Summary:

- Abercrombie & Fitch Co. is an American apparel retailer, owner of the Abercrombie & Fitch and Hollister brands.

- The company’s 1Q24 results were very good, beating expectations. Revenue grew more than 20%, operating income increased close to 200%, and EPS increased 600%.

- These results build on top of good performance in 2023. This performance was driven by trend-right assortment, and good pricing management.

- However, Abercrombie & Fitch trades at a P/E ratio of 25x when comparing the company’s current market cap with net income derived from management’s FY24 guidance.

- In my opinion, this valuation is excessive, both in absolute and in comparative terms. For that reason, Abercrombie & Fitch stock is not an opportunity.

Robert Way

Abercrombie & Fitch Co. (NYSE:ANF) is an American apparel retailer. The company owns the namesake brand, which focuses on millennials, and Hollister, which focuses on teenagers.

This article covers the company’s earnings results and call for 1Q24, which were released today. As this is my first article on the company, I also provide some background on its recent developments and what, I believe, could happen in the future, plus a valuation.

The company’s results have been very good and beat analyst expectations. The company delivered revenue growth of 22% and leveraged its relatively fixed cost base to grow operating income by about 200% and EPS by close to 600%.

In future quarters, the company’s comparables will be more challenging, and management has already guided for a more muted 2H24. So far, AUR increases from lower promotions and a more expensive mix have been the main engine behind growth, but this source is slowing in future quarters.

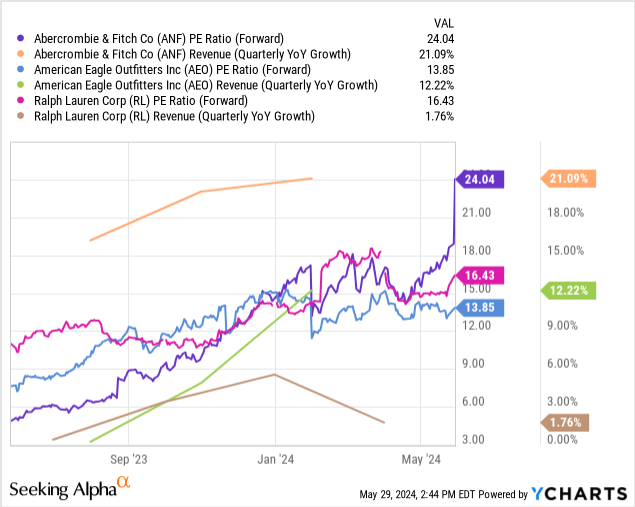

In terms of valuation, Abercrombie trades at a P/E ratio of 25x. In my opinion, this represents a high absolute number, given the company’s characteristics and growth prospects ahead, and also a high comparative number, in relation to peers. For that reason, I believe ANF stock is not an opportunity, and rate it as a Hold.

Another good quarter

Abercrombie’s results were excellent. The company posted revenue growth of 22% YoY. It surpassed the $1 billion mark for the first time in Q1, a seasonally low period. Regarding brands, the company’s main engine has been Abercrombie and Fitch, growing 30% YoY, with Hollister growing 12% YoY.

More interestingly, the company has combined falling input costs (mainly from freight and cotton) and higher AUR from lower promotions to grow gross margins by 540 basis points, reaching 66.4% for the quarter. In combination with relatively controlled SG&A expenses, this led to operating income growing from $39 million in 1Q23 to $130 million in 1Q24, representing growth of more than 200%.

With small interest expenses (about $5 million net), plus a particularly low effective tax rate for the quarter (of 15%), these results generated basic EPS of $2.24 compared to $0.33 one year ago. This represents a growth of close to 600%.

The Abercrombie success story

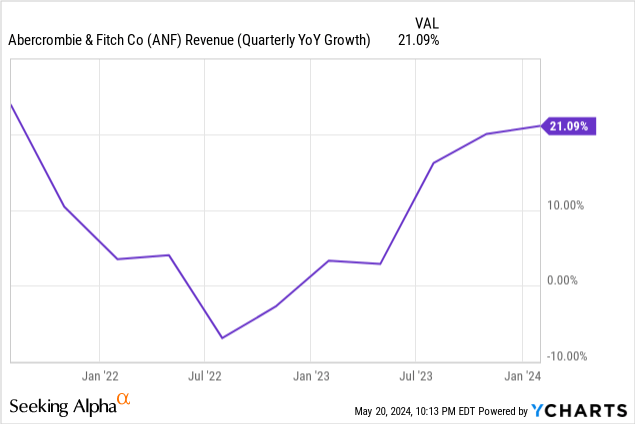

This was not the company’s first good quarter. ANF has posted top-line growth rates close to 20% for four quarters since 2Q23. If we look at the brand level, Abercrombie and Fitch (the brand) grew 11% already in FY22, but bad results at Hollister drove down the company-level aggregates.

When we look at FY23 data (the 10-Q for 1Q24 has not been released yet), we find revenues were up 16%, whereas CoGS were flat, delivering 600 basis points of higher gross margin. The company explained that 300 basis points came from lower costs (mostly cotton and freight). This means that, without that cost decrease, ANF’s FY23 CoGS would have been about 7.5% higher than in FY22. In my opinion, that 7.5% is a good approximation to how many more units (t-shirts, jeans, and dresses) the company sold. The remaining 8.5% of growth (16% minus 7.5%) was driven by selling those items at a more expensive price.

So, about half of the growth came from higher AUR (increasing the price of its items, selling a higher weight of more expensive items, or discounting less), while the remaining half came from selling more stuff.

The last “easy” quarters

1Q24 was the second-to-last quarter with an “easy” comparable for topline revenue growth. Future quarters will be more challenging. To deliver more growth in 2H24 and beyond, ANF has to grow on top of growth.

As mentioned above, this growth can come from two sources: units or prices. Regarding prices, management has mentioned on both the 1Q24 and 4Q23 calls that the company is not running fewer promotions or increasing prices quarter on quarter. This means that half of the engine from FY23 will not be thrusting upwards in 2H24.

The picture is less clear in terms of units. Abercrombie (the brand) has been very good at merchandising in recent quarters, with management mentioning that it was ‘chasing’ inventory (meaning replacing inventory when it is about to run out of stores or deposits). Semrush data for Abercrombie shows that traffic is still growing. The same trend is evident in Google Trends. With digital representing 60% of Abercrombie’s business (from the company’s FY23 10-K), traffic growth could very well translate into more unit sales.

Based on the company’s guidance for FY24 (as expressed in the 1Q24 call), ANF’s sales will grow by $430 million in FY23 (10%). 1Q24 already represented half of that growth ($184 million, or $1.02 billion in 1Q24 minus $835 million in 1Q23). Management also guided that 2Q24 sales would be about $140 million higher than in 2Q23. Between these two quarters, they represent $324 million out of the $430 million expected in absolute revenue growth for the year. This means management is expecting very little growth in 2H24.

Valuation

ANF is doing the right things. Its products are what the customers want and in the right quantities. For that reason, it can charge full price for its products instead of running discounts or clearance sales (you can visit the company’s websites for Abercrombie or Hollister and find very few signs of discounting).

However, as Howard Marks would say, there is no company so good that any price is cheap, nor a company so bad that any price is expensive. This means that if ANF’s stock price already discounts most of the positive characteristics and future developments of the company, then it is not an opportunity.

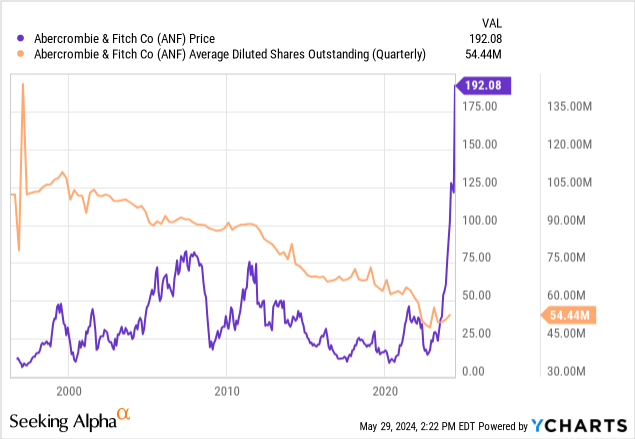

After earnings, ANF’s stock was up 26%, reaching a price of $192. This represents a market cap of about $10.5 billion, considering the company has close to 54.5 million shares outstanding.

In the 1Q24 call, management provided guidance for the FY24 year. They expect sales to reach about $4.7 billion (10% above FY23), and operating margins to reach 14%. This represents an operating profit of $560 million. Interest expenses are negligible, and the tax rate expected is about 25%. Therefore, as derived from the company’s guidance, net income is expected to be about $420 million in FY24. Compared to a market cap of $10.5 billion, this represents a P/E ratio of 25x.

In my opinion, this ratio is high in absolute terms. A high P/E ratio is only reasonable for companies in non-discretionary industries, with highly defensible businesses, and with significant growth prospects. Apparel is a highly discretionary category, which implies a higher sensitivity to macroeconomic trouble. Apparel retailing is also extremely competitive, so ANF does not have a truly defensible business. If the company failed to provide a trend-right assortment or charged a price too high for it, customers would simply go to the next store in the mall. Finally, as evidenced by management’s own guidance, ANF does not have an easy path to growth ahead, given that there are limits to how much it can raise prices or how many customers it can attract without opening more stores.

When investors buy a stock with a high P/E ratio, they face two risks. First, if the company does not grow, the future earnings yield of the stock will be lower than that of another, cheaper stock. That is, the higher P/E stock needs to grow more to deliver the same return. Second, if the company does not grow, or even worse if it shrinks, the multiple can contract meaningfully, leading to price losses. Therefore, buying a stock with a high P/E ratio is very risky.

The ratio is also high in comparable terms. For example, both American Eagle Outfitters, Inc. (AEO) and Ralph Lauren Corporation (RL) have been growing recently. However, their forward P/E ratios are lower. It is true that ANF’s growth has been much faster than peers, but as evaluated above, it is not clear that these high growth rates are sustainable in the future.

Conclusion

ANF posted another good quarter, surpassing analyst estimates and showing one of the fastest-growing rates in the apparel retailing industry. The company’s top line grew more than 20%, leveraging through the income statement to reach almost 600% YoY EPS growth.

However, as judged by the company’s own guidance and the analysis of the company’s current growth engines, it will be difficult to sustain this elevated growth rate in the future.

The currently elevated multiple on earnings already discounts most of the positive developments and requires very good future performance for Abercrombie & Fitch Co. stock to provide an adequate return. In addition, it exposes shareholders to the stock multiple shrinking if the company fails to deliver to such lofty expectations.

For that reason, and despite ANF’s good results and operations, I believe the stock is not an opportunity at these prices.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.