Summary:

- NKE stock has been under pressure, with prices retreating by over 15% in the past year.

- The upcoming Paris Olympics could be a turning point for NKE, boosting sales and brand loyalty.

- NKE’s valuation is reasonable considering its brand power and profitability, with a discount compared to its historical averages.

Robert Way

NKE stock has been under pressure

Nike stock (NYSE:NKE) has been under large price and earning pressure lately. The stock price retreated by more than 15% in the past year as you can see from the chart below. In contrast, the broader market had one of the most terrific runs and went up by almost 30% in the same period. The main factors to blame in my mind are the company’s recent sales guidance cut and the pressure from rising costs (more on this later). NKE’s management recently commented that the top line is likely to dip by a low single-digit percentage over the first half of the coming year due to Nike’s product portfolio shifting and a subdued outlook for the economy.

Seeking Alpha

To add to the problems, the overall retail environment has also been challenging this year. According to a Wells Fargo report (slightly edited by me):

An early Easter and a slow start to April turned Wells Fargo more bearish towards highly cyclical names in the retail sector, with the setup to Q1 results looking less favorable than last year, exacerbated by interest rate expectations and their historical impact on discretionary spending. Wells Fargo is not impressed with how traffic is shaping up for the season. Weak trends exiting March and into April have put more focus on what is a tough second-half set-up, exacerbated by negative commentary from key names like Lululemon (LULU), Nike (NKE), PVH (PVH), and Ulta (ULTA).

Against this rather gloomy setup, the thesis of this article is to argue that the sentiment pendulum has swung too far in a pessimistic direction, so that now I see a high-quality company priced at a discount. Furthermore, I will also argue that the stock could get a boost with the upcoming Paris Olympics and development in its inventories.

NKE stock: How the Paris Olympics can help

I expect the upcoming Paris Olympics to be a huge event for NKE and possibly a turning point for market sentiment. I expect its new product launches and elongated marketing campaigns to be as highly effective as they have been in the past. I foresee NKE products and sponsored athletes being everywhere at the competition. Global exposure and athlete endorsements can boost sales of new apparel and footwear lines launched specifically for the games. Additionally, a strong showing by its sponsored athletes could also translate to increased brand loyalty and consumer demand.

As a matter of fact, I’m already seeing some signs of the momentum building up, judging from its inventory levels. An invaluable lesson I learned from reading Peter Lynch is about the use of inventory for stock analysis:

To start, unlike many other financial data that are more open to interpretation, inventory is one of the less ambiguous financial data. Lynch then explained why inventory levels can be a telltale sign of business cycles. Especially for cyclical businesses, inventory buildup is a warning sign, which indicates the company (or sector) might be overproducing while the demand is already softening. Conversely, depleting inventory could be an early sign of a recovery.

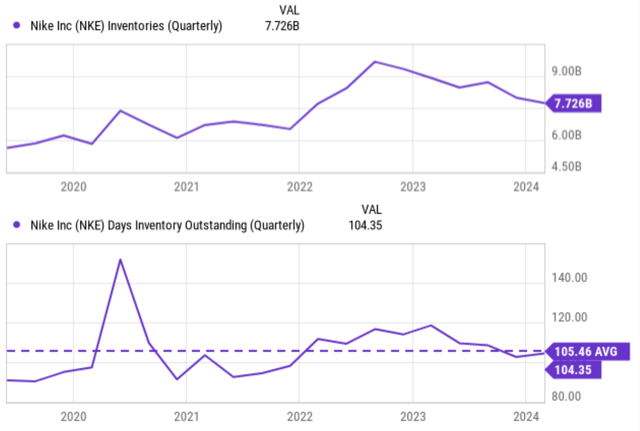

The next chart shows NKE’s inventory in absolute dollar amount (top panel) and in days of inventory outstanding (DOIO, bottom panel). In my view, the huge inventory build-up in 2020 amid the COVID-19 breakout foreshadowed many of the issues later on. At that time, its quarterly inventory surged to almost 7.5 billion dollars and DOIO to around 150 days. The inventory kept increasing to a peak of almost $10B in late 2022 and then started to fall. Currently, the inventory sits at around 7.7 billion dollars, a significant decrease from the peak level. In the meantime, the DOIO has also reverted its upward trend since 2020 and now has renormalized to 104 days, very close to its historical mean of 105 days.

Seeking Alpha

NKE stock: Valuation is reasonable

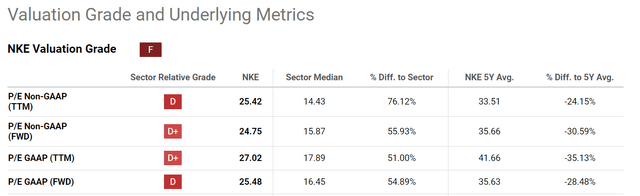

Admittedly, potential investors could feel off-putting by NKE’s valuation premium over the sector, as shown by NKE stock’s valuation grade in comparison to the sector median. Based on the chart, you can see that NKE’s P/E ratios are much higher than the sector median. For P/E Non-GAAP (TTM), NKE’s ratio is 25.42x, compared to the sector median of 14.43. This translates to a whopping difference of 76.12%. The same trend holds for other P/E ratios, e.g., based on non-GAAP earnings or on an FWD basis.

Seeking Alpha

However, my view is that the premium is well justified given NKE’s brand power and differentiating business model. Nike boasts probably one of the most powerful brand images in my mind, cultivated through decades of celebrity endorsements, high-profile sponsorships, and a focus on athletic innovation. Such an emotional connection with consumers always translates to a premium pricing advantage and higher brand loyalty compared to competitors, which I can testify by firsthand experience by just observing what my teenage son and his teammates (track team) love to wear. Thanks to such brand power, NKE has one of the most successful DTC models (direct to consumer), which now accounts for more than 40% of total sales. This shift bypasses traditional wholesalers and allows Nike to capture a larger share of profits, improve margins, and gain valuable customer data to inform product development and marketing strategies.

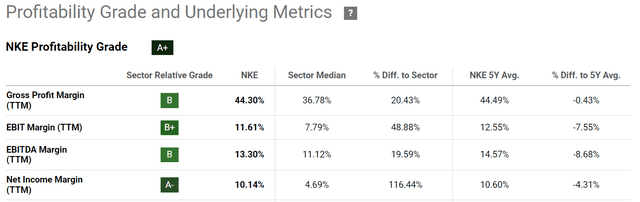

Thanks to these differentiating factors, NKE’s profitability is far superior to its peers in the sector, as you can tell from the next chart below. As a result, I think it’s more reasonable to benchmark NKE’s valuation against its own historical averages rather than its sector median. Such a vertical comparison points to a discounted valuation. For example, the five-year average for NKE’s P/E on a non-GAAP and TTM is 33.51. Its current P/E is 24.15% lower than this average. In terms of dividend yield (see the second chart below), the signal for a discount is even louder. NKE’s dividend yield is currently around 1.55% and is among the highest levels in at least the past five years (even higher than the levels during the COVID fire sale).

Seeking Alpha

Seeking Alpha

Other risks and final thoughts

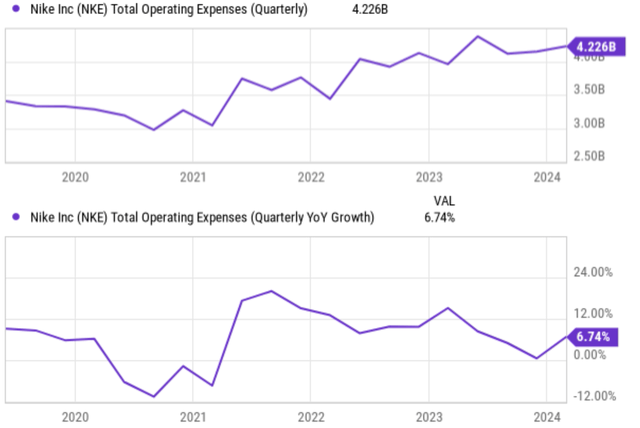

In terms of downside risks, NKE and its peers face common challenges like a slowing overall economy, global supply chain disruptions, rising inflation, etc. Here I want to focus on a more specific issue to NKE – the costs as touched on earlier. As you can see from the chart below, Nike’s total operating expenses have been increasing steadily over the past few years. In late 2020 and early 2021, total operating expenses were around $3 billion on a quarterly basis. Now, they have grown to nearly $4.23 billion. This represents an increase of around 40% over that period, far outpacing its sales growth in this period. The company has recently begun a series of efforts targeting cost control, including a play to lay off ~2% of its workforce. The effectiveness of these measures and the impact on its profitability remain to be seen given the overall backdrop of inflation, elevated labor costs, and fuel costs.

All told, my verdict is that NKE presents a compelling buying opportunity under current conditions. The stock now features an appealing combination of near-term and long-term growth catalysts. The upcoming Paris Olympics offer a significant boost in brand exposure and potential sales gains in the near term. The current valuation discount off its historical levels (especially in terms of dividend yield) is very likely to create robust returns in the longer term considering its terrific profitability, brand power, and also highly successful direct-to-consumer sales.

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.