Summary:

- Pfizer’s earnings and sales have fallen due to decreased demand for COVID-19-related products, leading to a large selling pressure this year.

- The stock price has recently started rebounding from its low point and is showing bullish technical signs for continued momentum.

- Besides these technical signs, I also see fundamental catalysts that could support further price rallies.

- At current prices, the market has already factored in the potential headwinds judging by the pessimistic EPS outlook and the low P/E even assuming such an outlook.

- Its ongoing pipeline, especially the oncology pipeline with the Seagen acquisition, offers further upside potential.

JHVEPhoto

PFE stock: COVID-19 product demand deterioration

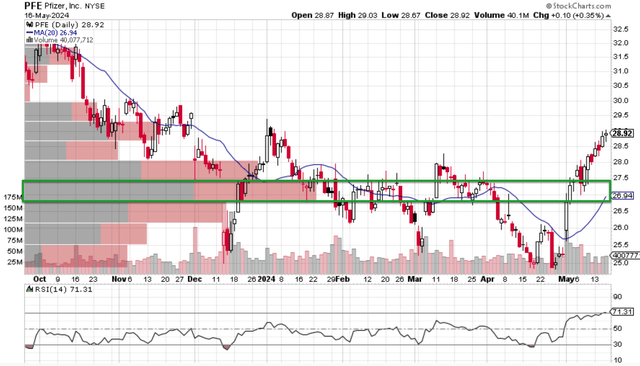

Pfizer Inc. (NYSE:PFE) (NEOE:PFE:CA) is facing a challenging year ahead. Earnings and sales fell markedly last year due to the deterioration in demand for its COVID-19-related products. The market probably already saw this coming as the pandemic ran its course over the recent years. However, the impact was even more substantial than what was anticipated. As a result, PFE had to issue multiple downward revisions of its earnings outlook in recent quarters. All told, the current figures point to a sales plummet of ~70% for its Comirnaty vaccine franchise on a year-over-year basis and a 93% drop for its Paxlovid (therapeutic) franchise. The market responded with tremendous selling pressure, as seen in the chart below, pushing the stock price down from ~$32 a year ago to as low as $25. The stock price then recently (in early May) started rebounding from the bottom and moved up to the current level of ~$29.

Against this background, in the remainder of this article, I will argue A) from a technical perspective that the rebound is likely to continue to even higher price levels, and B) there are also good catalysts that could sustain the rebound at a fundamental level. Let’s start with the technical perspective based on the chart above. The top panel of the chart shows PFE’s price-volume trading pattern in the past year with a 20-day moving average (“MA”) price. The bottom panel shows PFE’s Relative Strength Index (“RSI”). There are a couple of bullish technical signs here.

- Its price is now well above the 20-day MA (around $26.9), a textbook sign of bullish momentum.

- Its RSI also displays bullish signs. An RSI reading above 70 is generally considered to be overbought (while below 30 is considered oversold). The RSI for PFE is currently at 71.31, an indicator of strong buying pressure. Also note that the RSI itself has been on an upward trajectory since early May, providing further support for the buying pressure.

- Finally, the price range that has attracted the largest trading volumes recently was around $27~$27.5 as highlighted by the green box. PFE’s current stock price is decisively above this range now. To me, this indicates that the larger number of shareholders in the $27-$27.5 range has now been replaced by investors who are more bullish (or have turned into more bullish investors themselves), laying the groundwork for PFE prices to go further up.

Next, I will focus on the fundamental catalysts that could support further rallies.

PFE stock: Market EPS outlook is too pessimistic

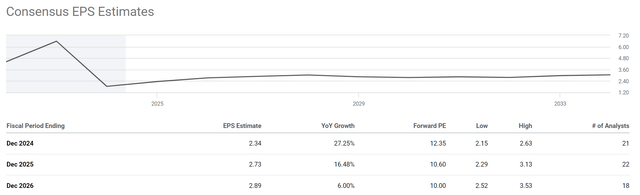

Due to the headwinds from its COVID-related products, the market has adjusted its EPS outlook for PFE, with good reasons. However, my view is that the adjustment has been overdone. More specifically, the chart below shows the consensus EPS estimates for PFE stock in the next three years. As seen, analysts expect PFE’s EPS to be only $2.34 in FY 2024, $2.73 in FY 2026, and $2.89 in FY 2027. These projections imply a three-year average EPS of $2.65 in the next three years.

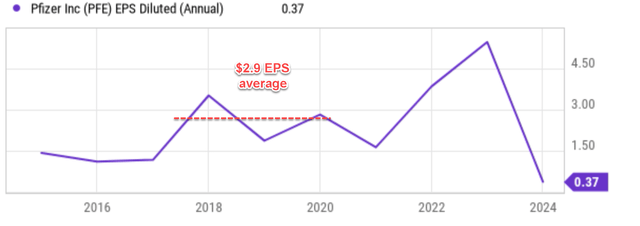

To better contextualize things, the next chart shows PFE’s historical PFE in the past 10 years. As seen, its average EPS for the three years before the COVID-19 breakout (i.e., when it had no COVID-related income at all) was around $2.9 already.

Looking ahead, even if the income of its COVID-19-related products all drops to zero (which I highly doubt), the company is working on the further development of several non-COVID assets that should also be supportive and help to mitigate lingering pressure from the Comirnaty/Paxlovid declines. Notably, PFE is focused on bolstering its oncology portfolio. PFE recently purchased cancer specialist Seagen (at a price of around $43 billion). This addition roughly doubled the size of its oncology portfolio, with 60 programs spanning multiple modalities, including antibody drug conjugates, small molecules, biospecifics, and other immunotherapies. With this acquisition, I’m optimistic that its oncology pipeline has the potential to deliver several new drugs, potentially blockbuster drugs, in the next few years to come.

Other risks and final thoughts

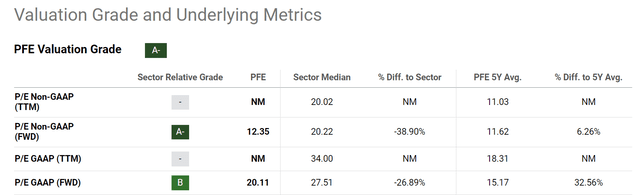

Besides the above considerations, another positive is its valuation. The current price correction is so overblown that the FWD P/E looks very attractive even if the pessimistic EPS projections do materialize. If you recall from an early chart, PFE’s forward P/E ratio is expected to be only around ~10x based on its FY 2025 and FY 2026 EPS projections. This is only half of the market median and also a substantial discount from its five-year average as seen in the chart below. Given its pipeline, scale, and financial strength, I think such valuation compression is unjustified.

In terms of downside risks, PFE faces several challenges alongside its pharmaceutical peers. Drug development is inherently risky, with a high chance of failure during clinical trials and a lengthy approval process by regulatory agencies like the FDA Source. Additionally, both PFE and its competitors grapple with patent expirations, which can lead to generic competition and significant revenue erosion.

Besides these common risks, a few risks are more specific to PFE. Firstly, as aforementioned, the company’s current income hinges heavily on its blockbuster drugs like Comirnaty (the COVID-19 vaccine). The future of this vaccine is highly uncertain due to the development of the pandemic, new variants, or alternative treatments. Secondly, with the Seagen acquisition, PFE faces more pressure to manage its research and development pipeline effectively. With multiple drugs in development, any setbacks or delays could negatively impact investor sentiment.

All told, my verdict is that PFE represents a Buy opportunity for investors under current conditions. There are indeed uncertainties ahead as analyzed in this article. However, my view is that the market has already priced in these potential headwinds judging by the pessimistic EPS outlook and the low P/E even assuming such an outlook. Additionally, I see some strong technical indicators pointing towards near-term upside too. Finally, PFE’s current dividend yield is very attractive (see the next chart below) at 5.74%, not only far above the sector median but also near the highest level in at least five years. Such a yield provides a sizable stream of income for investors and a meaningful degree of downside protection.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.