Summary:

- Intel’s stock has experienced a significant selloff this year, and there is still potential for it to fall further, which makes buying the dip risky.

- The company is struggling to compete with Nvidia and AMD in the semiconductor market, losing market positions and experiencing stagnating revenue.

- Intel’s future prospects are cloudy due to disruptions in the chips industry and the potential for the x86 CPU segment to be disrupted by more energy-efficient alternatives.

- My target price is $7.12.

JHVEPhoto/iStock Editorial via Getty Images

Introduction

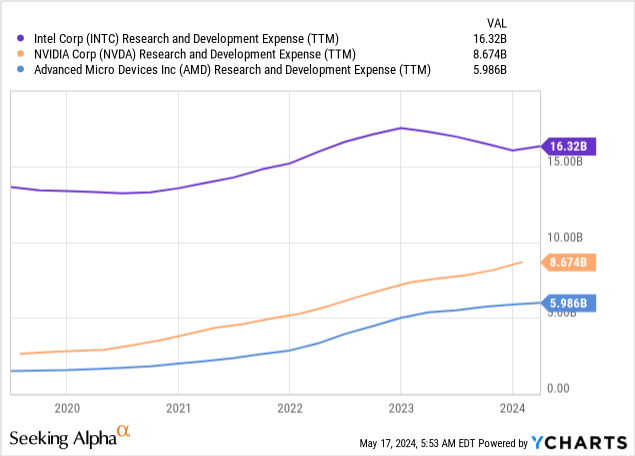

Intel’s (NASDAQ:INTC) stock experienced a big selloff this year, but last year’s 90% rally was quite impressive. In this situation, some investors might consider buying this year’s dip. However, my valuation analysis suggests that there is still a lot of space for INTC to fall further. The company’s strategic position is weak as it struggles to compete with Nvidia (NVDA) and Advanced Micro Devices (AMD). The company invests in R&D more than NVDA and AMD combined, but it does not convert into financial success or market share expansion. Considering all these negative catalysts, I am inclined to give INTC a ‘Strong Sell’ rating.

Fundamental Analysis

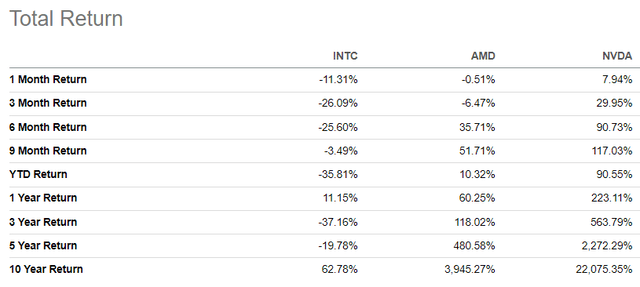

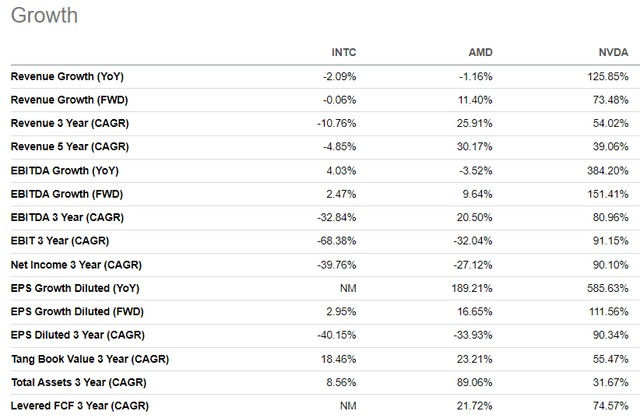

Intel is one of the largest semiconductor companies in the world and supplies the market with both hardware and software, which are primary components of any computer’s infrastructure. Intel undisputedly dominated the chips market decades ago but has been struggling to compete with aggressive competitors like Nvidia and Advanced Micro Devices in the past decade. Losing market positions to NVDA and AMD is evident from total stock returns over the last decade. INTC appreciated by 62.78% over the past decade, not even close to AMD and NVDA.

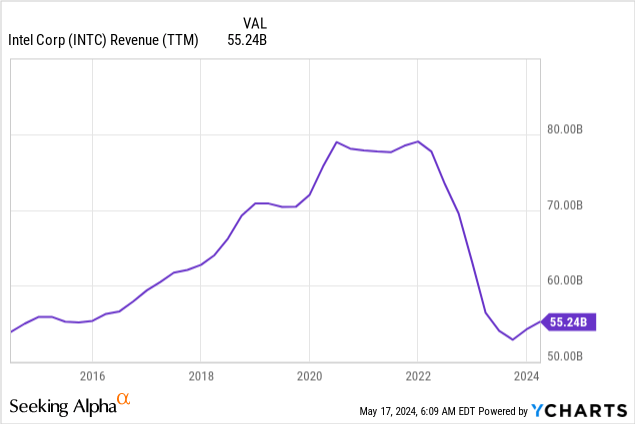

Another good evidence of Intel’s struggles against its rivals is stagnating revenue. The company’s revenue CAGR over the last five years is negative, compared to above 30% CAGR for AMD and NVDA. From the perspective of profitability metrics like EBITDA and EPS the dynamic is even worse for INTC.

Despite its rapidly deteriorating financial performance, the stock rallied by 90% in 2023 due to the AI mania around semiconductor stocks. However, this year is tough for INTC investors as the stock lost 36% of its price YTD. I would like to warn my readers not to buy this dip, not only because of the disappointing financial performance in recent years but also due to quite cloudy future prospects.

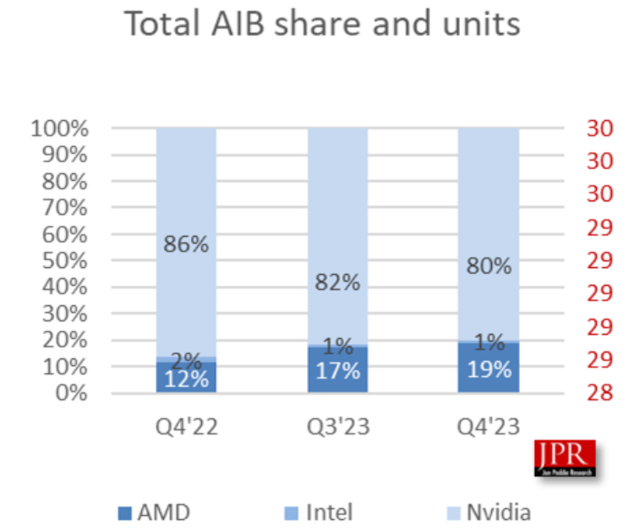

The chips industry has been disrupted in the last few years, and the demand for graphic processor units (‘GPUs’) has jumped in 2023. The GPU field is dominated by Nvidia, and AMD is the second-largest provider. Intel’s market share is just one percent, and it shrank from 2% demonstrated at the end of 2022.

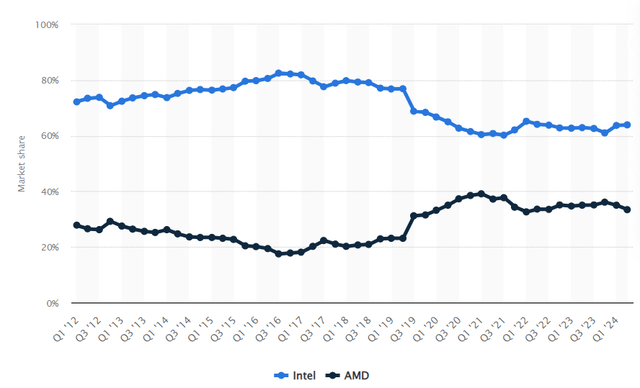

That said, Intel is in a complicated situation. Apart from the GPU revolution started by Nvidia, Intel also faces disruptions in the CPU domain. Intel has been historically dominating in the x86 CPU for computers, with above 80% market share before 2017. However, in recent years, AMD closed the gap aggressively. Intel still holds the largest share in this market, but the trend is certainly warning.

Apart from fierce competition from AMD in x86 CPUs market, there is a great risk that the whole segment of the market will be disrupted by the ARM-type architecture. The legacy x86 architecture is a relatively old technology and its 64-bit history traces back to 2003, more than twenty years ago. As the digital world currently experiences a revolution in cloud computing and AI, new applications require more efficiency and greater power. Moreover, there is a notable risk of an energy crisis due to the rapid expansion of data centers. According to the source, ARM-architecture is 15% more energy efficient compared to x86, which is a massive advantage.

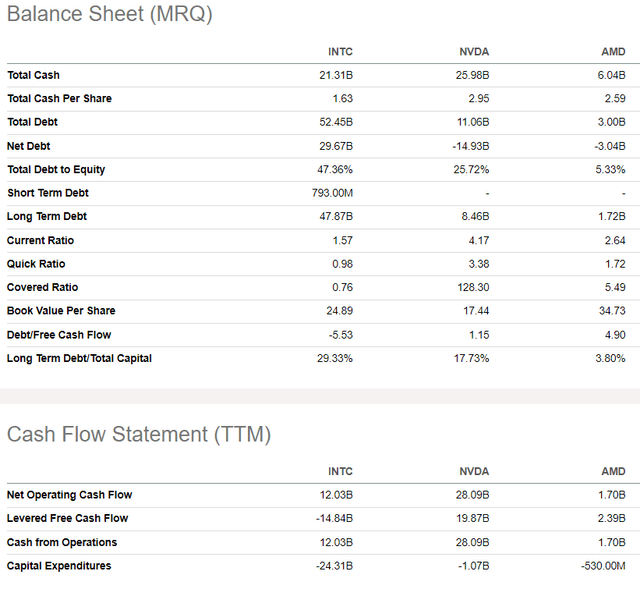

Last but not least, Intel is in a much less favorable position compared to the closest rivals in terms of the balance sheet. While AMD and Nvidia have total debt levels two times lower than their cash piles, it is completely different for Intel. INTC has a massive $52 billion total debt, which also drags on the company’s growth potential. It is also crucial to understand that while AMD and Nvidia outsource the manufacturing of chips to Taiwan Semiconductor (TSM), Intel operates its own foundries. This means that Intel’s business model is much more capital-intensive, which makes it more difficult to compete.

Overall, Intel’s current business position is unenviable. The company is far behind even the second spot in GPUs and is rapidly losing its dominance in the x86 CPU segment. Moreover, there is a notable risk of the whole x86 CPU segment to be disrupted by more energy-efficient alternatives.

Valuation Analysis

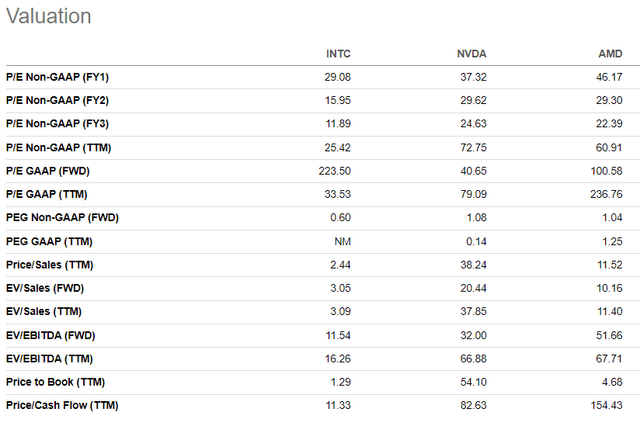

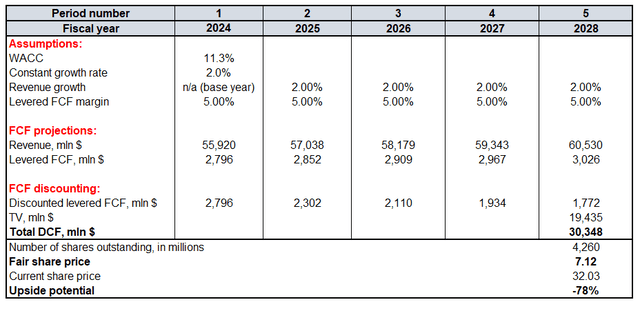

It appears to be useless to compare Intel’s valuation ratios to Nvidia and AMD because there is no match between revenue and EPS growth between them. Therefore, it is fair that Intel has much lower ratios compared to its rivals, and it does not indicate the attractiveness of INTC’s valuation.

What I would rather look at is the discounted cash flow (‘DCF’) model. Future cash flows will be discounted using an 11.3% WACC. As we saw above, Intel’s revenue CAGR has been negative over the last five years and its future outlook is uncertain. Therefore, I incorporate a 2% growth rate for both FY 2025-2028 and for the constant growth rate. Base year revenue is in line with consensus estimates. Intel’s average levered FCF margin has been 5% over the last five years, and I incorporate the same level for the entire horizon. According to Seeking Alpha, there are 4.26 billion INTC shares outstanding.

My target price is $7 per share. The stock appears to be massively overvalued. For INTC bulls, I propose to look at the below chart, where we can see that revenue is currently at 2014 levels, indicating that there was no nominal growth. Therefore, the 2% revenue growth which I used for my DCF is a generous assumption.

Mitigating Factors

Intel experienced last year’s rally partially due to the CHIPS Act, which is aimed to boost domestic research and manufacturing of semiconductors in the U.S. Since Intel operates and invests in opening its own foundries, the company was one of the major beneficiaries of this Act. Therefore, if the budget of this Act is expanded, it will highly likely mean more support for Intel, which will highly likely be a solid positive catalyst for the stock price.

While Intel is significantly behind Nvidia and AMD in chips to accelerate AI adoption, the company is still in the race with its Gaudi Accelerator. Moreover, in absolute terms, Intel spends on R&D two times more than Nvidia and three times more than AMD. Therefore, there is always a chance that Intel might release a sensational product, which will pose threats to Nvidia’s and AMD’s strength in the GPU segment.

Conclusion

Intel does not look like a good investment to get AI exposure, in my opinion. Despite spending on R&D much more than Nvidia and AMD, the company struggles to compete with its fabless rivals. The company does not offer growth, which I see in the long-term financial performance compared to Nvidia and AMD. Dividend yield is also quite modest, below the inflation rate.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.