Summary:

- Energy Transfer LP reported strong Q1 2024 earnings, with double-digit growth in net income and adjusted EBITDA.

- The company is acquiring WTG Midstream for over $3 billion, expanding its natural gas pipeline and processing network.

- Energy Transfer aims to generate strong shareholder returns through unit buybacks and continued growth in dividend yield.

Just_Super

Energy Transfer LP (NYSE:ET) is among the largest midstream companies in the world, with a market capitalization of more than $50 billion. The company has an impressive and connected portfolio of assets it utilizes to generate strong cash flow, and it recently connected those assets with WTG Midstream, in a more than $3 billion acquisition. As we’ll see throughout this article, the company should be able to generate strong cash flow and long-term shareholder returns.

Energy Transfer Earnings

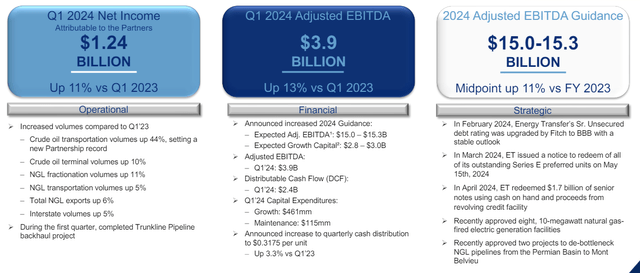

Energy Transfer managed to earn more than $1.2 billion in Q1 2024 net income, up double-digits YoY.

Energy Transfer Investor Presentation

The company earned just under a hair in $4 billion in adjusted EBITDA, also up double-digits YoY. The company is expecting 2024 guidance of more than $15 billion in adjusted EBITDA, with $2.9 billion in growth capital. The company continues to have a hefty debt load that costs it billions in annual interest expenditures.

The company earned a massive $2.4 billion in Q1 2024 DCF, with roughly $0.7 billion in quarterly growth capital, and $1 billion in quarterly dividend payments. That leaves the company with roughly $700 million in additional quarterly discounted cash flow (“DCF”) that it can utilize for various shareholder returns. The company has announced a 3.3% increase in its quarterly cash distribution.

We expect the company’s overall shareholder returns to increase. The company’s debt has upgraded with a stable outlook, and the company has issued a notice to redeem all preferred units. The company has continued to redeem debt as well. The company’s strong financial results despite hefty debt show its ability to drive substantial shareholder returns.

Energy Transfer And WTG Midstream

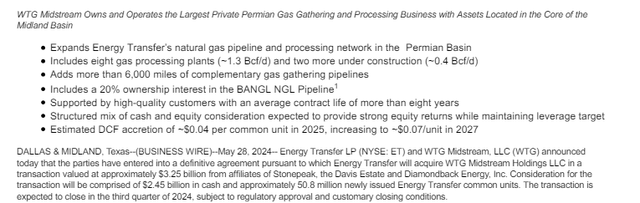

Energy Transfer is making the $3.25 billion acquisition of WTG Midstream, for $2.5 billion in cash and approximately $750 million in shares, a heavy cash-based acquisition.

Energy Transfer Investor Presentation

The Permian Basin is all the rage right now, and Energy Transfer is jumping in. The acquisition expands the company’s natural gas pipeline and processing network, with a massive 1.3 billion cubic feet / day in gas processing plants and construction to expand that by 30%. The company gains 6000 miles of new pipelines and a 20% interest in the BANGL NGL pipeline.

The company expects its DCF will increase by $0.04 / share in 2025 and almost double going into 2027. That’s exciting to see for a primarily cash-based transaction and will enable the company to improve its long-term shareholder returns.

Energy Transfer 2024 Goals

The company’s 2024 goals center around continuing its impressive growth and shareholder returns.

Energy Transfer Investor Presentation

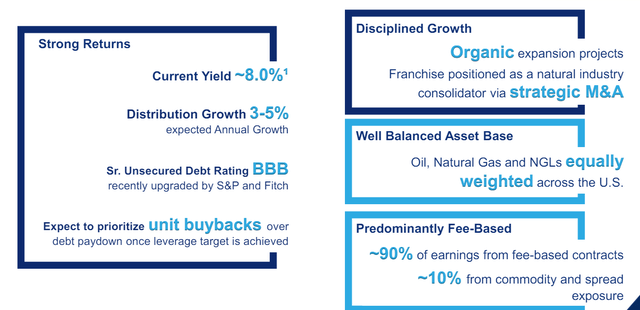

The company has a yield of more than 8%, and it’s expected to continue growing it at 4% annualized. That’s a double-digit return. The company saw its unsecured debt rating recently upgraded, and it continues to manage its debt load. In a higher interest rate environment, that’s key to keeping interest rates down, which frees cash for shareholder returns.

The company expects to hit its target and focus on unit buybacks. That’s something that it can comfortably afford, and at an 8% dividend yield, buybacks are very profitable. We would like those ramped up as soon as possible, as the company continues its double-digit YoY EBITDA growth.

Energy Transfer Consolidation

The company remains one of the largest companies in the midstream business focused on consolidation.

Energy Transfer Investor Presentation

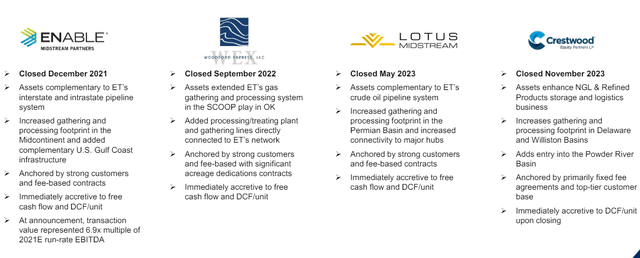

Since late 2021, the company has spent more than $10 billion in acquisitions, and this is another major acquisition for the company. The company made two major acquisitions in 2023, and it continues to purchase small bolt-on acquisitions where it’s able to. That consolidation shows the company’s strategy and its goal to generate strong returns.

The company does have a substantial amount of debt; however, we prefer that over continued dilution. The company is one of the few consolidators in the industry, and that allows it to take advantage of the best situations to generate strong returns.

Energy Transfer Shareholder Returns

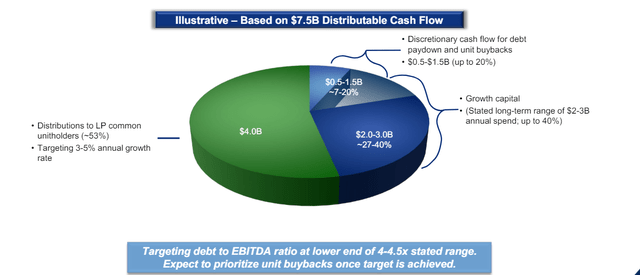

Putting this all together, the company is focused on generating strong shareholder returns. The company’s annualized DCF is almost $10 billion, dramatically higher than the illustrative numbers of $7.5 billion below.

Energy Transfer Investor Presentation

The company’s core shareholder returns is a $4 billion annual dividend, a more than 8% yield, and less than half of the company’s true annualized DCF. It’s a number that the company can comfortably afford, and one of the highest secured yields in the market today. The company follows that up with ~$2.5 billion in annual investment in growth.

That’s an investment level that the company can comfortably afford, and we expect the company can continue its EBITDA growth sufficiently to justify its annual growth rate. The company has discretionary capital it plans to use for debt paydown and unit buybacks, and we’d like to see it ramp up buybacks as quickly as possible.

The company has a double-digit DCF yield that we expect to continue growing over the long term, enabling strong shareholder returns.

Thesis Risk

The largest risk to our thesis is Energy Transfer’s strategy. Building a massive debt fuel business makes the company susceptible to any major downturn, especially a protracted one that could result in lower volumes. That could hurt the company’s ability to service its debt and generate long-term shareholder returns, a risk worth paying close attention to.

Conclusion

Energy Transfer is an undervalued company despite its recent share price growth. The company has a market capitalization of more than $50 billion and a dividend yield of more than 8%, a dividend yield that it comfortably afford. That uses less than half of the company’s FCF. The company plans to continue growing this distribution at 4% annualized.

That alone would justify investing in the company, and it’s something that the company can easily afford. That doesn’t count continued growth capital investments along with the company’s ability to buy back shares or payback debt for strong shareholder returns. All of that together makes Energy Transfer stock a valuable long-term investment in any portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.