Summary:

- PayPal’s price action has been muted due to a lack of growth catalysts and a decline in active customer accounts.

- Transaction revenue has shown some signs of a rebound, but net revenue growth remains in the single digits.

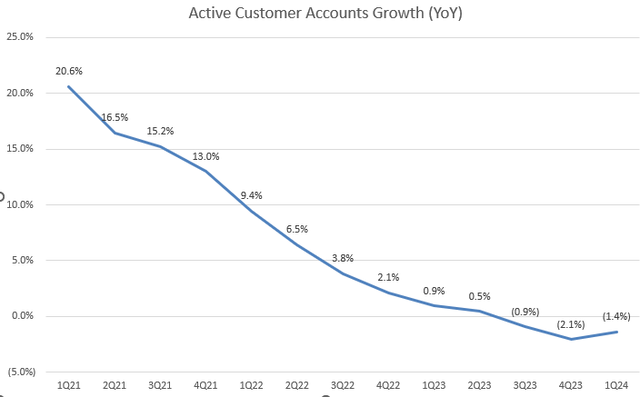

- Active customer accounts have declined for three consecutive quarters, highlighting the need for customer adoptions to sustainably boost volumes.

- Margin expansion on unbranded is the key, as overall margins have stabilized but remain flat over the past few quarters.

- The stock’s valuation multiples look very cheap but remains a value trap as the growth outlook keeps disappointing investors.

fotostorm/E+ via Getty Images

Investment Thesis

PayPal Holdings (NASDAQ:PYPL)’s price action has been muted for the past year due to a lack of growth catalysts and a deterioration in active customer accounts. In my previous Buy coverage from last November, I was optimistic about the new CEO’s priorities on growth and transaction margin improvement. Since then, the stock has rallied over 10% after my rating upgrade. Although the company has achieved better-than-expected results in both top and bottom lines in 1Q FY2024, the forward guidance is below expectations. I admit, PYPL has shown early signs of growth rebound in transaction revenue and stabilization in margins. However, the transaction margin continued deteriorated to 45% from 45.8% in 4Q FY2023.

While it’s still hard to see clear upside momentum in the stock price, investors should be patient for a potential long-term turnaround. Given the overall lofty market valuation, the stock is actually trading at a significant discount compared to its historical levels. But I believe PYPL is currently fairly valued and will likely continue trading on the sideline. I have downgraded the stock from a buy rating to a neutral rating, as the turnaround play may take longer than previously expected due to a persistent weak growth outlook.

Single Digit Revenue Growth

It’s very encouraging to see that transaction revenue has reached double-digit growth of 10.5% in the last quarter, the highest over the previous five quarters. However, net revenue growth remained in the single digits, largely due to a significant slowdown in revenue from Other Value-Added Services, which declined by 1.6% YoY. This was the first negative growth since FY2020. During the earnings call, the management explained that the slowdown was due to two major factors: lower merchant receivables and lower revenue from the off-balance sheet U.S. consumer revolving credit portfolio.

In terms of guidance, the company projects only 6.5% YoY growth in net revenue in Q2 FY2024, which is below the market consensus. The current single-digit growth trajectory is largely below the +20% top-line growth experienced during the pandemic era from FY2020 to FY2021. I still believe PYPL’s top-line growth remains a major concern for investors. If PYPL stops growing active customer accounts, my expectation is that it will continue to maintain mid to high single digit revenue growth. This will impact the stock’s multiple expansion and maintain its current valuation multiple as a value trap in the future.

Active Customer Accounts Continues Decline

Let’s look at PYPL’s key growth metrics. Although the Total TPV in Q1 FY2024 maintains a mid-teens growth trajectory, active customer accounts declined by 1.4% YoY, marking three consecutive quarters of negative year-over-year growth. This demonstrates that the growth in volume per transaction and the number of payment transactions per active account are still on track, showing resilient customer engagement. However, higher revenue per user may partially be attributed to the high inflation backdrop. As the transaction take rate continues to drop due to high competition in the fintech industry, I believe growing customer adoptions is key to sustainably boosting total TPV, as the number of payment transactions per active account within a 12-month period is unlikely to increase significantly. Therefore, I will turn more bullish on the stock if I see a growth re-acceleration in active customer accounts.

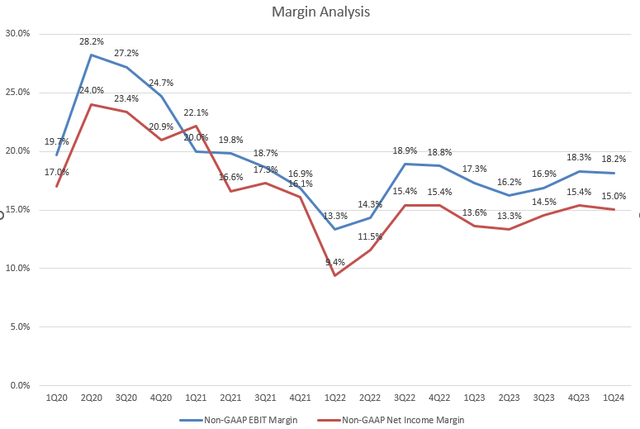

Margin Analysis

Looking at margins from the chart, we see that PYPL’s non-GAAP EBIT margin and non-GAAP net income margin have largely dropped from over 20% after the pandemic to a high mid-teen range over the past few quarters. This decline is also contributed by the growth slowdown in net revenues. I think the lack of margin expansion is another reason preventing investors from being bullish on the stock in the near term. Since both the growth outlook and margins are significantly below pandemic-era levels, I hardly see the stock making a major comeback to its previous highs.

Early Progress in Fast Lane

In the earnings call, the management mentioned that Fast Lane checkout has achieved a low-double-digit lift in guest checkout conversion for participating merchants. They expect to make Fast Lane available in the U.S. in the second half of 2024. The team is confident that around 40% of unrecognized customers coming through and using Fast Lane now provide an opportunity to remarket to them and convert them into PayPal customers.

However, we notice that unbranded checkouts typically have a lower take rate, which may not translate into significant top-line growth compared to branded checkouts. I believe it makes sense for the management to prioritize adoption over pricing. But this process may take a few quarters to actually see the value contributed to the overall revenue growth.

Valuation

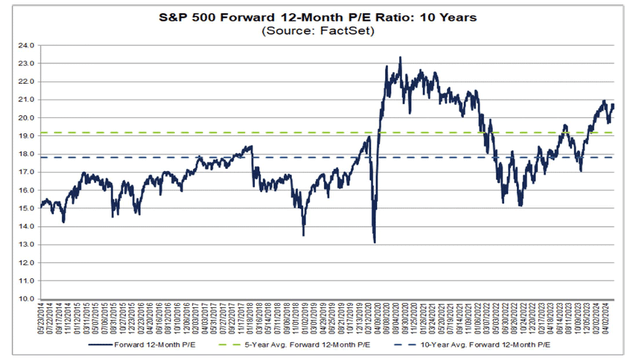

PYPL is currently trading at 14.7x non-GAAP FY2024 P/E, which is significantly below the +20x P/E for S&P 500 index, implying a sub-par growth outlook for the company. Let’s look at the chart above, PYPL has GAAP P/E of 15.48, which is near the 10-year low. As discussed in my previous article, PYPL has been a value trap due to a lack of growth catalysts. Investors should be mindful that holding the stock requires patience.

According to FactSet, the 10 year-average FTM P/E for S&P 500 is around 17.7x. As a single-digit growth company with flat margins, I believe this average multiple is a fair benchmark for PYPL. If we factored in the PYPL’s GAAP EPS FY2024 guidance, the company is expected to generate $3.65 per share. This implies that PYPL’s fair value is close to $64.6.

Conclusion

In conclusion, while PYPL may present strong upside opportunities for long-term investors who are willing to wait for a potential turnaround, the current outlook suggests that the road to recovery may be longer than previously anticipated. The current cheap valuation has reflected a single-digit growth trajectory and potential flat margins in the near term. Again, due to the high competition in the fintech industry, enhancing customer engagement is important, but the company needs to grow its customer base to boost the volume growth outlook. Therefore, I have downgraded the stock to neutral as the company continues to grapple with stagnant customer growth and a muted growth outlook.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.