Summary:

- Rivian Automotive reported a wider-than-expected loss for 1Q24 due to high production expenses.

- Despite the loss, the company saw an 82.1% increase in sales year-over-year.

- The company’s valuation is now up to 80% of its cash value, making it an attractive investment despite the lack of growth.

hapabapa

Rivian Automotive Inc. (NASDAQ:RIVN) released its quarterly earnings on May 7, 2024 and reported a wider-than-anticipated loss for 1Q24 amid an underwhelming production ramp.

The electric-vehicle maker lost $1.45 billion in 1Q24 amid high production expenses; however, Rivian Automotive did succeed in growing its sales which were up 82.1% YoY.

Taking into account Rivian Automotive’s high cash burn and ongoing losses, I think that investors will likely see more dilution in the coming quarters.

Rivian Automotive reaffirmed its output guidance for 2024 as well which unfortunately implies that the electric-vehicle marker will not see much growth at all.

What keeps my ‘Hold’ stock classification valid, I think, is that Rivian Automotive’s valuation is now up to 80% of cash value.

My Rating History

In my February piece on Rivian Automotive Rivian Automotive Q4: Guidance Is A Shocker, I mentioned that the electric-vehicle company was looking at a no-growth year in 2024, primarily because Rivian Automotive’s output guidance was very disappointing.

The electric-vehicle maker projected that only 57,000 electric-vehicles would be produced this year compared against 57,232 vehicles last year. Rivian Automotive’s reaffirmed its guidance for 2024. While the near-term outlook remains uncompelling, the company’s valuation isn’t.

Rivan Automotive Is Burning Through Cash

Rivian Automotive is still losing a lot of money on its electric-vehicles which might become a major obstacle for a stock price recovery in the quarters ahead.

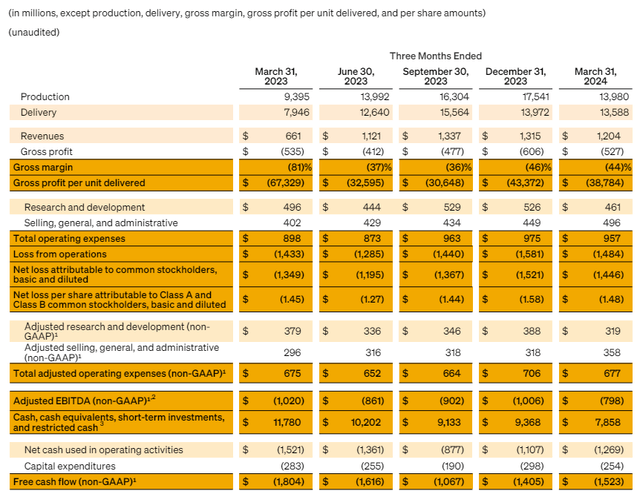

Rivian Automotive lost $1.48 per share in the first quarter, which was $0.33 per share worse than anticipated. The electric-vehicle maker lost $1.5 billion in 2024 as it still has not reached the necessary scale to allow for profitability. In terms of free cash flow, Rivian Automotive also lost $1.5 billion which was $100 million higher than in the prior quarter.

As you can see in the table above, Rivian Automotive lost $39K for each vehicle it sold in the first quarter which is not sustainable. The gross loss per unit decreased 42% YoY, but the electric-vehicle company is not anywhere near profitability which is what might remain an anchor for Rivian Automotive’s valuation for quite some time.

Rivian Automotive announced in 1Q24 that it will soon start to produce new mid-size SUVs and crossovers, dubbed the R2 and R3, which are anticipated to see first deliveries in the first half of 2026. The new R2 is expected to retail for $45,000 while the R3 is anticipated to launch at an even lower price. The introduction of the R2 and R3 needs to be seen in the context of a shift toward lower-priced electric-vehicle models which might pose an additional margin risk for Rivian Automotive and other U.S. EV makers.

China’s BYD Company (OTCPK:BYDDF), for instance, just made waves by introducing the Seagull electric-vehicle with a price tag of $12K. The introduction of cheap electric vehicles in the U.S. would be the most formidable competitive challenge for Rivian Automotive, in my view.

Protective tariffs may provide some temporary relief for Rivian Automotive, but the availability of cheap electric-vehicles is definitely a major risk for those EV companies that are not profitable yet.

By that same token, Tesla Inc. (TSLA) also said that it was looking at building a lower-cost electric-vehicle (a cheaper Model 2), with Elon Musk possibly eyeing a market introduction in 2025. The drive towards lower-cost electric-vehicles poses a substantial risk to Rivian Automotive as it exacerbates margin pressures at a time when electric-vehicle demand is already waning.

Rivian Automotive’s Market Value Is Made Up To 80% Of Cash

Rivian Automotive’s core strength (and competitive advantage) is its considerable cash pile as well as ability to access debt markets. The electric-vehicle maker still hoards a lot of cash and had about $7.86 billion in cash and short-term investments available at the end of 1Q24. This means that Rivian Automotive had about $8.12 per share in cash on its balance sheet at that time.

With a stock price of $10.20, the company’s market value thus consists to 80% out of cash. In my view, the cash value per share is what substantially reduces risk for Rivian Automotive. Thus, even without convincing production growth, Rivian Automotive remains an attractive investment for investors that want to remain invested in the EV market.

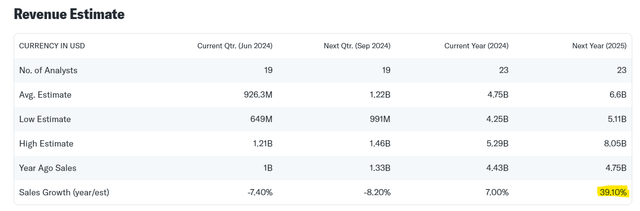

From a sales valuation angle, Rivian Automotive is selling for 1.5x leading sales (based on $6.6 billion in estimated sales in 2025). Tesla is selling for 4.8x leading sales, but there is a reason for this: Tesla is leading the market in terms of sales, is profitable and has substantially higher production than Rivian Automotive.

Revenue Estimate (Yahoo Finance)

Why The Investment Thesis May Not Pan Out

The electric-vehicle market is struggling for buyers right now which in itself is a formidable challenge. Ford Motor (F) scaled back F-150 Lightning production at the start of the year amid softening demand for electric-vehicles and this softness in demand is also reflected in Rivian Automotive’s output guidance for 2024.

In addition, Rivian Automotive is still losing an enormous amount of money for each electric-vehicle it sells which does raise some questions about the long-term validity of the electric-vehicle maker’s business model.

The entry of low-cost Chinese electric-vehicles would be a major challenge for Rivian Automotive as well as such a move would probably exacerbate the company’s margin pressures.

My Conclusion

Rivian Automotive’s output guidance for 2024 was reaffirmed at 57,000 electric-vehicles which unfortunately signals that the company does not expect any meaningful growth this year.

On the flip side, at least things didn’t get worse for Rivian Automotive and the company stands by its forecast for now. Rivian Automotive is also still losing a lot of money for each vehicle it sells to customers and with a weak guidance for 2024, I think there are few catalysts here that could catalyze a stock price re-rating to the upside.

However, from a valuation angle, Rivian Automotive offers solid value with 80% of its market value made up of cash.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.