Summary:

- Visa is a dominant player in the payment processing space, with a large market share and growing revenue.

- The company has shown strong financial performance, with significant growth in revenue and net income over the past decade.

- Visa has rewarded shareholders with price appreciation and share buybacks, and has a track record of high dividend growth.

The Good Brigade/DigitalVision via Getty Images

Everyone shops. Whether it’s online or in a store, people need to buy stuff. As online shopping becomes more common, so does the need for a debit or a credit card. Indeed, about 93% of American adults hold a debit card, while 82% have at least one credit card. All of that plastic is tied to a payment network, and the largest payment processor is Visa (NYSE:V).

Most of Visa’s business occurs in the United States, but about one-third of its revenue comes from transactions outside the country. As credit cards become even more common, it is likely that there will be more customers to tap in markets outside the US. This could lead to more revenue for card processors.

Processing networks like Visa make money every time a consumer swipes a card at a merchant. Those fees tend to range in the 1.5% to 3.5% range. Those fees are effectively a convenience cost to businesses so that they don’t have to handle large amounts of cash. Credit cards also come with fairly hefty consumer protections. The revenue earned through swipe fees is also fairly resistant to inflation. As prices go up, the fees charged by processing networks go up because the payment is based upon a percentage of the transaction, not a flat dollar amount. Visa looks somewhat pricy at the moment, but that’s normal. The company is still a great company for many investors to own.

Visa’s Financials

Visa has grown rapidly in recent years, and its investors have done quite well. Visa’s revenue has more than doubled over the past ten years, from $14.5 billion in 2014 to $32.6 billion in 2023. Indeed, the only year revenue dropped for Visa was 2020 when COVID slowed down the economy. Even though revenue has grown by nearly 125% over this period, net income has grown even more rapidly. In 2014, Visa’s net income was $5.4 billion. By 2023, that number had grown to $17.2 billion–an increase of 219% over a ten-year period.

When looking at the company’s debt, it has definitely grown over the last decade. The company reported $0 debt in 2014, but this number now exceeds $20.6 billion. This is not much above the company’s net income for the past year, which has grown to $18.4 billion on a trailing twelve-month basis.

Free cash flow YTD is $7.6 billion as of the second quarter. Visa is a cash cow, to say the least, and the company’s business model provides a massive profit margin, unlike most of the vendors it serves. The market promises to grow in the short term.

Shareholder Returns

Much of the return on Visa over the past ten years has come from price appreciation. On June 2, 2014, a share of Visa was $53.25. As of May 30, 2024, the price of a share is $270.68. This is a 408% increase in the share price over the past decade. While this might not be as massive a return as investors in Apple (AAPL) or Microsoft (MSFT) could realize, it’s still well above that of the market as a whole. For example, the S&P 500 (VOO) has seen share appreciation of 169% over the past decade. Long-term investors in Visa have been rewarded for their investments.

In terms of more tangible returns, Visa has bought back a substantial portion of its outstanding shares over the past decade. The share count is currently about 20% lower than it was in the 2014 annual report. This has provided a positive impact to the company’s earnings per share, which have grown from $2.16 in 2014 to $8.28 (on a diluted basis) as of the most recent annual report. EPS has grown faster than both revenue and net income. The share count is likely to drop even further in the coming months, as the company announced a new $25 billion repurchase program in October 2023. Over the past year, Visa has spent $12.7 billion buying back its stock.

Visa has also returned money to investors through dividends. Those who are interested in dividend income might be tempted to ignore V at this point. The yield is quite low at 0.77%. The S&P 500 has a low yield, but Visa’s is just a little more than half of the broader market’s yield (1.33%).

Despite the low yield, Visa has shown massive dividend growth over the past decade, clocking in at an average annual increase of 18%. Over the past five years, that’s dropped slightly to just under 16% per year. Continuing this growth rate would double the dividend in about 4.5 years. Indeed, the dividend today is about five times what it was 10 years ago, growing from $0.42 per share to the current annual payout of $2.08. With the company anticipating low double-digit growth in revenue over the next year, the company should be able to continue its strong record of dividend growth.

The current level of dividend growth has come without a big jump in the payout ratio. Even with such robust dividend growth, the payout ratio is about 21%, which is not much higher than the 18.5% payout ratio from 2014.

Valuation

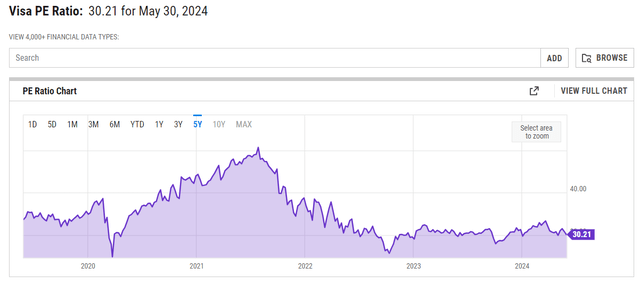

This is where some prospective investors might pause. The current price/earnings ratio is 30. Seeking Alpha’s valuation estimates peg Visa with an F grade. However, the current P/E ratio is actually on the low end of where Visa has been over the past five years.

Despite the high valuations of the stock, Visa’s share price has grown by 66% over the same period. This is a bit below the S&P 500’s growth over the same period (89%), but it’s still a healthy, double-digit level of compounded annual growth.

Risks

One major risk that could impact Visa’s returns going forward comes from Congress. The Credit Card Competition Act intends to limit swipe fees. Whether that cuts costs for consumers (which it is supposed to do) remains to be seen. However, it would likely cut down on lucrative credit card rewards offers, which might cut down on usage in addition to cutting revenue for companies like Visa. There is also competition in the payment processing space, and there is the possibility that new technology could cut into Visa’s dominance. However, for the present, the company has a dominant position in the payment processing space.

Conclusion

Visa has been a great investment over the past decade. As long as it can keep charging the same fees, its revenue should increase. While the current dividend payout is low, investors could see a pretty hefty yield on cost in coming years and decades (those who purchased 10 years ago are approaching a yield on cost of nearly 4%). Dividend growth has been very high over the past decade, and the payout ratio has barely budged. If Visa can continue this going forward, it will greatly benefit income investors. As the company continues to buy back shares with its massive free cash flow, those who stick with the company should be rewarded with higher EPS numbers in the future, as well, which could lead to higher share prices. There is much to like about Visa stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a certified financial professional. Readers should do their own due diligence before making any investment, as losses up to and including all capital invested can happen.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.