Summary:

- PayPal’s undemanding valuation does not align with its strong fundamentals and growth prospects.

- The company has a leading position in the digital payments industry and has grown through organic initiatives and acquisitions.

- While PayPal’s growth has slowed in recent years, it remains highly cash generative and has a solid financial position.

Tom Werner

PayPal (NASDAQ:PYPL) is currently trading at an undemanding valuation, which does not seems to be justified given that it has strong fundamentals and good growth prospects ahead.

Company Overview

PayPal is a leading fintech company, being focused on digital and mobile payments across several platforms, including its checkout business, Venmo, and others. It has grown historically both through organic initiatives and through acquisitions, being nowadays one of the leading companies in the digital payments industry. Its current market value is about $66 billion and its share trade on the NASDAQ stock exchange.

Its core business is providing online payment solutions to merchants and consumers, generating fees from transactions. Therefore, a key metric to consider is total payment volumes, which is highly correlated to its overall revenues.

Its business has evolved since its beginning, evolving from an online checkout button to offer several financial services, both through organic growth efforts and acquisitions, enlarging its product offering to digital wallets, money transfers, loans, beyond others. This has created a powerful ecosystem for consumers and merchants that is hard to challenge, which was key for PayPal to have a leadership position in the digital payments industry.

PayPal’s Growth

PayPal has a great growth history since its inception, a profile that is justified by its leading position in the digital payments industry and the digitalization trend over the past 25 years, namely the rise of e-commerce across the globe.

Over the past decade, the financial industry has also become increasingly digitalized, which was a strong tailwind for PayPal’s growth, allowing it to increase its total addressable market by enlarging its product offering, beyond its core checkout business.

This background allowed the company to report strong growth for many years, even when it was suffering headwinds from eBay’s (EBAY) decision to switch from PayPal to other competitors in its platform.

Moreover, the pandemic was also a strong boost for its business, as people moved from in-store purchases to online due to several lockdowns across the globe, being a major boost for its business during 2020-21.

While at the time the company was very bullish about its growth outlook and announced aggressive growth targets back in February 2021, its growth proved to be short-lived and more related to the pandemic than structural, even though the digital payments industry as a whole still has good long-term growth prospects.

Indeed, since the last quarter of 2021, PayPal’s growth has been quite muted as consumers switched back to in-store purchases and competition has increased across its several business segments, a background that has been clearly challenging for PayPal over the past couple of years.

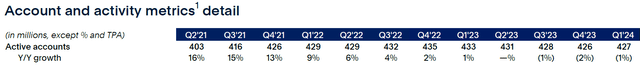

As shown in the next table, PayPal’s total consumer and merchant’s accounts have been more or less unchanged since the end of 2021, coming from double-digit annual growth to declines in recent quarters.

At the end of last March, its total accounts were 427 million, a decline of about 9 million since its peak of 435 million at the end of 2022, not boding well for its growth ahead. This shows that PayPal’s business has reached a maturity phase and further growth may be challenging to achieve, as competitors such as Adyen (OTCPK:ADYEY) or Block (SQ) have improved their offerings and PayPal’s competitive advantage seems to be waning.

Moreover, PayPal had a very good pricing power, but this also seems to be changing as the company no longer seems to be able to increase prices without losing customers. This had a negative effect on its business margins over the past few quarters, and is another worrying sign about its earnings growth ahead.

It’s also another signal that customers have nowadays more options and can switch to another payment platform, especially among merchants, given that PayPal’s fees were somewhat high and competitors are increasingly offering less expensive products and services and pressuring PayPal’s leading position.

To offset these trends, PayPal has been investing in new offerings and using data to offer a better customer service, which can have a positive impact on reducing customer churn and have higher engagement, but it’s not likely to be a major growth driver in the coming years.

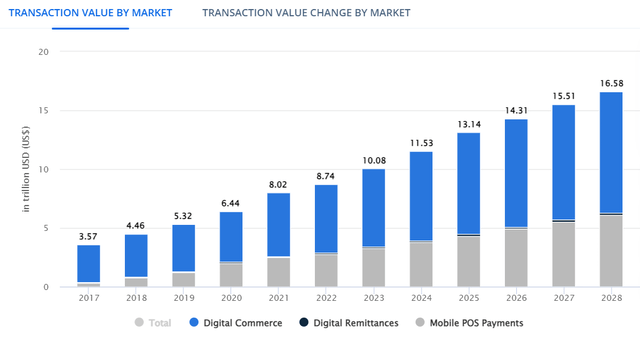

Nevertheless, despite increasing competition and potentially less differentiation from its competitors, PayPal’s growth should continue to be supported by the structural shift of transactions from physical retail to online. Indeed, according to Statista, the total transaction market value is expected to grow at close to 9.5% annually from 2024-28, being a strong tailwind for PayPal’s growth in the coming years, even though at a smaller rate than before the pandemic.

Financial Overview

Regarding its financial performance, PayPal has a mixed history given that it reported very strong growth until 2021, but more recently its financial figures have been much weaker, reflecting its lower growth amid increasing competition and a more challenging macroeconomic environment.

Despite that, PayPal has been able to grow its top-line and earnings in recent years and generate significant free cash flows, showing that its business still has good fundamentals and maintains a strong position in the digital payments industry.

In 2023, its total payment volume (TPV) amounted to more than $1.5 trillion, up by 13% YoY, which means PayPal has a market share of about 15% of the total industry. This led to revenues of $29.7 billion, an increase of 8% compared to the previous year, which is lower than its historical growth rate, but still acceptable for a large company like PayPal. Despite higher TPV and revenues, its transaction margin declined by 1% YoY to $13.7 billion, showing that its pricing power has been weaker recently compared to previous years.

Despite the inflationary environment, PayPal has made some efforts to reduce costs and operate more efficiently, which explains why operating expenses declined by 11% YoY to $7 billion, leading to a non-GAAP operating income of $6.7 billion in 2023 (+14% YoY). Its non-GAAP operating margin was 22.4%, which is still quite good, even though considerably below its peak margin reported in 2021 at about 28%. Its net income for the year was $4.1 billion (+13% YoY) and its free cash flow amounted to $4.2 billion.

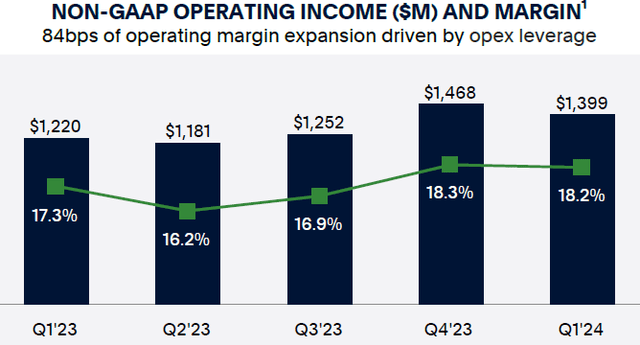

In the first quarter of 2024, PayPal has maintained a positive operating momentum, delivering a financial performance above its own guidance. Its TPV increased by 14% YoY to more than $400 billion, while its quarterly revenue was nearly $7.7 billion (+9% YoY9). Its transaction margin performed better than in previous quarter, up by 4% YoY to $3.46 billion.

Regarding its operating margin, PayPal has made a significant change to the way it reports results, and now include stock-based compensation (SBC) in its non-GAAP results. This explains why in Q1 2024 its non-GAAP operating margin was 18.2% (vs. 22.4% in 2023), but adjusted for SBC its operating margin was practically unchanged from the previous quarter.

Its non-GAAP operating income was about $1.4 billion (+15% YoY) in the quarter and its free cash flow was above $1.8 billion, up considerably from the same quarter of the previous year.

Regarding its guidance, PayPal expects to maintain a solid growth path ahead, expecting to grow revenues by about 6.5% next quarter and for the full year grow its non-GAAP EPS by mid to high single-digit and reach about $5 billion in free cash flow.

While PayPal’s growth has clearly decelerated over the past couple of years, its operations are still growing and the business remains highly cash generative, boding well to continue to benefit from industry tailwinds over the next few years.

Regarding its financial position, PayPal has a rock-solid balance sheet considering that at the end of last March it had a net cash position of about $6.6 billion. Its strategy has been to return the vast majority of its free cash flow to shareholders, through share buybacks.

Indeed, during the last year it performed share repurchases of about $5 billion, which was above its annual free cash flow, and during Q1 2024 it bought back $1.5 billion of its own stock, slightly lower than its free cash flow generation. For the full year, it expects to generate some $5 billion in free cash flow and buyback shares in the same amount, thus its strong cash position is not expected to change much in the foreseeable future.

Despite this strong backdrop, PayPal does not pay dividends and there isn’t much prospects of changing that strategy in the short term. However, the company is clearly in a position to distribute a sustainable dividend over the long term, which could be a positive factor for a higher share price in the future by enlarging its investor base to also include income-oriented investors.

Conclusion

While its growth has decelerated over the past two years compared to its historical norm, PayPal is still a leading company in the digital payments industry, its growing its business and is highly cash generative, plus it has a solid financial position.

Despite this strong backdrop, the market has penalized its growth slowdown and its shares are currently trading at only 14.2x forward earnings, while its historical average over the past five years is close to 30x. Moreover, compared to Block (trading at 19x earnings), Visa (V) at 26x or MasterCard (MA) at 29x, PayPal also seems to be clearly undervalued.

This means that, in my opinion, there is clearly a mispricing of its shares in the marketplace, as PayPal is a leading company in a growing industry, making it a good play both for growth and value for long-term investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.