Summary:

- Ford’s dividend investment thesis remains robust, thanks to the management’s raised FY2024 FCF guidance and its well-diversified automotive offerings across different end markets.

- For example, as retail EV adoption stalls, it has reported double-digit growth in Hybrid sales and commercial/ Ford Pro sales, well balancing its overall performance.

- F’s exclusive partnership with BLBD is likely to be a tailwind as well, as the US government offers new funding for electric heavy-duty vehicles and school buses.

- With the stock currently trading at relatively cheap valuations, it remains a compelling buy for those looking to add, with its predictable trading pattern also suitable for swing traders.

fredrocko

We previously covered Ford Motor (NYSE:F) in March 2024, discussing its promising FY2024 guidance and excellent supplementary FQ1’24 dividend payouts, demonstrating the safety of its investment thesis.

With a highly profitable legacy business to fall back on during the decelerating EV growth, we believed that it might continue delivering stable top/ bottom line moving forward, warranting our Buy rating then.

Since then, F has continued to trade sideways at +1.4% compared to the wider market at +3.7%. Even so, we are maintaining our Buy rating here, with its dividend investment thesis still robust and safe thanks to the management’s raised FY2024 Free Cash Flow guidance.

With the legacy automaker’s well diversified offerings continuing to perform well in an inherently cyclical market, we believe that F remains well positioned to survive the slow but sure electrification transition over the next decade.

F’s Dividend Investment Thesis Remains Robust, Despite The Inherently Cyclical Business Model

For now, F has reported a double beat FQ1’24 earnings call, with automotive revenues of $39.89B (-7.7% QoQ/ +2% YoY), adj automotive EBIT of $2.59B (+146.6% QoQ/ -20.5% YoY), and adj overall EPS of $0.49 (+68.9% QoQ/ -22.2% YoY).

In our previous article, we have highlighted the end of first wave EV adoption, with consumer and market attention increasingly shifting to hybrid vehicles as a way to bridge the gap between ICE and electric vehicles.

The same thesis has held well until now, with F reporting impressive growth in hybrid sales to 56.41K units through April 2024 (+51% YoY), well balancing the negative growth reported in the ICE segment at 603.01K units (-0.7% YoY) and decelerating growth in the EV segment at 28.24K units (+96.6% YoY) in the US.

At the same time, commercial demand has triggered a robust growth in the Ford Pro segment with FQ1’24 revenues of $18B (+16.8% QoQ/ +36% YoY) and adj EBIT margin of 16.7% (+4.9 points QoQ/ +6.4 YoY).

Most of F’s tailwinds are attributed to the robust US sales of Super Duty work trucks at 139.81K units (+63.1% YoY) and Transit vans at 63.04K units through April 2024 (+18.2% YoY).

This is on top of the software segment’s high gross margins at over 50%, with the management highlighting over 700K paid subscribers (+47% YoY) and higher revenue per unit software sales (telematics/ charging software) in the latest quarter.

At the same time, we believe that there remains great opportunities for the legacy automaker in the Pro commercial segment, thanks to the new US funding for electric heavy-duty vehicles and buses.

This is attributed to F’s exclusive partnership with Blue Bird (BLBD), with the former expected to supply its 7.3L engines to power the latter’s propane- and gasoline-powered school buses to comply to the US’ stringent emission standards from 2027 onwards.

For now, BLBD has already reported growing backlog of 500 units in the latest earnings call (+56% YoY), triggering long-term tailwinds for F as a component supplier.

This also builds upon the robust growth observed in the growing sales for Ford E-transit vans at 3.92K units through April 2024 (+127.9% YoY), thanks to the promising electrification trends observed in the federal and commercial markets.

And this is why we believe that F’s well diversified ICE, Hybrid, and EV capabilities in the automotive industry across different end markets are highly critical for its eventual survival as a legacy player, allowing the management to strategically switch its growth levers depending on the cyclical market demand.

This is especially since inflation has proven to be stickier than expected with the Fed’s pivot only expected by the November 2024 FOMC meeting, triggering prolonged interest rate pains for consumers through 2026, if not 2027.

At the same time, with EV adoption slowing down and the EU governments delaying their electrification goals, we believe that F’s lowered FY2024 capex guidance of $8.5B at the midpoint (down from the previous number of $8.75B) is highly prudent indeed, allowing the management to better invest in other growth opportunities.

And these developments are also why the management has moderately raised its FY2024 Ford Pro adj EBIT guidance to $8.5B (+18% YoY) and overall adj Free Cash Flow guidance to $7B at the midpoint (+2.9% YoY), against the original Free Cash Flow guidance of $6.5B (-4.4% YoY).

With only $727M of F’s automotive debts maturing within the year, we believe that its automotive balance sheet remains relatively healthy at cash/ equivalents of $10.87B (-23.4% QoQ/ -15.2% YoY) as well.

So, Is F Stock A Buy, Sell, or Hold?

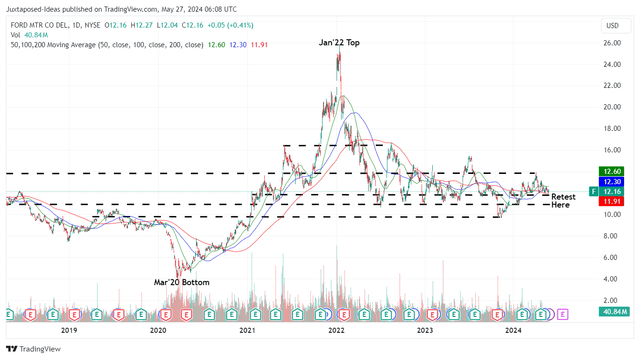

F 5Y Stock Price

TradingView

For now, F has lost much of its 2024 gains while pulling back to retest its previous support levels of $11s.

Thanks to the correction, its dividend investment thesis remains robust with an expanded forward dividend yield of 4.93%, compared to its 4Y average of 4.54%, the sector median of 2.15%, and the US Treasury Yields at between 4.46% – 5.40%.

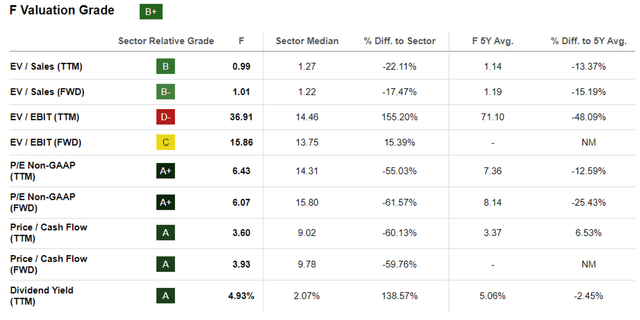

F Valuations

Seeking Alpha

At the same time, F continues to trade at relatively cheap FWD EV/ EBIT valuations of 15.86x and FWD P/E valuations of 6.07x, compared to its 1Y mean of 17.37x/ 7.18x, 3Y pre-pandemic mean of 28.17x/ 7.11x, and the sector median of 13.75x/ 15.80x, respectively, triggering an excellent margin of safety for those looking to add.

Due to the cyclical nature of its automotive business, traders may consider doing swing trades between the stock’s established support levels of $11s and the resistance levels of $14s, potentially triggering increased gains in the intermediate term.

It goes without saying that with borrowing costs for new vehicles still elevated at 7.2% as of April 2024, compared to the normalized 5.4% in December 2019, we may see a further deterioration in F’s consumer business in the intermediate term.

As a result, while F’s dividend investment thesis remains safe thanks to its robust profitability, as similarly reflected by Seeking Alpha Quant with decent Interest Coverage Ratio of 3.65x and Dividend Coverage Ratio of 3.34x, compared to the sector median of 6.79x and 3.01x, respectively, it is unlikely that we may see a payout hike anytime soon with special dividends only disbursed on a time to time basis depending on their full-year performance.

We maintain Buy for the F stock here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.