Summary:

- Nu’s 1Q24 results were in line with market expectations, despite profits growing 167% YoY.

- There may be a deterioration in credit quality, with delinquency rates rising.

- Nu’s entry into the Brazilian telecom market could be a potential growth avenue for the company.

onurdongel

Investment Thesis

I recommend holding Nu (NYSE:NU) shares after the 1Q24 results released on May 14th. Although the results were strong, with profits growing 167% year-on-year, the numbers did not exceed market expectations. Furthermore, there appears to be a deterioration in credit quality, with default rates rising.

On the other hand, Nu has announced that it will enter the Brazilian telecom market, which could be the first of several growth avenues that the bank can leverage to monetize its customer base outside of banking services.

Nu Results Update in 1Q24

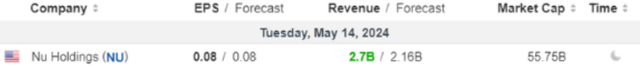

Nu released its 1Q24 results in line with market expectations, as we can see:

Despite this, it must be said that major brands were reached. As an example, Nu reached 100 million customers. And now, let’s analyze each segment of the result in detail before talking about other highlights.

Total Portfolio – Growing With Consistency

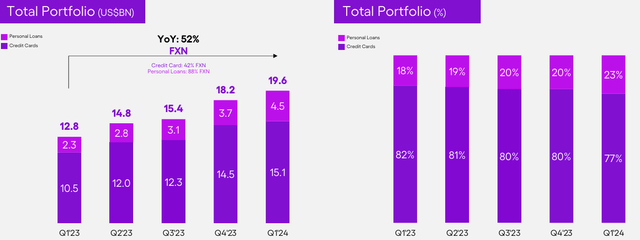

The credit portfolio reached $19.6 billion (7.5% q/q and +52% y/y), with the interest portfolio representing 49% of the total portfolio (+18% q/q).

The growth was driven by an increase in personal loans and strong originations of $2.4 billion, increasing the personal loan portfolio to $3.7 billion (+21% q/q and +92% y/y).

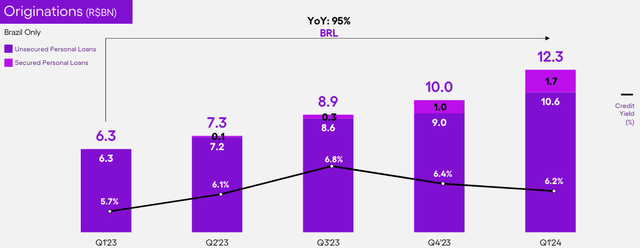

Doing some analysis, of the R$12.3 billion (or $2.5 billion) in personal loan originations, R$1.7 billion (or $340 million) came from guaranteed personal loans (increasing 70% q/q). The perspective is that the portfolio will continue to shape the company’s growth, as one of Nu’s priorities in 2024 is to expand its relevance.

Nonperforming Loan (NPL) – Growing In More Profitable Segments

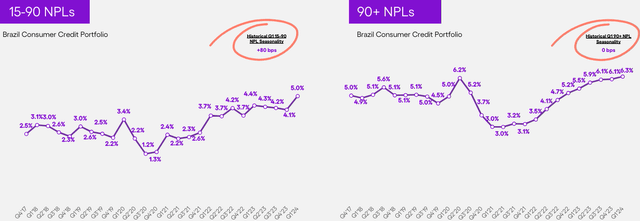

The NPL rate worsened significantly, with the NPL rising 20 bps Q/Q to 6.3% and the leading indicator (NPL 15-90) rising 90 bps. Although there is seasonality, I see that a real deterioration in credit quality may be occurring.

Delinquency Ratios Tracking Expectations (IR Company)

Looking at the quarter’s results, it seems that some difficulties are beginning to emerge in this regard, and I confess to being curious to see how provisions will behave in the next results. Currently, credit loss provision expense totals $831 million (+40.2% Q/Q and +75.0% Y/Y).

The company states that this increase is linked to “the growth of the credit portfolio, as Nu advances provisions based on expected losses over the life of the credit”. In my opinion, the relationship between NPLs and provisions should be one of the reasons for investors to pay more attention to the upcoming results.

Services – Below Expectations, But With Great News

Services revenue reached $456 million, an increase of just 0.5% q/q and 25% y/y. Due to the latest results, I believed this line would grow 40% y/y. Nu showed improvement in efficiency ratio (down 390 bps q/t to 32.1%), as the digital bank benefits from the platform’s operational leverage.

However, to my surprise, Nu announced that it would enter the telecom market. The news (little publicized) indicates that the company will have its own mobile phone operator. Anatel, the National Telecommunications Agency, confirmed that Claro (a subsidiary of América Móvil) signed a personal mobile service representation contract.

This can be very interesting, as it represents the transition from a model of services provided only to the banking segment to a broader one, reaching other sectors.

Brazil has few telephone operators, and I talk about the sector in my report on TIM. Nu, with its consolidated brand as a great service provider, can bring great competitiveness to the sector.

For calculation purposes, I will consider that Nu achieves a net income margin of 20% in its digital operation, while the sector operates at 12%. If we estimate that Nu charges an initial ticket of $10 per month and manages to reach 20% of its base, this would represent $480 million in annual profits.

That means more than a quarter of profits and would possibly be a reason to raise the recommendation from neutral to buy. However, it is necessary to understand how the company will conduct the new business and whether this can be replicated in other growth avenues. Finally, let’s talk about profits and what entry price I think is fair to recommend buying the company under current conditions.

Net Income – As Expected

Nu continues to grow and the cost of serving per customer remains under control, further improving the company’s operational leverage. As a result, Nu delivered a higher net income of $378.8 million in 1Q24 (+5.0% Q/Q and +167.2% YoY).

Net income was also favored by a lower effective tax rate of 34.5% (35.5% in 4Q23), and implies an ROE of 23%. With these numbers in hand, we can once again check Nu’s valuation versus its competitors.

Valuation remains stretched

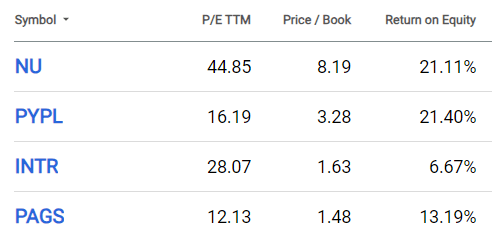

In the following, I will use Seeking Alpha to compare it with peers in Brazil and USA, such as PayPal (PYPL), Inter (INTR) and PagSeguro (PAGS). We will analyze the P/E TTM, Price / Book with the Return on Equity:

Valuation (IR Company)

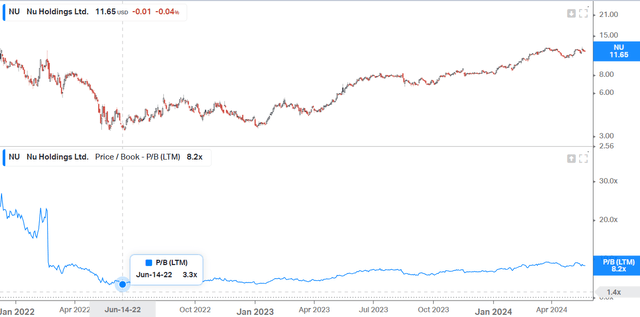

Well, all indicators show that the company is expensive compared to its competitors, therefore not offering an attractive margin of safety given the current scenario, but let’s check the company’s historical P/B to project a buy point:

The company traded at 3.3x P/B, and currently trades at 8.2 P/B. But I think that the average P/B of 5.75x would be a good entry point given the current conditions. Assuming the company gives this opportunity and returns to trading at these P/B levels, a price of buying would be $8.17, so my recommendation remains to hold the shares.

Reducing Risks

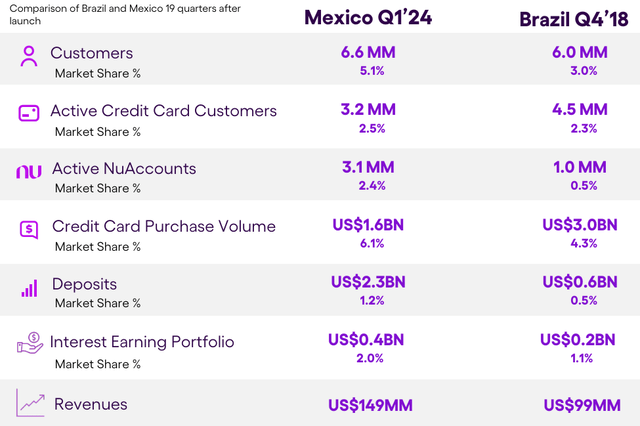

I think it’s worth noting that in my coverage initiation report, I warned that it was unwise to buy Nu at current price levels, as the market appeared to price the company’s success in Mexico as being equal to or greater than in Brazil.

This didn’t make sense to me since they are different cultures and completely different situations. However, Nu also surprised me with this presentation:

Major Milestones in Mexico Materializing Faster than in Brazil (IR Company)

In the same period of time since the start of operations, México has shown even greater growth than operations in Brazil. It is worth remembering that in Brazil, Nu reached 90 million customers in 10 years, while Itaú (the largest bank in Latin America) reached 100 million customers in 100 years.

Therefore, apparently I may have overestimated the risk of Nu having difficulties implementing its business model in Mexico, a country where the population lacks banking services.

The Bottom Line

Since my coverage initiation report, I have seen that Nu continues to grow its customer base incredibly, the company added 5.5 million customers during the quarter and 20.2 million in the last twelve months.

In terms of activity rate, Nu maintained an impressive 83%. Another interesting fact is that Nu provided additional operational figures, such as 17 million customers in the investment segment and 2.4 million SME accounts. Although Mexico and Colombia have been gaining share, Brazil still represents more than 72% of new customers.

However, if the increase in defaults is not just seasonal, the concentration on Brazilian operations may continue to be a risk. Likewise, we have the new telecom business, with which the company can further monetize its customers. However, paying 8.2x P/B I think there is little margin of safety.

Based on this analysis, I recommend holding Nu shares. I really believe in the managers’ ability, however with such a stretched valuation, it is necessary to wait for the price to become more attractive or for new initiatives to be able to beat the market’s expectations of results. At the moment, the risk-return ratio remains unattractive, in my opinion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.