Summary:

- I warned about Palantir stock’s “irrational exuberance” in March. PLTR then fell into a bear market through its recent lows.

- Palantir’s recent guidance likely disappointed investors who craved more.

- Palantir’s boot camp-driven AI sales cycle is still nascent, although robust.

- I explain why PLTR stock’s overvaluation risks remain a valid concern.

- Despite that, I assessed why a timely buying opportunity has surfaced as fears have likely peaked.

hapabapa

Palantir Stock Fell Into A Bear Market Decline

Palantir Technologies Inc. (NYSE:PLTR) investors who chased its “irrational exuberance” since my March 2024 update have significantly underperformed the S&P 500 (SPX) (SPY). I acknowledged PLTR’s incredible AI growth momentum and opportunities through its Artificial Intelligence Platform. However, I highlighted my doubts about PLTR’s overvaluation. As a result, I assessed that PLTR was priced for perfection, as AI investors headed into early 2024 with too much AI FOMO.

As a result, the recent post-earnings selloff in PLTR likely stunned these euphoric investors. Palantir’s Q1 earnings release in early May delivered another quarter of GAAP net income profitability for PLTR, underscoring its ability to deliver sustainable, profitable growth. In addition, it also demonstrated Palantir’s boot camp-driven sales growth momentum. Observant investors should note that Wall Street’s enthusiasm for Palantir’s boot camp-driven sales cycle has been mixed. However, Palantir believes that eschewing the “traditional” enterprise go-to-market strategy has reaped rewards for the leading AI platform company. Accordingly, Palantir credited its ability to achieve a 69% surge in US commercial customers to the success of its AIP boot camps.

Palantir’s Robust Boot Camp Sales Cycle

Therefore, Palantir assessed that its “innovative” go-to-market strategy has helped to compress its deal cycle. The market seems to concur, with PLTR’s buying momentum still assigned a robust “A-” grade. Despite that, there are concerns about potentially slowing growth for Palantir in the second half of 2024. Therefore, Palantir investors should continue to assess the conversion cadence from Palantir’s AIP boot camps, given their nascent developments in its sales cycle.

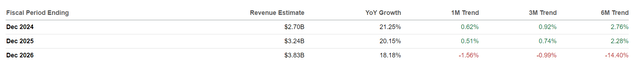

Palantir’s raised revenue guidance for FY2024 suggests its AI growth spurt remains robust. Accordingly, Palantir anticipates revenue of between $2.677B and $2.689B. However, it didn’t markedly surpass Wall Street’s previous estimates of $2.68B. As a result, I assessed that the market was likely disappointed with Palantir’s inability to markedly outperform, leading to a justified valuation de-rating to reflect potentially higher execution risks.

Palantir revenue growth revisions (Seeking Alpha)

Notwithstanding my caution over Palantir’s guidance, analysts have upgraded their estimates of Palantir’s near-term revenue growth cadence. As a result, Wall Street seems to think that Palantir could be conservative over its guidance. In addition, PLTR’s solid “B-” earnings revisions grade lends further credence to my observation, underpinning its robust buying sentiments.

Palantir management is confident that its enterprise-grade AIP is designed for broad adoption across several industries and use cases. It’s also intended to accelerate enterprise AI adoption more robustly, allowing companies to deploy AI systems more effectively.

In addition, Palantir believes that its battle-tested systems underscore the government’s confidence in its quality and trustworthiness. In addition, Palantir’s expanded partnership with Oracle (ORCL) is expected to improve its distribution reach. Therefore, Palantir environs the US commercial segment as the most critical growth lever in the near term, anticipating a 45% revenue uptick from these customers in FY2024. While Palantir’s European business could continue to face near-term challenges attributed to economic headwinds, Palantir’s reacceleration in its government business (an increase of 8% QoQ) should provide some respite as the market reassesses PLTR’s bullish thesis.

Is PLTR Stock A Buy, Sell, Or Hold?

With a forward adjusted EBITDA multiple of nearly 48x, PLTR is hardly cheap, as it’s well above its SaaS peers’ median of 20x. Moreover, PLTR’s forward adjusted PEG ratio of 2.7 is almost 40% higher than its tech sector peers. As a result, I assessed that PLTR’s relative overvaluation remains its most significant risk, even as its AIP go-to-market has shown early promises.

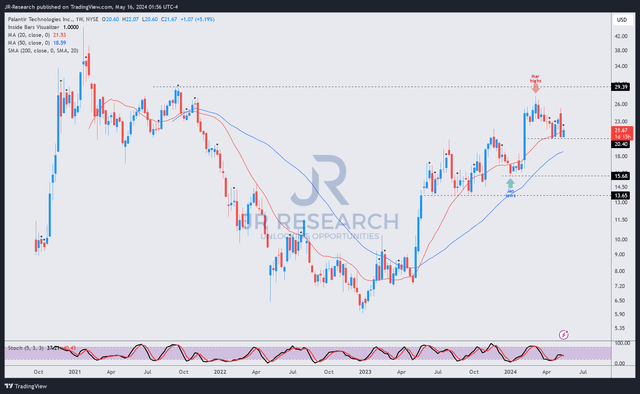

PLTR price chart (weekly, medium-term) (TradingView)

PLTR’s price action indicates that a consolidation zone has formed above the $20 level, as PLTR stock fell nearly 30% from its early March 2024 highs.

Therefore, PLTR’s bear market decline seems to be bottoming out at a pivotal moment, as the S&P 500 and the Nasdaq (NDX) (QQQ) broke into new all-time highs.

PLTR’s buying momentum has remained remarkably resilient, helping PLTR form a higher low above the $15 level. Therefore, PLTR stock has managed to maintain its upward bias, corroborating its uptrend continuation thesis.

Accordingly, I assessed that my Sell rating has played out accordingly, helping to mitigate downside risks for investors who didn’t chase PLTR’s March euphoria.

While the risks of relative overvaluation cannot be ruled out, I assessed a possible buying opportunity above the $20 zone as PLTR looks ready to surge higher and re-test the $30 region.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!