Summary:

- Potential drivers for Intel to improve its position include positive trends in PC shipments and global capital expenditures in the data center segment.

- If Intel’s 18A chip gains market appreciation and the company can ramp up mass production before the release of TSMC’s 2 nm chip, Intel’s market share could expand.

- We expect the company’s revenue to total $56 bln (+3% y/y) in 2024, and jump to $65.3 bln (+17% y/y) in 2025.

- INTC’s adjusted EBITDA is set to total $13.8 bln (+7% y/y) in 2024, and rocket to $20.3 bln (+47% y/y).

- We believe the company is trading well below fair value. The rating is BUY.

tupungato/iStock Editorial via Getty Images

Investment thesis

Intel Corporation, (NASDAQ:INTC), founded in 1968, has been the most important company in the semiconductor industry, in the US and globally, for decades. However, over the past few years, Intel has lost its leadership position and is significantly lagging behind its competition in terms of technology. Production delays disrupted Intel’s product roadmap, while rivals gained an advantage by bringing cutting-edge technology to market. Intel’s integrated model, the company’s competitive advantage for decades, became its vulnerability as the company drastically lacked the resources to maintain the pace of developing new technology.

However, we now see several potential drivers for Intel to improve its position, which will drive the company’s financial results over the next 2-3 years.

- The expected positive trends in PC shipments and global capital expenditures in the data center segment will drive up the company’s revenue because ~80% of Intel’s sales come from the PC and server segments.

- If Intel’s 18A chip (scheduled to go into production in the second half of 2024) gains market appreciation and if the company can ramp up mass production before the release of the 2 nm chip by TSMC (mid-2025), then Intel could boost its share of the chip manufacturing market.

If Intel acquires a reputation as a reliable supplier in the future, the company has a high chance of sustained growth in revenue from external customers in the Intel Foundry segment and an upward revaluation of the stock by the market.

We have not previously covered Intel Corporation, so in this review, we will take a closer look at the company’s business structure. The status of the stock is BUY. The price target is $49.

Intel’s losing strategy

Over the past few years, Intel has lost its leadership position and is significantly lagging behind its competition in terms of technology, including the current leader of the semiconductor industry, TSMC.

To understand exactly how this happened, let’s look at several types of business models and the history of how different types of semiconductor companies interact with each other:

1. IDMs (integrated device manufacturers) are vertically integrated manufacturers. One prominent example is Intel.

IDMs are engaged in both designing and manufacturing chips. The key advantage of this model is the high degree of control over the entire chip manufacturing process from idea to finished product and over its sale. However, IDMs require high capital expenditures and have a harder time adapting to market downturns.

2. Fabless companies don’t have fabrication plants. One prominent example is NVIDIA.

Fabless companies are focused on designing chips and outsource manufacturing to foundry companies.

The advantage of fabless companies is that they don’t need to make capital expenditures to build production facilities, make regular outlays to maintain and upgrade them, and have the option to choose between factories to assemble their products. Due to the absence of high costs associated with factories, fabless companies can funnel more funds into R&D processes. The key disadvantage of such companies is their dependence on chip manufacturers and less control over their production compared with IDMs.

3. Foundries are contract manufacturers. One prominent example is TSMC.

Such companies are exclusively engaged in the production of chips to customer design. The success of foundry businesses depends significantly on the success of their customers. Optimization of the production process and the possibility of high-capacity utilization allow foundry companies to increase their profitability.

At the beginning of the semiconductor era in the 1970s, all leading manufacturers tested and produced their chips themselves. Later, in the 1980s, smaller manufacturers that did not have the necessary resources to produce chips on their own appeared on the market – and to their aid came IDMs with idle capacity. However, it quickly became clear that this type of cooperation benefitted IDM more than it did small manufacturers because the manufacturing company could put its own interests above the interests of other companies.

This changed in 1987 when TSMC opened the first factory to produce exclusively for fabless customers. The model of interaction between fabless companies and fabs allowed the former to outsource production and focus exclusively on chip development without worrying whether the partner company’s factory will meet its production plan, and allowed the latter to gain access to advanced manufacturing technologies and increase foundry capacity utilization.

At first, TSMC was technologically lagging behind IDMs, but within 10 years it managed to catch up with them by offering more favorable cooperation terms to chip developers, which set off a transition of customers from IDMs to TSMC. Since then, for more than 25 years, the remaining IDMs were, sooner or later, forced to abandon some or all of their own production plants due to higher production costs compared with foundry companies, and a significant lag in technology.

During this time, TSMC, the world’s largest foundry company, set improvements in manufacturing efficiency as its sole priority and made significant progress: TSMC now has >60% share of the global semiconductor foundry market. Meanwhile, Intel continued to be an IDM, forcing it to divide its resources between chip design and manufacturing, which ultimately led to problems in both areas.

Intel’s technology fell behind

As we mentioned earlier, at a certain point in time, IDMs started to lag behind foundry companies technologically. Intel was not an exception: at this time the best TSMC chips use the 3 nanometer process, while Intel is still mass-producing only 7 nm chips.

Previously, Intel engineers and managers were proud of the pace of their manufacturing, which evolved in line with Moore’s Law (as a reminder, Gordon Moore, one of Intel founders, made the observation that the number of transistors in an integrated circuit doubles about every two years), meaning that about every two years Intel released a chip on a new technological process.

However, in 2015, it became clear that Intel’s 10nm process was being delayed and that the company would continue to ship its advanced 14nm processors for longer than the usual two years. It wasn’t until 2018 that Intel moved to 10nm chip production in small volumes. Production delays disrupted Intel’s product roadmap, and rivals, such as AMD, gained an edge by bringing to market technology that was more advanced. When Intel was moving to the next process, 7nm, it faced even worse delays.

In addition to falling behind its own plans, Intel was not transparent enough about these failures. It wasn’t until 2020, after five long years of talking about “temporary” delays, that Intel acknowledged the problem by publishing a note in its 2Q 2020 financial results report, much to the chagrin of investors.

Why Intel fell behind

Problems integrating extreme ultraviolet lithography (EUV) technology into the manufacturing process were one reason for the failure to move to smaller nodes. Some other companies, such as TSMC, adopted the EUV technology earlier, allowing them to achieve smaller technological nodes (7nm and 5nm) sooner than Intel. This technological lag put Intel at a disadvantage, affecting its ability to compete effectively in terms of chip performance and productivity.

Another reason why the engineering process at Intel was slower than at TSMC was a directly opposite corporate culture: Intel’s rather self-contained approach prevented an inflow of ideas and views from external sources, while TSMC’s more open and collaborative culture, on the contrary, allowed it to establish partnerships with research institutes and startups, which facilitated an exchange of ideas and ultimately stimulated innovation.

To summarize this brief overview of how the company evolved and developed, it is worth noting that Intel has been one of the most important companies in the US and global semiconductor industry for decades. Thanks to the foresight of founders Robert Noyce and Gordon Moore, the company’s focus on R&D investment right from its inception has allowed it to lead the semiconductor industry for many years by innovating, setting one industry standard after another, and discovering ways to reduce the cost of semiconductor production.

Over time, Intel’s integrated model, which was the company’s competitive advantage for decades, became its vulnerability as the company drastically lacked the resources to maintain its leadership position and began to get lost amid the successful collaboration of fabless and foundry companies.

However, we now see several potential drivers for Intel to improve its position, which will drive its financial performance over the next 2-3 years.

Further down in the report, we will look at the company’s revenue segmentation and lay out our forecasts for key segments.

Intel’s revenue structure

Effective from 1Q 2024, the company modified its segment reporting, with revenue now coming from the following business units:

1. Intel Products

- Client Computing Group (CCG)

- Data Center and AI (DCAI)

- Network and Edge (NEX)

2. Intel Foundry

- Intel Foundry Services (IFS)

3. All other

- Altera

- Mobileye

- Other

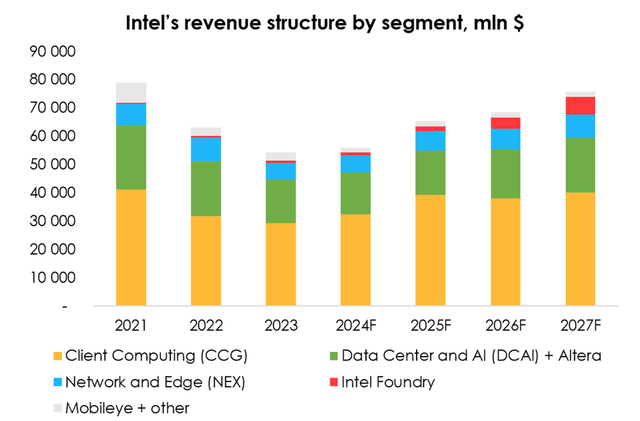

Let’s take a closer look at what, we believe, are the company’s key segments, namely Client Computing Group (CCG), Data Center and AI (DCAI) and Intel Foundry.

Intel’s revenue structure: CCG

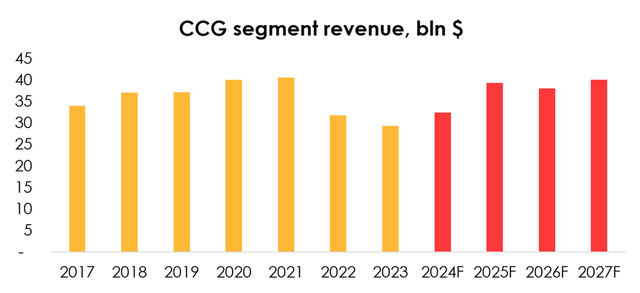

Client Computing Group (CCG) – this segment generates about half of the company’s revenue. It supplies central processing units for desktop PCs and notebooks, so CCG’s revenue dynamics significantly depends on global supplies.

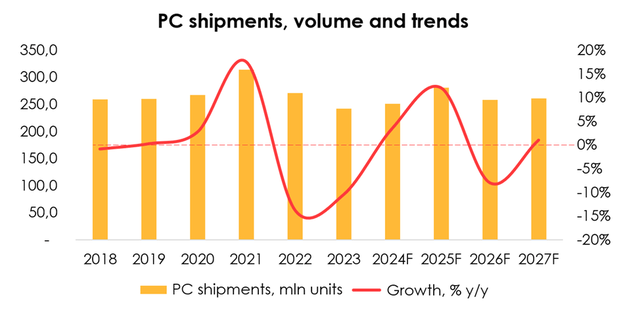

According to aggregate forecasts by Canalys and IDC, a long-awaited recovery in global PC shipments is expected in 2024 and 2025, to be followed by a decline in 2026 and near-zero growth in 2027.

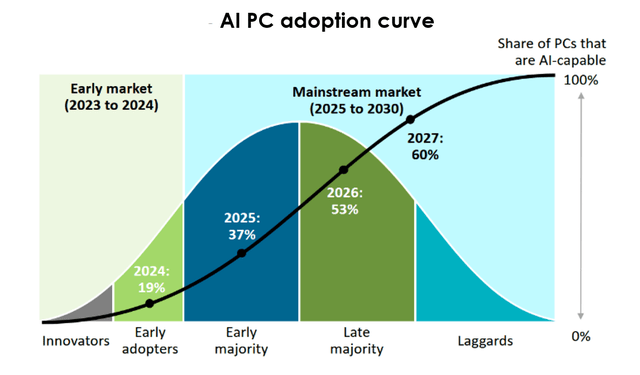

We see the adoption of AI-capable PCs (higher performance PCs that are capable of processing and performing AI tasks and machine learning tasks) as a revenue driver for the CCG segment. AI PCs are slightly more expensive than conventional models (within 5%-10%), as they incorporate more expensive components.

According to Canalys, the proportion of AI PC shipments in total PC shipments will almost double in 2024 from the 2023 level, reaching 19%. The year 2025 will see the largest increase in AI PC shipments, with their proportion jumping to 37% of total shipments.

Based on the above projections, we expect CCG segment revenue to be $32.4 bln (+11% y/y) in 2024 and $39.3 bln (+21% y/y) in 2025.

Intel’s revenue structure: DCAI

Data Center and AI (DCAI) – The key products in this segment are CPUs, GPUs and Gaudi AI accelerators.

This segment has accounted for just under 30% of the company’s total revenue in recent years. Therefore, if combined with the CCG segment, ~80% of Intel’s sales come from the PC and server segments. Consequently, the company’s revenue reacts most strongly to trends in PC shipments and capital expenditures on data centers.

Previously, the DCAI segment included the operations of Altera, a company acquired by Intel in 2015 that manufactures FPGAs, but as of 1Q 2024, Altera has been made in a separate segment. The earnings report with the new segment reporting provided historical data for Altera’s annual revenue from 2021-2023 and quarterly revenue for 1Q 2024, but we don’t believe the data is sufficient to make a reasonable forecast for Altera (by which we mean a quarterly forecast due to the lack of information on the presence of seasonality in this segment), so we will continue to include Altera’s revenue in our revenue forecasting model for the DCAI segment as it was previously presented in Intel’s reported results.

As for Gaudi, the release of updated versions of this chip could serve as a key driver of the segment’s revenue growth. Intel started developing AI chips for servers after acquiring Habana Labs in 2018, whose technology provided the basis of the Gaudi chip. The chip is manufactured based on a 5nm process at TSMC’s foundry.

Gaudi 3 is a far cry from NVIDIA’s latest designs in terms of performance, but it is a cost-effective alternative to expensive GPUs, especially at a time when NVIDIA’s chips are simply not enough for everyone. According to Intel management, Gaudi 3, unveiled in early April 2024, outperforms NVIDIA’s H100 by 50% in AI tasks, is 40% more energy efficient, and will be much cheaper than the H100. Until independent test results are released, these figures should be treated with caution, as they are based on Intel’s own internal benchmarks.

In late March 2024, Intel joined a consortium of technology companies that was formed to challenge NVIDIA CUDA’s dominance of AI software. The creation of alternative software that enables work of AI accelerators regardless of their manufacturer will provide opportunities to increase sales of such chips as Gaudi 3. Intel expects it to generate $500 mln in revenue in 2024.

Based on the estimates for global capital expenditures on data centers and the potential for the growth in sales of Intel DCAI products, we expect revenue in the DCAI segment to total $14.8 bln (+17% y/y) in 2024, and $15.8 bln (+6% y/y) in 2025.

Intel’s revenue structure: Intel Foundry

Intel Foundry – the segment that includes chip manufacturing for Intel’s own needs as well as for external customers. Intel entered the market of contract manufacturing of semiconductors in 2021 as Intel Foundry Service (IFS) to capitalize on the growing demand for foundry capacity. To provide transparency in the segment’s operations, the company in its reporting separates revenue generated from external customers and revenue from inter-segment sales within Intel. As of the end of 2023, revenue from external customers totaled $953 mln (+96% y/y), or 5% of total IFS revenue of $18.9 bln (-31% y/y).

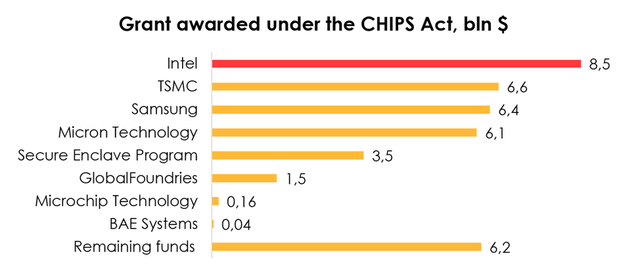

Even though IFS revenue from external customers is relatively small, Intel has ambitious plans to expand the plants by investing its own funds and with the help of government subsidies (Under the CHIPS Act the US government has given Intel $8.5 bln in grants and the option to draw $11 bln in federal loans).

Intel currently has 15 wafer fabs, which are mostly used to produce its own chips, but the corporation intends to bolster its foundry capacity manyfold in the next few years, which will empower it to take more orders from external customers, and raise the prospect of contract manufacturing for such companies as NVIDIA, AMD, Qualcomm and others in the future.

US fabless companies would benefit from having a domestic chipmaker such as Intel in order to reduce dependence on Taiwan-based TSMC, as the partnership with that company may sooner or later fall prey to geopolitical risks.

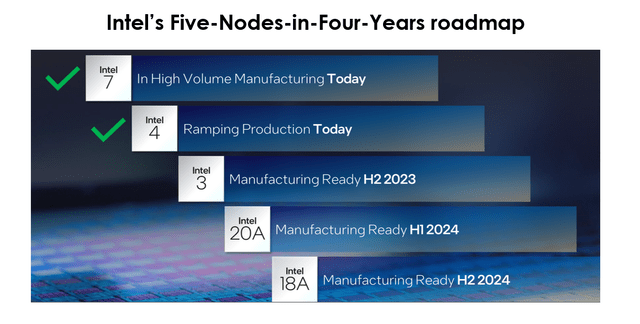

In order to close the technology gap with the competition and draw external customers to IFS, the company has set itself a goal of “five nodes in four years” in an updated roadmap.

At this point, Intel is known to have completed the development of the Intel 18A (1.8nm) and Intel 20A (2nm). Production of the 20A is set to start in 1H 2024, 18A in 2H 2024. In February 2024, the company announced the Intel 14A (1.4nm), which will go into production in 2026, and the Intel 10A (1nm), with its production to start near the end of 2027.

To put this in perspective, Intel’s main competitor in the foundry business, TSMC, plans to start its 2nm chips production in mid-2025, and start production of 1.4nm chips in 2027.

Therefore, provided that:

- the Intel 18A chip (to go into production in 2H 2024) gains recognition on the market,

- the company manages to ramp up production before the release of TSMC’s 2nm chip (mid-2025),

…Intel will be able to boost its share of the chipmaking market. If it then succeeds in establishing a reputation as a reliable supplier, the company has a high chance of sustained growth in revenue from external customers in this segment and an upward revision of its share prices by the market.

Even though not too many companies have officially announced cooperation with Intel Foundry (one of the few is Microsoft), Intel’s management asserts it already concluded contracts valued at $15 bln with external companies.

In the base-case scenario, if production of the Intel 18A becomes a success, we expect Intel Foundry’s revenue from external customers will total $1 bln (+8% y/y) in 2024, and surge to $1.8 bln (+74% y/y) in 2025.

With respect to the company’s other segments, we don’t see them as holding much promise and expect them to deliver moderate growth.

Financial results

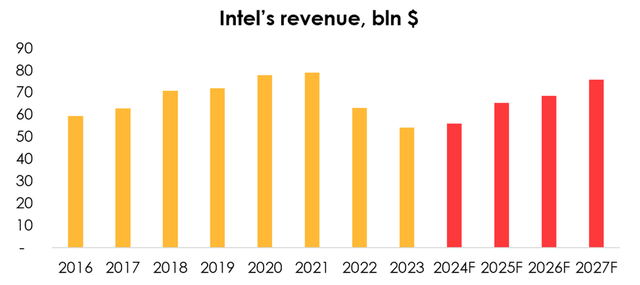

Therefore, we expect the company’s revenue to total $56 bln (+3% y/y) in 2024, and jump to $65.3 bln (+17% y/y) in 2025, which will be largely driven by rising revenue in the Intel Products segment, as PC shipments will bounce back in 2024 and 2025, and also by rising revenue in the DCAI segment.

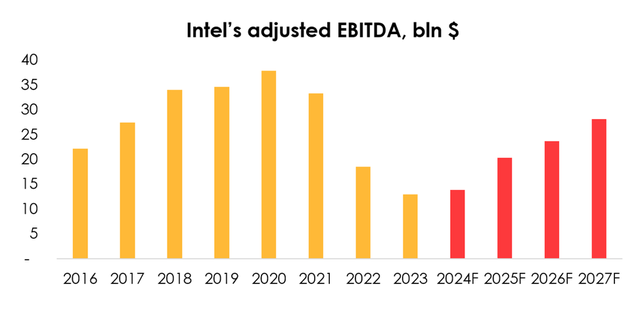

The company’s adjusted EBITDA is set to total $13.8 bln (+7% y/y) in 2024, and rocket to $20.3 bln (+47% y/y). We expect operating margin to average (1)% (+0 pp y/y) in 2024, and 8% (+9 pp y/y) in 2025.

Starting from 2022, the company’s R&D expenses has risen sharply. Their ratio to revenue was 28% (+9 pp y/y) in 2022, and 30% (+2 pp y/y) in 2023. In 1Q 2024 the metric reached 34%. We expect R&D expenses to normalize steadily. We estimate their ratio to revenue to total 30% (+0 pp y/y) in 2024, and 24% (-6 pp y/y) in 2025, which explains the projection for a strong growth of operating margin in 2025.

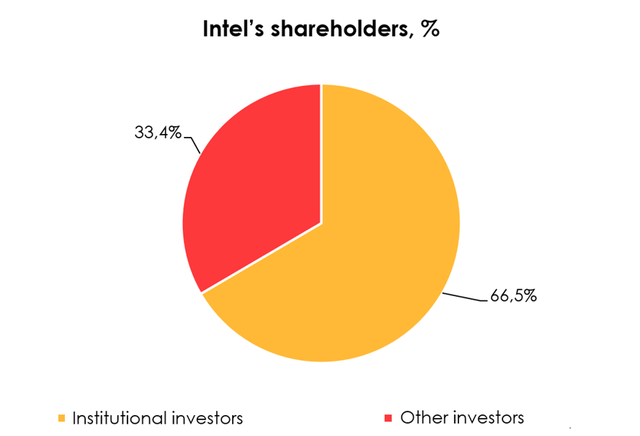

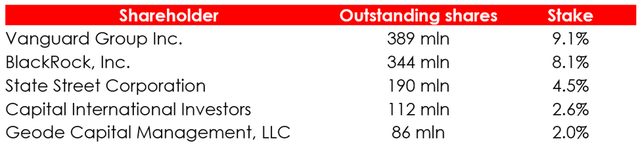

Intel’s shareholders

Most of the company’s shares are owned by institutional investors, so we rule out the risk of a corporate conflict. The proportion of individuals/insiders makes up less than 0.1%.

The table below shows the largest institutional investors and their ownership of the company’s shares.

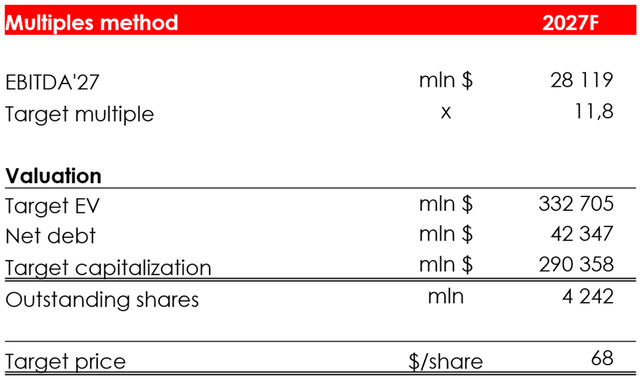

Valuation

We are evaluating the company by its projected results in 2027 using the EV/EBITDA multiples method.

The price of $49 was achieved by computing 2027 financial results and discounting them at the rate of 13% per annum.

Conclusion

At current prices, Intel Corporation stock holds appeal for long-term investors as the expected positive trends in PC shipments (from 2024-2025) and in global capital expenditures in the data center segment will drive up the company’s revenue because ~80% of Intel’s sales come from the PC and server segments.

In addition, if the contract manufacturing of Intel 18A chip becomes a success and a reputation of a reliable supplier is established in the future, the company has a high chance of sustained growth in revenue from external customers in the Intel Foundry segment and an upward revaluation of the stock by the market.

We believe the company is trading well below fair value. The rating is BUY.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.