Summary:

- Tesla’s pivot to AI and robotics, rooted in EVs, creates a unique moat in advanced physical products.

- Current financial contractions are seen as temporary, driven by macroeconomic pressures and competitive dynamics in AI, robotics, and EVs.

- Tesla should be valued like a big tech company, reflecting its heavy AI and robotics involvement, making it potentially undervalued over a 10+ year horizon.

Eoneren

I’ve written about Tesla (NASDAQ:TSLA) before, and since my last report, the stock has lost roughly 7.5% in price. Currently, the stock is down nearly 60% from all-time highs. A large part of what analysts are debating now is whether the investment is having a reconfiguration in terms of valuation multiples accepted by the market. I caution that a smaller allocation is warranted due to the nature of uncertainty in sentiment at the moment, but Tesla is trading significantly cheaper than previous valuation multiples. I believe it will continue to evolve into an AI-automobile-robotics company, and in doing so, investor sentiment is likely to significantly improve over the long term again. Based on this nuanced approach of sentiment analysis and market psychology, I think Tesla is undervalued over a 10+ year time horizon.

A Nuanced Analysis Of Tesla In AI And Robotics

It’s no understatement to say that AI is the most popular business field in the world right now. I don’t think this attention is going away. I am of the ilk that AI, robotics, and automation are going to significantly transform our global economy, with long-term effects greater than any previous economic revolution. Elon Musk was foundational to the start of the fastest-growing AI company on the planet at the moment, OpenAI. The company decided it didn’t want to be merged with Tesla, according to a recent statement by Sam Altman and OpenAI’s executive team. The current lawsuit Elon Musk has raised against OpenAI suggests fears that OpenAI might be getting ahead of the competition significantly here. When Sam Altman was ousted momentarily by the OpenAI board, this culture clash was lurking in the background.

I think this is a very hard time for Elon Musk and Tesla. Despite all great business leaders not really following the stock valuation when appraising their results, it is almost impossible to be completely immune from the gyrations of the market. It’s one thing for a CEO to be able to block out the noise, another thing entirely for the full management team to be able to.

Tesla stock is down nearly 60% from its all-time highs, and analysts on Seeking Alpha and elsewhere are expressing negative sentiments more regularly now, putting out frequent Sell ratings. One of the big arguments these analysts commonly make is that Tesla is “just a car company”. To me, that’s naïve and uninformed. Here are the major areas of AI, robotics, and automation that Tesla has in the works:

- Autonomous Vehicles: Tesla’s FSD has the potential to dominate in the field of autonomous taxis because of the scale of Tesla’s operations when compared to smaller outfits like Alphabet’s (GOOGL) Waymo.

- Optimus is a general-purpose humanoid robot designed to perform repetitive and dangerous tasks. It is also known as Tesla Bot.

- Energy Management Systems: Tesla has an AI-powered platform for energy trading. The company also offers virtual power plants to aggregate distributed energy resources to act as a unified power plant.

- Manufacturing Automation: The company employs extensive automation in its Gigafactories, using advanced robotics to assemble vehicles and batteries. The company also uses AI in quality control.

- AI Research and Development: Tesla is developing Dojo, which is a supercomputer optimized for AI machine learning training; this will significantly affect its FSD and other AI-driven features.

- Customer Service and In-Car Experiences: Tesla vehicles incorporate natural language processing and predictive maintenance.

The culture clash between OpenAI and Tesla is significant as it highlights the tension between corporate interests and the initial ethos of OpenAI, which was founded as a non-profit organization. Microsoft is reported to have an equity stake of 49% in OpenAI, based on multiple reports from the time of the extended partnership deal in 2023. However, this specific detail has not been officially disclosed by OpenAI or Microsoft in their public statements.

However, the industry may benefit from a more considerate nature of competition. Considering how genuinely transformative AI is likely to be for the world, the healthy competition amongst major players, including Tesla, Microsoft, Google and Amazon (AMZN), is critical. I believe a big part of this conflict rests in which AI company’s CEO gets the accolade as the “next Steve Jobs” of AI. In reality, I believe that the field is going to advance so much that no single figure will be deemed the absolute pioneer of AI. This is already evident in the diversified nature of Microsoft in the field of AI, Google’s expansive reach in AI, and Tesla’s vast AI ecosystem it is developing. In other words, Tesla can be a revolutionary leader in AI alongside OpenAI. There’s room for both in an industry I believe will be the largest in the world in 10 years’ time.

Financial Considerations For Tesla Moving Forward

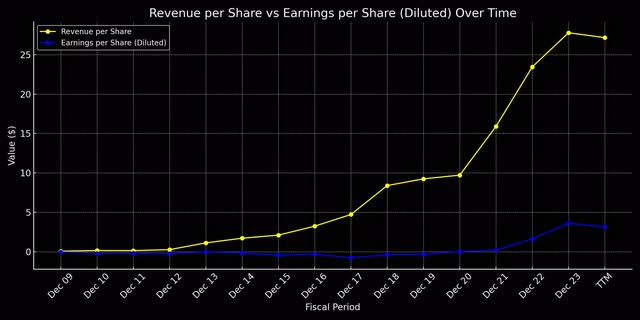

Here is the historical revenue and diluted EPS performance for Tesla on a chart:

Tesla Data (Author’s Chart)

This shows significant promise for Tesla, particularly on the earnings front, where the prominent growth has been quite recent. I believe there is likely to be some continued contraction in earnings while the company readjusts during this pivot from mainly electric vehicles to a heavier emphasis on AI, robotics, and automation. The market might complain, and the stock might go down, but if holding over a long time horizon, I truly believe this is an opportunity to buy more. I’ll explain more why in my valuation analysis below.

Additionally, investors have been concerned with Tesla’s significant contraction of around 4% in gross margin from its 10-year median:

Tesla Data (Author’s Chart)

However, from the above graph, we can see that Tesla’s gross margins have not been stable, so the current contraction isn’t as severe as it looks. However, I wanted more information, so I conducted some deeper research into why this was taking place. The answer can be broken down into three segments:

- Aggressive Price Cuts: Tesla implemented multiple rounds of price reductions in an effort to stimulate demand in a tough macroeconomic environment and rising competition in the EV field, including from BYD (OTCPK:BYDDY) in China.

- Increased Production Costs: Increased costs were caused by supply chain disruptions and higher prices, including for lithium and cobalt for battery manufacturing. Furthermore there were new factory ramp-ups that the company initiated.

- Model Transition and Upgrades: Significantly, the Cybertruck and other new models and updates led to further costs. There were significant investments in upgrading manufacturing facilities and adjusting production lines.

This shows how Musk is navigating a two-fold issue, and it must be difficult. On one hand, you have BYD competing on the pure EV front, and on the other hand, Musk sees the potential for Tesla to evolve into an advanced technology and robotics firm with automobiles at its foundation. My personal opinion is that Musk would benefit the company and long-term investors by evolving the company into an advanced, physically-oriented AI firm, which is what he seems to be doing. I believe this would significantly distinguish it from companies like BYD, and it also has the physical infrastructure to make more compelling large-scale products than a company like OpenAI, which has its core power in artificial intelligence software at this time.

In other words, the current contractions are likely temporary. Over the long term, I think Tesla’s moat is only going to improve. The main reason for this is that it has the capability to offer something truly unique to the market: a kind of synthesis of OpenAI, Nvidia (NVDA), and BYD. That’s a very strong foundation for a long-term investment, and I believe it bodes very well for long-term shareholders and will be the beneficiary of higher sentiment again once AI really starts to take flight in the world and begins changing the physical economy more prominently.

Assessing The Valuation Given The Current Pivot

Analysts who say Tesla is just a car company are wrong, in my opinion. Therefore, valuing it as such is also invalid. These analysts might be right on a time horizon of 5 or fewer years but extrapolated out over the next few decades, and I believe they will look silly. The reason I say this is that Musk is clearly more than a car developer. He has also proven that he is reliably ahead of the curve in many respects, opting for technologies that are pioneering. The idea that it will be any different this time around when it comes to heavier use of AI and robotics for Tesla is simply unfounded, especially when you consider the company’s investment in Dojo and Optimus. Tesla, in many respects, is likely just getting started as an advanced AI firm.

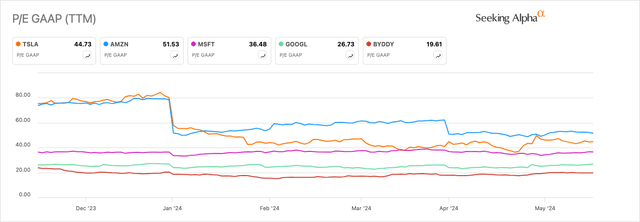

Tesla’s P/E GAAP ratio at this time is around 45, significantly lower than its 10-year median of around 107. In my opinion, the present P/E ratio is cheap and a welcome opportunity to invest. Even in a worst-case scenario where Tesla cannot continue to sustain valuation multiples of 50+ because of reduced sentiment, I think the stock is fairly valued. However, taking into account the growing reliance on AI that the economy is about to experience and Tesla’s pivot into a heavier AI firm, I think the stock could be significantly undervalued at this time, making for an exceptional buying opportunity. The main risk is that we can’t guarantee that Musk will execute the transition perfectly, and areas of conflict, like with the OpenAI case, show signs of some concern, in my opinion. If Musk can focus on collaborative competitiveness and dedicate himself to developing Tesla’s unique moat in AI and physical products, long-term shareholders could see significant success. However, due to these current concerns, my rating for Tesla stock remains a Buy rather than a Strong Buy.

Author, Using Seeking Alpha

Key Elements

Tesla is pivoting into an advanced AI and robotics company that has a foundation in electric vehicles. Analysts who cannot see this do not know the company well enough and understand the firm’s long-term strategic direction. The development of the business in this manner could place Tesla with a significant and unique moat in physical products enhanced by advanced AI and robotics capabilities.

Investors are concerned by current contractions in Tesla’s financial results, but the evidence seems to suggest that these results are temporary and are largely the result of macroeconomic pressures and navigating a careful dialogue between AI and robotics competition and rising EV threats, particularly in China. In some respects, Tesla is continuing to develop and working on grounding its new pioneering operational model to move forward with at this time.

Tesla cannot be valued as a mere car company; it is way more heavily involved in AI and robotics than other pure automobile or EV companies. As such, it is most fairly valued alongside other leading big tech companies. Compared to Tesla’s historical valuation multiples and future potential in the evolving tech field, the stock could be significantly undervalued at this time over a long time horizon of 10+ years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, AMZN, MSFT, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.