Summary:

- fuboTV Inc. stock has plummeted 35.7% since February, despite some positive growth in user base and narrowing losses.

- The company faces significant competition and uncertainty due to a joint sports streaming venture between Disney, Warner Bros. Discovery, and Fox Corp.

- fuboTV’s financial performance is improving, but it may take several years before it reaches profitability and justifies its current valuation.

simpson33

The last few months have been a wild ride for shareholders of fuboTV Inc. (NYSE:FUBO). For those not familiar with the company, it operates largely as a live-streaming platform that has built its business around streaming sports. It has been moving in the direction of other streaming content as well. But with larger players in the streaming market growing, the company is faced with a tremendous amount of uncertainty regarding its future.

Back in early February of this year, I looked at the problems the firm was facing and assessed its financial condition. This led me to rate the firm a “Sell” to reflect my view at the time that the stock should underperform the broader market for the foreseeable future.

Sure enough, that is precisely what transpired. Since the publication of that article, shares have plummeted 35.7%. That compares to the 6.5% rise seen by the S&P 500. This downside is even though its user base is growing and losses are narrowing. But the company is still far away from being even fairly valued. Add on top of this, competitive pressures, and I would argue that there are far better opportunities on the market today that investors should be paying attention to.

Downside isn’t over yet

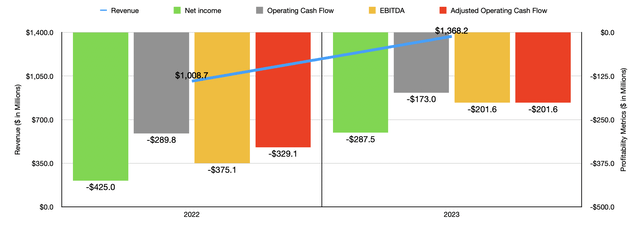

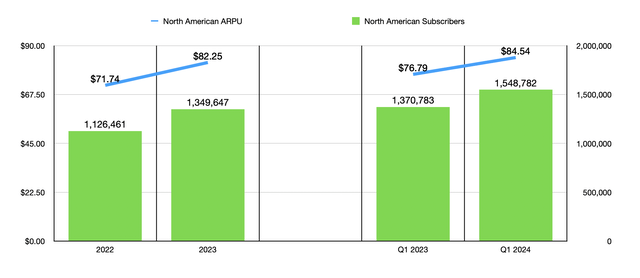

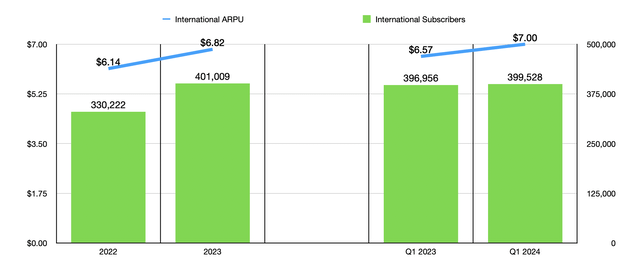

The problem with buying companies that are not profitable is that, even if they continue to grow at a nice pace, they can still warrant downside. Consider the 2023 fiscal year compared to the 2022 fiscal year. In 2022, revenue for the company came in at $1.01 billion. Sales spiked 35.7% to hit $1.37 billion in 2023. This increase was driven by a couple of different factors. For instance, the number of paid subscribers that the company had on its service throughout North America grew from 1.13 million to 1.35 million. In addition to this, ARPU managed to increase from $72.74 to $82.25. International users grew from 330,222 to 401,009. And ARPU for them jumped from $6.14 to $6.82.

Looking solely at this data, you might be perplexed as to why shares have faced the kind of pressure that they have. Some of this is because of bottom-line weakness. Despite seeing revenue improved nicely, net profits still came in negative to the tune of $287.5 million. That’s far better than the $425 million loss reported the year prior. Other profitability metrics also improved, with operating cash flow going from negative $289.8 million to negative $173 million and adjusted operating cash flow going from negative $329.1 million to negative $201.6 million. Meanwhile, EBITDA went from negative $375.1 million to negative $201.6 million.

Author – SEC EDGAR Data Author – SEC EDGAR Data

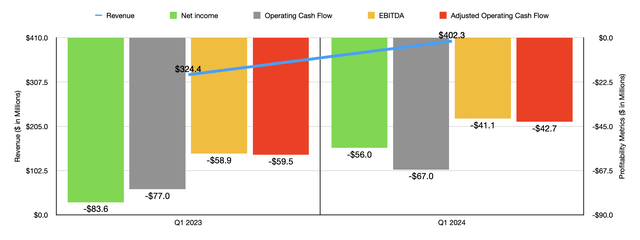

Further progress has been seen for 2024. During the first quarter of the year, the company reported revenue of $402.3 million. That was up comfortably from the $324.4 million reported at the same time one year earlier. This was thanks to the number of North American paid subscribers growing from 1.37 million to 1.55 million. An increase in ARPU from $76.79 to $84.54 also contributed to this.

Internationally, growth was more modest from 396,956 to 399,528. However, this was despite ARPU expanding from $6.57 to $7.00. Even with these improvements, however, the firm saw weakness on its bottom line continue. Admittedly, there was an improvement year over year. This can be seen in the chart below. Net losses, as well as every cash flow metric I looked at, improved from the first quarter of 2024 to the first quarter of 2023. But the company is still in a significant negative position.

But not all the firm’s problems can be attributed to the weakness on the bottom line. In fact, what initially got me to write about the firm in February of this year was the fact that shares plunged 22.7% after news broke that a joint sports streaming venture had been announced between The Walt Disney Company (DIS), Warner Bros. Discovery (WBD), and Fox Corp (FOX). This was a massive development in the industry considering that ESPN alone, which Disney owns 80% of, boasted 71 million domestic subscribers. Add on top of this the other properties involved in this arrangement, and, according to fuboTV itself, the three companies combined control between 60% and 85% of all sports content in the markets in which they operate.

Since that announcement was made, fuboTV has been on the warpath. With a market capitalization of only $430.5 million as of this writing, the company is a flea on the elephant that is its competitors. However, it’s not alone in this. On May 2nd of this year, it was joined by DISH Networks, DIRECTV, Newsmax, and various other parties in encouraging a congressional hearing on the impact that this joint venture would have on consumers. They claimed that the joint venture would control 80% of all national live sports broadcasts, as well as 55% of all live sports when you add regional activities to the mix.

There is also some support that this movement has received from the court system, with one court agreeing to set a hearing date for a preliminary injunction motion. The Department of Justice is also conducting an investigation into the joint venture, so it is unclear exactly what the result will be.

The company is also facing what appears to be a backlash from at least one of the members in that joint venture. On April 30th, for instance, management announced that Warner Bros. Discovery is refusing to renew its content agreement with fuboTV for content that includes Discover, HGTV, Food Network, and TLC unless fuboTV wants to pay up. It has also denied fuboTV the ability to obtain license rights for its Turner sports networks TNT, TBS, and truTV. The one exception to this is unless fuboTV is willing to pay what it describes as being above market rates. As a result of fuboTV’s unwillingness or inability to pay fees that it considers to be unfair and anticompetitive, it said that, as of April 30th of this year, all Warner Bros. Discovery networks would no longer be aired by the streaming service.

Despite all of these issues, management does believe that growth will continue this year. They expect, for instance, for the number of paid subscribers in North America to rise to between 1.675 million and roughly 1.695 million by the end of this year. As a result, they are forecasting revenue of between $1.525 billion and $1.545 billion. This excludes international revenue that should be between $33 million and $35 million, with the number of subscribers ranging between 395,000 and 405,000. This would be more or less flat compared to the 401,009 reported for 2023.

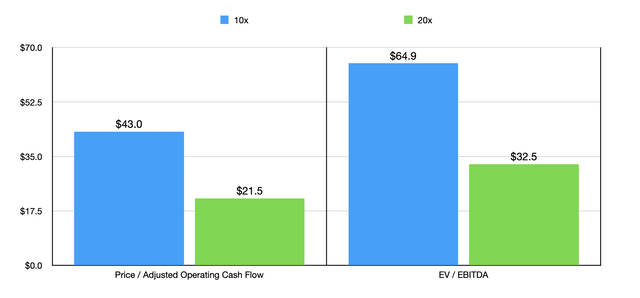

It’s unclear how things will turn out eventually. However, I would argue that, even if things go right, the picture for shareholders is not all that great. In the chart below, you can see how much adjusted operating cash flow the company would need to generate to trade at a price to adjusted operating cash flow multiple of either 10 or 20. You can also see the same thing for EBITDA regarding the EV to EBITDA multiple.

It is good to see that financial performance is improving on a year-over-year basis. But in all likelihood, profits and cash flows will still be significantly negative this year at least. Even if things go right, it could take another two or three years before hitting the kind of levels that would justify the multiples shown in the chart.

Takeaway

As much as I would love to see fuboTV thrive, I have a hard time imagining that it would turn out to be a great opportunity for investors. It is a small player in a massive space. Yes, the company is growing nicely. However, it’s facing significant competitive pressures. It would be one thing if management had succeeded in pushing the company even further to breakeven. But where things are now does not inspire confidence. At the end of the day, I would say that further downside is not unreasonable to expect. As a result, I have decided to keep the company rated a “Sell” for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!