Summary:

- Block combines financial services with content and cryptocurrency, highlighted by Cash App’s growth and TIDAL’s strategic acquisition, creating a unique, future-oriented ecosystem.

- The company’s financials show high-growth potential with a strong balance sheet, despite EPS volatility and modest margins, driven by strategic investments and a focus on long-term innovation.

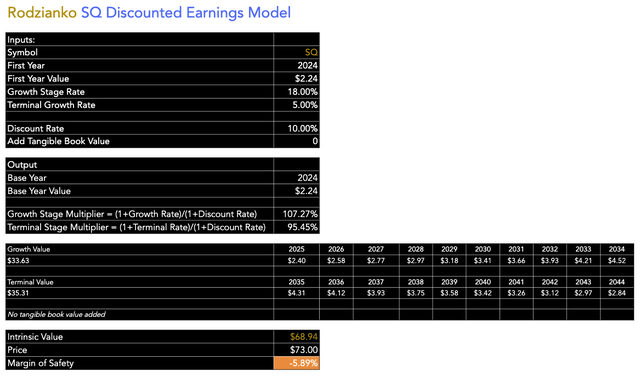

- My discounted earnings model values Block at $69 per share, reflecting a 5.9% overvaluation. Despite this, I think it is a compelling long-term investment because of high forecasted growth rates.

- Critical risks include exposure to potentially more aggressive AI and ML in finance, which could cause inhibitions in growth if the field’s regulatory environment becomes more severe.

PM Images

A Brand Of Personality And A Future-Oriented Ecosystem

Block, Inc. (NYSE:SQ) has many attractive features as a company, which, in my opinion, includes Jay-Z on the board of directors after Block acquired the majority of TIDAL from him. His impact on the company is stark from a marketing front, and when viewing Block’s website, you can see the influence of pop music culture. Investors may already know Block well, but for those who don’t, let me give you a brief breakdown of the company’s core operational scope:

- Cash App is one of the largest revenue generators for Block, it is growing fast due to offering peer-to-peer payments, direct deposits, Bitcoin trading, and stock investing. Cash App has over 80 million annual transacting customers.

- Square provides various financial services, including payment processing, POS systems, and business solutions. It is foundational to Block and was the original name of the company.

- Afterpay adds a significant revenue stream through its buy-now-pay-later (‘BNPL’) services. It’s popular in Australia, the U.S., and Europe.

- TIDAL adds less direct revenue but is a strategic acquisition in the long term, in my opinion, as it opens up the ecosystem to a wider audience with significant brand power.

- TBD is an early-stage project focusing on blockchain and decentralized finance (‘DeFi’).

I believe if Block continues to develop its ecosystem in financial services, stock investing, and cryptocurrency and develops its content ecosystem from its stake in TIDAL, the company will have a very compelling operational profile, in my opinion. I think the company is on to something quite significant in bringing revolutionary technology to traditional banking. Furthermore, I truly believe that the retail financial industry is in for a rude awakening with the continued development of AI, and I think that we are going to see more powerful applications that blur the lines between stocks, cryptocurrency, payments and content to create a more seamless experience moving forward. I believe that Block could be one of the clear players in this, and I believe it is showing signs of some radical innovation, albeit with a slight niche focus and a lot of personal character, which helps it stand out. Let’s compare this to PayPal Holdings, Inc. (PYPL), which is taking the more direct and conventional route, whilst still playing a significant role in innovation and making vital acquisitions like Venmo. The two companies come across as mightily similar in many regards. The core difference, I believe, is the types of customers the ecosystems will attract.

On that note, the main competitors to Block include:

- PayPal, which many know as one of the first revolutionary online payment platforms.

- Stripe, which focuses on internet businesses through providing APIs, with a strong presence in e-commerce.

- Adyen N.V. (OTCPK:ADYEY), which offers a unified platform to accept payments in multiple ways.

- Coinbase Global, Inc. (COIN), which is one of the leading platforms for cryptocurrency exchange.

- Apple Inc. (AAPL), which has the potential to develop its financial services segment significantly and is arguably the most powerful company tackling music, finance, AI, application development, et al.

Investors should remember that the competition in the online payments industry is rife, and Block might not be able to grow over the long term in a way that some technology investors would like. I believe the company can be compared similarly to PayPal in future operational value. I think that it is quite unlikely for the firms to deliver high outsized alpha over the next decade, but the current valuations are appealing (although PayPal more so than Block), which presents a compelling Buy case. What I think Block has going for it is that it offers a genuinely unique synthesis of many revolutionary financial services, now introducing content. It has an edge in which companies like Apple and PayPal offer a more mainstream and commercial portfolio of products and services, but lacks in the specific way Block is cultivating this. In many ways, Block feels like a mixture of Coinbase, PayPal, and Adyen. That’s quite a powerful and cutting-edge mixture, in my opinion.

Financial Analysis

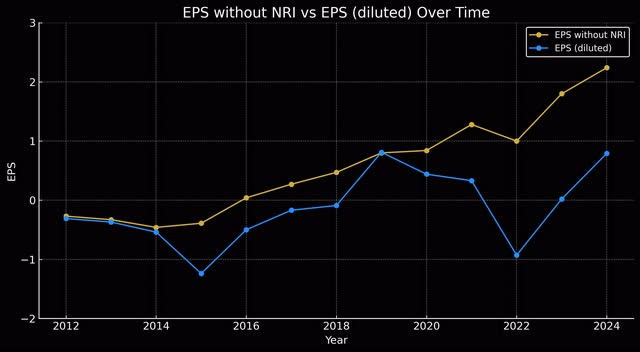

Block is growing fast, and while it has delivered EPS volatility, this changes significantly when removing non-recurring items:

Block EPS Data (Author’s Chart)

This makes a big difference to the discounted earnings analysis I am about to present, which takes into account earnings without non-recurring items. Using EPS without NRI regularly produces more reliable results in the market when value investing over significant time periods.

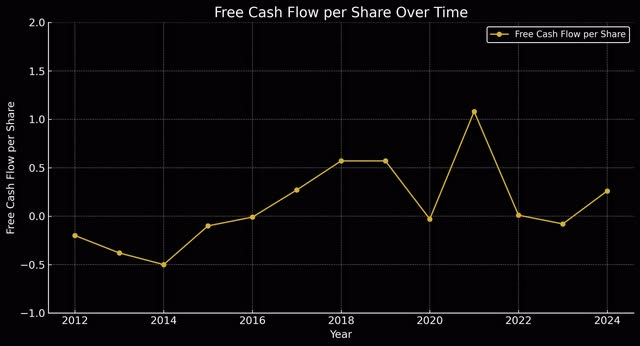

I have chosen a discounted earnings model as opposed to a discounted cash flow model because, at this time, Block’s free cash flow per share, while making progress, is not reliably positive:

Block FCF Data (Author’s Chart)

FCF is undoubtedly the better metric to assess value because it takes into account non-cash expenses and gives a more reasonable assessment of “true earnings”, but in this instance, its FCF growth is not as promising as it would need to be (and could be in the future) to develop a DCF model that accurately incorporates the firm’s significant growth history and potential as elucidated in its EPS without NRI data.

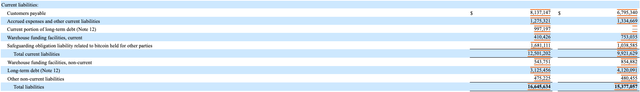

Another element that, I believe, is worth outlining here is that Block has a decent balance sheet, with an equity-to-asset ratio of 0.53. This strengthens its long-term outlook, and a lot of its liabilities are customers payable, bitcoin safeguarding liabilities, and accrued expenses, outlining the lower level of typical debt the company holds than one might initially assume:

March 31, 2024 Data (SEC, Form 10-K, Block Inc.)

Margins need to be improved for Block, currently resting around 1.68% for its TTM net income margin and 1.73% for its TTM levered FCF margin, but it is still early days for the company, and it is introducing high levels of SBC and growing R&D, as well as having made critical acquisitions, so I think the company is focused on the long term. That being said, it might benefit from higher levels of internal efficiency and reduced costs, which I believe the firm may be able to drive with deeper AI integrations and introductions of automation in coding, design and moderation in due course.

Valuation

For my discounted earnings model, I used a 10% discount rate, as I consider this the market standard annual return. Additionally, I used a 5% EPS without NRI annual growth rate for my terminal stage because I believe the company will grow higher than the overall economy on average from 2034-2044, which is more likely to be between 2-3%. Based on analyst consensus estimates on Seeking Alpha and my own estimates of continued growth in alternative finance platforms rooted in technology, I think an 18% EPS without NRI growth rate is achievable by the firm on average over the next decade. This indicates an intrinsic value for Block stock at this time of $69. The current stock price is $73, indicating a slight overvaluation of 5.9%. However, because of the high investor sentiment around SQ that, I believe, will be enduring and the good growth rates I forecast over the next 20 years, I believe that it is reasonable to propose that the stock is a Buy at the current price.

Risks To Consider

Despite my optimistic outlook on Block, some considerations mean that the company may do less well than I predict in my DE model above. For example, a customer reversion away from alternative financial platforms due to poor integrations of technology like AI and ML, as well as any failure in security that protects against modern cyberattacks, could mean that the firm loses reputational value and its growth rates are impacted as a result.

These points add to a wider macroeconomic concern that I believe relates to Block. As it is very exposed to cutting-edge technologies, it is also exposed to the same risks. These include a fiercer regulatory environment that may arise, inhibiting its growth in areas like cryptocurrency and AI-integrated financial management (the latter, I believe, is reasonable to speculate that Block might venture into more aggressively given its focus on cutting-edge fintech).

Key Elements

I believe Block has a strong position in the market; although there is significant competition, the partnership with Jay-Z and venture into crypto and stock investing is clever, and the company is clearly defining a brand for itself that is distinct and captivating.

The financials show high growth, and analysts expect this to continue for the next decade. I have incorporated the consensus optimism into my sensitive discounted earnings analysis. In addition, Block’s balance sheet is stronger than it seems on the surface.

I consider Block to have an intrinsic value per share of around $69, indicating a potential 5.9% overvaluation at the time of this writing. I believe Block would make a compelling long-term investment of similar weight to PayPal but with less of a value opportunity at this time.

Risks include failure in AI and ML technologies, cybersecurity threats, and macroeconomic pressures from a fiercer regulatory environment that may arise around AI in general. This could reduce my DE model outputs considerably, delivering lower alpha.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.