscal Q3 ’24 earnings call, Nvidia may very well be the next foot to hit the ground and send the broader indices into a spiral.

Given AI/ML’s importance for the next generation of compute and networking in the data center, I believe Nvidia’s Hopper technology success is what will make or break the market. Despite SMCI’s modest forecast, Dell Technologies (DELL) and Hewlett Packard Enterprise (HPE) have each experienced significant backlog growth relating to AI-enabling infrastructure. Sourcing NVDA’s GPUs has been a major bottleneck due to the vast demand, making me hopeful for Nvidia’s eFY25 growth. Given the continued growth of demand for Nvidia’s GPUs, the manufacturing de-bottlenecking at Taiwan Semiconductor (TSM) at the end of CY24, and the seeding adoption of GenAI across enterprises, I believe Nvidia will continue its accelerated growth path and will realize significant strength going into eFY26. I, therefore, will upgrade my BUY recommendation to a STRONG BUY with a price target of $1,451/share at 18.35x eFY26 price/sales.

Nvidia Doesn’t Need China For Growth In AI Chips

Nvidia & Industry Investment Thesis Theme

My investment thesis is based on two themes for CY24-25 in the face of dimming macroeconomic landscape. My two themes for technology are consumer vs. enterprise and enterprise vs. hyperscaler. Starting with consumer vs. enterprise, I anticipate the technology sector to be driven primarily by commercial use of next-generation AI-enabling technologies. My expectation for the coming years is that compute infrastructure in the data center will continue to realize significant growth as firms seek to leverage internally generated data for business optimization and administrative automation.

I anticipate that networking, or data in motion, would follow suit, with endpoints being the final growth component. Given that Dell & HPE have each voiced flat trends for legacy data center infrastructure and a challenging market for endpoints and networking while AI-infrastructure is building, I anticipate that next-generation networking and workstations will follow AI-enabled data center infrastructure. My rationale is based on the idea that enterprises wouldn’t spend on AI-infrastructure for it to be slowed down by their networking capabilities or lagging PCs/workstations.

Part of my assumption is based on enterprises seeking to minimize operating costs as firms are faced with persistent inflationary pressures, allowing organizations less of a necessity to pass along more costs to the consumer.

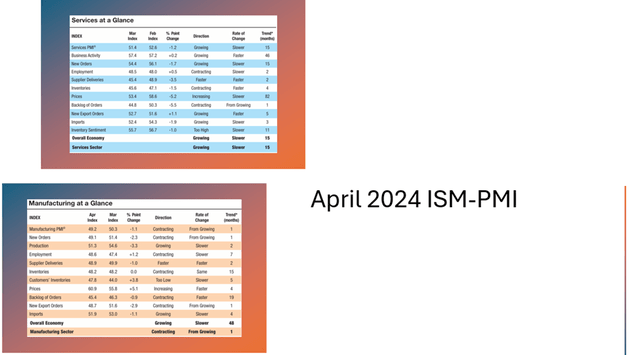

In addition to challenging inflationary pressures, April PMI readings suggest that business activity is forecast to be slowing down 6–12 months out. Though these readings aren’t exactly directed towards the technology sector, they may pressure firms to delay infrastructure-related projects to manage costs and maintain headcount in hopes of a turnaround.

Given that the trends for Services-PMI have narrowed closer to contractionary territory, a <50% reading in the coming months might mark a turn for GDP growth going into the end of the year. This would solidify my technology investment thesis.

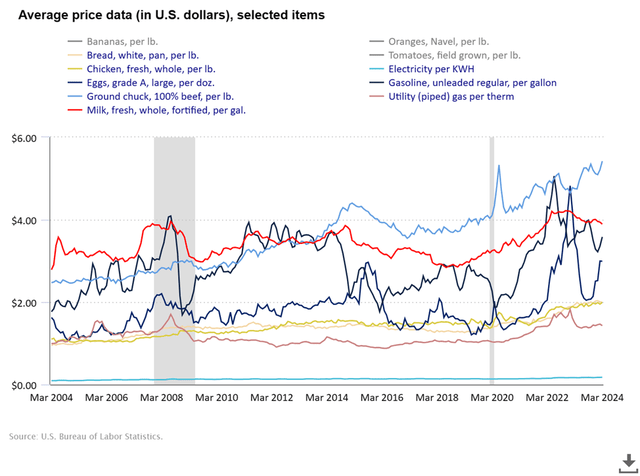

On the consumer side, I anticipate a challenging market for AI PCs and smartphones as consumers are faced with harsher inflationary pressures through the daily cost of living expenses. As devices are a discretionary expense, I anticipate the refresh cycle to be elongated in favor of managing cost of living expenses.

Considering my second theme, enterprise vs. hyperscaler, I anticipate that early adoption of GenAI applications will reside in cloud-based environments before migrating to private data center environments. Given the challenges faced in sourcing Nvidia GPUs due to production capacity, I believe enterprises will seek to test drive applications in cloud-based environments as a POC; however, given the consumption models that are broadly being adopted by firms like Snowflake (SNOW), I anticipate enterprises will inevitably seek to reduce data consumption-related costs by in sourcing their AI/ML applications in the coming years.

In the near-term, this should benefit the hyperscalers like Oracle OCI (ORCL), Microsoft Azure (MSFT), Amazon AWS (AMZN), and Google GCP (GOOG, GOOGL) as regional data centers are built out. I do anticipate that as Nvidia’s GPUs become more readily available, enterprises will advantageously build out their AI-enabled infrastructure and in source their hot data, assuming feasibility and costs are aligned to benefit from in sourcing. In this instance, Nvidia will benefit greatly from investments at both ends, from the hyperscalers and the enterprises in the years to come.

Nvidia’s Growth Prospects

As alluded to in the header, Taiwan Semiconductor (TSM) will be doubling their CoWoS capacity for manufacturing high-performance semiconductors towards the end of 2024, which should de-bottleneck the supply chain for these highly sought-after hardware components. As capacity comes online, I anticipate Nvidia’s data center sales to accelerate towards the tail end of eFY25 and into eFY26.

This may also be bolstered by the next wave of refreshes as Nvidia ramps up production of H200 and Spectrum-X to offer end-to-end, high-performance computing and networking. Given that the H200 nearly doubles the performance of the H100, I believe that hyperscalers will quickly adopt these next-generation GPUs to remain at the forefront of the continuous improvement of ChatGPT with the most recent release of GPT-4o and to-be-released AGI. My growth assumption is based on the fastest network getting the business at the hyperscaler level, meaning a tandem investment effect across all major hyperscalers to ensure customer retention. I believe this will drive the transition to Nvidia’s recently announced Blackwell GPU architecture, as the platform commands faster processing speeds at up to 25x lower cost and energy consumption when compared to its predecessor. Given that power consumption is one of the biggest hurdles faced across AI factories, I anticipate energy efficiency to be a major factor when weighing platform options. Accordingly, H200 is expected to begin shipping in eq2’25 and Spectrum-X in eQ1 ’25.

Even a simple ChatGPT request uses nearly 10 times more electricity than a regular Google search

International Energy Agency.

Whether enterprises adopt H200 vs. H100 will be entirely dependent on necessity and feasibility. Though I anticipate hyperscalers to quickly migrate to the newer technology platforms, I anticipate enterprise environments to be drawn to the H100 as the processing capacity may be sufficient for this type of environment, especially when compared to CPU-level compute rates.

Looking at Nvidia’s other segments, including gaming, automotive, and OEMs, I anticipate a relatively less dynamic growth cycle when compared to data center with flattish results. With the consumer technology spend assumption outlined above, I believe gaming and automotive to be reflective of this trend. One of the biggest factors for automotive is the transition away from EVs towards more traditional ICE and hybrid vehicles, which are less technology-driven when compared to the more advanced EVs, excluding the infotainment and ADAS systems. I anticipate these segments to remain relatively flat throughout eCY25, with a ramp-up beginning in eCY26.

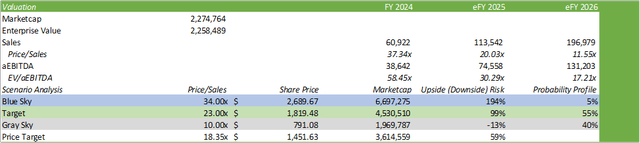

Nvidia Financial Forecast

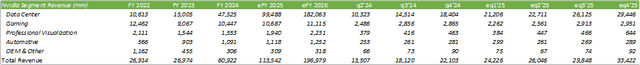

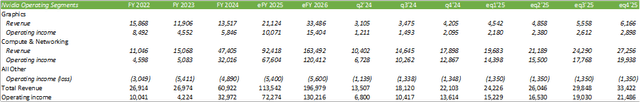

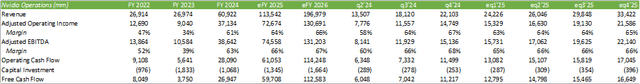

Looking ahead through eFY26, I anticipate significant revenue growth as new manufacturing capacity comes online at TSM.

I believe this will drive capacity availability for Nvidia’s hardware, which will result in continued heightened revenue generation. I anticipate that this will also drive margin expansion to a certain degree through economies of scale, especially with the ramp-up of the H200. Given the broadening adoption of GenAI applications, there are impediments to Nvidia’s ability to grow operations at this rate.

Bull Case For Nvidia

Nvidia has numerous positive catalysts working for them as new capacity comes online towards the end of CY24. I anticipate both new capacity and the adoption of the firm’s next line of GPUs will drive significant growth at the top line and enhance margins through scaling. As hyperscalers gear their data centers to the H200 and Blackwell platform and enterprises begin building out their internal AI applications, Nvidia will have the opportunity to realize significant growth through continued adoption. I anticipate that hyperscalers’ adoption of faster networking speeds with Spectrum-X will follow suit in the coming years.

Additionally, if inflationary pressures for consumers wind down paired with moderating interest rates, I believe that consumers will have more spending flexibility, allowing for investments in AI-enabled PCs, handhelds, and the potential move towards EVs or plug-in hybrids. Though I don’t anticipate this to occur in the near-term, this may lead to a certain degree of reinvigorated growth in eFY26-27.

Bear Case For Nvidia

I believe that a bear case for Nvidia will primarily be driven by macroeconomic forces as a result of lower spend at the enterprise and consumer levels. Given that hyperscalers are flush with cash, I do not anticipate a reduction in spend, as having the highest performing infrastructure drives business for these firms. Statista forecasts smartphone sales will grow at a 3.53% CAGR through 2028 with 2024 revenue to sit at roughly $500b. Given that China will be phased out as Huawei more heavily utilizes internally developed chips, I anticipate that the throttled models Nvidia is developing for sales in China will result in lackluster results. Any signs of a slowdown in growth will have serious implications to the share price, leading me to more heavily weigh my bear case in the valuation table in the next section.

Valuation & Shareholder Value

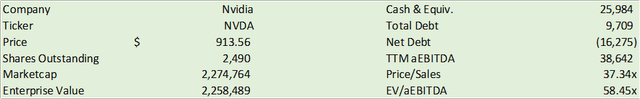

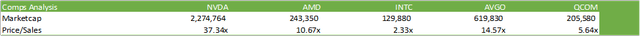

NVDA shares are currently valued at 37.34x trailing sales.

On a comps basis, NVDA shares trade at a relatively high premium; however, I believe this premium is justified given the firm’s significant growth as realized in the previous year. Given my forecast through eFY26, NVDA shares trade closer to 11.55x eFY26 sales, a more modest valuation on a comparable basis. Given the risk of a slowdown in growth, I believe it is prudent to more heavily weigh the bear case for NVDA shares, as any sign of a slowdown may result in a significant decline in the share price.

Despite this factor, I believe NVDA has a strong forward trajectory given the broad investment outlay across hyperscalers followed by enterprises as further adoption of GenAI takes hold. I rate NVDA with a STRONG BUY with a price target of $1,451/share at 18.35x eFY26 Price/Sales.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.