Summary:

- Block is a unique company that leverages two strong ecosystems simultaneously.

- Having two ecosystems allows to exercise strong cross-selling power and increase switching costs for customers. This is a strong blend to build sustainable value for shareholders.

- In my opinion, a company like Block deserves a notable premium to its fair value. At the same time, my valuation analysis suggests that the stock is approximately fairly valued.

BlackJack3D/E+ via Getty Images

Investment thesis

I like companies which leverage robust ecosystems as this approach creates strong cross-selling opportunities and increases switching costs for customers, a formidable mix to build sustainable value for shareholders. In this respect, Block, Inc. (NYSE:SQ) is a unique company because it leverages two ecosystems simultaneously. This creates massive opportunities for the company to drive strong revenue growth for longer. The business looks resilient to challenges and its wide diversification across different revenue streams is also an indicator of strength. The company is financially well-equipped to continue investing in innovation and differentiation, which will likely help in building a moat. My valuation analysis suggests that the stock is approximately fairly valued, which is a compelling opportunity for such a stellar business. Block is certainly a “Strong Buy” for me because there is a quote from the great Warren Buffett, which is one of my most favorable ones.

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Company information

Block provides payment and point-of-sale [POS] solutions to merchants in the U.S. and internationally.

The company’s fiscal year ends on December 31 and there are two reportable segments: Square and Cash App. Square combines software, hardware, and financial products to serve merchants. Cash App is an ecosystem of financial products and services to serve consumers.

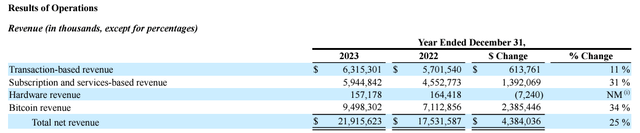

According to the latest 10-K report, Cash App is the largest segment which contributed around 67% to the company’s total revenue in FY 2023. It is also vital to understand the company’s revenue by type, where Bitcoin revenue is the largest one.

Financials

Looking at long-term trends in a company’s performance gives me an understanding of how numbers reflect the efficiency and potential of the business model. Over the last decade, Block’s revenue compounded with a staggering 44% CAGR.

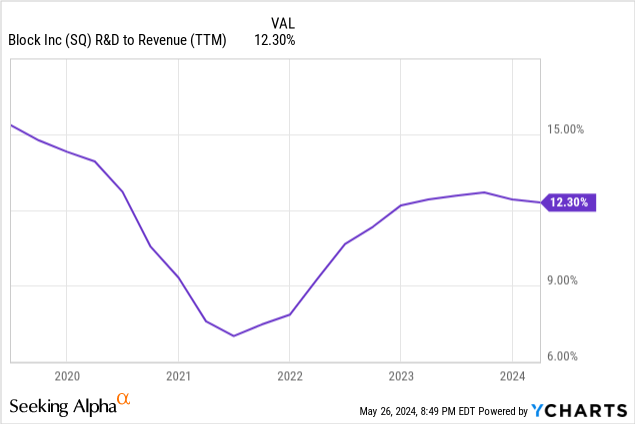

The crucial factor is that the gross margin improved as the business scaled up, indicating that the business model is economically sound, and the economies of scale effect is leverageable. The operating and free cash flow [FCF] margins also demonstrated positive dynamics before the company notably boosted R&D spending starting in 2021. The company invested $2.7 billion in R&D in FY 2023, which significantly weighed on the operating and FCF margins.

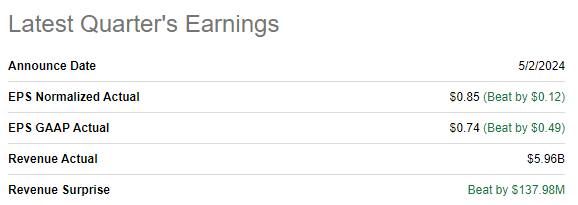

The latest quarterly earnings were released on May 2, when the company topped both revenue and EPS consensus estimates. Revenue grew by 19.4% YoY and the adjusted EPS more than doubled, from $0.40 to $0.85. The EPS strength was ensured by the solid YoY operating margin improvement, from -0.12% to 4.19%. Block generated $900 million FCF in Q1, which represents a 15% FCF margin. The FCF margin looks solid even if the stock-based compensation [SBC] is deducted, approximately 10%.

Seeking Alpha

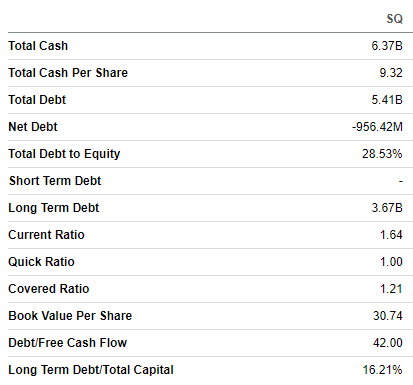

Despite having a close-to-zero FCF margin in recent years, Block’s balance sheet is robust with moderate leverage and net cash position. Liquidity metrics are also in good shape, providing SQ with solid financial flexibility to support its further expansion and innovation. Like most of the growth companies, SQ demonstrates growth in the number of shares outstanding. However, the dilution does not look dramatic as over the last two years the number of shares outstanding grew from around 580 million to 617 million as of the last reporting date.

Seeking Alpha

As we see, the company demonstrates strong long-term trends in its financial performance. Recent strength also adds to my optimism but let me switch to forward-looking insights now.

Block’s latest earnings presentation

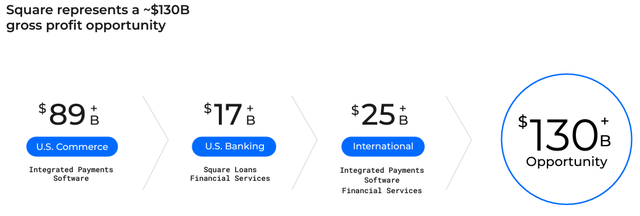

The addressable market is massive, as the company mostly targets small and medium businesses [SMB], which represent around 44% of the American economy. The company sees a vast $130 billion gross profit opportunity, meaning there is still strong potential for growth.

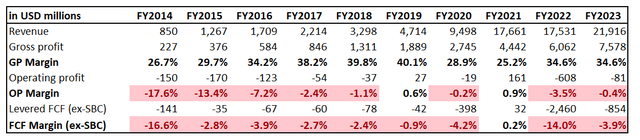

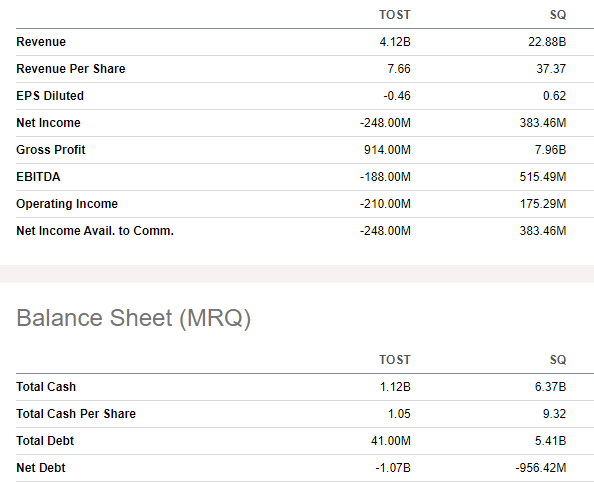

Block is in a solid market position with the largest, around 27%, market share in the POS market. Toast, Inc. (TOST) is not far behind with a 24% market share. However, if we speak about the scale of the two companies, they are incomparable. Block’s revenue is more than five times higher, and it has much more potential to reinvest and innovate. This makes Block better equipped to compete among these two companies.

Seeking Alpha

Understanding of Block’s dominance in the cloud POS market is crucial because the industry is thriving. According to Mordor Intelligence, the cloud POS market is projected to grow at a 24.2% CAGR. This is a strong tailwind, especially considering Block’s leading positions in the niche.

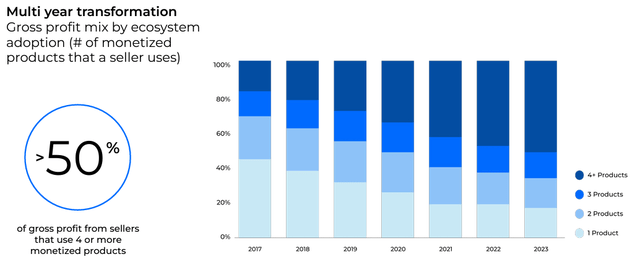

Another strong bullish sign is that each of the company’s segments represents a separate ecosystem. This allowed to significantly strengthen the company’s business mix through cross-selling. The share of gross profit generated from customers that adopted four or more products continues increasing and already represents around 50%.

SQ’s latest earnings presentation

In my opinion, companies build ecosystems to increase their cross-selling potential and increase switching costs for customers. The above bar chart suggests that SQ is quite successful in pursuing both these tasks.

According to the latest 10-Q report, Square generates around 94% of its revenues within the U.S. Quarterly international revenue is below $400 million, meaning there is a robust international expansion opportunity.

Last, but not least, apart from focusing on nurturing the top line, the management started prioritizing cost efficiency as well. This indicates that the company is switching to a new phase of its growth when quality growth becomes more important than growth at all costs.

Overall, I like Block’s business model which simultaneously leverages two ecosystems, creating strong cross-selling potential. The market opportunity is huge, both domestically and internationally. The business mix is well diversified across various revenue streams and end markets, which makes the company’s financial performance resilient. This is underscored by the fact that revenue did not dip during very challenging FY 2022, and the gross margin expanded during this turbulent year.

Valuation

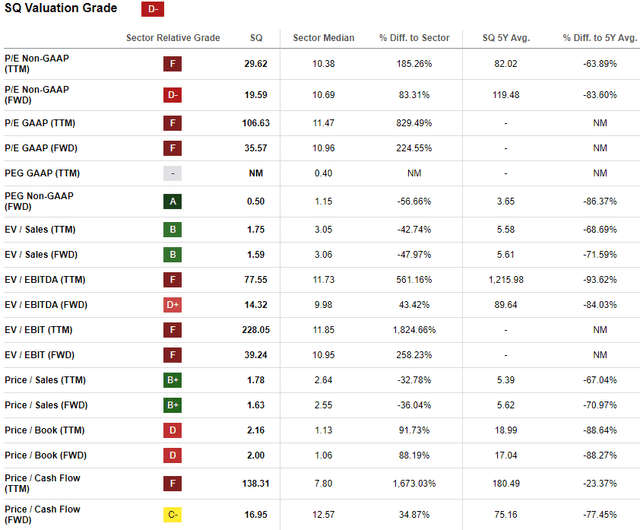

SQ currently trades multiple times lower compared to its 2021 highs achieved during the pandemic-driven stock market craze. Despite such a dip, valuation ratios are still extremely high compared to the sector median. On the other hand, SQ is a company that demonstrated a 44% revenue CAGR over the last decade and comparing it to the sector median might not be correct.

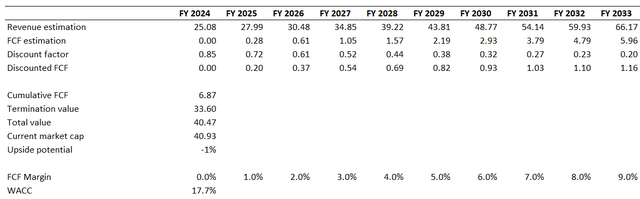

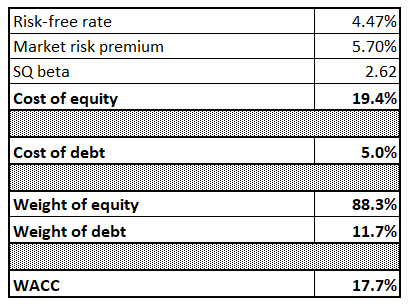

Since looking at valuation ratios does not help much in Block’s case, I must simulate the discounted cash flow model [DCF]. Resources which I usually rely on to obtain a company’s WACC provide very different recommendations for SQ. Therefore, I decided to calculate it by myself.

The risk-free rate is 10-year Treasuries yield of 4.47% at the moment. The market risk premium is last year’s level of 5.7%. According to Seeking Alpha, Block’s beta is 2.62. The weight of debt is not significant, so I apply a 5% rule of thumb for the cost of debt. Tax shield also does not apply for SQ due to losses. All in all, Block’s WACC is 17.7%.

Author’s calculations

Relying on revenue consensus estimates proved to be a sound valuation strategy for me. Moreover, it does not look like consensus estimates exaggerate revenue growth since the projected CAGR is 11%. Block’s FCF margin still dances around zero, which will be my estimate for the base year. For the years beyond FY 2024, I project a one percentage point yearly expansion in FCF.

As shown above, SQ is almost perfectly priced because its current market cap is very close to the business’s fair value.

Risks to consider

Since the addressable market for SQ is significant, it is highly likely that the competition in this field will intensify. The competition in digital payments is already fierce with several well-known brands already in the game like Apple Inc. (AAPL), Alphabet Inc. (GOOG), (GOOG), PayPal Holdings, Inc. (PYPL), Visa Inc. (V), and Mastercard Incorporated (MA). Swiftly transforming to adapt to changing consumer preferences will be a crucial aspect to endure the competition. Differentiation from competitors requires substantial investments in R&D, which will require exceptional efficiency from the management.

International expansion is a solid growth opportunity for SQ, but we also have to understand that operating internationally significantly increases legal and foreign exchange risks. Moreover, domestic success does not guarantee that SQ will succeed internationally.

As a company that handles financial and other sensitive customer data, Block is subject to considerable data privacy and cybersecurity risks. Any data breach could erode the company’s reputation, likely resulting in litigation and financial disruption.

Bottom line

To conclude, Block is a “Strong Buy”. It is a wonderful company with massive growth potential and robust resilience. The current share price is close to the fair value, which is a compelling opportunity because a company like SQ certainly deserves a premium to its share price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SQ over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.