Summary:

- Pfizer’s stock has hit bottom and could see a boost from bird flu fears.

- Covid-related sales now account for less than 15% of Pfizer’s total revenues, de-risking the investment story.

- Pfizer is cutting $4 billion in annual costs and has raised its EPS target for the year.

- The stock only trades at 10x ’25 EPS targets while offering investors a nearly 6% dividend yield.

JHVEPhoto

Pfizer (NYSE:PFE) (NEOE:PFE:CA) hasn’t been a favorite biopharma play due to the unsustainable Covid boost, leading to a period of sales declines. The stock appears to have hit bottom and could get a push higher from the bird flu fears, though the company is now too focused on cost cuts. My investment thesis is now slightly bullish on the stock due to the cheap valuation.

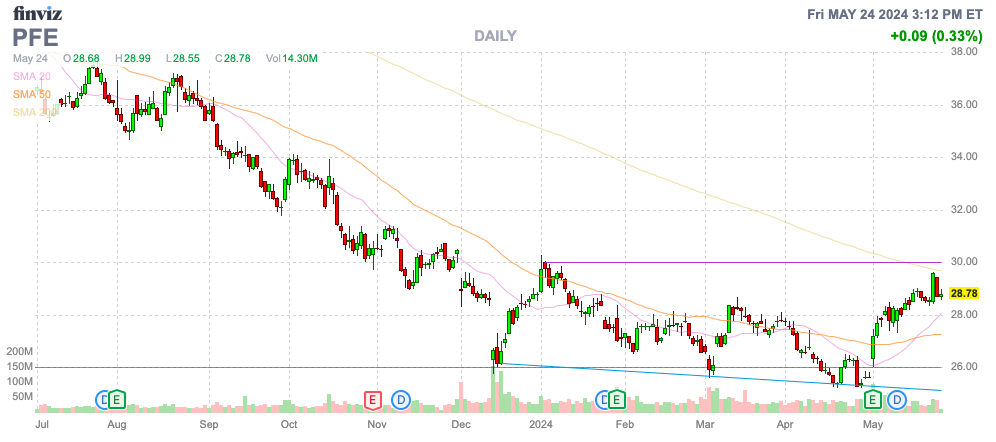

Source: Finviz

Hitting Bottom

The key to the investing story is removing the risk of additional Covid sales downside. Pfizer reported Q1’24 revenues of $14.9 billion, with Covid sales of over $2 billion and revenues growing 11% outside of Comirnaty and Paxlovid.

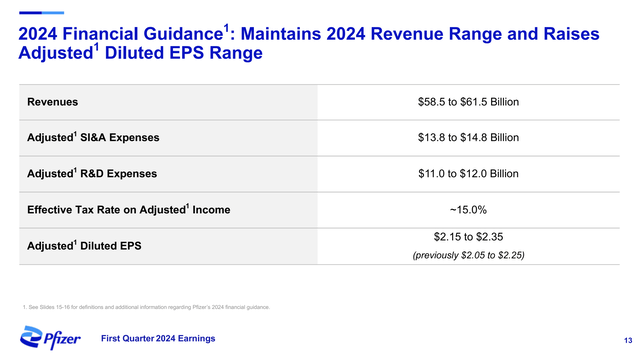

Pfizer still expects 2024 revenues to be in the range of $58.5 to $61.5 billion. The sales target includes approximately $8 billion in anticipated revenues for Comirnaty and Paxlovid (approximately $5 billion and $3 billion, respectively), and approximately $3.1 billion in anticipated revenues from legacy Seagen drug sales.

Source: Pfizer Q1’24 presentation

Covid related sales are now targeted at less than 15% of total revenues, reducing the downside risk going forward. At the start of the year, Pfizer had targeted Covid sale at $21.5 billion, leading to total revenues of above $70 billion.

The market for Covid drugs is likely somewhat stable at the current levels with Moderna (MRNA) highlighting a market where U.S. Covid vaccination rates for the Fall 2023 season were only at 11%, substantially below the flu vaccination rate at 44% while hospitalizations for Covid were higher than the flu and RSV.

Source: Moderna Q1’24 presentation

The opportunity definitely exists for Pfizer to build on the annual Covid vaccine sales now targeted for $8 billion in 2024. The general public has definitely lost faith in the untested vaccines, but demand will likely always exist in the vulnerable population.

The biopharma has promising drugs in Oncology and RSV, setting up a growth avenue outside of any impact from Covid going forward. Pfizer might actually get a boost from Covid vaccine sales, considering the ongoing flu vaccination rate is much higher.

Pfizer is in the middle of cutting $4 billion in annual costs, which is a massive 7% of sales. Due to stabilizing revenues and these cost cuts, the biopharma recently hiked the EPS target for the year by $0.10 to $2.25, at the midpoint.

Also remember, the EPS took a $0.40 hit from the financial costs of the Seagen deal. Analysts forecast the 2025 EPS jumping to $2.73, partly due to reducing those costs and expectations for sales growth going forward.

Bird Flu Boost

The recent news has Pfizer and Moderna (MRNA) working with the U.S. Department of Health and Human Services on a possible vaccine program aimed at the H5N1 virus. The government has already been converting a 4.8 million dose stockpile into doses for the avian flu.

The big question is how willing the public would be to take another untested vaccine from the mRNA-based vaccine manufacturers. Despite persistent Covid infections, most U.S. patients are reluctant to take the vaccines, with the 2023-24 season watching shots dip to only an estimated 40+ million.

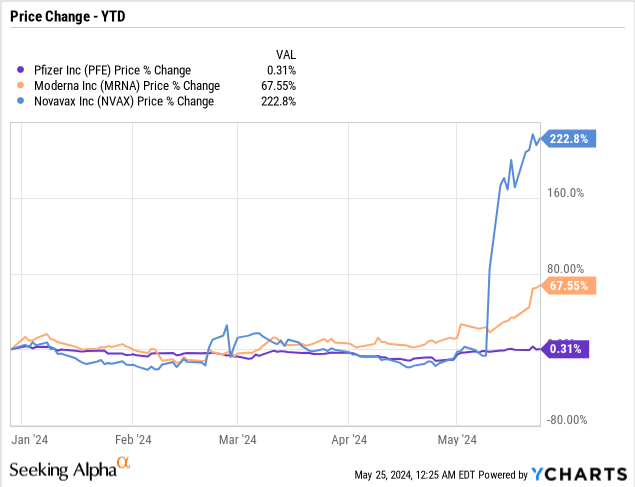

For various reason, the other Covid vaccine stocks have already soared this year. Novavax (NVAX) signed a co-commercialization deal with Sanofi (SNY) to supply vaccines, while Moderna has jumped due to excitement over their pipeline and the opportunity for a bird flu vaccine boost.

So far, Pfizer is flat on the year, while Moderna is up 68%. Due to the scale of Pfizer, the biopharma isn’t going to get the same boost from another one-time vaccine event, but the market has appeared to forget about the drug company.

The stock only trades slightly above 10x the normalized EPS targets for 2025. Pfizer is starting to offer better risk/reward scenarios and the chart is more bullish on dips with Pfizer looking close to hitting bottom.

The biopharma has a large net debt balance of ~$59 billion, partly from closing the Seagen deal. The company pays a solid dividend yield of 5.8% offering a strong return, while investors wait for the stock to rally.

The opportunity is clear for a catalyst of Covid sales rebounding in the 2024-25 season, along with a bonus bird flu order from the U.S. government. On top of that, the stock could be due for a speculative rally following the recent moves of Novavax and Moderna as the market becomes more bullish on the beaten down Covid vaccine stocks after a couple of tough years.

Takeaway

The key investor takeaway is that Pfizer appears to have hit bottom. The biopharma might finally see some tailwinds for Covid drug sales while the rest of the business is back in growth mode from the Seagen deal. A bird flu outbreak might provide another catalyst for the stock.

Investors should use any dips in Pfizer to load up on the stock at only 10x forward EPS targets with a nearly 6% dividend yield to reward investors white waiting for the biopharma to turn the corner.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start May, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.