Summary:

- Nvidia Corporation released another blockbuster earnings where it mentioned that large cloud providers like Amazon’s AWS, Microsoft’s Azure and Google Cloud make up “mid-40%s” of Data Center revenue.

- Data Center Revenue itself made up over 85% of the total revenue for Nvidia, which shows the massive impact of recent purchases by cloud providers on Nvidia’s performance.

- It is highly likely that cloud providers are front-loading their purchases, and the current scale of purchases will not last beyond a few quarters.

- Nvidia and other chip stocks have a very high correlation between stock movement and EPS estimates of 2 fiscal years ahead.

- A drop in the scale of purchases by cloud providers is likely, which will lead to downward correction in forward EPS estimates as well as increase the bearish sentiment towards the stock.

BING-JHEN HONG

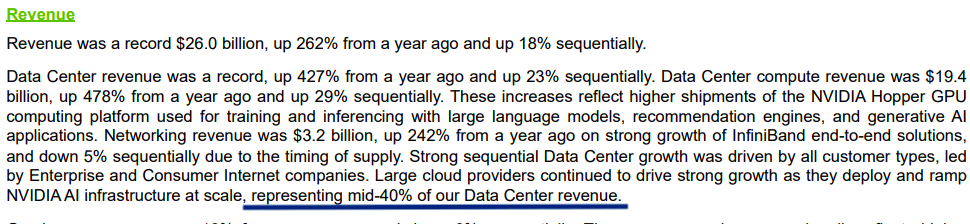

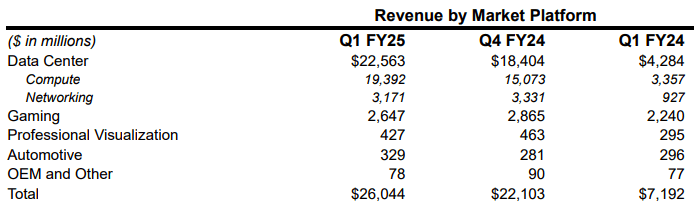

Nvidia Corporation’s (NASDAQ:NVDA) blockbuster first quarter has increased the future expectations of Wall Street. There is an overwhelming number of Strong Buy and Buy ratings for the stock among the analysts. Nvidia announced revenue of $26 billion in the recent quarter. Out of this, 86% or $22.5 billion was contributed by the Data Center segment.

The company mentioned in their filing that large cloud providers like Amazon’s (AMZN) AWS, Microsoft’s (MSFT) Azure, and Google (GOOG) Cloud contributed “mid-40s” of the data center revenue. This would be equal to $10 billion.

In a previous article in December 2023, it was mentioned that Nvidia will face a key hurdle in impressing Wall Street. The company faces tougher comps and should see higher competition for the AI chip market share.

It is highly likely that the cloud providers and other data center chip buyers are front-loading their purchases of Nvidia’s chips. The recent scale of purchases is almost impossible to maintain for even bigger buyers like AWS. Nvidia’s and other chip stocks like Advanced Micro Devices (AMD) and Intel (INTC) have a close correlation with EPS estimates of 2 fiscal years ahead. Nvidia’s recent quarterly EPS was $5.98, and the market estimates that the EPS estimate for 2 fiscal years ahead would be close to $40. This EPS growth is possible only if the current scale of purchases by cloud providers increases significantly in the coming quarters.

The cloud providers have not shown a big monetization growth due to these chips, and it is highly likely that there will be a drop-off in the scale of purchases even if the chips gain reasonable traction among clients of cloud companies.

Nvidia stock has had a very hot run in the last few quarters. But investors need to look at the uneven purchases of chips and the impact it can have on the revenue growth in the next few quarters. Nvidia stock is a Sell at the current price due to the high probability of a decline in sales within the Data Center segment in the next few quarters, which will also cause a drop in overall profitability and forward EPS guidance.

Front-loading of chips by big buyers

There has been a lot of news about almost all Big Tech companies investing heavily to buy Nvidia’s recent chips. In the recent filing, Nvidia mentioned that large cloud providers contributed mid-40% of the Data Center revenue. The Data Center revenue itself is close to 85% of the total revenue.

Nvidia Filings

Figure: Impact of purchases by cloud companies. Source: Nvidia filings.

Nvidia Filings

Figure: Segment-wise revenue of Nvidia. Source: Nvidia filings.

This means that large cloud providers contributed close to $10 billion in revenue for Nvidia. It is highly likely that the high level of purchases by cloud providers is due to front-loading. All these companies want to try new AI tools and make heavy investments in the initial stages. We could see a decline in purchases by the end of the year. One of the key indicators is the recent data in Amazon’s earnings to see the impact of chip purchases.

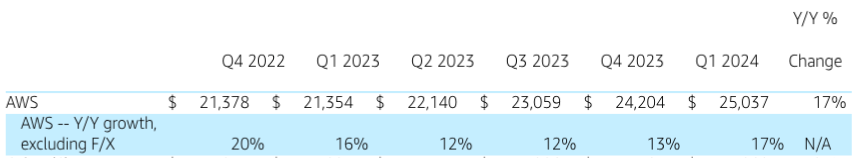

Amazon Filings

Figure: Revenue growth in AWS over the last few quarters. Source: Amazon Filings.

In the recent quarter, AWS reported $25 billion in revenue, with 17% YoY growth. The recent revenue growth is marginally ahead of the year-ago quarter when it was 16%. In the previous quarter of Q4 2023, AWS reported 13% YoY quarter compared to 20% in Q4 2022. This indicates that AWS is not gaining massive revenue growth from the investment in Nvidia’s chips until now. It is likely that AWS is still developing AI tools, and we could see a better growth trajectory in the next few quarters, however, the data from the last few quarters shows that the revenue growth trend has not changed significantly.

AWS has close to 30% market share in the cloud business. If we apply this ratio to the $10 billion worth of chips purchased by large cloud providers, then AWS would have bought $3 billion worth of chips from Nvidia. This would be 12% of AWS’s quarterly revenue in the recent quarter. Unless AWS can see a massive increase in revenue growth, it will not be able to maintain the current scale of purchases of Nvidia’s chips. This is another reason why we could see a decline in chip purchases by the end of this year.

Change in EPS projection

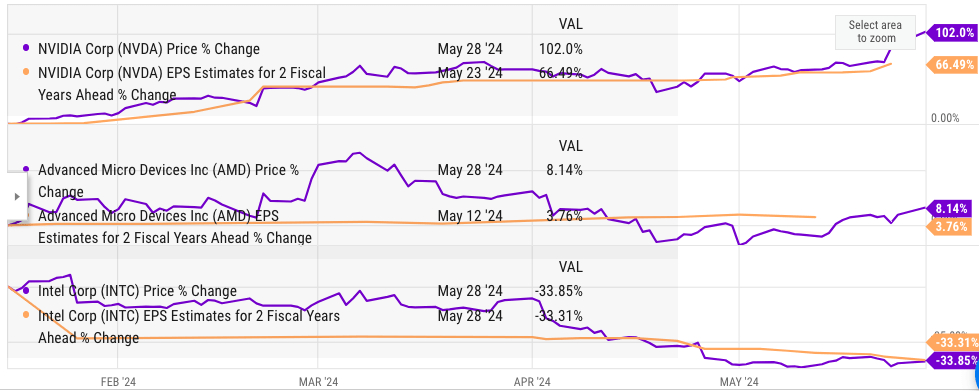

There is a strong correlation between EPS estimate for 2 fiscal years ahead and the stock price movement for Nvidia. In the YTD, Nvidia’s stock price increased by 102% while its EPS estimate for 2 fiscal years increased by 67%. For Intel, the stock price has declined by 33% in YTD and the EPS estimate of 2 fiscal years ahead has also declined by 33%.

Ycharts

Figure: Strong correlation between EPS estimate for 2 fiscal years ahead and stock price in YTD. Source: Ycharts.

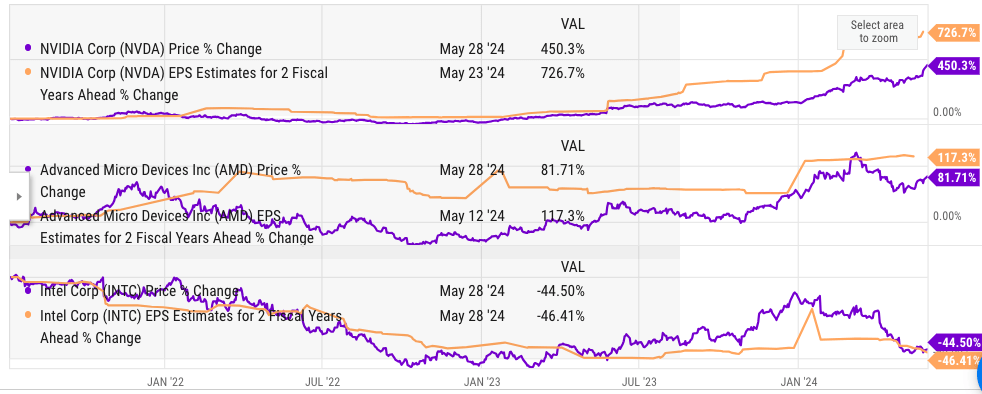

A similar trend can be seen over a longer time frame of 3 years.

Ycharts

Figure: Strong correlation between EPS estimate for 2 fiscal years ahead and stock price in YTD. Source: Ycharts.

The recent quarterly EPS of Nvidia was $5.98 and the market is estimating that the EPS for 2 fiscal years ahead would be close to $40. To reach this level, Nvidia would need to almost double its revenue base in the next two years, which would require a similar growth by the bigger cloud platforms. However, as mentioned above, AWS is already spending close to 12% of its revenue base on Nvidia’s chips. To maintain the market’s growth expectation for Nvidia, AWS would need to invest close to 25% of its revenue base in new chips in the next 2 years. This seems highly unlikely due to the slower revenue growth trend in AWS. It is also likely that front-loading of purchases would reduce the requirement significantly to buy new Nvidia chips in the next few quarters.

Counterargument to Sell thesis

The current consensus is that the AI chip growth will continue for the near future, which will drive Nvidia’s revenue and EPS growth. Many startups are building new AI models which would require the intensive compute power of Nvidia’s chips. There is also some good progress in getting the costs down. CNBC mentioned CoreWeave, a GPU cloud, which is charging only $4.25 per hour to access Nvidia’s H100 chips. We could see more innovations by Nvidia, cloud providers, and smaller startups to bring down the costs for AI chips. This should help in driving demand higher.

If the current growth trend continues, we should see higher forward EPS estimates for Nvidia’s stock, which will help maintain the current bullish sentiment. However, investors should also closely look at the growth and profitability trends within bigger cloud providers, which contribute close to half of the total revenue base of Nvidia’s Data Center segment. As mentioned earlier, if AWS continues with its 10%-20% YoY revenue growth, it would be very difficult for the company to invest higher amount in buying the expensive chips from Nvidia.

Future trend in Nvidia stock

Nvidia’s stock trend in the last year has rarely been seen. However, all stocks and companies have to follow the rules of gravity. If the consensus estimate is overwhelmingly positive, investors should become cautious of the hype. Making an entry at a high point increases the possibility of downside risks if the company misses even a single quarterly earnings estimate.

While the AI hype is still strong, we would need to see actual monetization of AI tools. This will clearly be reflected in the revenue and profitability trends of bigger cloud providers. If the cloud providers fail to see a big uptick in profitability, we might see a slowdown in their purchases of Nvidia’s chips. Investors should also carefully look at the front-loading factor, which will have a significant negative impact on the future demand of Nvidia’s chips.

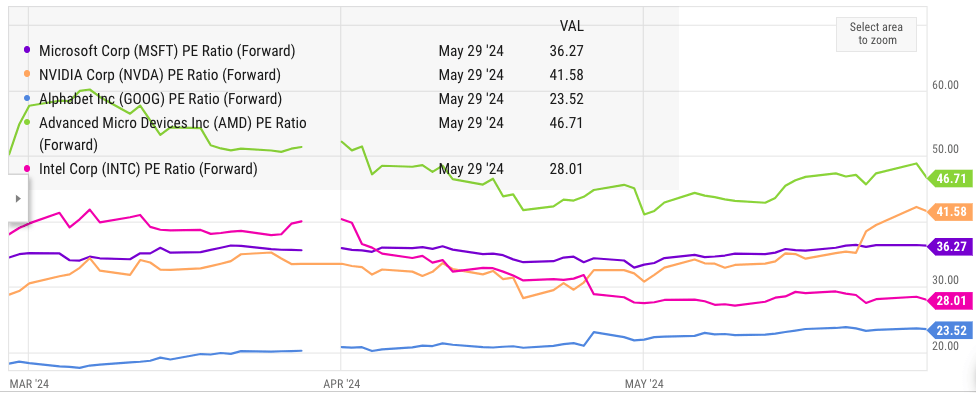

Ycharts

Figure: Forward PE ratio of Nvidia and other stocks. Source: Ycharts.

In terms of forward P/E ratio, Nvidia stock is more expensive than almost all Big tech companies and is only slightly behind AMD stock. The expectations with Nvidia are very high, one might even say unrealistically high. This is rarely the recipe for a stock to deliver returns that can beat the broader index.

Investor Takeaway

Nvidia stock has jumped by another 100% in YTD. The company has mentioned that large cloud providers contributed close to half of its revenue base. However, there has not been a massive growth uptick in AWS or other cloud providers in the last few quarters. It is also likely that these cloud providers were suffering from FOMO and rushed to buy as many Nvidia’s flagship chips as possible. The front-loading of investment means that the demand for chips from bigger cloud players would decline by the end of the year.

These trends can lead to a rapid correction in the future EPS growth trajectory, which will also hurt the bullish run of the stock. We might be close to “Peak Nvidia” unless there is significant monetization improvement by the end users. These factors lead to a Sell rating for Nvidia Corporation stock at the current price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.