Summary:

- Boeing shares have depreciated by over 30% YTD due to regulatory scrutiny, but the company remains a solid investment.

- The company has avoided a full grounding of its planes and has been working with regulators to address quality control issues.

- Boeing’s Q1 performance was relatively decent, and the full recovery of the air travel market and defense contracts provide growth opportunities.

Rathke/iStock Editorial via Getty Images

The Boeing Company (NYSE:BA) had a tough start to the year, as its shares depreciated by over 30% YTD due to regulatory scrutiny. While the company certainly faces some challenges that already had a negative monetary effect on its financials and resulted in the weaker performance of its business in recent months, there are reasons to believe that the company remains a solid investment as it’s too big to fail.

Too Big To Fail

In January, I wrote a bullish article on Boeing in which I said that the ongoing crisis is unlikely to result in the full grounding of the company’s planes, as was the case in 2019 during the 737 MAX crisis. Since that time, Boeing’s shares have depreciated by ~20%, and while the momentum is not on the company’s side, I still believe that Boeing is a BUY, especially at the current price.

There are several reasons why I remain optimistic about Boeing’s future. Firstly, it’s safe to assume that the 2019 scenario has been avoided so far and my initial thinking was correct. Shortly after the door plug issue was addressed, the FAA approved the path for Boeing’s newest planes to return to operations. At the same time, the company has been working with the regulator to create a plan that would fix the systemic quality control issues, which is expected to be revealed in the following days. As such, it’s safe to say that the company has a decent chance of dealing with the ongoing regulatory scrutiny without facing severe monetary damages like it was in 2019.

In addition to that, Boeing was still able to report a relatively decent Q1 earnings report last month despite the ongoing challenges. Despite having some of its newest planes grounded for a couple of weeks in January, Boeing’s revenues in Q1 decreased by only 7.5% Y/Y to $16.6 billion. At the same time, its non-GAAP EPS of -$1.13 in Q1 was above the estimates by $0.30. What’s more, is that it appears that Boeing has more than enough growth opportunities to mitigate the downside of the ongoing risks and challenges.

One of the biggest things that Boeing has going for it is the full recovery of the air travel market to above the pre-pandemic levels. There are reasons to believe that the annual air travel this year will surpass the 2019 levels as the demand is expected to continue to grow in the following months. At the same time, the growth of the Chinese market and the expansion of routes from China also indicate that the full recovery is indeed underway. Given that Boeing’s backlog in Q1 grew to $529 billion, it’s safe to assume that the latest crisis shouldn’t significantly affect the company’s performance in the long run, and the worst-case scenario has likely been avoided.

In addition to all of that, Boeing continues to be an important defense contractor, which has been greatly benefitting from the higher federal defense spending that’s aimed at tackling the rising geopolitical challenges. In Q1, Boeing’s defense division managed to increase its revenues by 6% Y/Y to $6.95 billion as the company continues to win new awards for military aircraft from the United States and its allies. Given the importance of Boeing to American interests, it’s unlikely that the ongoing regulatory scrutiny will significantly undermine the company’s business as it’s too big to fail.

Given all of those developments, there are reasons to be optimistic about Boeing’s future. Despite the ongoing challenges and the weaker top-line performance in Q1, the street continues to believe that Boeing will be able to improve its Y/Y top-line and bottom-line performance in FY24 and beyond. As such, I decided to create a DCF model to see whether Boeing’s stock is an attractive investment at the current price after the latest depreciation.

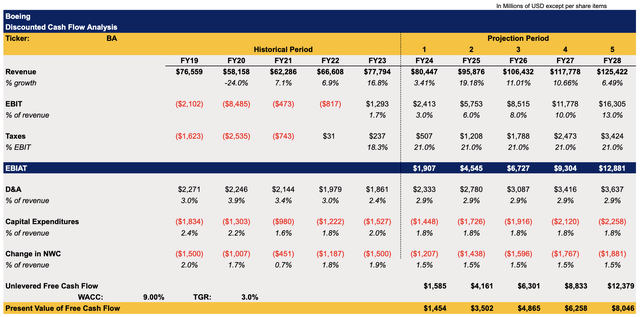

The revenue growth assumptions in the model correlate closely with the street’s updated estimates. The earnings in the model are expected to gradually grow in the following months thanks to various growth catalysts that should help the company minimize the negative effects caused by the latest developments. The tax rate in the model stands at 21%. The assumptions for all the other metrics correlate closely with Boeing’s historical performance. The terminal growth rate in the model is 3%, while the WACC is 9%.

Boeing’s DCF Model (Historical data: Seeking Alpha, Assumptions: Author)

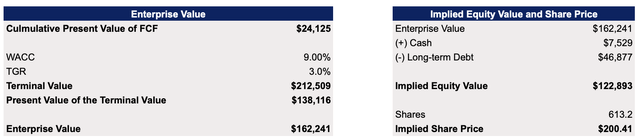

My DCF model shows that Boeing’s enterprise value is $162.2 billion, while its fair value is $200.41 per share, which indicates that the company’s stock represents a decent upside of ~15% at the current price.

Boeing’s DCF Model (Historical data: Seeking Alpha, Assumptions: Author)

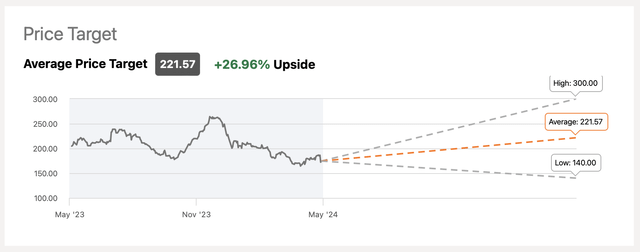

The street currently believes that Boeing is undervalued as well and has a consensus price target of ~$222 per share. Considering this, I decided to stick with my BUY rating for now.

Boeing’s Consensus Price Target (Seeking Alpha)

Major Risks To Consider

There’s no doubt that Boeing faces a major PR crisis that has already affected its business and the performance of its shares. Countless stories that question the safety of its planes are certainly negatively affecting the trustworthiness of the company. Even though thousands of planes that are built by Boeing are safely transporting thousands of passengers every day, and the company itself appears to be taking all the safety concerns seriously, the brand name has already taken a serious reputational hit that could minimize the upside of the overall business in the future.

The Chinese Comac manufacturer has been aggressively expanding the production capacity of its C919 narrow-body airliner in recent months to take a portion of Boeing’s market share in China. At the same time, the European manufacturer Airbus SE (OTCPK:EADSY) has been receiving major orders this year from international clients, who now take Boeing’s reputation into account when deciding who to work with. Therefore, while Boeing is likely to successfully weather the ongoing reputational storm and improve its overall performance in the following quarters, there’s a risk that it could start receiving fewer international orders due to the rising global competition. This could make the company overexposed to the American market, which carries its own sets of risks.

The Bottom Line

Boeing is too big to fail. Even though the latest troubles have certainly led to monetary damages and resulted in the underperformance of its business, there are reasons to believe that the 2019-type scenario under which all of its 737 MAX 9 planes were grounded across the globe for years will likely be avoided. While the company might continue to underperform in the next couple of months due to regulatory scrutiny, I believe that the long-term picture remains solid for now. That’s why I’m sticking with my BUY rating, especially since Boeing appears to be a decent investment at the current price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.