Summary:

- Palantir’s stock dropped after Q1 2024 earnings due to lower-than-expected Q2 guidance, but the overall growth story remains intact.

- Q1 earnings beat estimates, with increased revenue and net income, and strong growth in customer base and deal values.

- PLTR appears undervalued based on its PEG ratio, and its potential inclusion in the S&P 500 could further boost its stock price.

Michael Vi/iStock Editorial via Getty Images

Introduction

Palantir Technologies’ (NYSE:PLTR) stock price dropped after its Q1 2024 earnings were announced. Interestingly, it was not the earnings themselves that startled investors. Instead, their less-than-expected guidance for Q2 caused the stock to drop by up to 10% on the following trading day. To us, this reaction seems a bit exaggerated. In fact, Palantir raised its outlook for the full year and crossed the $100M net income mark for the first time during Q1.

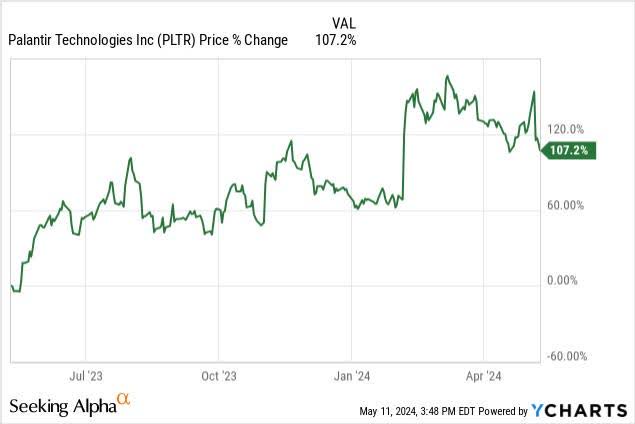

YCharts

Despite the selloff, the stock is still up over 100% in the past year, and we believe the growth story is still intact – there’s still potential for further revenue streams, making Palantir an interesting stock to watch. In this article, we will unpack the key figures from Palantir’s Q1 earnings, evaluate how they compare against the broader sector on several valuation metrics, and explore potential short-term scenarios with a technical analysis.

You are missing the bigger picture if you focus on Q2 guidance

When Palantir reported its Q1 earnings for FY2024 on May 6th, it beat the market’s top and bottom-line estimates. Analysts were expecting an average of $615.3M in revenue and an EPS of $0.077, but Palantir managed to hit $634.3M in revenue and an EPS of $0.08. These might be slightly better than expected, but they’re part of Palantir’s ongoing trend of outdoing market estimates.

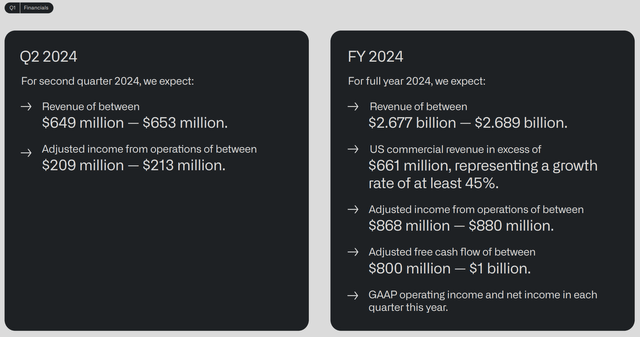

During their Q1 presentation, Palantir set the Q2 revenue expectations between $649M and $653M, with adjusted net income between $209M and $213M. Generally, the consensus was revenues at $653, Palantir’s upper-band estimate. Hoping for figures better than this, the market was disappointed with these projections, triggering the sell-off on May 7th.

Seeing Palantir’s top forecasts only match the middle range of analyst expectations was a bit underwhelming this time. Still, with an adjusted operating income projected between $209M and $213M, Palantir is looking at a healthy operating income margin of around 32%.

Moreover, Palantir has increased its full-year guidance to between $2.677B and $2.689B while aiming for a free cash flow of between $800M and $1B. Despite the Q2 guidance, the strong full-year outlook remains good. While short-term investors may see weakness, there’s a compelling case for those looking at the bigger picture. We’ll get into why later in the article.

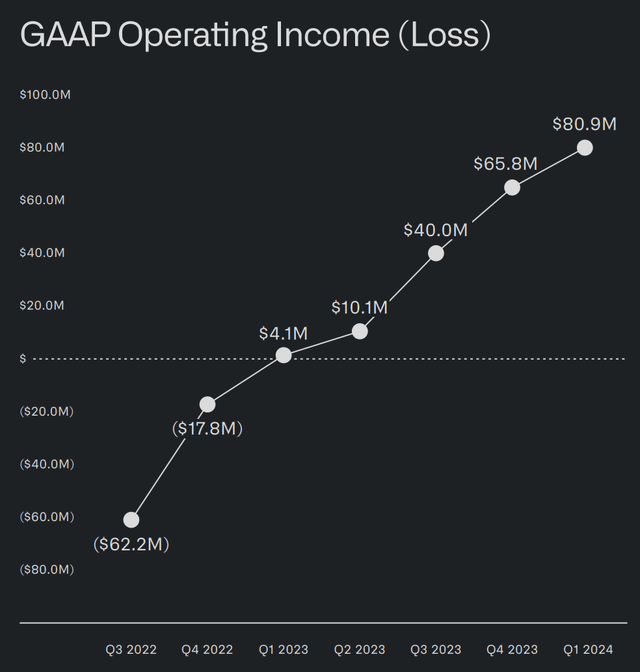

Let’s focus on some of the standout figures Palantir revealed during their Q1 earnings presentation. One particular number jumps out: operating income. Since Q2 2023, Palantir’s operating income has been climbing steadily, reaching just under $81M in Q1 2024. It is key for Palantir to continue increasing its operating income as it continues to grow at a steady pace.

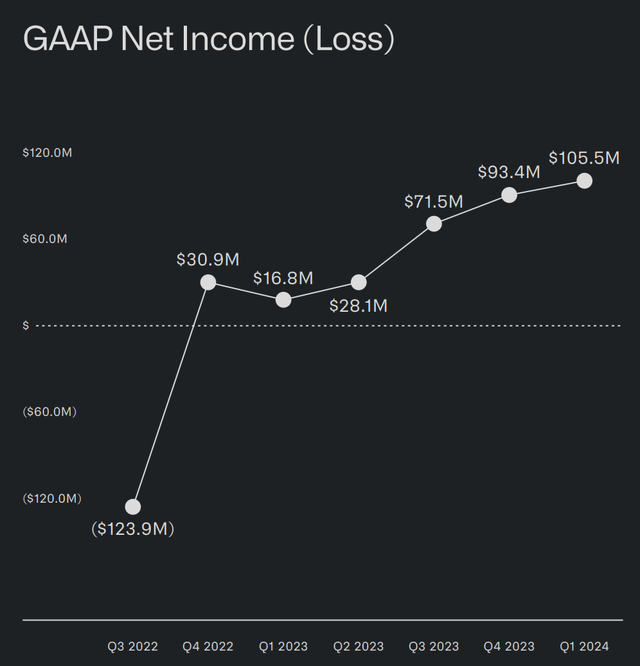

In addition, there is more good news from Palantir this quarter. They’ve crossed the $100M mark in net income, posting a $12.1M increase from Q4 2023. While the percentage growth in net income has slowed, Palantir is still effectively expanding its bottom line. We’re quite optimistic about their financial future and expect to see even stronger performance in the upcoming quarters. It wouldn’t be a stretch to predict that Palantir might even outdo themselves throughout the rest of 2024.

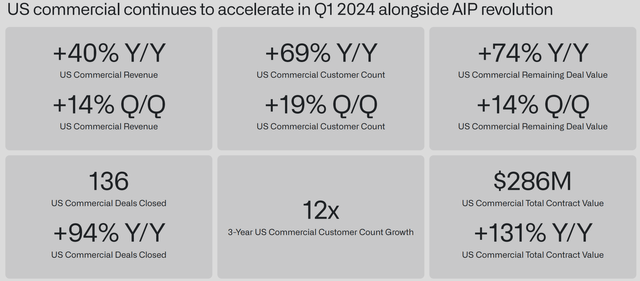

Palantir’s Q1 2024 earnings report has certainly turned heads with some exciting developments, particularly in its U.S. commercial operations. Looking into the details, they’ve posted a stellar 40% YoY revenue growth. This impressive surge highlights a significant increase in market penetration or, perhaps, more effective customer monetization strategies over the last year.

Moreover, the 14% growth from the previous quarter indicates Palantir’s consistent financial performance and suggests its sustainable growth trajectory.

The growth in their customer base is equally noteworthy. With a 69% increase in customer count over the past year, it’s evident that Palantir’s offerings are resonating more widely in the market, leading to a rapidly expanding client base. The 19% QoQ rise in customer numbers is even more encouraging, which shows the sustained demand for Palantir products.

On the deals front, Palantir had some great stats to share from their latest earnings report. It closed 136 US commercial deals, marking an increase of 94% YoY, basically doubling the number of deals in the same quarter from the prior year. The major increase indicated higher operational efficiency and higher demand in the marketplace. The sum of the total contract value of these deals amounted to $286M, accounting for a surprising 131% growth from the previous year. This hints that apart from the increasing number of deals, the contract sizes are growing bigger and, hence, more valuable.

The remaining deal value, which reflects ongoing or uncompleted contracts, has also seen a notable jump – up 74% YoY. The figure is important as it suggests a robust pipeline that could continue fueling healthy revenue streams. In addition, Palantir has achieved a twelvefold increase in customer count over three years, showcasing an aggressive and sustained push to expand its customer base.

These numbers highlight significant and consistent enhancements across revenue, customer counts, and deal values. Palantir’s distinct AIP product sets them apart in the market, a point that CEO Alex Karp has made: “I don’t believe we have competitors. So, I don’t believe we have competition in the U.S. commercial market. I don’t believe in the U.S. government market, we have competition.” This confidence underscores the unique position of Palantir and hints at a clear path ahead for continued, if not accelerated, growth. Given these dynamics, it’s plausible to expect the strong growth figures we’re seeing now to persist and expand well beyond 2024.

Palantir is cheap relative to its PEG ratio

Many Palantir bears point to the company’s high valuation as the main reason for its overall negative sentiment. While that is true, it’s crucial to remember that Palantir is still in its growth phase of the company lifecycle. Therefore, traditional valuation metrics might not be the best to use in this instance.

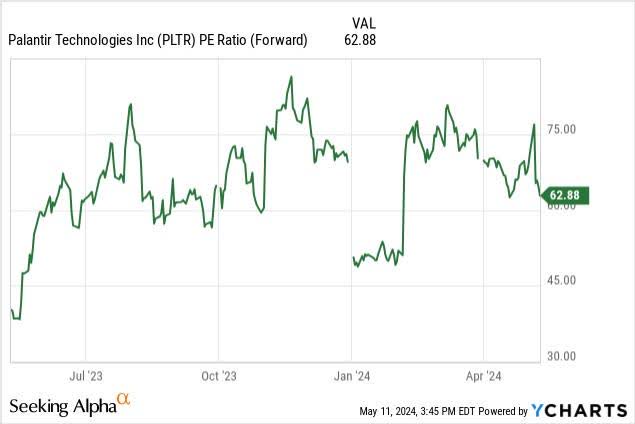

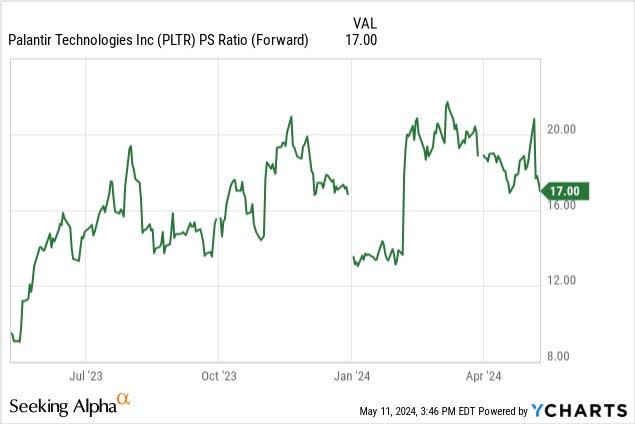

YCharts

The same conclusion can be drawn when looking at Palantir’s forward P/S ratio – the company appears overvalued by this metric as well. However, these ratios often do not capture the potential growth of rapidly growing tech companies, which is important to consider when assessing Palantir’s value.

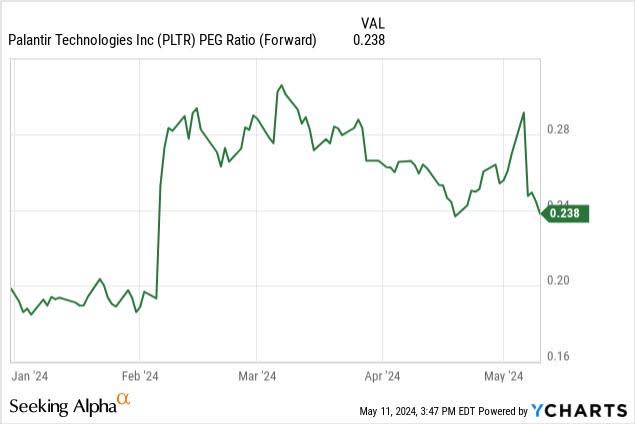

YCharts

However, a more relevant metric for Palantir is the PEG ratio, which factors in the company’s expected earnings growth. When we switch our focus to the PEG ratio, Palantir suddenly appears undervalued compared to normal standards. With a PEG ratio of just 0.238, Palantir is an attractive investment, as PEG ratios below one are generally considered good.

Generally, when the PEG ratio goes below 1, it implies that the stock is undervalued compared to its expected earnings growth. From our point of view, this is an attractive point, as we are paying less money for every unit of growth in earning potential. A low PEG ratio conveys that the stock price does not fully reflect the company’s potential growth.

Peter Lynch (Investors Guide to the PEG Ratio & Finding High Growth Stocks), for instance, noted that a PEG ratio below one usually indicates a stock selling for less than its future earnings growth, which theoretically can yield high returns assuming the company grows as expected. It is very important to realize, however, that the PEG ratio is heavily dependent on the accuracy and validity of the forecasted earnings, apart from not taking into account various elements such as industry and company-specific risks. With that being said, the current PEG ratio is still so small that even a slight inaccuracy would still warrant a cheap valuation based on this metric.

YCharts

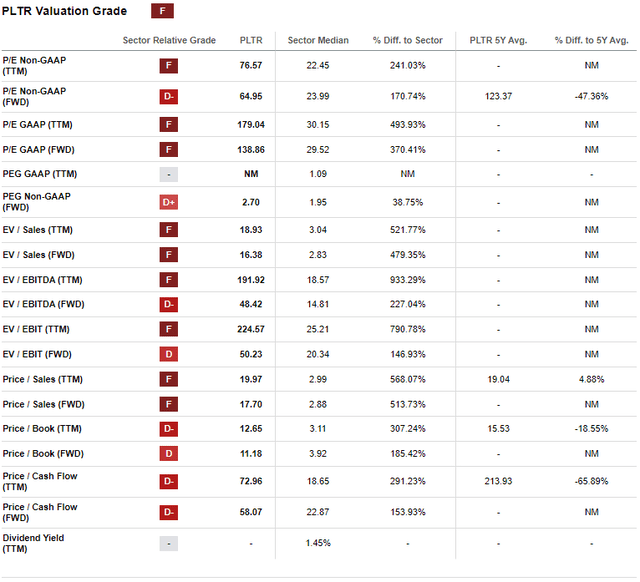

We understand the thinking behind the overvaluation argument, and when looking at Seeking Alpha‘s valuation grades, Palantir definitely stands out for its poor valuation grade. Focusing on the P/E ratios, both non-GAAP and GAAP for TTM and FWD figures are significantly worse than the sector median, receiving ‘F’ grades. Specifically, Palantir’s P/E GAAP (TTM) stands at 179.04 and P/E Non-GAAP (TTM) at 76.57, both much higher than the sector medians of 30.15 and 22.45, respectively. While this could be due to anticipated higher growth or unique competitive advantages, the current market sentiment seems skeptical of these premiums.

Palantir’s valuation is definitely striking when measured by EV relative to EBITDA, with its TTM ratio at a high reading of 191.92, far exceeding the sector median of 18.57. However, its forward-looking figures show a notable improvement to 48.42, which, while still above the sector median, represents a substantially better measure than the rest of the sector.

Our main point is that many valuation metrics suggest that Palantir is generally viewed as overvalued compared to its sector, except for its promising growth-adjusted PEG Non-GAAP (FWD) ratio. We emphasize this metric primarily because it factors in earnings growth, which is crucial for a company that is still growing rapidly.

Is the S&P 500 Inclusion on the table?

Given Palantir’s ability to turn a sizeable profit for the past many quarters, many started wondering if Palantir could be on its way into the S&P 500 index. Palantir already has the required market cap, and with several profitable quarters, it now fulfills all requirements. You can read more about the requirements here.

Palantir’s first step towards inclusion into the S&P 500 started in 2022 when it had its first quarter of profitability with over $30M in GAAP net income. The focus is now on whether Palantir can maintain this profitability, which it has shown it can. It may very well just be a question of time before it happens, with people already asking these questions back in February.

Should Palantir be added to the S&P 500, its stock price could surge significantly. Given the high frequency and volume of the index, stocks generally perform exceptionally well when included in it. This potential inclusion could mark a pivotal milestone in Palantir’s financial narrative, further anchoring its stature in the investment community.

While this is pure speculation and requires a company to exit the index, it is still something to keep a keen eye on going forward. Palantir is, without a doubt, a prime candidate to enter the S&P 500, and not many other companies are currently higher on the list.

Technical analysis

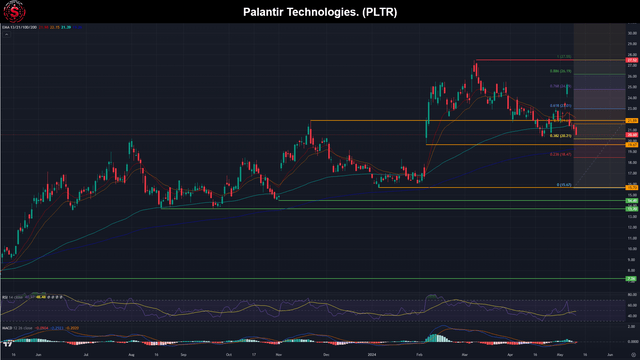

To conclude this article, let’s examine Palantir’s stock from a technical perspective. We’ll examine the chart on a daily time frame stretching back to mid-May 2023.

One of the first things you’ll notice is that Palantir has generally been upward over the past year, and as you can see on the graph in the introduction, it’s, in fact, up over 100% YoY. The stock price has then dropped more than 25% from its March peak of $27.50, and the pullback is likely due to profit-taking, particularly after Palantir’s strong earnings in Q4 2023.

So, where do we stand now? The daily chart has several supportive indicators. A key area to watch is the 0.382 Fibonacci retracement level at $20.21, which is closely aligned with a support level of around $19.70. This creates a supportive confluence and a high-probability demand zone between $19.70 and $20.21.

This technical setup suggests that Palantir’s stock might attract decent buying interest in this price range, potentially stabilizing or reversing the recent downtrend. Investors should monitor these levels, as they could indicate important turning points in the stock’s trajectory.

In addition, it is worth noting that in April, Palantir’s stock price rebounded at the 0.382 Fibonacci level, reinforcing our belief that we’ve spotted a potential demand zone.

If we look at the RSI, it is down significantly in the past week of trading, primarily due to Palantir’s Q1 earnings and poor economic data that came out on May 10th. On top of that, the MACD shows a bearish trend as the fast EMA dips below the slow EMA, with the MACD line itself sitting below zero.

Normally, this would signal that the stock price might drop even further. However, the fact is that this all happened at the same time as a market-wide sell-off triggered by that same economic data. Thus, the dip might be more about algorithm-driven market reactions than any underlying issues with Palantir.

Let us summarize what we see on the chart: with the current price below the 13, 21, and 100-day EMAs, Palantir’s stock might face some short-term challenges. Nonetheless, there’s a strong possibility that major buyers could be eyeing the $20 price area. Should buying activity increase around this level, it could propel Palantir’s stock back above these key EMAs and potentially shift the momentum to bullish again. This setup makes the current price levels an interesting watch for potential opportunities.

Conclusion

In wrapping up our analysis, it looks like the market might have jumped the gun a bit with its reaction to Palantir’s Q2 2024 guidance during its earnings call, especially considering that they actually raised their full-year guidance. Palantir is still on a strong growth trajectory, with increasing revenues and a growing customer base, not to mention their steadily improving bottom line.

Even though Palantir’s stock might seem pricey if you’re just looking at the usual valuation metrics, the PEG ratio tells a different story. This measure is key when assessing a company in its growth phase, and by this measure, Palantir looks quite undervalued compared to others in the sector. This makes it an intriguing option for those thinking about investing.

Also, the $20 price level could be an appealing spot to invest in Palantir. Our technical analysis points to this as a pivotal moment when we will likely see more buyers step in. Despite recent stock price dips, Palantir stands out as a solid pick for the long haul. All things considered, Palantir has great potential to be a cornerstone in a robust investment portfolio.

As such, we currently rate Palantir as a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.