Summary:

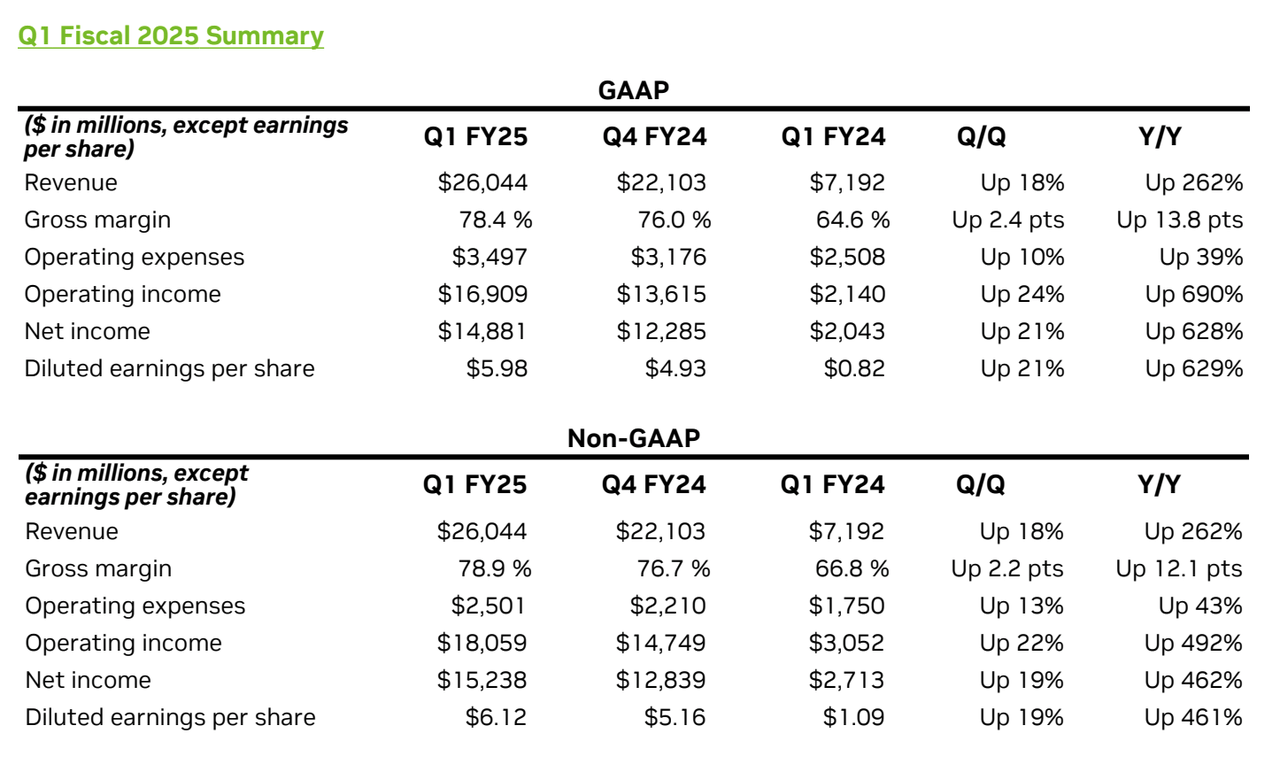

- Nvidia Corporation has beaten Wall Street’s expectations for the 6th consecutive quarter, with sales totaling $26.0 billion, up 18% sequentially and 262% year-over-year.

- NVDA’s earnings-per-share came in at $6.19, beating consensus expectations by $0.54/share, posting 19% sequential growth and 461% year-over-year growth.

- Nvidia has increased its dividend by 150% and bought back $7.7 billion worth of stock, indicating a focus on shareholder returns.

Antonio Bordunovi

Nvidia Q1 Earnings Results

No one should be surprised about this at this point, but Nvidia Corporation (NASDAQ:NVDA) just crushed Wall Street’s expectations again, with a double beat and raise quarter.

This is the 6th straight quarter that Nvidia has beaten expectations on both the top and bottom lines, extending its streak of amazing (and no, I don’t use that word lightly here) quarters.

Two years ago, Nvidia’s fiscal Q1 sales came in at $8.29 billion. Its earnings during that quarter were $1.36/share. And, NVDA’s free cash flow was $1.35 billion.

Well, flash forward 24 months and all three of those metrics have improved drastically.

During NVDA’s most recent quarter, its sales totaled $26.0b, up by 18% on a sequential basis, and 262% on a y/y basis.

As great as that growth is, NVDA’s success on the bottom line was even more impressive.

On a GAAP basis, the company’s earnings-per-share came in at $5.98 during Q1, up by 21% sequentially and 629% y/y.

On a non-GAAP basis, NVDA’s EPS came in at $6.19, beating consensus expectations by $0.54/share, posting 19% sequential growth, and 461% y/y growth.

NVDA Q1 Results

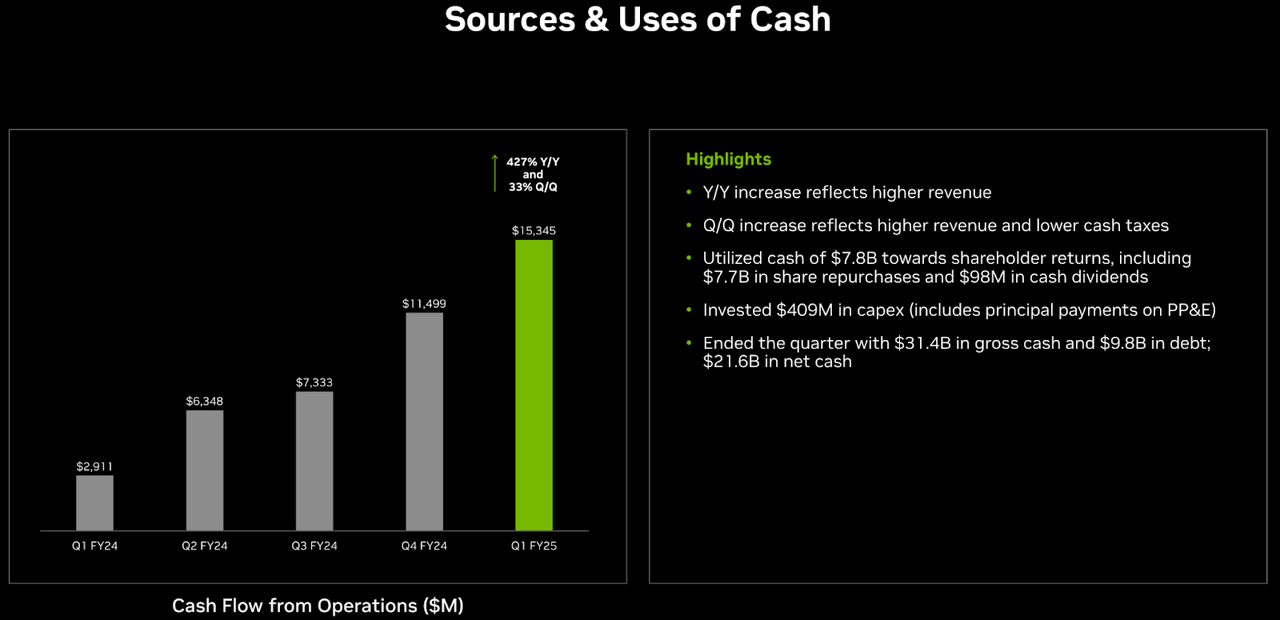

NVDA’s free cash flow was $14.94 billion during Q1.

Think about that…NVDA’s FCF is more than 10x higher than it was just 2 years ago.

This is precisely why I chuckle anytime I hear people talking about this stock being a bubble.

I think many people see a company up by ~200% in a year…or 3,000% during the last 5 years…and simply assume that the share price appreciation is irrational.

For most stocks, that would be the case.

I’ve been doing this for a while, and I can’t think of another situation like this where an already relatively mature company has sustained growth like this.

Nvidia is truly a unicorn. And that’s a great thing for NVDA bulls because these shares are cheaper now than they were before the most recent leg of the rally began because the stock’s bottom-line growth has outpaced its incredible share price performance.

All of this is to say, I haven’t lost my conviction on this stock.

Coming into 2024, I named NVDA as one of my top picks for the year.

In January, I wrote this article, explaining why I believed that shares were “Still Cheap At All-Time Highs.”

During the last 5 months or so, NVDA shares have outperformed my expectations, rising by triple digits. But, even so, with the company’s recent results in mind, NVDA is still a top pick for me and my portfolio moving forward.

Nearly all of NVDA’s Q1 results were stellar. The growth that this company is generating is unheard of. But, here’s what I liked most about Nvidia’s Q1 results…

Rising Shareholder Returns

First and foremost, I loved seeing NVDA get more generous with their shareholder returns.

Mentally, it’s easier for me to be happy to pay higher premiums for shares, and hold them over the long-term, through thick and thin, when I know that I’m being rewarded generously for my patience by management.

I’m up more than 1,700% on my NVDA stake (current cost basis $61.61) because of long-term ownership. Having “diamond hands” when it comes to buying and holding blue chip growth stories is how to hit home runs in the market. And a growing dividend will help me to stay disciplined, in that regard, moving forward.

When I started buying NVDA back in 2017, it was a strong dividend growth play.

The yield was ~1% and the dividend had been growing at a double-digit annual rate.

In short, I grouped my NVDA shares up with the likes of Visa (V) or Mastercard (MA) from a dividend yield + dividend growth perspective.

But, in 2019 that growth began to slow and by 2021, there was no dividend growth to speak of here. Price appreciation had pushed the yield to incredibly low levels. This was a good problem to have as a long-term investor; however, from a dividend growth standpoint, it was disappointing.

I actually trimmed my NVDA stake back in 2019 because of disappointing dividend related metrics, locking in 27% profits at the time. Well, obviously the joke’s on me here because if I had held those shares, NVDA would now be my largest position, and I’d be a much richer man.

Thankfully, I just trimmed the position back then (I sold roughly 38% of my position), instead of selling it all. After reducing my overall weighting, I was content to let the rest of the position run as a pure growth-oriented vehicle.

Well, after Q1, I think NVDA is a stock that becomes interesting again from a dividend growth standpoint.

Last year, in fiscal 2024, NVDA began to return a lot of excess cash to shareholders, buying back $9.5 billion worth of shares in the year. However, because of the enormous market cap here ($2.55 trillion, currently) that’s just a drop in the bucket. I was hoping to see NVDA follow along the more generous path that other tech companies like Apple, Alphabet, Meta, Salesforce, and Booking.com have taken recently. And that they did…

During Q1, NVDA bought back roughly $7.7 billion worth of stock (still not a lot, but putting them on a pace to spend more than 3x the amount they allocated towards buybacks last year).

Furthermore, NVDA increased the dividend by 150%.

NVDA Q1 ER Presentation

After the upcoming 10-1 split (something that I’m not going to harp on here because it doesn’t impact my bullish sentiment since the split doesn’t change any of the company’s fundamentals), NVDA will pay $0.01/share dividend.

That still amounts to a miniscule 0.04% yield based upon today’s share prices.

However, for longer-term investors like me, it’s a bit more meaningful. As of right now, my post-split basis will be ~$6.00/share. Therefore, my yield on cost is closing in on 0.70%.

And looking at NVDA’s fundamentals, I think it’s very realistic that this company could compound its dividend at a 15-20% clip moving forward.

Based upon EPS expectations for the current fiscal year, NVDA could grow its dividend at a 15% annual rate for the next 5 years, and it would still only have a ~3% payout ratio.

Heck, even though I don’t see this happening, NVDA could post 100% annual dividend growth for the next 5 years and even if its EPS doesn’t grow during that period of time (which also seems incredibly unlikely) it would still have a sub 50% payout ratio.

Either way you slice it, this company’s payout ratio is essentially non-existent, and its fundamentals could definitely support sustainable dividend growth for years, if not decades, to come.

So, with that in mind, I’m a happy camper because while I don’t own NVDA for the dividend, I wouldn’t be surprised if in a decade or so, my position in this company was playing a significant role in my passive income stream.

Sales/Margins Holding Strong With Blackwell On The Horizon

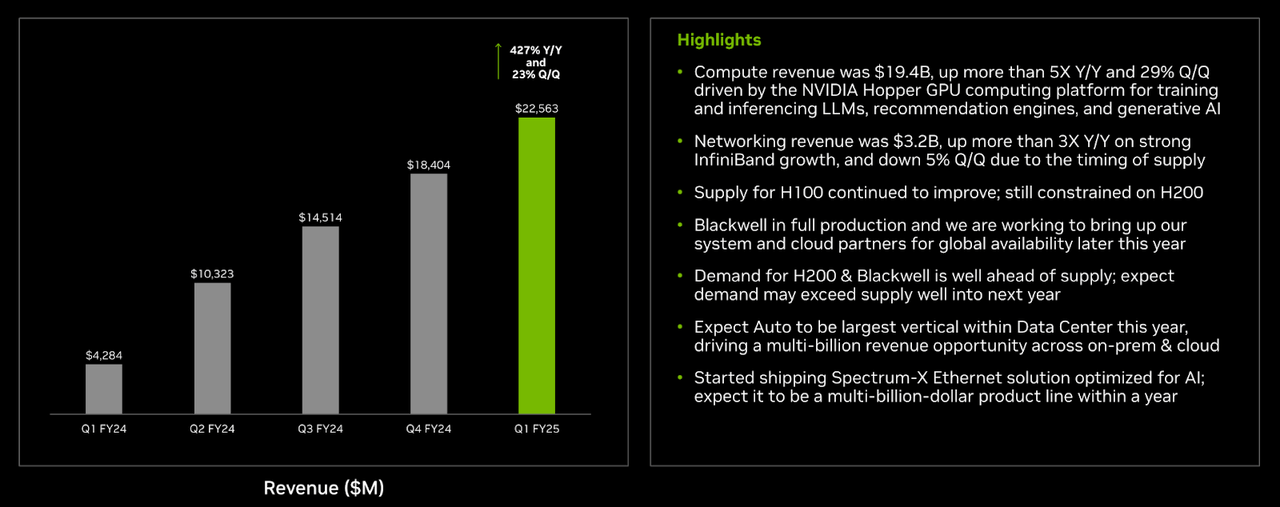

I’d be lying if I wasn’t concerned about the Hopper to Blackwell transition in the latter half of 2024 (before the Q1 results).

I worried that NVDA was looking at tough sequential growth prospects during Q3 and Q4.

However, NVDA’s CEO, Jensen Huang, put those fears to rest with his Q1 commentary.

Blackwell is a technological marvel, even compared to NVDA’s current Hopper chip offerings.

It provides the computing power (and improved efficiency) that big-tech players are looking for when it comes to driving their large language model development, and I was worried that these big enterprise customers might stop purchasing H100 chips with H200 models on the horizon.

But, during Q1 NVDA made it clear that they’re reducing lag times between new chip offerings – to ~1-year cycles – and this reduced lag time in between new chip models should eliminate cyclical spikes as innovation plays out.

NVDA doesn’t provide full-year guidance, but management’s commentary points towards this thesis playing out moving forward (which is why NVDA shares are up so much since reporting earnings).

During the Q1 conference call, Huang said, “Demand for H200 and Blackwell is well ahead of supply, and we expect demand may exceed supply well into next year.”

NVDA Q1 ER Presentation

When Bernstein analyst, Stacy Rasgon, asked Huang about near-term H200/Blackwell sales expectations, his answer took everyone by surprise.

Rasgon asked, “So this year, we will see Blackwell revenue, it sounds like?”

Huang responded, “We will see a lot of Blackwell revenue this year.”

Coming into the quarter, I think most people expected Blackwell to be a 2025 catalyst. NVDA is pulling those sales into 2024, bolstering likely sales/EPS results for this year, causing many analysts, including myself, to increase our price targets for shares due to rising fundamentals.

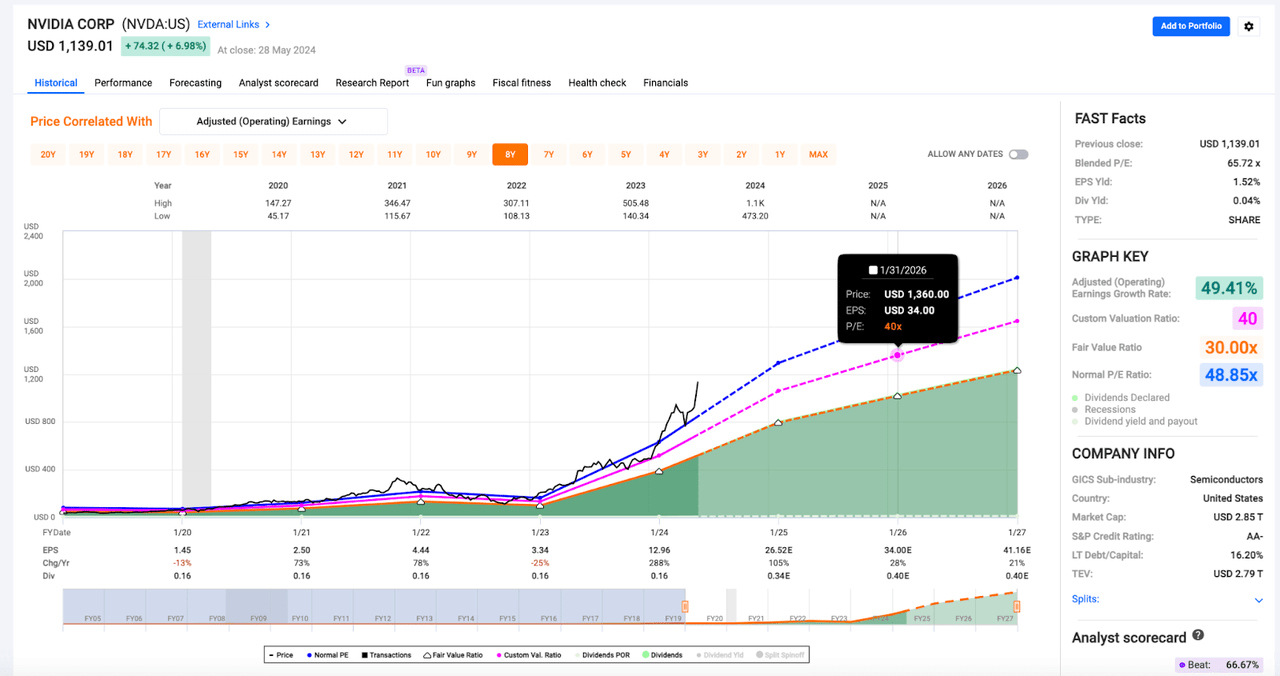

NVDA Stock Valuation

After digesting NVDA’s Q1 numbers, I was inspired to raise my fair value estimate on shares.

The fact that my cyclical spike/lag fears have been alleviated certainly helped.

As did the company’s big beats, plus my rising EPS expectations for both fiscal 2025 and 20256.

Earlier in the year, I said that NVDA was cheap at all-time highs. I’ll admit, I don’t think the margin of safety is quite as attractive here, with shares north of $1,100/share. But, I still think NVDA offers attractive upside potential, even here.

6 months ago, the consensus analyst estimate for NVDA’s fiscal 2025 (this year’s number) EPS was $20.39. Today, that estimate is $26.52.

6 months ago, the consensus analyst estimate for NVDA’s fiscal 2026 (next year’s number) EPS was $23.83. Today, that estimate is $34.00.

I think $35-$36 is more likely next year and frankly, if capex guidance keeps rising in the big-tech world, I don’t think $40.00/share is out of the question.

I think placing a ~35-40x multiple on next year’s earnings is fair here (considering that we’re talking about 100%+ EPS growth this year and another 30% or so next year).

FAST Graphs

Obviously, this growth rate will slow down over time. And when that happens, we’ll likely see multiple compression. But, I expect to see 20%+ growth here for years to come, which supports a 2.0x PEG (40x multiple).

So, that means I’m looking at a fair value range between $1225 and $1400.

I’ll split the difference here, arriving at a $1312.50 price target.

For simplicity’s sake, I’ll round down to a $1,300.00 round number.

That’s my new fair value estimate for NVDA shares, implying ~14% upside from here.

That’s not a ton of upside (relative to NVDA’s recent past); however, I’m not really thinking about near-term (18 month) gains when adding to my NVDA stake today.

Instead, I’m positioning myself to take advantage of the most powerful growth trend in the market, looking 5–10 years down the road.

By 2030, I think continued AI proliferation can push NVDA’s market cap up towards the $6-$8 trillion level.

Beth Kindig, the lead tech analyst from the I/O Fund, who is even more bullish, made a strong case for a $10 trillion market cap recently on CNBC.

She noted that both AMD and Intel are calling for a massive data center total addressable market ($1 trillion/year by 2030, according to Intel) moving forward.

Well, she believes that NVDA will command a ~90% market share in this space, and looking at its technological advantages right now, I don’t disagree.

That sort of market share is going to result in strong margins (maybe not the 75%+ margins that NVDA is generating today, but I think 50%+ is a reasonable target as the AI market matures because of NVDA’s hardware and software dominance). And therefore, when you model out sales growth and margin expectations, you arrive at enormous cash flow figures.

And as a long-term investor, I want overweight exposure to that cash flow generation.

Conclusion

So, with all of that being said, I feel compelled to add to my NVDA position.

Currently, NVDA is my second-largest stake, making up approximately 7% of my portfolio. But, I wouldn’t mind pushing that weighting up to the 10% level because to me, NVDA remains one of the best growth stories in the market.

NVDA is up approximately 33% during the last month alone, so I don’t intend to chase this rally too aggressively.

Thankfully, because of the large size of my existing stake, I don’t feel very FOMO.

With a 7% weighting (above the S&P 500’s 6.3% weighting), I won’t be left behind if NVDA shares continue to rocket higher.

But, when I think about my own (early) retirement plans, I’d like to bolster the size of this stake.

So, instead of diving in headfirst here at $1,100, I’ll likely slowly build up my stake, from that 7% to 10% level, with steady monthly additions (at the very least, I plan to buy NVDA when making monthly selective dividend reinvestment for the foreseeable future).

If we see a near-term dip back below the $1000 level, I’ll accelerate that accumulation process. But, with the excitement surrounding the upcoming stock split in place, I don’t see that happening without a broader market correction.

Either way, I hope to continue building out my Nvidia Corporation stake moving forward – despite the naysayers’ negativity, I view NVDA as a sleep well at night type of stock because of its best-in-class leadership, technology, and its recent pivot towards more generous shareholder returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of A, AAPL, ACN, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, AWK, BAH, BIL, BLK, BKNG, BR, CME, CNI, CP, CPT, CRM, CSL, DE, DHR, ECL, ELV, ENB, SPAXX, GOOGL, HON, HSY, ICE, JNJ, KO, LMT, MA, MAIN, MCD, MCO, META, MSCI, MSFT, NKE, NNN, NOC, NVDA, O, ORCC, PEP, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, SBUX, SHW, SPGI, TMO, TD, TXN, USFR, UNH, V, WM, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.