Summary:

- Nvidia Corporation stock continues to outperform, defying the gravity of high valuation multiples.

- Nvidia’s revenue growth rate is declining, and the company’s stock buybacks are at an all-time high.

- Microsoft’s partnership with AMD highlights the competitive threat to Nvidia’s dominance in data centers.

- Nvidia investors should note one important comment by a senior Microsoft executive.

Justin Sullivan/Getty Images News

Nvidia Corporation’s (NASDAQ:NVDA) stock price continues to defy gravity with stretched valuation multiples, but I remain on the sidelines due to three reasons that I discuss in this article: Slowing revenue growth, intensifying competition from Advanced Micro Devices (AMD), and stretched valuation multiples that assume continued, high pace of growth rates for many years.

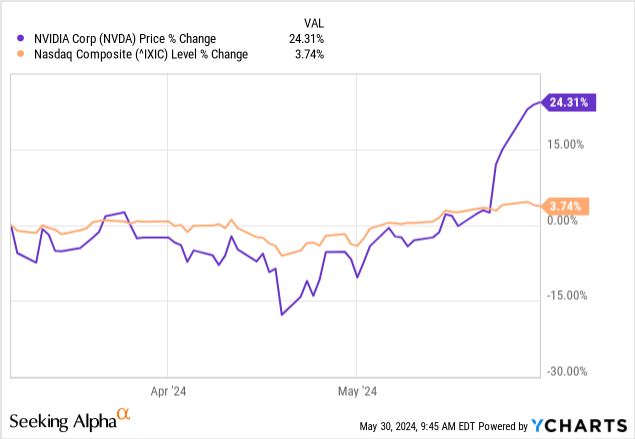

I last reviewed NVDA stock in “Nvidia: Consider Selling Amidst Insider Selling And Stretched Valuations,” in which I highlighted that most sell-side analysts viewed the stock favorably, indicating that the boat might be full, discussed the heavy insider selling in the stock, and discussed the company’s valuation multiples, and I recommend reading it. Following my article, NVDA declined by 17 percent in seven weeks, underperforming the NASDAQ index (COMP:IND) during that period, but then recovering and greatly outperforming the index, especially since the recent earnings release, which I review in the next section.

Nvidia’s Growth Is Slowing

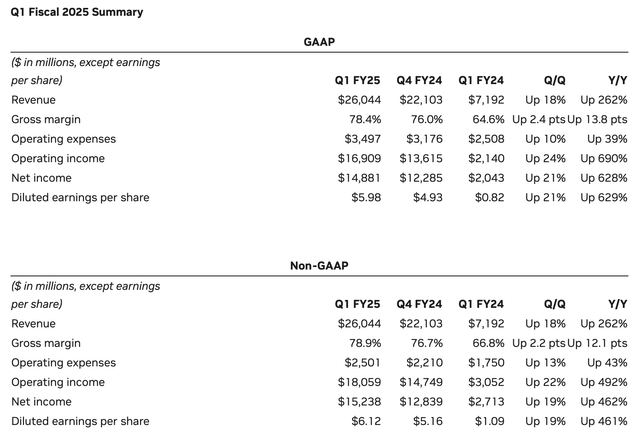

On May 22, Nvidia announced its financial results for the first quarter of fiscal year 2025, and the company blew consensus estimates out of the water on all fronts from top-line to bottom-line as well as guidance for the next quarter. The following table presents Nvidia’s GAAP and non-GAAP results for the first quarter of, compared to the last quarter and the same quarter from last year.

I won’t rehash the company’s results, except to highlight two key takeaways, followed by a material comment by Microsoft that I discuss later in the article.

First, Nvidia’s revenue guidance of $28.0 billion for the second quarter of fiscal 2025 represents a sharp slowdown in the company’s revenue growth rate, both on a quarter-over-quarter basis from 18% in Q1 to 8% in Q2, and on a year-over-year basis from 262% in Q1 to 107% in Q2. Even though the year-over-year growth rate is still high, I emphasize that the growth rate is declining, and I expect it to continue to decline in the coming quarters due to the two reasons I discussed in the Competition section of my previous article and the material comment from Microsoft that I discuss later in this article.

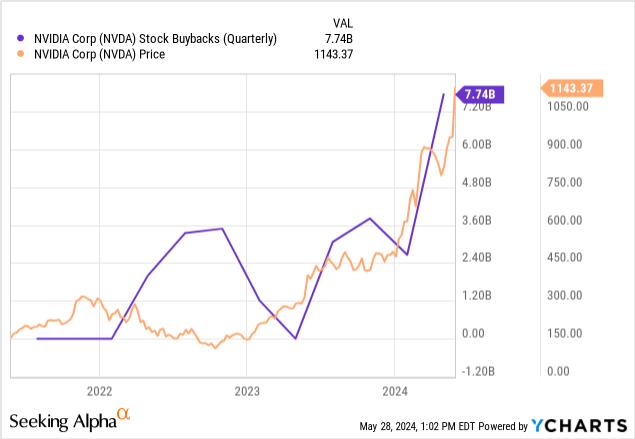

Second, Nvidia repurchased $7.74 billion of its stock, according to the cash flow statement included in the earnings release, representing the highest amount of stock buybacks that the company has ever conducted even though the stock traded near its all-time high throughout the first quarter:

Before continuing further, please review the Competition section in my previous article, in which I predicted that AMD’s MI300X accelerators “could upend the status quo and entice potential customers away from Nvidia’s offerings.”

Shots Fired: Microsoft Partners With AMD

Last week, Microsoft (MSFT) held its annual conference for developers, and in an analyst briefing ahead of the conference, Scott Guthrie, Microsoft’s executive VP of the Microsoft Cloud and AI group, described AMD’s MI300X accelerators as the “most cost-effective GPU out there right now for Azure OpenAI.”

The above comment supports my argument that AMD MI300X poses a material competitive threat to Nvidia’s dominance in data centers. Further, AMD issued a press release that discusses its growing partnership with Microsoft and illustrates the competitive challenge it poses to Nvidia. The most important takeaway from the long press release is that Microsoft is now using AMD’s MI300X accelerators to power Azure Open AI ChatGPT 3.5 and 4, “which are some of the world’s most demanding AI workloads,” and because I can already see the “But CUDA!” replies below this article, let me also point out that AMD ROCm software is used to power the new Microsoft Azure ND MI300X virtual machines used by customers like Hugging Face.

With that material comment in mind, let’s review Nvidia’s valuation multiples.

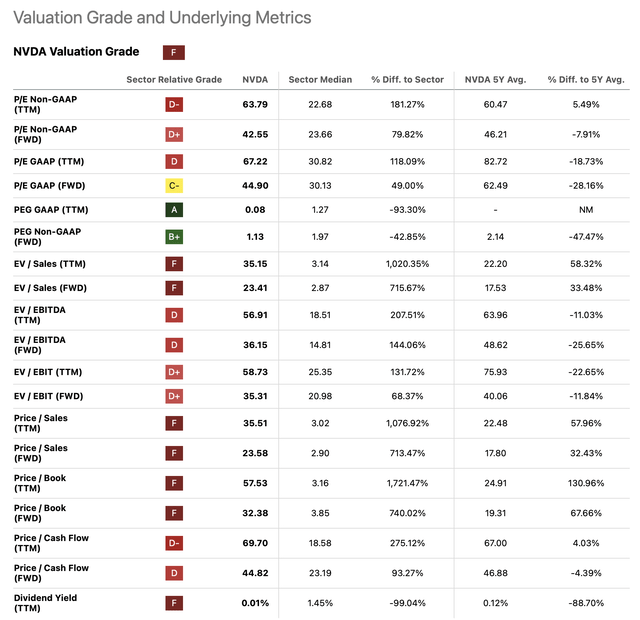

Nvidia’s Valuation Continues To Be Stretched

Seeking Alpha does an excellent job of summarizing valuation metrics for all companies, and I included the Valuation Metrics table for Nvidia below:

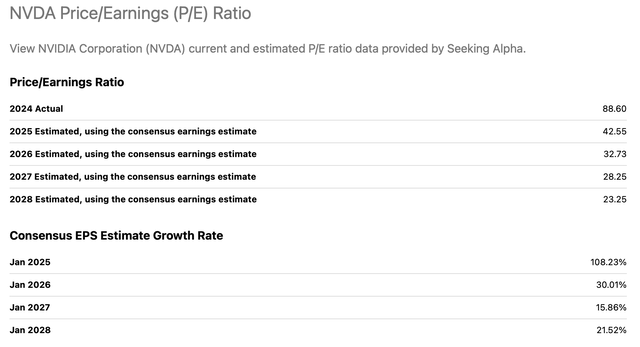

Nearly all of Nvidia’s valuation multiples continue to be stretched both on a historical and a forward-looking basis, but as the following table illustrates, sell-side analysts expect the company’s valuation multiples to rapidly decline throughout the coming years if the growth rate assumptions materialize:

A key takeaway from the above tables is that the growth rates implied by the consensus forecast drop sharply from 108% in fiscal 2025 to 30% in fiscal 2026, and this is a material risk for those shorting the Nvidia stock. Management’s comments on the recent earnings call regarding demand for the current H200 and the coming Blackwell platform chips indicate there’s room for growth estimates to increase for the next several quarters (emphasis added):

While supply for H100 prove, we are still constrained on H200. At the same time, Blackwell is in full production. We are working to bring up our system and cloud partners for global availability later this year. Demand for H200 and Blackwell is well ahead of supply and we expect demand may exceed supply well into next year.

Having pointed out that risk, however, I will be keeping a very close eye on the relative market shares of Nvidia, AMD, and other players to better understand and forecast growth trajectories for all industry players beyond the next two years. Given commentary from Microsoft, my view is that material downside risk exists in the growth assumptions baked into the Nvidia forecasts beyond fiscal 2026.

I’m actively involved in the comments below my articles because I’d like to interact with my readers to quicken the feedback loops and address head-on any disconnects in discourse as soon as possible. If you agree or disagree with me, please feel free to share your thoughts below this article. I look forward to learning from you.

The Bottom Line

Nvidia’s technology leadership continues with the Blackwell platform of next-generation chips, but as indicated by Microsoft’s comments, AMD’s MI300X is a cost-effective alternative, and the latter fact is not yet appreciated by market participants. Although Nvidia’s stock price outperformance may continue in the coming weeks, I caution investors to not chase the stock because competitive analysis points to a closing gap between Nvidia and its competitors. I continue to rate Nvidia stock SELL, and I will update my analysis in future articles.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.