Summary:

- Energy Transfer has been one of my top picks in the midstream space.

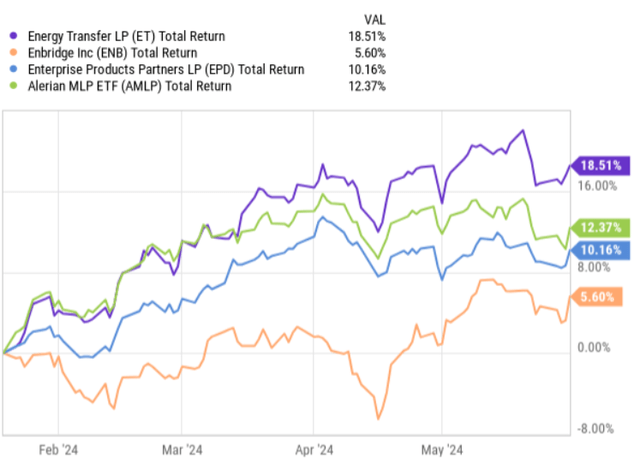

- Since my issuance of my bull thesis, ET outperformed its closest peers by a notable margin.

- This could raise the question of a potential overvaluation.

- In this article I explain why this is not the case and why I am still maintaining my buy rating for ET.

Monty Rakusen

January this year, I issued a bullish article on Energy Transfer (NYSE:ET) arguing that its dividend, which at that time yielded ~9%, was in a much safer position than several years ago when ET was forced to cut it. In the article I also highlighted several dynamics, which, in my opinion, introduced quite favorable conditions for ET to deliver strong total returns. In other words, the investment case did not revolve just around the dividend, but also around ET’s organic and M&A growth potential.

Since the publication of this bull case, ET has outperformed the index and other popular midstream names for which I have also assigned buy ratings.

This situation, just as back when I reassessed the case after Q4, 2023 earnings report, could raise the question of a potential overvaluation and whether there is still a decent upside left for ET.

Namely, April this year, I analyzed the Q4 report to see whether the fundamentals still justify above-average multiple and the run-up in the share price. The combination of ET’s strengthened balance sheet, steadily growing business segments and first signs of a more ambitious M&A program motivated me to maintain a bullish view on ET. Since then (April 14, 2024), ET has continued to deliver alpha over the MLP index.

Let’s now contextualize the most recent data points from Q1, 2024 earnings report with the current bull thesis to determine the current attractiveness of ET.

Yet, before we dissect the Q1 dynamics, I would like to underscore that my investment strategy is not based on speculation or short-term profits. Instead, I am focused primarily on capturing enticing dividends that are underpinned by robust fundamentals and then only the capital appreciation component comes into play.

Thesis review

All in all, by looking at the core performance metrics of Q1, 2024 it should not be surprise that ET’s share price has ticked higher in such a fashion. All of ET’s business segments experienced a growth relative to Q1, 2023 and even the prior quarter. Compared to Q1, 2023, the net income and adjusted EBITDA for Q1, 2024 increased by 11% and 13%, respectively, which were driven by higher volumes and more favorable pricing.

Interestingly, that ET registered also record volumes in its crude pipeline segment, which is one of ET’s most profitable segments (i.e., where the cash conversion rate is the highest). As a result, the DCF in Q1, 2024, which reflect the true cash generation level, landed at $2.4 billion compared to $2 billion for the first quarter of last year. This, in turn, allowed ET to retain circa $1.3 billion of cash at its books after distributing the quarterly dividend, which on an annualized basis yields 8.1%.

If we think about the future it is important to start with the fact that currently about 90% of ET’s adjusted EBITDA is comprised of fee-based segments, which means that only ~10% is exposed to volatility in the commodity markets (i.e., pure market risk). Given that the fee based segments are connected to periodic (annual) escalators and inherently less volatile, it provides the necessary stability for ET to keep the dividends safe and better manage the leverage profile.

Now, just recently ET announced that it will venture into a sizeable acquisition of WTG Midstream paying ~ $3.2 billion in cash. The new acquisition is set to be accretive to the underlying DCF generation by adding $0.04 per share already in 2025 with a forecast (after realizing the synergies) of reaching $0.07 per share in DCF by 2027.

This move goes hand in hand what Tom Long – Co Chief Executive Officer – communicated in the recent earnings call:

Yes, listen, that’s obviously a very, very, very good question. We spend a lot of time within Energy Transfer strategizing here. I will, I think I will start off saying that we still feel like consolidation makes sense in the midstream space. So just at the 50,000 foot answer to your question, we still fully intend on evaluating various opportunities as we look out. So we’re not going to slow down on that front. Now, as far as what we look at is going to be always trying to look at those things that feed all the way downstream. We always like to talk about how we go from wellhead to the water and we do it across all the commodities. So you can see our strategy as we look at this stuff and what assets we look at as to how it feeds all the way through the value chain when we make these acquisitions.

In other words, it is clear that ET has stepped up its M&A game to extract the benefits of a rather fragmented market. There is also a benefit of inorganic growth in the form of incremental diversification and especially DCF generation as we can, for example, notice by looking at the details of WTG Midstream acquisition.

With all of this being said, one might question ET’s ability to keep the balance sheet protected. This might indeed become an issue if ET continues to announce so sizeable transactions that are carried out on a cash basis. Yet, considering the current data points, I just do not see risks on the balance sheet end.

First, as outlined above, ET is able to retain circa $1.3 billion in cash each quarter – and this is after making the debt service and dividend distributions.

Second, the maintenance CapEx is quite low relative to the quarterly cash retention. For instance, in Q1, 2024, ET spent roughly $460 million on organic growth capital, which still leaves an ample of liquidity left to channel towards M&A

Third, ET has made some notable steps in decreasing the preferred share positions, by redeeming of all of its outstanding Series E preferred units. During the quarter, ET also redeemed $1.7 billion of senior notes using partly cash and partly its credit revolver.

Fourth, together with Q1 results, the Management raised its guidance on adjusted EBITDA to between $15 billion to $15.3 billion, compared to the prior guidance range of $14.5 billion to $14.8 billion. This will allow ET to access even higher amounts of liquidity each quarter to fund the acquisitions or optimize the balance sheet even further.

Now, while I stated earlier in the article that my ET’s bull case is not predicated on short-term results or ET’s ability to match the consensus expectations (but rather the focus in on attractive and steadily growing dividends), I do believe that ET will be able to deliver on the revised EBITDA generation. A major driver behind the increased EBITDA guidance is the integration (or consolidation) of the NuStar assets, which closed May, this year. This effect alone contributes to incremental $500 million in EBITDA generation, where the rest could be easily covered by further bolt-on acquisitions and a continued strong demand for oil and natural gas.

Finally, one could theoretically make a case that ET’s multiple has expanded a bit too far and now has reached rather elevated levels. While the EV/EBITDA of 7.8x could be deemed higher than on average in the past 24 month period, if we compare it to some of the most direct peers such as Enbridge (NYSE:ENB)(TSX:ENB:CA), Enterprise Products Partners(NYSE:EPD) or Plains All American Pipeline (NASDAQ:PAA), we will recognize that actually ET continues to remain undervalued. For example, the EV/EBITDA for ENB, EPD and PAA is 11.3x, 9.3x, and 9.2x. Considering ET’s growth momentum that is underpinned by an investment grade balance sheet, in my view, the stock is cheap.

The bottom line

In my opinion, the recent run-up in ET’s share does not mean that the upside is already exhausted. The increase in share price has been driven by strong underlying business performance and improved growth prospects, where the early signs of this were already observed in my previous (April, this year) article on ET.

Since my thesis update, ET has started to take tangible steps by executing its M&A strategy to capture the benefits of the fragmented midstream market, where incremental consolidation should allow ET to be more diversified and maintain the growth momentum in its DCF.

Given the combination of stronger EBITDA growth, accretive acquisitions, low maintenance CapEx, and ample quarterly cash retention (after servicing the ~8% dividend), ET’s financial risk remains well-managed.

As a result of the aforementioned dynamics, improving growth profile and attractive dividend that is well-covered, Energy Transfer remains a solid buy for me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.