Summary:

- PepsiCo consistently underperforms the S&P 500 and faces challenges in sales growth and volume decline.

- Consumer struggles are accelerating, with sales volume slowing despite modest price increases.

- The company’s reliance on unsustainable price increases, currency headwinds, and high debt levels make it overvalued and risky.

jetcityimage

Well-known brands and famous companies don’t always make good investments. While iconic corporations such as Apple (AAPL) sometimes make good investments, there are many instances of companies such as General Electric (GE) and General Motors (GM) that consistently underperform the broader market indexes.

PepsiCo (NASDAQ:PEP) is one of the most well-recognized brands and companies worldwide. The leading food and beverage provider sells products in over 200 countries and territories, and boasts iconic brands such as the Pepsi, Frito-Lay, Quaker, and Gatorade.

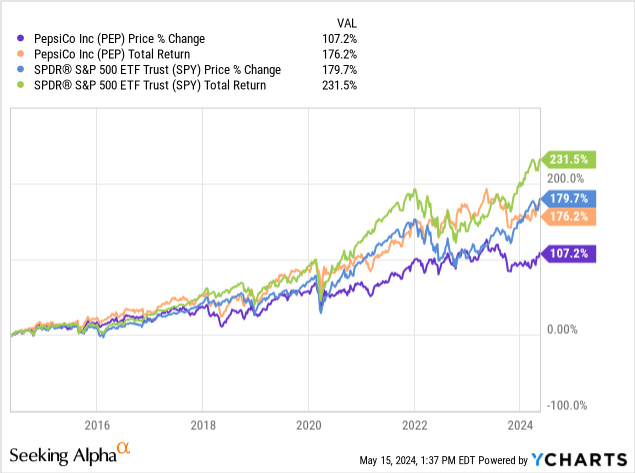

Still, while PepsiCo hasn’t performed badly over the last decade, the company has also consistently and significantly underperformed the S&P 500 since 2014. The leading beverage provider is up 110.13% during this timeframe as measured by total returns. The S&P 500 is up 180.29% as measured by total returns over the last 10 years.

I last wrote about PepsiCo in August of 2023. I rated the company a hold primarily because of the strength of the company’s core food and beverage brands, the slower rate of inflation, and the likelihood of the dollar weakening against most major currencies. I am downgrading the stock to a sell today. PepsiCo’s recent earnings report shows management’s pricing power is likely to be limited moving forward and the company’s sales volume growth is negative. The leading beverage and food provider will also likely continue to face significant currency headwinds since the rate of inflation also remains above the Fed’s target, Powell is also likely to remain cautious about lowering rates or reversing the current rate cycle for several reasons.

PepsiCo’s recent first-quarter earnings report and commentary clearly showed that consumer struggles are beginning to accelerate. While the company reported earnings per share normalized of $1.61 and revenues of $18.25 billion, beating expectations of EPS normalized by $.09 and revenue expectations by $145.79 million, management reported that sales growth in the beverage and food provider’s core brands stagnated despite the corporation implementing only modest recent price increase. The company stated that volume in the beverage unit fell by 5%, and Frito-Lay North America also reported a volume decline of 2%. These volume drops were notable since the company only raised beverage prices by 6% and Frito-Lay prices by 3%. The recalls related to Quaker Oats’ food safety issue predictably impacted earnings as well, with sales volume down nearly 22% in this segment. Management also reiterated that there were increasing signs the consumers were being forced to pull back in the difficult current economic environment as well.

PepsiCo has seen sales volume slow in previous quarters, but that was only after the company had instituted significant price increases that more than offset modestly lower purchasing levels. The company raised prices by 11% between July and September of last year, and sales volume only dropped 2.5%. The beverage and food provider’s recent and more significant volume declines came despite very modest price increases. PepsiCo’s concerning recent report should also be particularly alarming to investors, since competitor Coca-Cola (KO) recently reported strong earnings that included organic sales volumes growth of 1 percent in the company’s core business. Coke reported flat sales volume growth in North America, but the company saw sales volumes increase by 1 percent internationally. Coke has raised prices significantly since costs began to rise in early 2021, but the company did not see the negative sales volume trends that PepsiCo did. Coke also raised full-year guidance and stated the company expects to again raise prices in certain markets where inflation remains a larger problem, suggesting the company has pricing power PepsiCo does not right now.

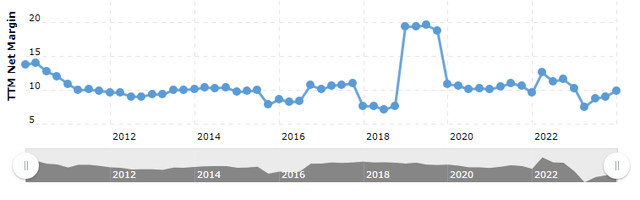

The company is likely reaching a breaking point with price increases. Wages have not risen as much as prices have gone up over the last three years, and consumer delinquency rates have also risen to nearly 9%. A recent New York Fed survey showed that one in five Americans feel maxed out with credit card debt and rising interest rates as well. PepsiCo’s margins have recovered decently since hitting a near ten-year low in March of 2023, but the company has been relying on what looks like unsustainable price increases to drive revenue growth and higher profitability levels.

A Chart of PepsiCo’s Margins (Macrotrends)

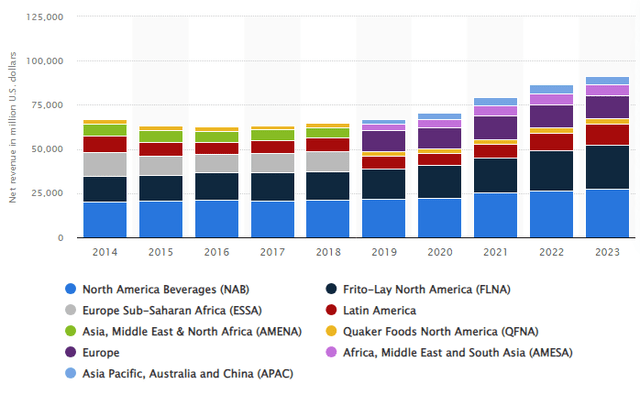

The company also continues to face significant currency headwinds, with the dollar rising against the Euro and most major currencies over the last year. The food and beverage provider gets nearly 40% of net revenues from outside of the United States. In just the first quarter. the company grew net revenues by 2.3%, but currency headwinds impacted revenues by negative a half a percent. While management has guided to a negative forex impact of 1% moving forward, that is likely an overly optimistic estimate for several reasons. Coke also reiterated significant concerns over continues forex headwinds in 2024 in the company’s recent earnings report as well.

A Graph of PepsiCo’s International Revenues (Statista)

The Fed has also recently made clear that rates will likely need to remain higher for an extended period of time, despite some economic data showing a slight slowing of the rate of inflation in May to .3%. Other recent data points, such as the producers index, which rose a concerning .5%, still showed elevated levels of inflation. Energy prices tend to rise in the summer months coming up when travel increases in the US.

Inflation, since price levels, remain high and the rate of inflation is also still above Powell’s 2% target. The Fed’s statements come even as the European Central Bank has also signaled a more dovish tone, with analysts expecting the bank to cut rates in June. China has cut important core rates recently as well, with the country’s property market struggling. The ECB continues to express more willingness to cut rates aggressively.

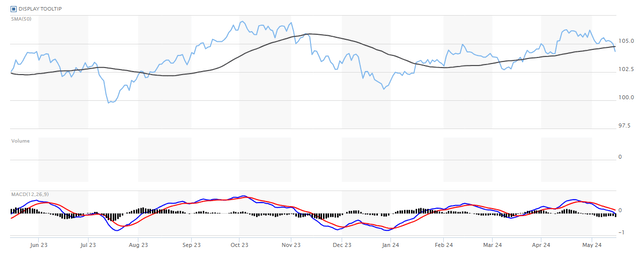

A Chart of the US Dollar (ICE)

The dollar has risen steadily against most major currencies since the beginning of this year, and the US economy also remains the strongest in the world. The dollar should continue to perform well this year, with the Fed maintaining a more hawkish stance than many central banks around the world.

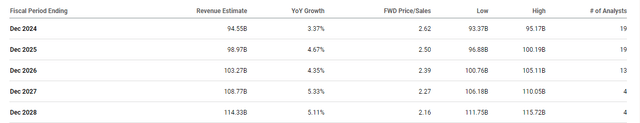

This is why PepsiCo now looks overvalued using several metrics. Even though the company currently trades at 23.14x forward GAAP estimates, and the food and beverage provider’s average 5-year valuation level has been 24.43x expected forward GAAP, analysts are projecting the company to grow revenues at just 4-6% per year over the next 4 years.

A Grid of Analyst Estimates of Pepsi Revenue Growth (Seeking Alpha)

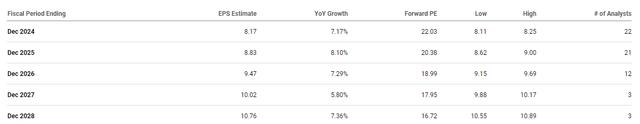

The sector median valuation is also 19x expected forward GAAP earnings, and peers such as Coke that have much stronger fundamentals are also trading at similar valuation levels to PepsiCo. Coke trades at 22.37x expected forward GAAP earnings. PepsiCo is also projected to grow earnings per share at just 7-8% per year, and these estimates seem overly optimistic since the current consumers are increasingly struggling in the current difficult economic environment.

Analysts’ Estimates for PepsiCo’s EPS (Seeking Alpha)

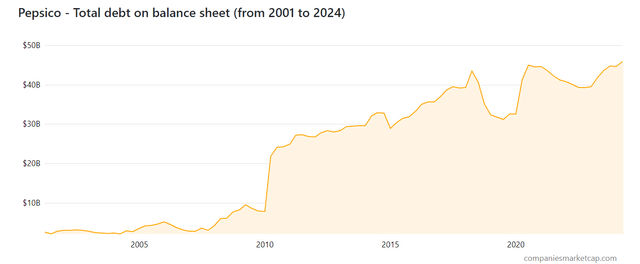

PepsiCo’s debt levels have also increased significantly in the last decade. The company currently has nearly $45 billion in debt, so management won’t likely enact major additional share buybacks. The company announced a $10 billion dollar share buyback in early 2022.

A Chart of PepsiCo’s debt (Companies Market Cap)

The beverage and food provider’s debt levels are near a 20-year high now and with rates higher, borrowing costs are obviously increasing. While competitors such as Coca-Cola have comparable debt levels, Coke’s core business has performed noticeably stronger than PepsiCo’s, and Coke’s cash flow has generally been 10-15% higher over the last 10 years than the leading food and beverage provider. Coke has long-term debt of nearly $42.5 billion.

All investment theses have risks, and if prices were to fall, the Fed became more dovish, real wages rose significantly over the next year, or there was a stronger economic recovery, PepsiCo would obviously benefit in multiple ways. The ECB could also wait for the Fed to pause the current rate cycle before lowering rates, would likely lead to the Euro performing better against the dollar and other major currencies as well. Still, these scenarios remain unlikely.

Finding value is hard, and iconic companies don’t always make good investments. Today, PepsiCo is facing increasing signs that consumers are pulling back, and forex headwinds remain strong. The company is facing a significant product recall as well. While this well-known food and beverage provider has been able to rely on price increases over the last several years, management will likely face greater challenges moving forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.