Summary:

- Earlier this month, Hyzon Motors or “Hyzon” reported Q1/2024 results, with revenues boosted by final customer acceptances for ten coach buses and one refuse truck in Australia.

- However, the company continues to burn cash at an alarming pace and will require a large amount of additional capital to continue executing its business plan.

- As a result, management was required to include a going concern warning into Hyzon’s quarterly report on form 10-Q.

- While the company is looking for strategic investors, a heavily dilutive equity raise or convertible debt offering looks like the most likely outcome at this point.

- Given elevated risk of substantial, near-term dilution, investors should consider selling existing positions and moving on.

Industrial Donut Picks/iStock via Getty Images

Note:

I have covered Hyzon Motors Inc. (NASDAQ:HYZN, NASDAQ:HYZNW) previously, so investors should view this as an update to my earlier articles on the company.

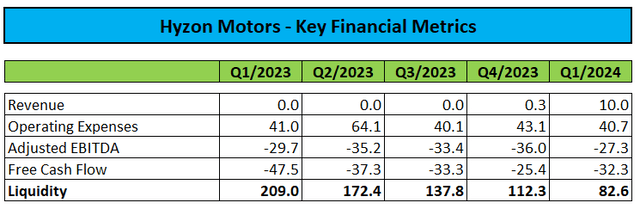

Earlier this month, Hyzon Motors Inc., or “Hyzon” reported Q1/2024 results with revenues boosted by final customer acceptances for ten coach buses and one refuse truck in Australia:

However, the company continues to burn cash at an alarming pace and will require a large amount of additional capital to make it through next year.

As a result, management was required to include a going concern warning into Hyzon’s quarterly report on form 10-Q (emphasis added by author):

The Company has incurred net losses since inception. Net cash used in operating activities was $31.2 million and $46.0 million for the three months ended March 31, 2024 and 2023, respectively. As of March 31, 2024, the Company has $52.4 million in unrestricted cash and cash equivalents, $30.2 million in short-term investments, and $6.0 million in restricted cash. The Company incurred net losses of $34.3 million and $30.3 million for the three months ended March 31, 2024 and 2023, respectively. Accumulated deficit amounted to $276.9 million and $242.6 million as of March 31, 2024 and December 31, 2023, respectively.

The Company has concluded that at the time of this filing, substantial doubt exists about its ability to continue as a going concern as the Company believes that its financial resources, existing cash resources, and additional sources of liquidity are insufficient to support planned operations beyond the next 12 months.

On the conference call, management stated its preference for strategic investors, but with the market for FCEV trucks still in its infancy and the company’s share price at all-time lows, it’s hard to envision prospective investors lining up in droves.

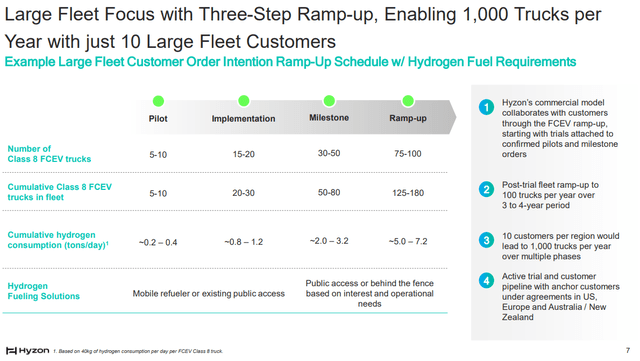

Similar to larger competitor Nikola Corporation or “Nikola” (NKLA), Hyzon is focusing on large fleet deployments:

However, this approach is likely to remain an uphill battle due to several key issues:

- Extensive testing requirements.

- Long decision-making processes, particularly when it comes to new technologies.

- Ongoing lack of hydrogen infrastructure.

- Concerns regarding the company’s financial viability.

- Customers requiring the company to share into the financial risks associated with the new technology.

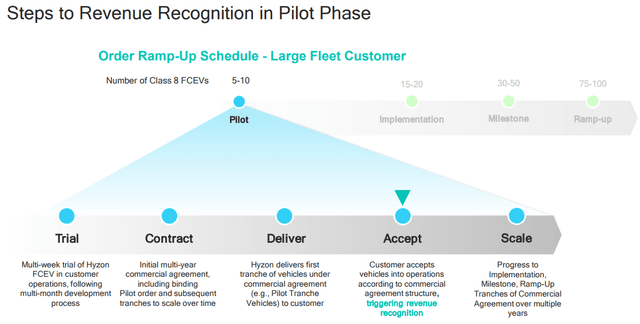

Particularly, the latter point is impacting the timing and treatment of revenue recognition in the initial phase:

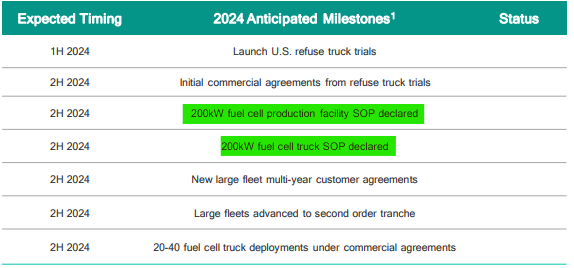

For this year, the company is targeting 20 to 40 FCEV truck deployments, with the vast majority still running on Hyzon’s legacy 110kW fuel cell system.

However, the company will require additional capital to achieve these rather moderate targets, as outlined by management on the call:

By deploying a smaller number of trucks per fleet to priority large fleets, we are purposely managing working capital and associated net cash burn, while maximizing the commercial foundation we have in place to enable scaling in 2025 and 2026 noting that Hyzon is tied to progress in our strategic capital raise and may be adjusted pending outcomes this year. Lastly, we are focused on strengthening our balance sheet and securing additional capital to fund our business.

The company continues to target commercial production of its new 200kW fuel cell system in the second half:

Company Presentation

But anywhere you slice it, Hyzon will require a considerable amount of new capital in the second half of this year in order to execute on its business plan.

Assuming quarterly cash burn of $28 million, the company will require more than $100 million to make it through next year.

Considering Hyzon’s market capitalization of $128 million, an outright equity raise would almost certainly result in massive dilution for existing shareholders.

While the company has no debt, there are no substantial assets either, so issuing secured debt won’t be an option.

However, similar to Nikola, Hyzon might be able to issue toxic convertible notes to specialized institutional investors but similar to an outright equity raise, this would likely require the company to secure shareholder approval for increasing authorized shares substantially above the current 400 million threshold as also outlined in the company’s quarterly report on form 10-Q (emphasis added by author):

The Company plans to improve its liquidity through a combination of equity and/or debt financing, alliances or other partnership agreements with entities interested in our technologies, and the liquidation of certain inventory balances.

If the Company raises funds in the future by issuing equity securities, dilution to stockholders will occur and may be substantial, and the Company may be required to seek shareholder approval for an increase in its authorized capital and issuance of equity securities. Any equity securities issued may also provide for rights, preferences, or privileges senior to those of common stockholders.

If the Company raises funds in the future by issuing debt securities, these debt securities could have rights, preferences, and privileges senior to those of common stockholders.

The terms of any debt securities or borrowings could impose significant restrictions on the Company’s operations. (…)

Given the Hyzon’s substantial cash requirements, lack of scale and the disappointing pace of FCEV truck adoption, I don’t expect the company to succeed in its search for strategic investors, particularly not when considering the fact that its largest shareholder and core IP provider remains Horizon Fuel Cell Technologies, a Chinese company.

Given these issues, I would expect Hyzon to come to market with some sort of equity-linked offering in the second half of the year and given the sheer amount required, major dilution appears to be in the cards.

Consequently, I would urge existing shareholders to consider selling their holdings and moving on.

Risks:

While the probability appears very low, a surprise strategic investment at favorable terms would likely result in the shares rallying quite meaningfully from current all-time lows.

Bottom Line:

To continue executing on its business plan, Hyzon Motors will require a substantial amount of additional capital in the second half of the year.

While management is looking for a strategic investor, I consider a heavily dilutive equity raise or sale of equity-linked securities as the most likely outcome at this point, as not even much larger competitor Nikola has managed to attract strategic investors in recent quarters.

With remaining liquidity depleting quickly, and additional funds required for planned vehicle deployments in the second half of the year, there’s elevated risk of substantial near-term dilution.

As a result, existing shareholders should consider selling their holdings and moving on.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.