Summary:

- Rocket Lab recently provided updates about its progress in both launch and space systems.

- In this article, I take a closer look at these updates and their significance for Rocket Lab.

- Overall, it seems that Rocket Lab is making good progress both technologically and financially, and the company is well-positioned for sustained growth.

- I maintain a strong buy rating for RKLB stock.

John M Lund Photography Inc

Rocket Lab USA (NASDAQ:RKLB) reported Q1 2024 earnings on May 6. The company also provided updates about its progress in both launch and space systems. In this article, I take a closer look at the most significant updates from Rocket Lab. My analysis suggests that Rocket Lab is making very good technological progress, and these moves are positioning it well on the path to revenue growth and profitability.

Overall, I maintain a strong buy rating for RKLB stock.

Space Systems Is Delivering Fast Growth

In Q1, Rocket Lab revenue clocked in at $92.8 million, amounting to a 55% increase sequentially and a 69% increase year-over-year. The year-over-year growth of $38 million was primarily attributable to Rocket Lab’s space systems division, which reported revenue of $60 million in Q1 2024 versus $35 million in Q1 2023. Space systems currently represents about two-thirds of Rocket Lab’s revenue.

In Q1, Rocket Lab delivered the first 2 spacecraft buses for its $143 million sub-contract with MDA (MDA:CA) for Globalstar’s (GSAT) next-generation constellation. Rocket Lab is slated to provide another 15 buses as part of this contract. On the earnings call, management noted that they “expect[s] to recognize the majority of the remaining contract value in 2024,” with revenue “peaking probably in the… Q3 period, maybe… Q4.”

Each spacecraft bus generates about $8 million in revenue, so Rocket Lab seems likely to see sequential growth in space systems at least for the next couple of quarters. Currently, Rocket Lab is guiding $77-81 million space systems revenue in Q2, which would represent 28-35% sequential growth for the division.

Management also expects continuing progress in space systems even once the MDA/Globalstar contract starts winding down toward the end of the year. Next on the agenda is the $515 million contract with the Space Development Agency (SDA) to build and operate a constellation of 18 satellites. Work has already started, and management expects revenue recognition from this contract to pick up as the MDA/Globalstar contract ends. Given the large value of the SDA contract, one can see how Rocket Lab’s space system division could continue to see strong growth next year and beyond (the SDA satellites are scheduled to ship and launch in 2027, although Rocket Lab should recognize revenue as it builds production capacity and meets other milestones along the way).

Rocket Lab’s satellite components business also continues to make strides. The company’s previously announced contract for reaction wheels for an unnamed mega constellation customer seems to have taken off. In a post-earnings interview, management stated that company is “on track for… 2,000 [reaction] wheels this year.”

In addition, Rocket Lab also announced a contract to supply solar cells to a space prime that has increased their backlog by $30 million, but which could be worth up to $150 million.

Overall, the space systems division should have its hands full for some time. Rocket lab has lined up a number of quite large contracts that are in various stages of execution at the moment. Given all the significant progress being made, it seems increasingly likely that the space systems division could help Rocket Lab keep growing at a solid clip in 2025 and beyond. Top line growth should also help Rocket Lab move closer to profitability, especially as management continues to focus on securing large contracts with good margins.

Neutron Is Materializing

The major negative headline this quarter is that Neutron is delayed. Rocket Lab had been aiming for Neutron to be on the launch pad by the end of 2024, but now expects to launch “no earlier than middle of 2025.” They had previously planned the hot fire test of the Archimedes engine in 2023, but this is now scheduled over the next few weeks, so it seems accurate that they are roughly six months behind schedule at the moment (and not more).

Of course, the Neutron delay will disappoint investors. Still, I think it is important to keep things in perspective. Rocket science and the space industry are very difficult, so a six-month delay in a new rocket’s design program is not particularly worrisome. Delays are not uncommon in the space industry, and timelines can slip even for very successful firms like SpaceX.

In my opinion, if Neutron actually launches within, say, six to nine months of its expected timeline, then investors should count it as excellent execution and a major success for Rocket Lab. Particularly for long-term buy and hold investors, a short Neutron delay is probably not going to make a very significant difference in the grand scheme of things. What matters much more is whether Rocket Lab can deliver a functioning rocket.

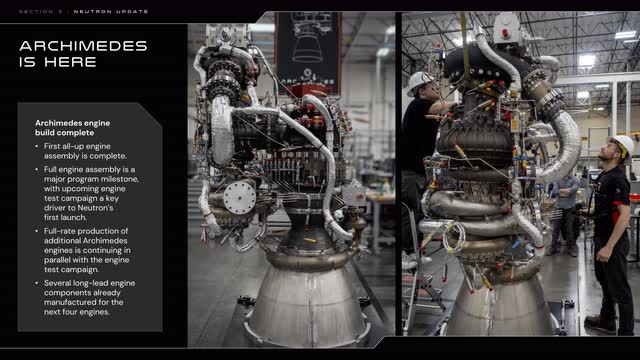

The good news on this front is that Neutron is materializing. Rocket Lab shared new pictures of the first Archimedes engine, which is now on the test stand and ready to undergo a testing campaign culminating in a hot fire test within a few weeks (if things go well). Rocket Lab also shared pictures of Neutron tanks and structures in various stages of completion.

Archimedes Engine (Rocket Lab Q1 2024 Investor Presentation)

Neutron tanks and structures (Rocket Lab Q1 2024 Investor Presentation)

As readers can see, Neutron has started to move from design to first production. Rocket Lab still plans to iterate the design as they learn more via the testing campaign, but clearly they have made quite a lot of progress. From what we have been shown, we can infer that there has been good progress related to both Neutron design and fabrication – the design seems to be fairly far along, and a good proportion of the production facilities seem to be installed and operational.

The Archimedes test campaign should give investors further clarity (one way or other) about Neutron over the next couple of months. The engine is the most difficult part of a rocket, so if Archimedes performs reasonably well during testing, then Rocket Lab could have a good shot at launching Neutron next year. Of course, if Archimedes does not perform sufficiently well, then there could be further delays.

Neutron is a big bet for Rocket Lab, and given an expected price tag around $50 million/launch, it could have a very significant impact on the company’s financials. We will have to wait and see how things go as Neutron reaches the final stages of development, but Rocket Lab certainly seems to be getting closer to (potential) success.

Electron Reusability May Be Close

Finally, Rocket Lab management also provided an important update about Electron reusability. Specifically, the first stage that they recovered in January 2024 is progressing well through testing and management seemed optimistic that it would make it back to the launch pad later this year. There are still a few steps along the way, so we will have to wait and see, but it seems that Rocket Lab continues to make solid progress toward reusing more of Electron over the coming years.

Rocket Lab is getting close to the 6 launches/quarter cadence where Electron is supposed to reach profitability. Electron reusability could further improve Rocket Lab’s position because it should (i) increase annual launch capacity, and (ii) improve margins and profitability.

Conclusion

Overall, it seems to me that Rocket Lab has been making good progress both technologically and financially, and the company is well-positioned for sustained growth. Of course, growth takes time to materialize, and the road to profitability is still likely to be fairly long for Rocket Lab, but the company seems to be making the right moves and progressing in the right direction. Of course, there is still quite a lot of uncertainty around Neutron, but investors should probably get a clearer picture over the next few months as Archimedes completes its test campaign.

The stock price remains not far from all-time lows, despite Rocket Lab’s significant technological progress and better-than-ever financials. Therefore, RKLB stock continues to look like a strong buy to me, and right now seems like a good time to buy or accumulate for long-term investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RKLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.