Summary:

- Nvidia’s earnings report is expected to beat expectations, and the company is expected to raise guidance, potentially leading to a big rise in stock price.

- The demand for Nvidia’s chips is insatiable, with the company expected to consume half of TSMC’s advanced chip packaging capacity.

- TSMC is increasing capacity 5X between 2023 and 2025, potentially allowing NVDA to deliver 80% higher sales in 2025 than currently expected.

- Big tech giants are directly profiting from AI, driving the demand for Nvidia’s products and contributing to its potential growth. Management expects to be supply constrained into 2026.

- The company’s historical 7% beat and raise track record could potentially double for the next two years, creating a strong tailwind for market-beating returns that are 100% justified by fundamentals.

peshkov

3 Reasons I Bought Nvidia Before Earnings

I just bought more NVIDIA (NASDAQ:NVDA) (NEOE:NVDA:CA) going into earnings. It’s already my biggest holding, accounting for 8.3% of my family fund and 6% of my net worth.

Here are three reasons I’m so confident about Nvidia’s earnings report on Wednesday, May 22 (after the bell) that I added a bit more, and I’m sleeping like a baby riding long and strong with CEO Jensen Huang.

Find out why I’m so confident in Nvidia’s short- and long-term future, and why you might want to join me in acquiring more shares before a potential 10% to 20% post-earnings pop.

3 Reasons I Think Nvidia Will Likely Beat Earnings, Raise Guidance, and Pop 10% to 20% Post Earnings

First, let’s talk about valuations.

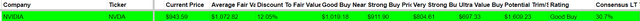

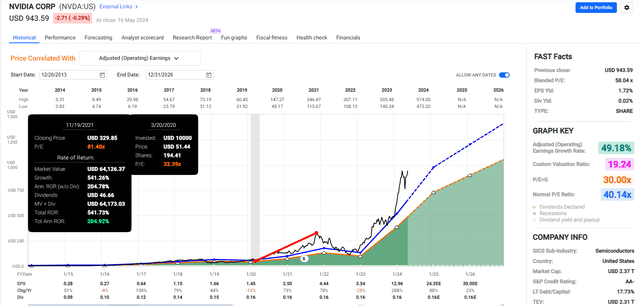

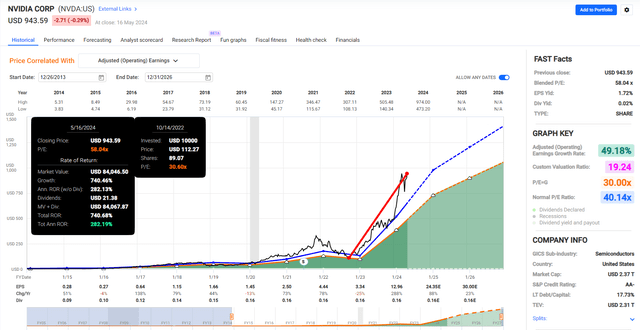

DK Master Research List

NVDA’s historical fair value (10-year average) is $1,063 today, based on current consensus estimates for 2024 and 2025.

That means if you multiply the 2024 EPS consensus by the 10-year average PE of 40.14, you get a 2024 fair value of $963.36

Take the 2025 consensus, and you get a 2025 fair value (end of year 2024) of $1,247.95.

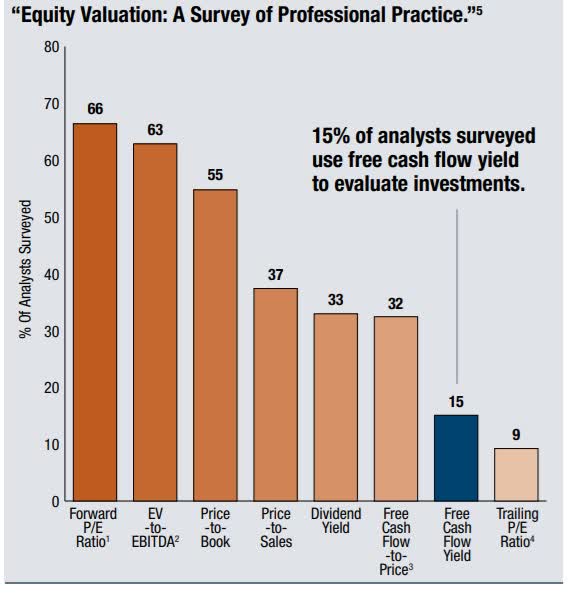

Then, we will blend them because we’re 20 weeks into 2024, and the forward PE ratio is the No. 1 most popular valuation metric on Wall Street.

Pacer Funds

60% in 2024 and 40% in 2025 give you a 12-month forward PE ratio.

Note that the trailing PE ratio, the most conservative metric, is the least used on Wall Street.

The 2025 consensus historical fair value of $1,247.95 is not a forecast.

Let me repeat: I never make price targets; I tell you a company’s historical market-determined fair value based on consensus estimates and current dividends.

Here’s what the model says.

If and only if NVDA grows exactly as analysts expect today and returns to the objective 10-year average PE of 40.14, then $1250 by the end of 2024 would be entirely justified by fundamentals.

In other words, a 32% gain in NVDA by year-end would be 100% sanctified by the righteousness of fundamentals if it meets current expectations.

If NVDA meets expectations, a $1,250 share price by year-end, with a market cap just north of $3 trillion, would not be a bubble or sign of an impending crash.

It would be 100% expected based on the company’s 10-year average valuations and strong fundamentals.

32% upside in seven months? That sounds pretty great, right?

Reason Two: Nvidia Has A Great Track Record of Beating Estimates And Raising Guidance

NVDA has beaten earnings estimates 88% of the time in the last four years.

| Quarter | EPS Beat |

| Q4 2024 | 11.40% |

| Q3 2024 | 18.73% |

| Q2 2024 | 29.36% |

| Q1 2024 | 18.80% |

| Q4 2023 | 9.46% |

| Q3 2023 | -17.32% |

| Q2 2023 | -1.49% |

| Q1 2023 | 4.86% |

| Q4 2022 | 7.96% |

| Q3 2022 | 5.81% |

| Q2 2022 | 2.27% |

| Q1 2022 | 11.43% |

| Q4 2021 | 10.36% |

| Q3 2021 | 14.20% |

| Q2 2021 | 10.67% |

| Q1 2021 | 6.87% |

| Average | 8.96% |

| Median | 9.91% |

(Source: Seeking Alpha)

Last quarter, NVDA beat by 11% and raised guidance by 10%.

FactSet Research Terminal

Over the last three years, NVDA has averaged 7% guidance raises each quarter.

If NVDA continues to follow its recent historical average, it will beat and rise by 10%. Those consensus estimates will likely rise by at least 10%.

- $1247 end-of-year fair value would rise to $1,371 fair value.

- 43% upside potential by year-end.

Why I’m Confident NVDA Will Keep Beating And Earnings For The Foreseeable Future

Jensen Huang has said that he expects Nvidia to remain supply constrained into 2026, implying they’re sold out through at least Q1 2026.

Who are its biggest customers?

Big tech giants beat on the top and bottom lines and reported AI directly driving those results.

Meta (META) announced that AI improved ad conversion rates, allowing them to raise ad prices by an average of 11%, and ad volumes rose 20%. They announced $4 billion in new AI spending for 2024.

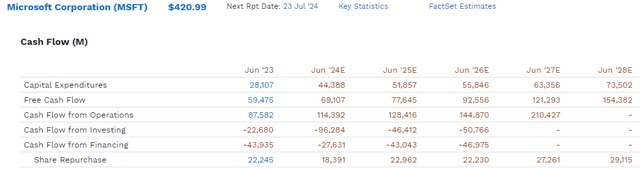

Microsoft (MSFT) announced that AI boosted Azure (cloud computing) sales by 7% to 31%, compared to a 6% sales boost last quarter (to 26%).

Alphabet (GOOG) (GOOGL) spent three hours in its I/O developer conference announcing 20 new features, each focusing on its AI Gemini platform.

Sundar Pichai mentioned that Google Cloud customers will have access to state-of-the-art Blackwell GPUs from Nvidia by the end of the year.

In other words, big tech is directly profiting from AI, not some theoretical 10-year future like Meta’s $150 billion bet on the Metaverse.

AI is real profit growth right now, and big tech is doubling down in a big way.

Microsoft has announced a $115 billion “Project Stargate” that will include millions of training GPUs, take five years, be 1000X more powerful than ChatGPT 4, and require 5 GW of power, equal to the energy requirement of New York City.

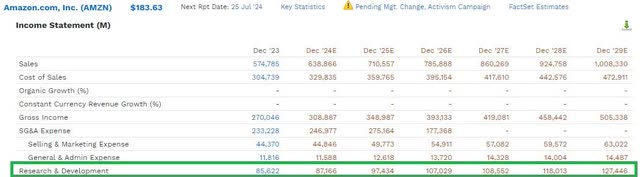

Amazon has announced it plans to spend $10 billion per year building data centers…for the next 15 years, a $150 billion AI-integrated cloud computing spending plan.

What about Google? They are all in on AI; they know it’s the key to their survival. It’s the No. 1 risk to their search/advertising business model.

FactSet Research Terminal

Alphabet is expected to spend $374 billion on R&D through 2029, which doesn’t count growth capex.

FactSet Research Terminal

- $374 billion in R&D spending.

- $319 billion in growth capex spending.

- $693 billion in innovation spending through 2029 alone.

For context, the Infrastructure Spending Bill, Inflation Reduction Act, and the CHIPs Act combined equal $2 trillion in spending on infrastructure and technology.

Alphabet is expected to spend $700 billion alone in the next six years on tech innovation and growth.

Over the next 10 years, Alphabet will likely spend over $1.2 billion, taking their average consensus spending through 2029.

If Alphabet continues growing its growth spending at current rates, it will spend $1.5 trillion on growth and R&D, most of which will be AI-focused.

Now consider the R&D spending of the other cloud giants.

FactSet Research Terminal

FactSet Research Terminal

Completing Project Stargate will result in $50 billion in R&D spending and $74 billion in growth capex spending in 2028 alone.

FactSet Research Terminal

Amazon’s R&D spending is expected to reach $128 billion by 2029, more than the Infrastructure bill passed in 2020 ($125 billion per year on average).

FactSet Research Terminal

Amazon is expected to spend over $200 billion on R&D and growth in 2029, with Microsoft $125 billion and Alphabet $130 billion.

Over $450 billion in innovation growth spending from the three cloud leaders alone.

Never mind about Meta or the non-Mag seven tech giants like Adobe (ADBE).

Never mind, Blackstone (BX) is building $50 billion worth of AI-integrated data centers.

OK, Plausible Story... Now Give Me Concrete Proof About The Short Term

TSMC’s monthly capacity to make advanced chips is expected to increase by 150% to 40,000 wafers a month this year. By next year, TSMC is expected to double its capacity once again. The key thing to note here is that Nvidia is expected to consume more than half of TSMC’s advanced chip packaging capacity. So, Nvidia’s tight control over TSMC’s advanced chip supply will help it keep the likes of Intel and AMD at bay.” – Nasdaq

Fact: Right now, the demand for NVDA’s chips is insatiable.

Fact: The limiting factor is Taiwan Semi’s (TSM) ability to make wafers that NVDA uses to make those GPUs and AI systems.

Fact: TSMC says it will increase capacity by 150% this year and by another 100% next year.

- That’s a 5X increase in capacity through the end of 2025.

Nvidia currently accounts for 50% of TSMC’s business. So, let’s assume they can’t get any additional capacity, no matter how much they are willing to pay. After all, TSMC doesn’t want to violate contracts or enrage key customers like Samsung (OTCPK:SSNLF), QUALCOMM (QCOM), or Apple (AAPL).

With insatiable demand, assume strong pricing power and that a 5X increase in GPU capacity translates into 5X sales growth, at least potentially.

- 2023 sales: $58 billion.

- 2024 sales consensus: $107 billion (84% sales growth)

- 2025 sales consensus: $138 billion (29% sales growth).

2023-2025 consensus sales growth: 138% vs 400% potential based on TSMC scaling.

CEO Jensen Huang has estimated that today’s AI chip market is $200 billion in size and will grow 20% to 25% annually for the foreseeable future.

That means potentially $313 billion in the addressable market in 2025. NVDA has a 90% market share in AI chips, and Mizuho estimates that even as late as 2033, it will have a 75% market share.

Let’s do a thought experiment.

If TSMC is increasing capacity by 5X from 2023 to 2025, what might NVDA’s potential sales be? $225 billion in data center chips (where AI is reported at NVDA).

At the high end of Jensen Huang’s current guidance, that would be a 71% market share of the $313 billion addressable market.

2025 consensus sales are expected to be 90% AI, so based on Jensen Huang’s upper-end guidance and TSMC’s official scaling plans, we’re looking at a potential $247 billion in NVDA sales.

So, based on objective facts from its suppliers and CEO, the upper end of NVDA’s realistic sales potential is $247 billion, compared to the current consensus of $138 billion.

NVDA might potentially beat sales estimates by 79% in 2025.

Net and free cash flow margins are expected to remain stable through 2029.

Assume that’s true; what would that mean?

2026 EPS consensus: $35.53

2025 year-end fair value: 2026 EPS X 40.14 (10-year average forward PE) = $1,426 consensus base-case (51% upside by the end of 2025).

Now imagine that TSMC delivers on its scaling plans and that NVDA delivers far more sales than expected.

2026 potential EPS (bullish case scenario): $35.53 * 1.79 = $2,553 end of 2025 fair value.

That’s a 171% potential upside by the end of 2025.

How realistic is this bullish scenario? I didn’t make anything up.

I used pure TSMC scaling data, confirmed it was within Jensen Huang’s current guidance’s addressable market capacity, and extrapolated total sales and margins using the current analyst consensus (all 62 analysts who cover NVDA).

I used zero speculative hands waving, “Just trust me, and let’s dream big because AI is magic.”

How much would NVDA have to beat and raise each quarter to achieve this hypothetical 79% higher sales than currently expected in 2025?

There are seven quarters left to report by then. 15.79% beats and raises each quarter is a 79% higher result than current 2025 estimates.

NVDA has averaged 10% beats for the last 10 years, and based on management’s guidance that it will remain supply constrained into 2026, I expect 5% to 15% beats and raises through the end of 2025.

Some analysts believe they will be supply-constrained through all of 2026.

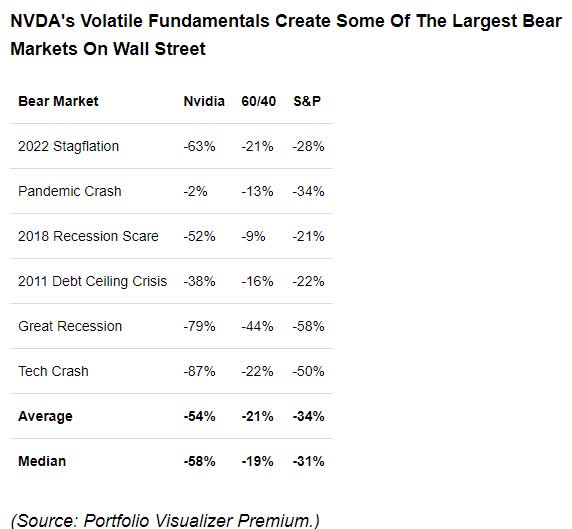

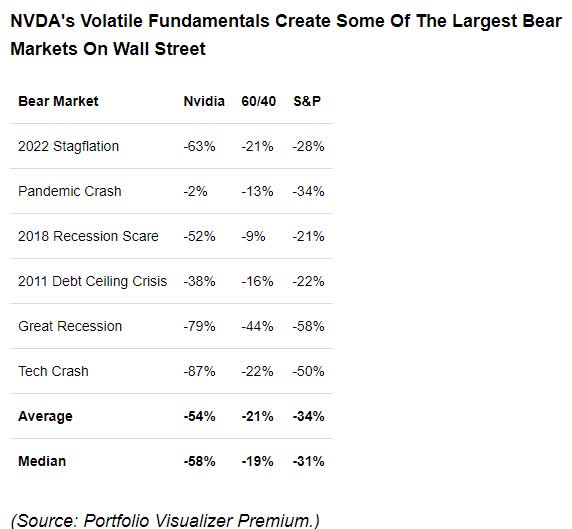

Risks To The Thesis

The most significant risk to NVDA meeting expectations, much less beating and raising by 5% to 15% (my base-case forecast), is double or tripling ordering, as we saw in the post-pandemic stimulus boom.

Remember that back then, the lockdowns caused many companies, like auto companies, to cancel orders for chips. Who would buy cars when the St. Louis Fed warned about potential 50% unemployment?

But we gave Americans $5 trillion in stimulus, and the Fed printed $4 trillion, so there was no depression. Instead, the demand for autos exploded, and there were no chips to build the cars.

The entire economy began double or triple-ordering chips to ensure they could get a sufficient supply.

It was a boom time for chipmakers, including NVDA.

FAST Graphs, FactSet

NVDA’s EPS tripled during that boom, but the price rose 6.5X, and the PE soared to 81X.

That was a 100% historical premium for a company whose median bear market is a 58% decline.

The S&P’s peak historical premium in March 2000 was 50%. NVDA was twice as overvalued as the tech bubble talk.

Portfolio Visualizer

That’s why I was warning readers to trim some NVDA through rebalancing.

So, NVDA’s 65% collapse in 2022 was not surprising.

8X Boom In EPS And Stock Up 8X = 36X Forward PE (Justified By Fundamentals)

FAST Graphs, FactSet

NVDA’s forward EV/FCF is 40X, and its median long-term growth consensus is 30.7%. Its PEG ratio is 1.25.

The forward EV/EBITDA (cash-adjusted earnings) is 30, for a PEG ratio 1.

Either way, NVDA appears to be growing at a reasonable price right now.

Facts Can Change In A Hurry

This time, that’s not likely to be the biggest threat since triple ordering would likely mean ordering GPUs from NVDA, Intel (INTC), and AMD (AMD). As long as NVDA can deliver and has the best performance per price, it likely won’t get canceled.

However, the biggest threat is the hyper-scale cloud computer giants like Google Cloud. Google is very proud of its Trillium sixth-generation GPUs, and Microsoft has said that those “millions” of GPUs needed for Stargate won’t all be Nvidia. They want their own in-house chips, like what Apple has been doing for years.

If NVDA’s strong sales and earnings growth happens as expected, investors can rest easy, as fundamentals would justify these strong gains and bullish forecasts.

If those sales don’t materialize, the market reaction could be brutal.

When the facts change, I change my mind. What do you do sir?” – John Maynard Keynes

NVDA beat and raised its guidance by 75% in Q2 2024.

Overnight, NVDA’s PE collapsed, and its fair value almost doubled. It went from overvalued to highly undervalued.

If NVDA continues beating and raising every quarter through 2025 and possibly 2026, which appears possible or even likely given current big tech spending on AI chips, then NVDA’s upside from here could be strong.

Does that demand evaporate like when those double or triple orders on chips were canceled? Then remember the median bear market on NVDA is 58%.

Portfolio Visualizer

Analysts don’t see a negative year of sales growth for NVDA through 2029.

The company is rapidly growing subscription software revenue that management says will one day represent the majority of sales.

Broadcom (AVGO) was once a chipmaker that diversified into subscription software sales.

Today, it’s a subscription software company that sells chips.

That is Jensen Huang’s vision for NVDA. If he can accomplish it, the age of collapsing sales and crashing earnings, the norm for this cyclical industry, will end... one day.

Those software sales are currently $1 billion per year, or just 1% of total sales.

It will take a long time for software to become the majority of sales.

Current 2030 consensus: $250 billion in sales.

If NVDA software sales double annually through 2030, $128 billion (51%).

In other words, NVDA will likely remain a hyper-volatile cyclical chipmaker for at least the next seven years and possibly for the next decade if AI chip demand proves much higher than current estimates.

Bottom Line Scenarios For NVDA Going Into Earnings

Like any analyst, let me give you the full range of what I expect for NVDA through the end of the year.

Not a forecast: Just what would be justified by fundamentals.

Today’s consensus year-end fair value: $1247 (32% upside potential).

6.5% beats and raises each quarter (3-year average): $1,508 fair value = 61% upside potential.

10% beats and raises each quarter (last quarter): $1,661 fair value = 77% upside potential.

15% beats and raises each quarter (bullish scenario I walked you through based on TSMC scaling and CEO’s upper-end TAM guidance): $,1937 fair value = 107% upside potential.

I think 5% to 15% quarterly beats and raises from management for the rest of the year are a reasonable expectation given the current state of the market and what TSMC and Arm Holdings (ARM) are reporting.

ARM reported 65% sales growth last quarter, up from 35% the previous quarter, and reports major customers are accelerating AI demand.

TSMC confirms they are supply constrained and scaling capacity as fast as possible (5X in two years).

If you understand that NVDA is a hyper-volatile company with a 58% median bear market and size your position appropriately, today is a potentially good buy going into earnings.

If NVDA beats and raises by 5% to 15%, as I expect, based on the last few quarter’s earnings days, I would expect a 10% to 20% post-earnings pop.

And that, my friends, is why I’m happy to own $150,000 worth of NVDA and ride long and strong with Jensen Huang, the techno-wizard of San Jose, into this earnings season’s most important earnings report.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my family’s $2 million real-money family fund.

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.