Summary:

- Netflix is focusing on three critical areas: live programming, ad-tier growth, and expansion into emerging markets.

- The ad-supported tier is gaining traction, with 40% of new sign-ups opting for this plan.

- Netflix’s recent deal with the NFL and expansion into emerging markets are seen as essential for enhancing audience engagement and building its ad base.

Nanci Santos

Impressively, Netflix continues to redefine the streaming landscape with bold, strategic moves designed to secure its dominance in an increasingly competitive market. The company’s renewed focus on three key areas-live programming, ad-tier growth, and expansion into emerging markets-promises to revolutionize its audience engagement, diversify revenue streams, and capture new global user bases. To begin with, live programming, exemplified by Netflix’s venture into streaming NFL games and WWE, positions the company at the forefront of a lucrative and untapped segment. Then, the ad-supported tier, experiencing explosive growth, reflects Netflix’s agility in catering to cost-conscious viewers while attracting advertisers. Meanwhile, the strategic push into emerging markets underscores Netflix’s commitment to broadening its international footprint despite the associated challenges. Insights from the recent MoffettNathanson Media Internet & Communications Conference, shared by Netflix executive Spencer Wang, reveal the game-changing potential of these initiatives for the company’s future trajectory. Netflix is not just adapting to market conditions but actively shaping the future of entertainment and streaming.

Growing the Ad-Tier

After years of reluctance to venture into ads, Netflix is now very focused on growing its ad tier to scale. This tier has seen a remarkable increase, with global monthly active users rising to 40 million from 23 million in January, up 8X YoY [Disney+’s ad tier has 22.5 million subscribers]. The ad tier was launched in November 2022 to diversify revenue streams for the company amid plateauing subscriber growth. For context on this remarkable growth fete, JPMorgan analysts in January 2024 predicted that the company would get to 42 Million subs by 2026. This significant growth reflects the success of Netflix’s strategy to offer a cheaper, ad-supported option, which has attracted a substantial portion of its user base. 40% of all new sign-ups opt for this plan [ Disney+ at ~50%] with the adoption rate consistent across different regions:

“So we’ve been growing our ads membership base so quickly. So 65% membership growth QoQ in Q1 on top of 70% growth in Q4. I thought the 70% growth in the quarter before that, on top of 100% growth. So there is naturally a lag in [indiscernible] in of it as we grow our inventory and our supply. But that’s a very fixable challenge for us. But I don’t want to paint it all is baby right now.”

—- Source: Spencer Wang, Netflix (NASDAQ:NFLX) VP of IR Spencer Wang (MoffettNathanson Media Internet & Communications Conference)

The company recently decided to end its partnership with Microsoft for advertising technology, opting to develop its ad platform instead. By creating its ad tech platform and partnering with industry leaders such as The Trade Desk, Google Display & Video 360, and Magnite, Netflix is demonstrating its commitment to evolving its business model and expanding its market presence. The focus at the moment is solely on getting to scale and building and refining the company’s ad capabilities which is seen as a long-term play, aimed at enhancing ARPU (average revenue per user) over time as the advertising business scales. Currently, the ad tier is not a significant contributor to revenues but is expected to improve in the near future. Getting to scale will take time which will require a bit of patience from investors..

Embracing Live Programming

“The goal is that we can do at-scale events around the world every week, and we are not even breaking a sweat,” Netflix ((NFLX)) Co-CEO Greg Peters said in an interview with Bloomberg.

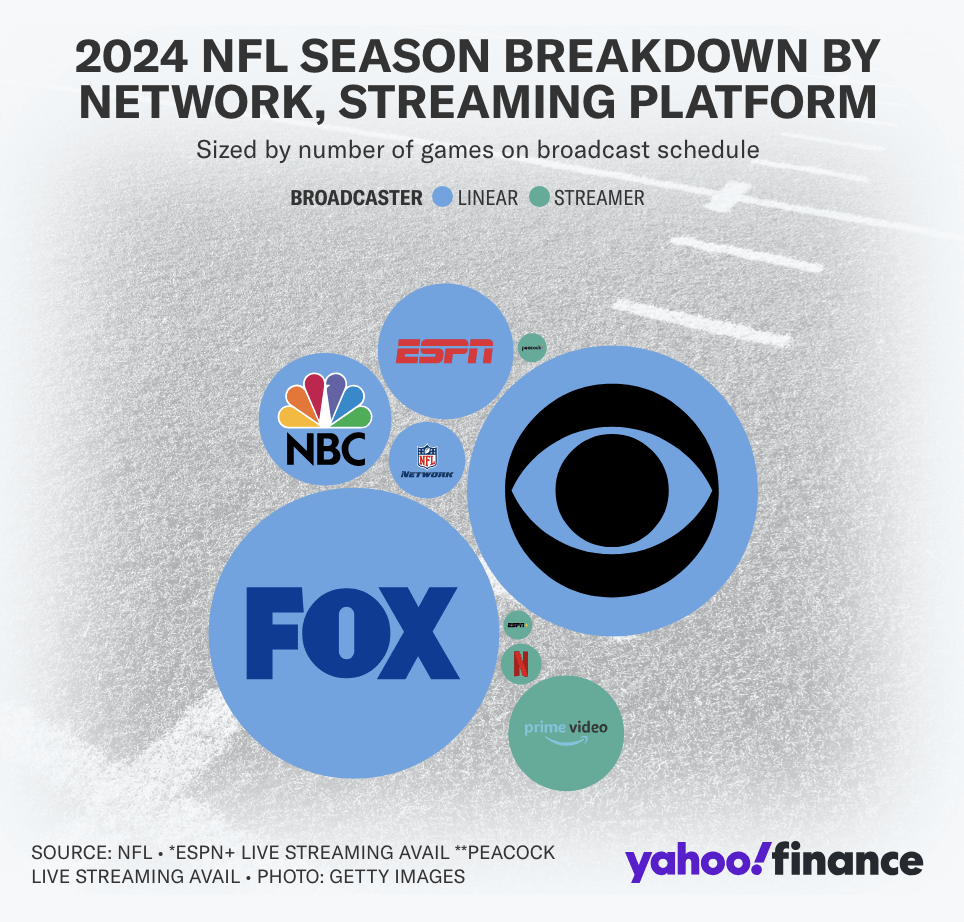

Netflix’s recent three-season deal with the NFL marks a significant shift into live programming as it streams two Christmas Day games, a first for the platform. This deal, in addition to the recent WWE deal, will allow Netflix to dip its toes into the potent mix of live sports and advertising. The partnership, while costly, is essential for enhancing audience engagement and building its ad base. Management assured investors that the cost of the NFL deal is manageable as it fits within Netflix’s existing $17 billion content budget for the year, ensuring no negative impact on operating margins.

“Most or next up with Mike Tyson and Jayou Paul fight in July and then with the WWE coming to Netflix in January of 2025. And I think that type of engagement is differentially important to both our members and to our business, because in a world of audience fragmentation and so many entertainment choices, I think what’s really rare are 3 things: attention, the ability to bring mass audiences together and thirdly, really passionate viewing. And I think the NFL really fits in well with that strategy. So again, I really think of this as an extension of that approach to build a big lot and types of programming.”

—- Source: Spencer Wang, Netflix (NFLX) VP of IR Spencer Wang (MoffettNathanson Media Internet & Communications Conference)

As currently is, the ad tier is dilutive to ARPU and the ad load is light compared to peers meaning the upside is huge. In the meantime, investors need the patience to allow the product to scale and monetize better:

“Ads need scale. What is, if you could buy one single product to get your ad product at scale very quickly, what would you buy? You buy the NFL. Are they going to lose money on it? Probably. Fox lost lots of money on the NFL for years but it was still very useful in actually building up their business at lightning speed to where it needed to be. I think that’s the way to understand the Netflix/NFL thing, and it makes a lot of sense.”

—- Source: Ben Thompson ( An Interview with Ben Thompson at the MoffettNathanson Media, Internet, and Communications Conference )

These Netflix experiments with live sports are meant to attract more viewers and generate advertising revenue. It would not be a surprise to see the company’s ambitions grow in the area of sports broadcasts.

Yahoo Finance

– Source: Yahoo Finance

Expansion in Emerging Markets

While Netflix’s expansion into emerging markets is integral to its global strategy, it has somewhat been margin-dilutive due to the lower income levels in these regions. Despite this growth being essential for broadening Netflix’s international footprint, it has presented unique challenges. For instance, despite India’s lower pricing, it remains one of Netflix’s fastest-growing markets, highlighting the delicate balance between scaling and maintaining profitability:

“In APAC, many markets haven’t had a price change in a while a year plus. And we also have had several countries where about a year or so ago, we actually lowered price…So that’s been one factor.”

—-Source: Spencer Wang, Netflix (NFLX) VP of IR (MoffettNathanson Media Internet & Communications Conference)

A Look at the Financials

Author’s

Overview of Annual Results

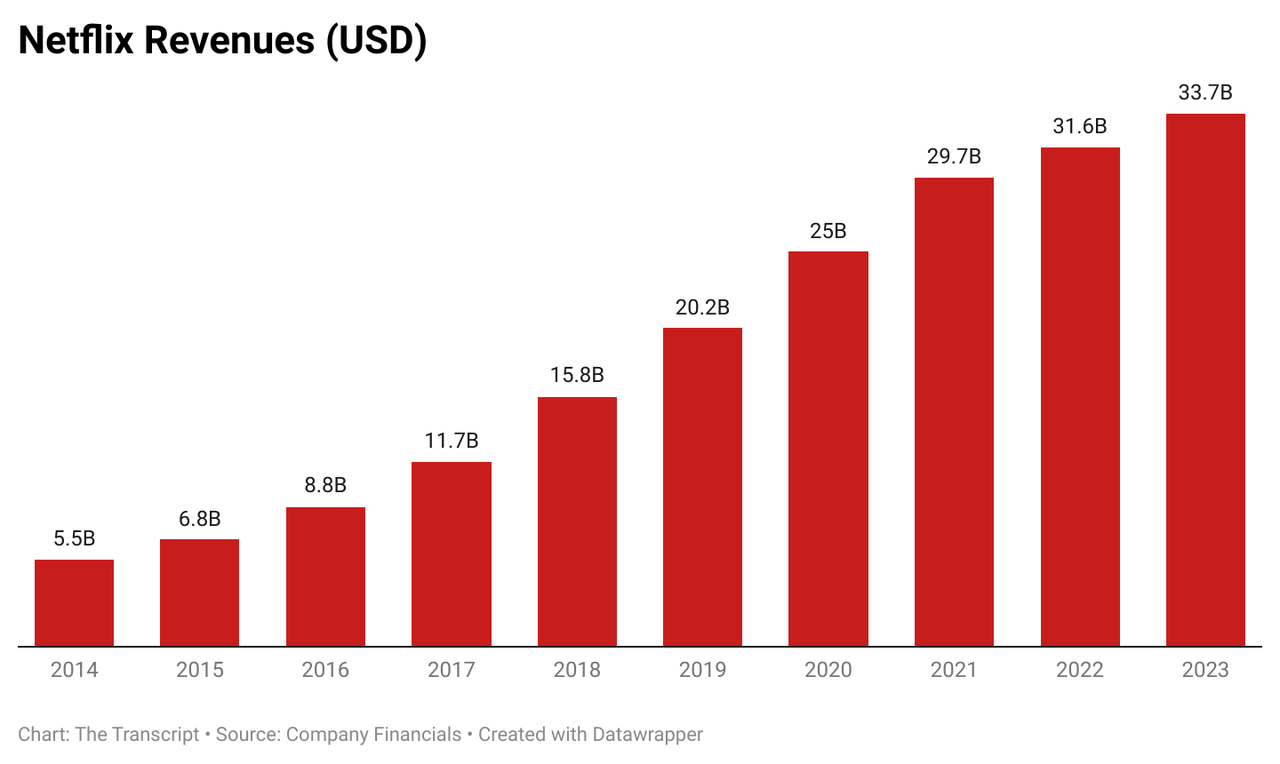

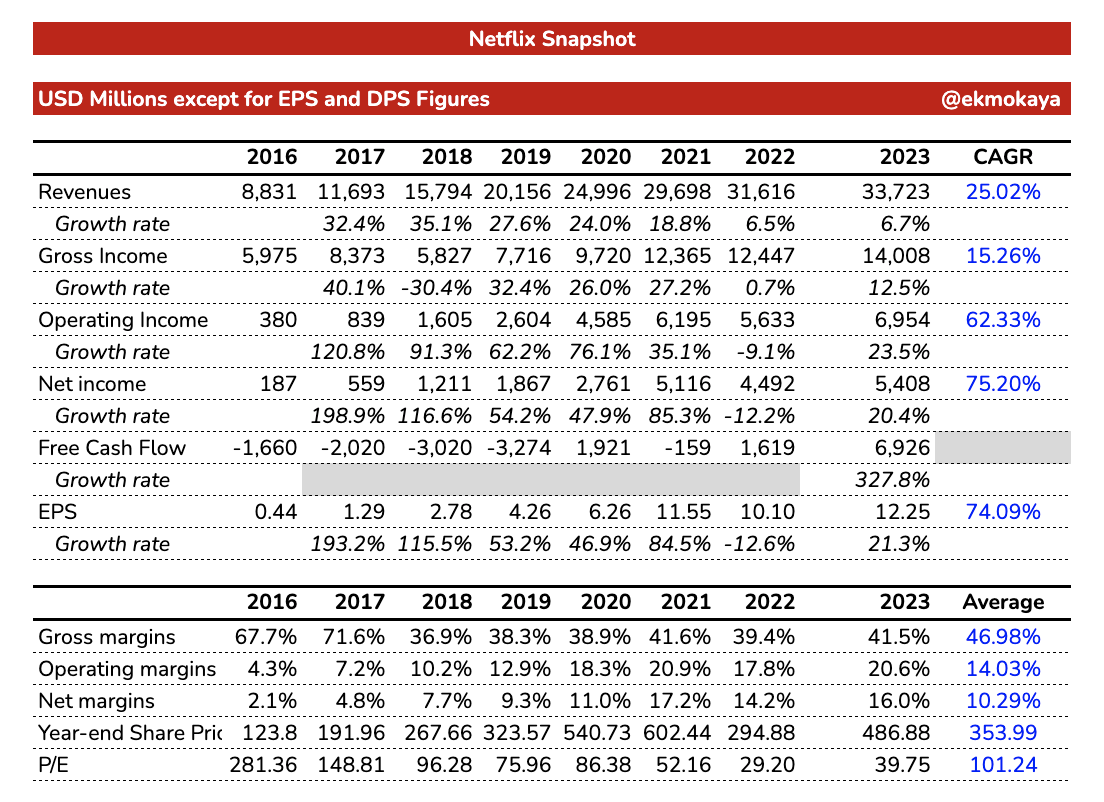

- Revenues: Streaming revenue is Netflix’s primary revenue stream, generated from membership fees tied to its content. Depending on the region, subscribers pay monthly fees ranging from $1 to $28, while additional sharing accounts are charged between $1 and $8 monthly. In FY 2023, streaming revenue increased by 7% to $33.6 billion, comprising 99.8% of total revenue. This growth was driven by a robust increase in average paying memberships, with Asia-Pacific up 17%, Europe, the Middle East, and Africa up 10%, and Latin America up 7%. Conversely, Netflix’s DVD business, which was discontinued on September 29, 2023, saw a significant revenue decline. Revenues from DVDs totaled $82.8 million in FY 2023, a 43% drop from $145 million in FY 2022. This decline reflects shifting consumer preferences toward streaming over traditional DVD rentals, marking the end of Netflix’s earliest product line. This strategic shift underscores Netflix’s adaptability to evolving market trends and its focus on sustaining growth in its core streaming business.

-

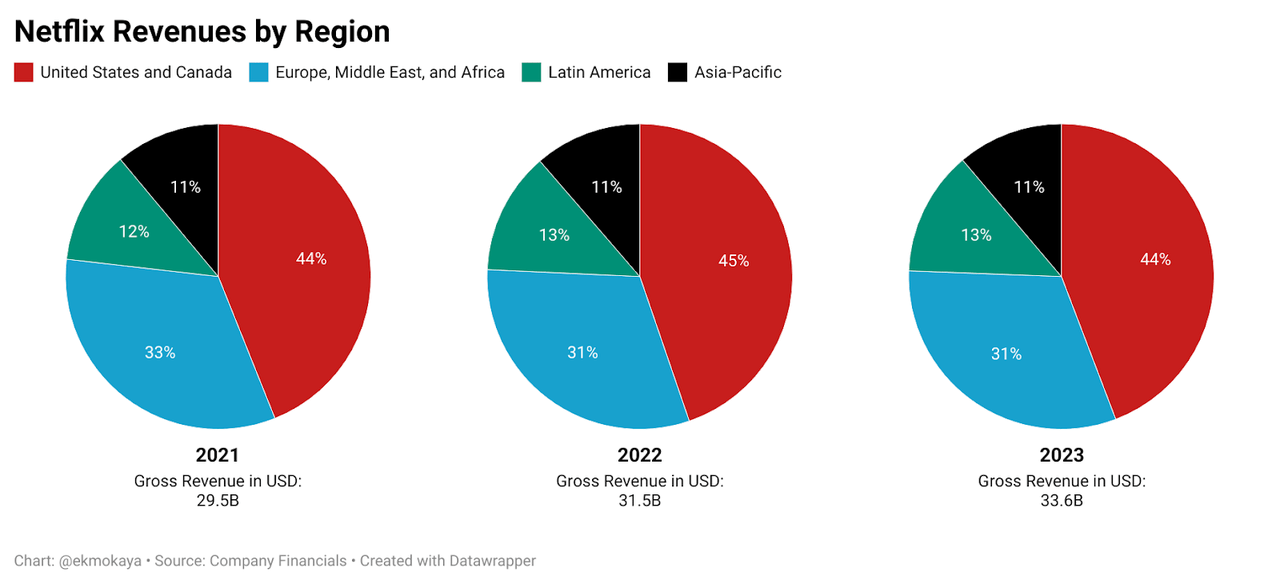

Geographically, in FY 2023, the US generated $13.8 billion in revenue, a 6.2% YoY increase, while combined with Canada, total revenue reached $14.9 billion, up 6% YoY. The EMEA region surpassed $10 billion for the first time, growing 8% to $10.6 billion. Latin America and Asia-Pacific reported revenues of $4.4 billion and $3.8 billion, with growth rates of 9% and 5%, respectively. These figures underscore Netflix’s strong global expansion and diversified revenue streams.

-

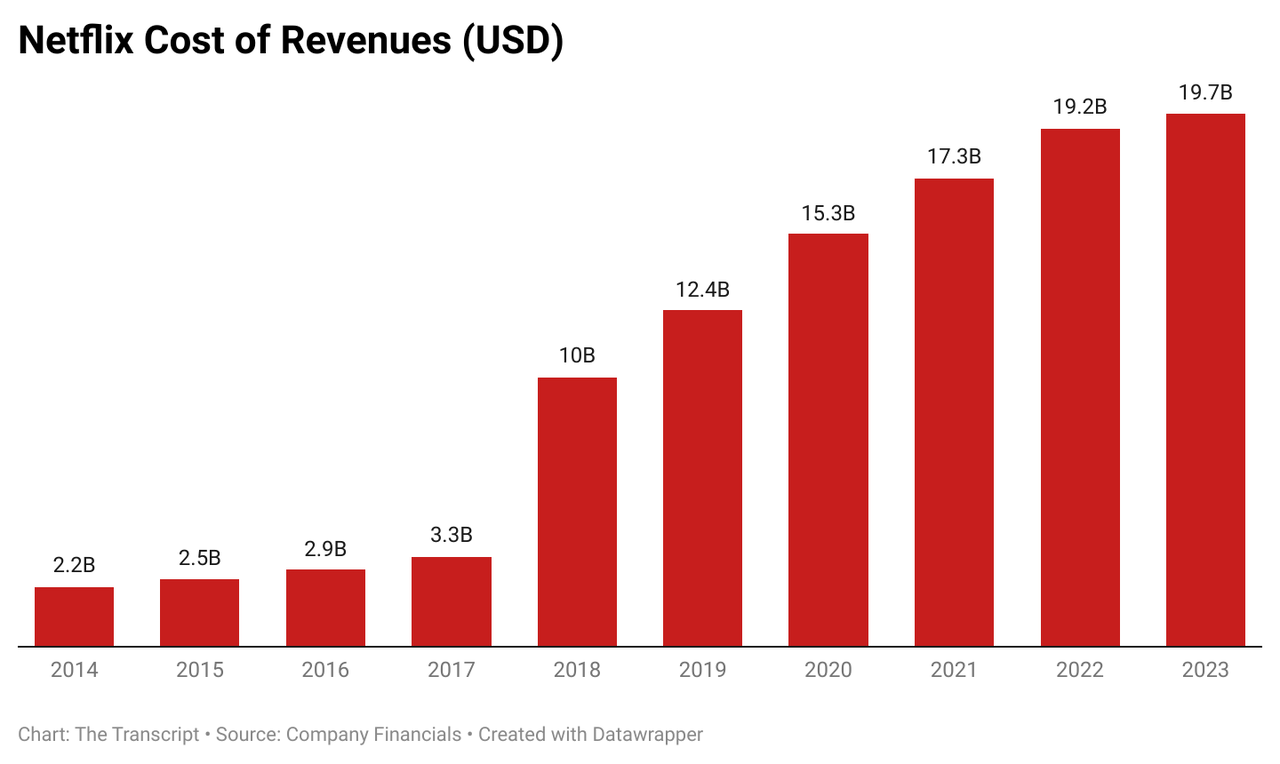

In FY 2023, Netflix’s cost of revenues, encompassing expenses for content acquisition, licensing, production, streaming delivery, music rights, content deals, and personnel, totaled $19.7 billion, a 3% YoY increase of $547 million. The rise was primarily driven by a $326 million increase in acquisition, licensing, and production costs, along with a $171 million growth in expenses for existing and new content. That jump in 2017 to 2018 visible in the graph below has more to do with Netflix’s choice to shift to spend on Originals.

-

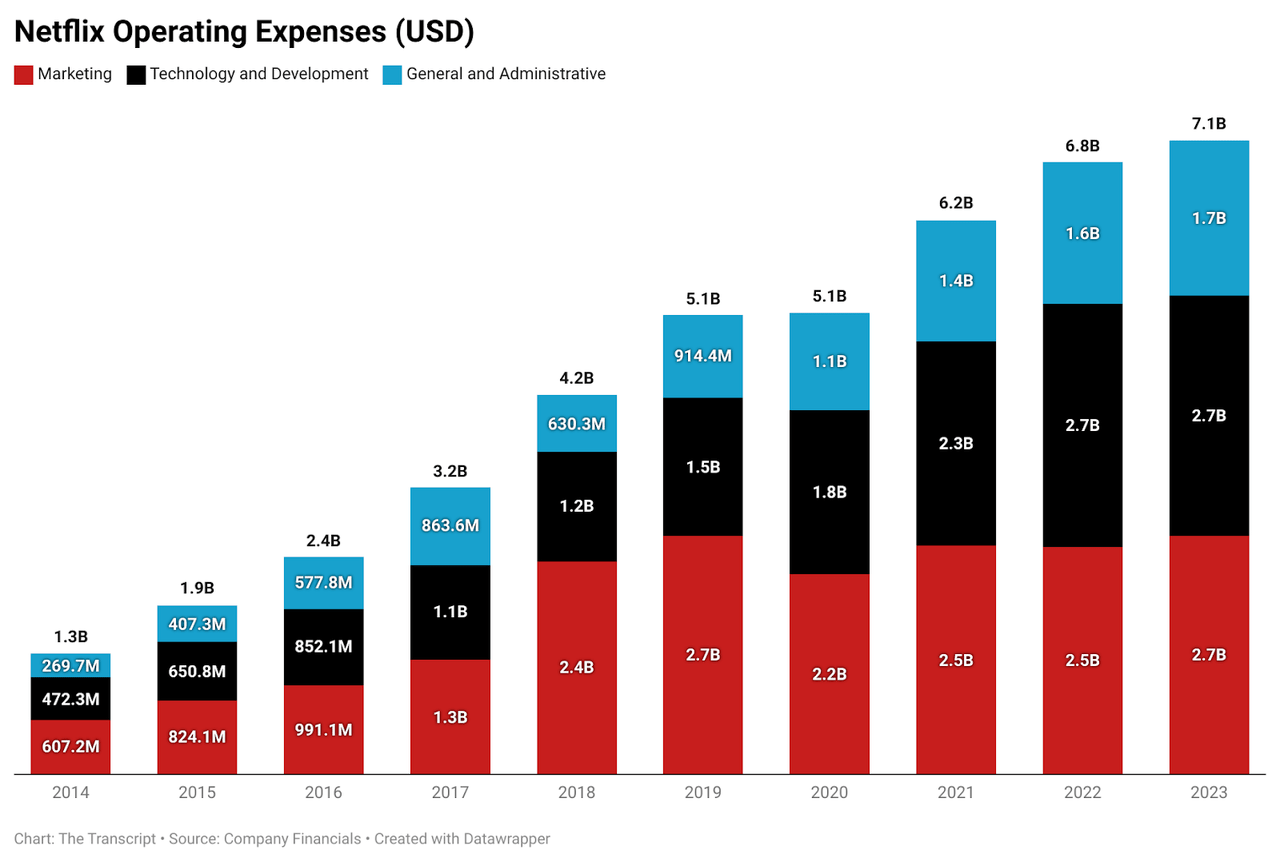

Operating expenses for Netflix fall into three main categories: marketing, technology and development, and general and administrative. Marketing expenses, which include advertising and personnel salaries, totaled $2.7B in FY 2023, up 5% YoY due to increases of $146M in advertising and $21M in personnel, remaining at 8% of revenues, consistent with FY 2022. Technology and development expenses, which cover payroll and tech-related costs for software development, testing, maintenance, and infrastructure, amounted to $2.7B, or 8% of gross revenues, and saw a 1% decrease ($35.3M) from FY 2022. General and administrative expenses, encompassing payroll, professional fees, and general operational costs, were $1.7B in FY 2023, up 9% ($147.4M) from $1.5B in FY 2022, maintaining a consistent 5% share of revenues since FY 2021.

-

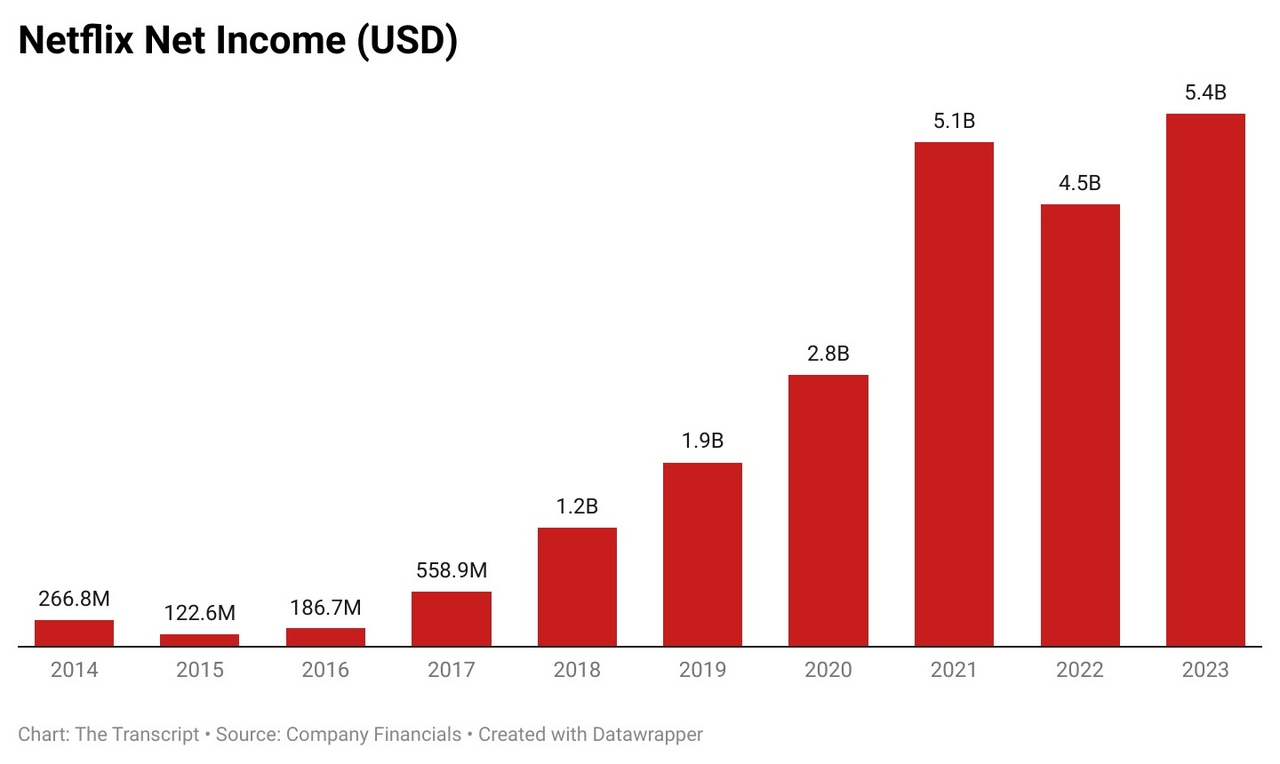

Profitability: In FY 2023, Netflix’s operating income grew by 23.5% YoY to $6.95B, recovering from a 9.1% decline in FY 2022. This increase was driven by a 6.7% rise in revenues, outpacing cost growth (2.85% for revenues and 3.51% for expenses). Consequently, the operating margin improved by 3 percentage points to 20.6%, double that of five years ago. Net profit for FY 2023 rose 20.4% to $5.4B, with net margins at 20.6%, up 280 basis points from FY 2022 but 30 basis points lower than FY 2021.

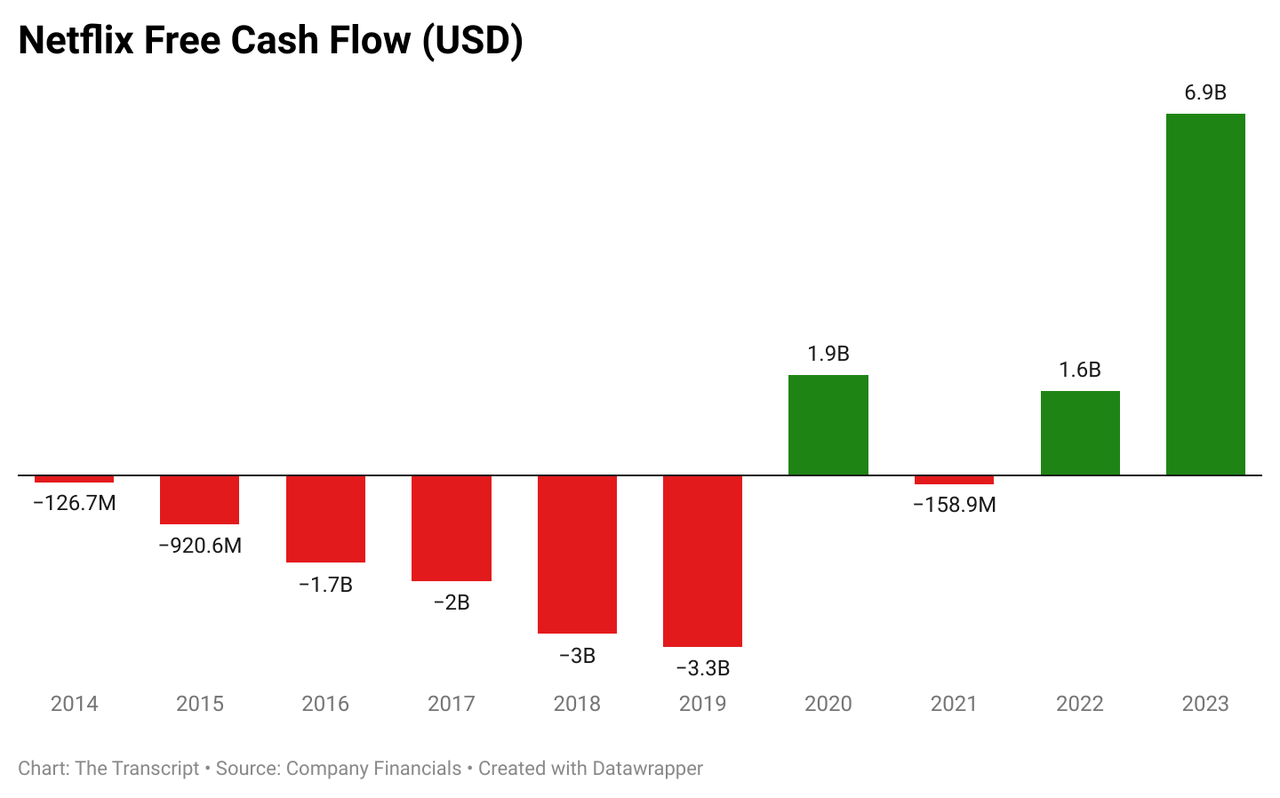

- Free Cash Flows: In the past two financial years, Netflix has achieved a turnaround in free cash flow, posting positive figures due to improved net cash from operating activities. This improvement is attributed to reduced payments for content assets, higher net income, and better overall working capital management. From FY 2014 to FY 2019, Netflix consistently experienced negative free cash flow, primarily due to substantial cash payments for streaming content assets and negative working capital differences.

Overview of Q1 2024 Results

For Q1 2024, Netflix reported revenues of $9.4 billion, marking a 14.8% YoY and 6.1% QoQ increase. Notably, the US and Canada generated over $4 billion in streaming revenue for the first time, comprising 45.1% of total revenue. Consequently, costs grew by 4% to $4.9 billion, primarily due to higher content amortization. This increase reduced the cost of revenue ratio to 53%, down from 59% in Q1 2023. Additionally, marketing expenses rose 18% to $702.5 million, driven by increased advertising spend. Meanwhile, technology and development costs saw a marginal increase of 2% to $702.5 million. General and administrative expenses remained flat at $404 million. As a result, operating income jumped 53.6% YoY to $2.6 billion, yielding a 28.1% operating margin. Furthermore, net income surged 78.7% YoY to $2.3 billion, resulting in a robust net income margin of 24.5%.

Conclusion: Netflix as the Gold Standard

Despite intense competition from major players like Amazon, Apple, and YouTube, Netflix distinguishes itself through solid execution and agility. The company’s “never say never” philosophy underscores its commitment to adaptability and continuous market evaluation. Once opposed to an ad-supported tier, Netflix pivoted decisively when market conditions changed, demonstrating its ability to adapt quickly:

“We’ve tried to sort of communicate that to you all, which is never say never in the sense like we’re always evaluating things. That’s part of our job is to pay attention to what’s going on in the world, and we need to adjust as circumstances change. I think that’s actually a healthy thing. And so we’re very open-minded to change. And honestly, that’s why the culture is the way it is. If you go back to the original culture deck from 2007, we talked about the ability to be adaptable because most companies are very good at this one thing that they do, but business environments are never constant. It may take 10 years, it may take 20 years, it may take 100 years, but things inevitably change. And we want to build a company that can adapt to those changes and thrive regardless of the circumstances”

—-Source: Spencer Wang, Netflix (NFLX) VP of IR (MoffettNathanson Media Internet & Communications Conference)

With a renewed focus on profitability, especially within the streaming sector, Netflix is on track to achieve $10 billion in profit this year, highlighting its financial resilience and operational efficiency. Netflix’s strategic execution has garnered admiration from competitors, including Disney, for its market leadership:

“We were neophytes at this, by the way. We didn’t — we had — we wanted to launch it. We want to launch it, look and make sure that it was navigable and elegant looking and then there was quality there and then it represented our company and its brands well. But — and we wanted the video to be stable at scale, meaning — and we needed that because of how many subs we signed up quickly. We got all that. We didn’t know about other — all the other factors that contribute to turning it into a real positive business like Netflix has done, and I’ve said in our earnings call last week, they are the gold standard.” [Emphasis Ours]

—- Source: Bob Iger, Disney (DIS) CEO (Seeking Alpha)

In short, Netflix’s strategic triple-play of live programming, ad-tier growth, and emerging market expansion cements its leadership and admirable status in the streaming industry. These initiatives, though challenging and costly in the short term, promise substantial long-term benefits in audience engagement, revenue growth, and global reach. Netflix’s adaptability and relentless innovation continue to set the industry standard, ensuring its dominance in a fiercely competitive market. We can be sure that as the company evolves, it will not only adapt to market conditions but also shape the future of entertainment. Netflix is here to stay, redefining the streaming landscape and raising the bar for all.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.