Summary:

- Goldman Sachs shares have seen significant capital appreciation, up more than 50% since October lows.

- The company’s Q1 earnings showed higher revenues, particularly in the Global Banking & Markets segment.

- The stock’s high valuation and reliance on the macroeconomic environment make future returns less compelling at this price point.

- Goldman’s big increase in market making revenues, and hopes on the future of investment banking do not justify current valuations.

primeimages

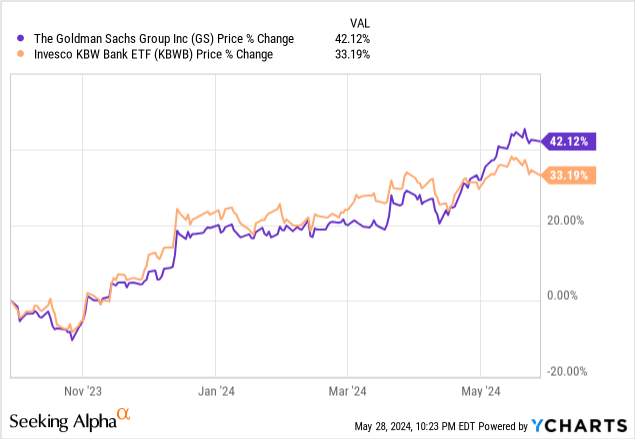

Goldman Sachs (NYSE:GS) has been, without a doubt, one of the most important financial institutions in history. Since the October lows, Goldman shares have seen significant capital appreciation, up more than 50%, and have outperformed its Banking ETF benchmark by close to 9%.

Unfortunately, future alpha returns seem already priced in from current prices.

Why the stock has appreciated so much?

There are some excellent reasons why Goldman’s stock is currently having such a run. First, the whole banking segment has experienced a well-deserved lull after the Federal Reserve stopped hiking interest rates back in August. This has allowed banks and the general financial system to stop thinking about something breaking again, like in March 2023, with some banks collapsing due to solvency worries.

With these risks off the table and relatively controlled inflation, the financial markets have seen the calm after the storm, at least momentarily. This has allowed banks to thrive from relatively depressed valuations to decent values, and in the case of Goldman, maybe even some over-optimism.

Secondly, independent of good general industry results, Goldman has generated a lot of revenue from companies looking for efficient financing because of its business model in the first quarter of 2024. This is a surprise to nobody, because Goldman is one of Wall Street’s most prestigious investment bankers.

Deep dive into Goldman’s Q1 earnings

The company saw a well-received higher revenue surprise for the beginning of 2024, following its Q1 2024 earnings release. Revenues were up from $11.32 billion at the end of 2023, to an amazing $14.2 billion in Q1. Most of this revenue increase comes from the biggest of the GS segments, Global Banking & Markets.

The Global Banking & Markets segment has plenty of divisions. Those who improved significantly over the quarter were Equity Underwriting, fueled by new IPOs and secondary offerings, and Investment Banking fees, which saw a big jump from $1.65 billion to $2.08 billion. Debt underwriting also saw a good revenue increase, from nearly $400 million to almost $700 million. Equities intermediation and financing also saw a good rise in revenues, from $2.6 billion to $3.3 billion.

The big star in the Global Banking & Markets segment, nonetheless, was the Fixed Income, Currencies, and Commodities, also known as the FICC sub-segment. Here, Goldman saw a massive increase from $2 billion in revenues to a whopping $4.32 billion. Following GS’ 10Q for Q1 2024, this increase, around page 115, was mainly due to mortgages, credit, and currencies market making or trading. This is particularly interesting, because these kinds of revenues are more of an anomaly for this specific time in the economic cycle than a real, sustainable source of growth in the future, in my opinion. I consider this a consequence of markets stabilizing after the Fed stopped hiking rates, generating pent-up demand again for those products that were relatively frozen, following the most recent 10K. For instance, it would be no surprise that if macroeconomic conditions hold, these revenues will be below Q1 numbers by the end of this year.

On the other hand, the Asset and Wealth Management division saw significantly lower revenues because of less revenue received from Equities Investments. This is not particularly scary since this number is quite volatile anyway, up $100 million since 2023 Q1, but down $616 million from 2023 Q4. The other Asset and Wealth Management segments were relatively flat.

The last Goldman Sachs revenue division, Platform Solutions, saw a $121 million increase over the Q4 2023 earnings results, or quarter over quarter. While relatively promising, I believe this is still immaterial for the company.

While these results seem quite reasonable and honestly pretty good, the valuation seems to be somewhat fueled by hope in near-future results, instead of real, sustainable growth for the company.

What is next for GS?

It is no secret that Goldman’s business model is heavily reliant on the macroeconomic environment, reflecting a good economy. In other words, a bet on Goldman is a bet on the promising future of the financial economy.

In the most recent earnings call, Goldman Sachs CEO David Solomon stated that the world is in the early stages of reopening its capital markets after measures taken by central banks to fight inflation. While this might be true, the business is not necessarily going to beat the record numbers of the post-pandemic boom in investment banking of 2021-2022.

I think the company, and generally the world, might see a good comeback to the business in a healthier economy, far from 0% interest rates. IPOs, debt, and equity underwriting would come back to normal levels after the 2023 drought. Unfortunately, this resurgence does not mean that the stock should be bought at this high price, but I still understand the market’s lack of selling pressure.

High valuation

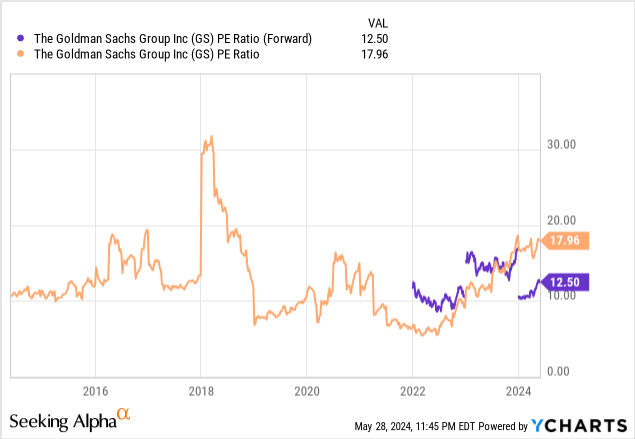

Although it seems Goldman has reached the promised land, future returns might not be compelling at this price point. First, the stock PE ratio is near 18, with a forward PE ratio of 12.5. This is a very high valuation for a cyclical company, especially a bank and especially an investment bank. Usually, this kind of stock, and Goldman in particular, tends to trade around ten times earnings, because of high volatility in earnings. Eventually, that PE ratio goes down quickly when the market and the economy run out of fuel, the cyclical stocks collapse, and the cycle begins all over.

Fortunately, the music is apparently just starting to play, and while the sound is loud enough, GS stock might be able to keep the prices high. Eventually, in my view, the stock can get a quick correction in the markets.

Of course, these assumptions don’t take into account some sort of black swan event that can suddenly and materially impact the economy. In this case, these financial cyclical stocks would rapidly get pummeled, and any price point would be a good exit point, at least until the Fed rescues the markets again, like in 2008 or 2020.

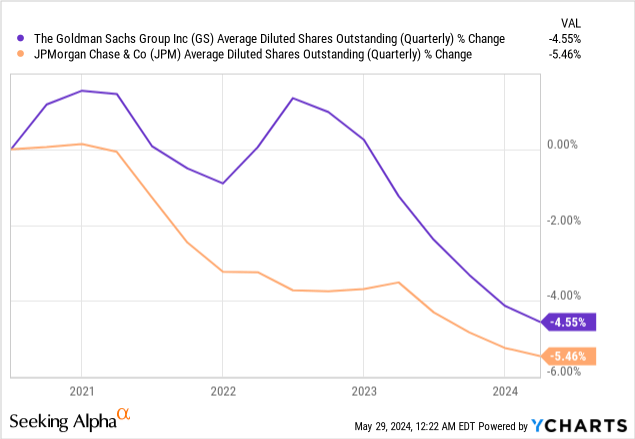

Additionally, while Goldman has done some share buybacks, those have reduced the share count only by 4% since 2020, when comparing the Q4 2020 earnings results to the 2023 Q4 earnings results. This is still below its closest competitor, best in class, JPMorgan.

Upside risks

In my view, the stock is not a buy because of high valuations, although the business will likely do well in the near term. In any case, the stock could present a reasonable price appreciation from this point, if at least some of these scenarios happen:

1. The Fed lowers interest rates without a tangible economic contraction: This might fuel money creation by banks via credit, and eventually, this would likely translate to a cash injection into the financial economy, bringing back the need for more IPOs, more debt refinancing at lower interest rates, more financial intermediation in equities and FICC, and eventually even higher revenues for the investment banking firms, especially big ones like Goldman. This can appreciate the stock considerably.

2. If so much unforeseen pent-up demand comes from financing needs, IPOs, M&A, and debt underwriting, while the economy holds relatively well.

In my opinion, the possibilities of either of these two scenarios happening are not justified by the high stock valuation, but are information that you need to know as an investor.

Conclusion

Goldman Sachs is a magnificent company. It is one of the best M&A professionals on Wall Street by revenue, with amazing traders. It is built to last and has very deep roots in the financial economy. Unfortunately, the time of buying this stock with a reasonable margin of safety has largely passed, and upside risks might not necessarily compensate for the current high share price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.