Summary:

- Energy Transfer has been one of my best investments ever.

- However, I recently sold my position.

- I detail why in this article and explain one of the places where I reallocated the capital.

bunhill

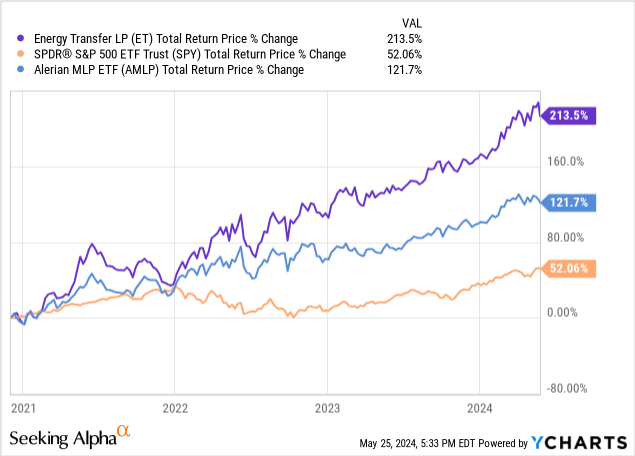

I originally bought Energy Transfer (NYSE:ET) in my core portfolio back in December of 2020. Since then, it has delivered very attractive returns of over 200%, crushing the broader midstream sector (AMLP) by nearly 2 to 1 and the S&P 500 (SPY) by roughly 4 to 1 over that period:

However, I recently sold my position, locking in very attractive returns in the process. In this article, I detail why.

My Original ET Stock Investment Thesis

My thesis for investing in Energy Transfer was predicated on a few factors. First, when I bought it, it had sold off significantly in the wake of management slashing its distribution in half. Management had promised unitholders that it was going to use the excess retained cash flow to pay down debt rapidly in order to secure its credit rating, and then, once its credit rating was on more solid footing, it would grow the distribution back to its pre-cut level. Given the selloff was as steep as it was, the Energy Transfer units already offered a very attractive distribution yield that was now covered extremely well by cash flow. As a result, I felt that even if management did not follow through on its promise to restore the distribution to its pre-cut levels, I would still be earning a very attractive income yield.

Meanwhile, the large amount of retained cash flow being used to pay down debt would at the very least increase the equity portion of ET’s enterprise value, which should lead to meaningful unit price appreciation over the long term. Moreover, it also had an attractive growth runway, which I felt would potentially add to returns. I optimistically hoped that they would be able to deliver on their promise, and once the balance sheet was on stronger footing, an aggressive distribution hiking program would likely drive significant upside in the unit price.

It turns out that Energy Transfer delivered even better than I expected on its program. Aided in part by Winter Storm Uri a couple of years ago, which landed it a massive windfall of cash flow that it was able to use to accelerate its debt reduction program, Energy Transfer grew its distribution not only back to pre-cut levels but beyond that, and has continued to guide for distribution growth on a 3-5% annualized basis moving forward. Moreover, it continues to invest in accretive growth projects, which have the potential to help drive further growth for the stock.

Why I Sold ET Stock

That being said, I recently sold my ET units for several reasons. First and foremost, the extremely strong outperformance of ET units has now driven its valuation into a range that is no longer particularly compelling. For example, its enterprise value to EBITDA multiple of 7.75 times is on par with its three-year average of 7.75 times. Meanwhile, interest rates have risen significantly over that period. While 7.75 is still a pretty decent EV/EBITDA multiple and likely reflects at least a slight discount to the private market value of its underlying assets, it is harder to make the case for significant upside potential in the unit price given that it’s trading in line with where the market has appraised it over the past three years despite interest rates rising substantially. Furthermore, its distribution yield of 8.43% is actually below its 3-year average of 8.55% and is roughly in line with its 10-year average of 8.4%. As a result, the market seems to be pricing the yield of Energy Transfer in line with its long-term average despite elevated interest rates.

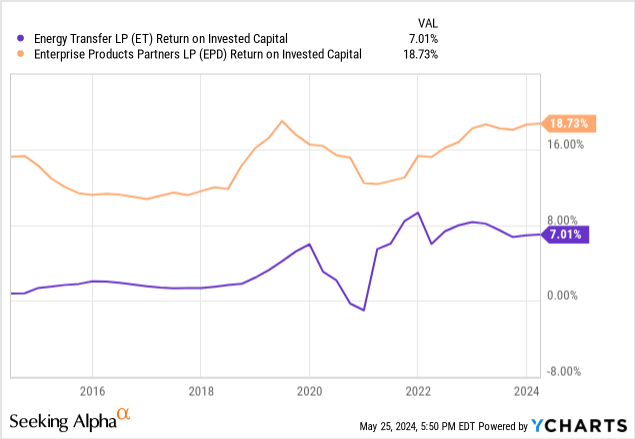

While it is true that management has been investing for growth, their track record of earning attractive returns on invested capital is not positive at all, as they have only exceeded 10% returns on invested capital once over the past 10 years. Most often, they have generated returns on invested capital in the mid-single digits. In comparison to peers like Enterprise Products Partners (EPD), which have consistently delivered double-digit and, in some cases, high-teen returns on invested capital in each of the past 10 years, this reflects quite poorly on Energy Transfer’s ability to allocate capital in a manner that is truly accretive for unitholders.

Additionally, management has not announced any plans for repurchasing common units, which would, in our view, be a much better use of capital than investing in growth projects that have so far proven to generate returns roughly in line with or below their weighted average cost of capital. Even better would be to further accelerate the distribution growth rate, given their hefty distribution coverage ratio expected to come in at over 1.9 times this year, as we think that would catalyze further upside in the unit price.

However, as it currently stands, we see ET units unlikely to appreciate more than their distribution growth per year and could potentially grow at a slower pace than that if the market prices in higher-for-longer interest rates, which it appears to have not done in the case of ET stock at the moment. With all of that taken into account, we do not see ET as being likely to generate more than 10-12% annualized total returns moving forward. While this is certainly a more than reasonable annualized return and will likely outperform the broader S&P 500 over that period of time, it is not extremely compelling either, and the margin of safety has declined significantly.

Moreover, there are always risks that Energy Transfer could underperform this number if the energy sector were to enter another steep decline, the economy were to enter a deep recession, or interest rates remain elevated for a longer period of time, which could potentially force Energy Transfer to invest less aggressively in growth and focus more on further debt reduction. Meanwhile, there are other businesses in the sector that offer similar total return profiles, such as Enterprise Products Partners, which has a roughly 100 basis point lower distribution yield but has stronger growth prospects moving forward, a much lower leverage ratio, and a stronger credit rating. Additionally, there are several other opportunities that we think offer higher risk-adjusted returns than Energy Transfer in the midstream space and beyond.

As I laid out in my article “Why I Do Not Buy and Hold High-Yield Stocks,” businesses like Energy Transfer tend to pay high yields because they lack a sufficient number of high-returning places to allocate that capital internally. This is acutely the case with Energy Transfer due to its very poor long-term track record of generating sufficient returns on invested capital. As a result, we think that retaining so much of their capital is actually value-destructive for unitholders, and we would be much more bullish on them if they were accelerating the distribution payouts.

Investor Takeaway

In summary, while Energy Transfer has been one of my greatest investments ever, its thesis has largely played out as we see little further material upside potential in the unit price. The yield, while quite attractive and safe, does not stand out from the pack in the midstream space as it used to. As a result, given that I’m highly selective and only hold my very highest conviction picks, I no longer view Energy Transfer as a particularly attractive opportunity. Consequently, I sold my units and recycled them into other opportunities like EPD and several other picks that offer similar or higher yields, similar or higher total return potential, and lower risk prospects.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EPD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio which has beaten the market since inception and all our current Top Picks, join us for a 2-week free trial at High Yield Investor.

We are the fastest-growing high yield-seeking investment service on Seeking Alpha with ~1,200 members on board and a perfect 5/5 rating from 166 reviews.

Our members are profiting from our high-yielding strategies and you can join them today at a compelling value.

With the 2-week free trial, you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!