Summary:

- My 2023 prediction for a +51% rise in the Netflix share price has completed, with an even larger wave of buying set to take place.

- The company has released another round of better than expected earnings and is set to both team up with a former competition giant and move into the lucrative sports market.

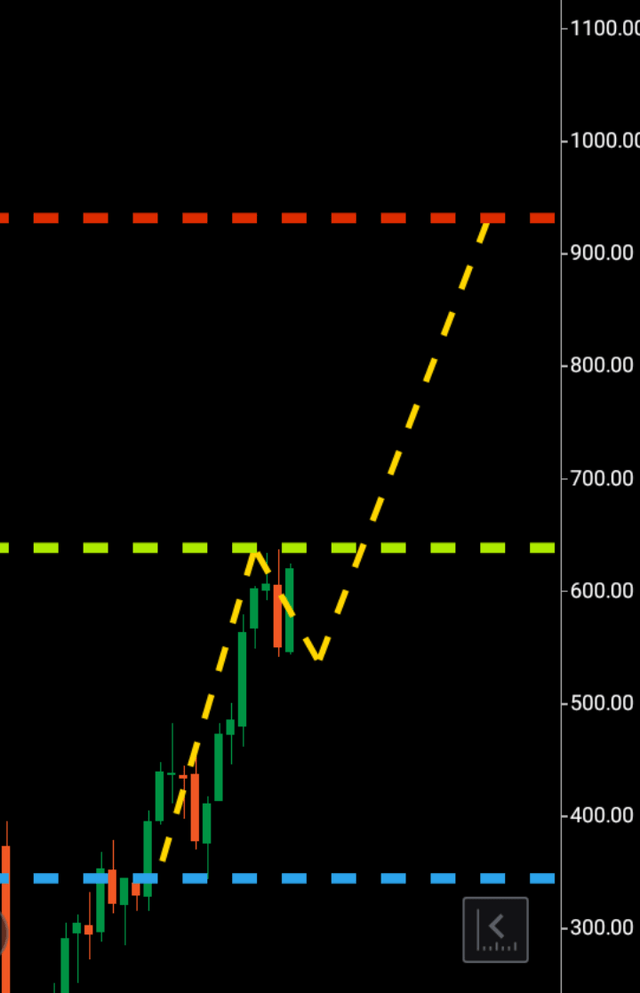

- Past protracted moves towards my bullish target from $330-$500 have been replaced with a technical clearer picture of bullish demand for this equity, with a move to the $950 region looming as $640 resistance fast approaches.

Kameleon007

Sometimes you make a call and it blasts to target, there are cases you make a call and it doesn’t land, sometimes, you look a bit older by the time it gets there.

In the case of my protracted Netflix (NASDAQ:NFLX) prediction from last year, calling the streaming giant breaking $330, it would go looking for $500 setting a buy call exclusively with Seeking Alpha. This call chose option three from the former, and I’m a shade greyer in the mirror.

I remember my friend Greg, a Seeking Alpha and options trading veteran mentioning one day “Netflix’s looking good Justin”, as I visually paused to time travel through a dimly lit corridor of my buried dusty calls.

What Netflix did, was broke $330 and made two additional monthly three wave patterns pausing at $475, before retreating for another three months and re ascending to target.

However it got there, and since it has done the company has actually seen far more printed bullish demand on the charts since that re assent to and through target initiated.

Seven bullish months out of the last eight to be precise and is looking to make a big move to the $950 region should recent resistance be broken.

We will now take a look at the business before moving to the charts to analyze this potential latest third wave.

To summarize my last Netflix article in early 2023, the breakout catalyst appeared to be the addition of advertising to the platform through a cheaper option the consumer can opt for that has risen from 5 million customers choosing the option to 40 million 12 months previously and increased by 23 million since January this year alone. In 2021 Netflix suffered a severe decline in its share price following the loss of 200,000 subscribers as the lockdown wound up and people opted for fresh air.

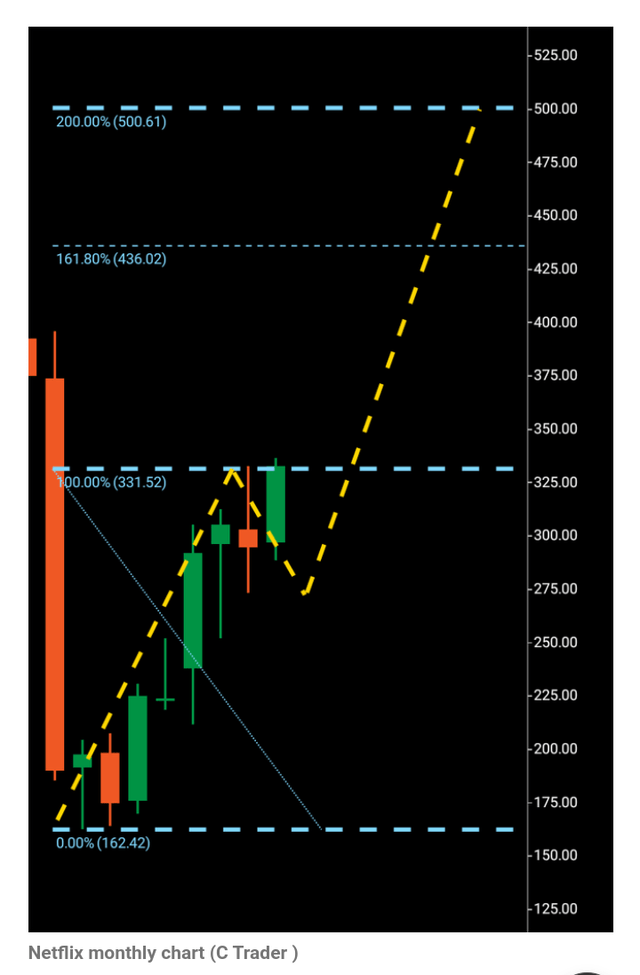

We can see the original structure from January of last year as Netflix looked to breakout for $500 in the chart below.

Netflix 2023 Breakout Set Up (C trader)

Netflix’s latest earnings saw a 16% surprise to the upside with EPS expected at 4.54 coming in at 5.28. Revenue reported was 9.37b just under 1% above expectations but up 14.81% year on year.

The company has competed well amongst additional competition dominants Apple TV, Disney+ and HBO Max. Now a new heavyweight split competitor package looms as competition evolves and according to Reuters last week, Comcast is due to release a tv and mobile steaming package with Netflix and Apple TV being provided as content for consumers in tandem at a ” Vastly reduced price to anything on the market today” according to Comcast CEO Brian Roberts.

Reuters also report that previous competitor Disney is teaming up with Warner Bros in a package of their own announced earlier in May so it will be interesting to see how this latest derived competitor evolution plays out.

Subscriptions also were better than estimated with 269 million being reported over the 264 million estimated. With Netflix also keen to delve into the lucrative sports market starting with broadcasting the pay per view boxing match between Mike Tyson and Jake Paul in July, WWE along with specialized NFL broadcasts, the company can surely expect growth in subscribers if it diversifies itself across the global sports sphere.

Several Wall Street research firms have recently adjusted their price targets mainly between the $600-$700 region, a theme I have seen countless times before, a mainstream bank or research firm issuing a conservative target where the path the equity is looking to take according to my analysis, is actually quite larger.

Firstly we will look at the protracted move to $500 from $330 and we can see the two additional three wave patterns created on the monthly chart before target was achieved. It is interesting to note that Netflix has printed a far more bullish set up since $500 was broken and we will now look at what may be next.

Netflix wave pattern journey to $500 target (C trader)

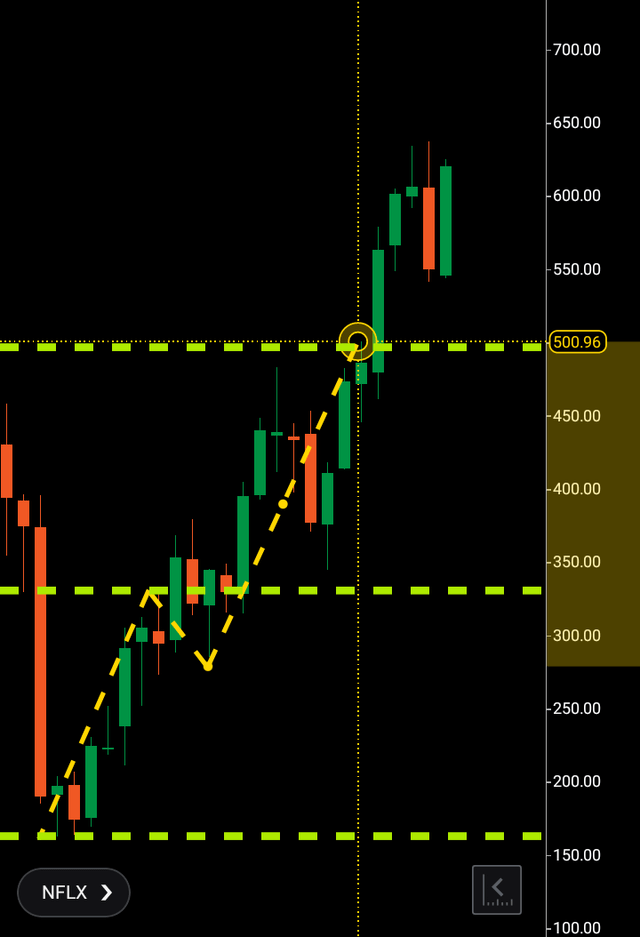

In a clearly different picture so far, magnified in the chart below, there have been six months of bullish demand from the low to the high of the now wave one, $350-$640.

Netflix Current Monthly Chart (C trader)

I would like to see more wick on the rejection candle wave two $640-$540, however given the pattern from the initial 2023 breakout, I wouldn’t be surprised if Netflix was to create an additional bearish monthly rejection candle that is more wick heavy in or around the $650-$700 region. The third wave towards $950 is due to technically breakout should $640 be broken above and also when I look at the weekly chart, it has printed only bullish candles towards resistance and will have to print a bearish rejection candle regardless, which will come before or above resistance before Netflix will push higher again.

What can go wrong and is there a bearish case for?

There is certainly no immediate bearish case, technically if there is no move higher from here and support of $540 is broken there would be a wave pattern to $475 but as mentioned there is no immediate set up for that scenario, the only thing I am apprehensive about is the break of $640 and how Netflix will go about it. A wave two should generally look for more wick than body on its candles or candle to signify clearly that there are less sellers than the market is looking for, before moving onwards to the next price region. Given its way of moving towards target in the past, an additional monthly rejection to print that scenario would not be out of the question.

From a business point of view, Netflix has seen strong growth and as all businesses are, open to a competitor move that leaves them in the shade so that could be one catalyst to trigger a sell off but the company has a solid history over its lifespan amongst competition so it remains to be seen how this team up with Apple and Comcast will compete with the Disney/ Warner package.

To finalize, I believe $640 will be broken above with a target of $950 for a third wave completion, as long as Netflix stays above the $350 wave one low and breaks the $640 mark, given the latest picture we have seen in this set up I will be looking for that to materialize within the next 250-300 days.

Justin Ward is the developer and author of The Three Wave Theory.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.