Summary:

- Broadcom continues benefiting from the AI revolution as the company provides cutting-edge solutions for modern digital infrastructure and continuously develops its offerings.

- The upcoming earnings release is expected to show strong revenue growth and beat consensus estimates.

- Broadcom’s valuation is attractive both compared to peers and according to the discounted cash flow model.

G0d4ather

Investment thesis

I have mixed feeling about my previous bullish thesis about Broadcom (NASDAQ:AVGO). On the one hand, the company’s fundamentals keep improving and that makes me happy as an investor. On the other hand, improving fundamentals did not convert into share price growth yet as the stock has -5.3% since early March.

Today, I want to share my insights about recent developments and discuss my expectations about the approaching quarterly earnings release, which is scheduled for June 12. Apart from AVGO’s flawless earnings surprise history over the last four years, there are a few strong fundamental reasons to be bullish about the upcoming earnings release. Valuation has become more attractive after the recent pullback, which makes me reiterate my “Strong Buy” for AVGO.

Recent developments

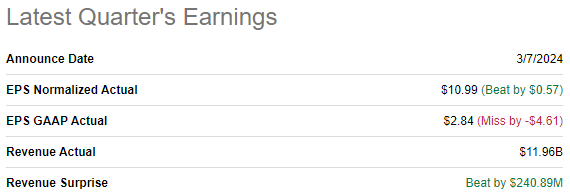

The latest quarterly earnings were released on March 7, when AVGO topped revenue and adjusted EPS estimates. Revenue grew by 34.17% YoY, the adjusted EPS expanded from $10.33 to $10.99. Massive revenue growth is explained by the addition of VMWare’s financials since it was the first quarter that consolidated VMWare. However, even without the effect of VMWare, organic growth was solid with an 11% increase YoY.

Seeking Alpha

Semiconductor Solutions segment’s revenue grew by around 4% YoY, while Infrastructure Software increased by more than twice.

AI revenues were the major driver for revenue growth as this business line’s sales approximately quadrupled YoY, reaching around $2.3 billion. Networking revenues also substantially contributed to growth with a 46% YoY growth.

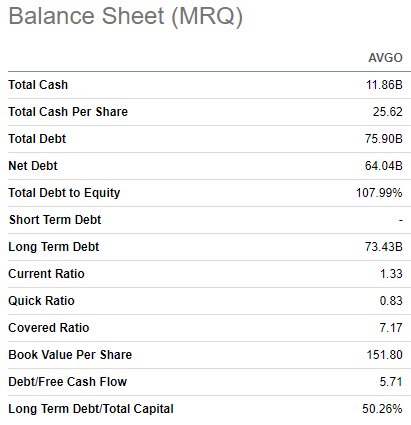

As a result of strong topline performance, AVGO generated $4.8 billion in cash from operations, around 20% higher YoY. This helped in maintaining a strong balance sheet with almost $12 billion in cash.

Seeking Alpha

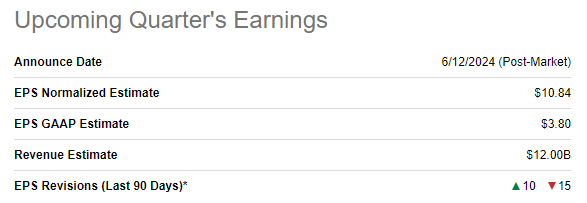

The upcoming earnings release is scheduled for June 12. Wall Street analysts project Q2 revenue to be $12 billion, 37% higher on a YoY basis. The adjusted EPS is expected to expand YoY, from $10.32 to $10.84. Wall Street analysts’ expectations about the upcoming earnings release are mixed since there were ten EPS upgrades and fifteen downgrades over the last 90 days.

Seeking Alpha

To understand the probability of a company beating consensus estimates, I prefer to look at the earnings surprise history. According to Seeking Alpha, AVGO never missed revenue or EPS consensus estimates over the last sixteen quarters. Therefore, the probability of AVGO beating consensus estimates again on June 12 is quite high. Apart from the exceptional earnings surprise track record, there are a few fundamental reasons to be optimistic about AVGO’s upcoming earnings release, in my opinion.

As I already emphasized in all my previous articles about AVGO, the company is an apparent beneficiary of the ongoing digital revolution, especially the latest wave of it called “AI”.

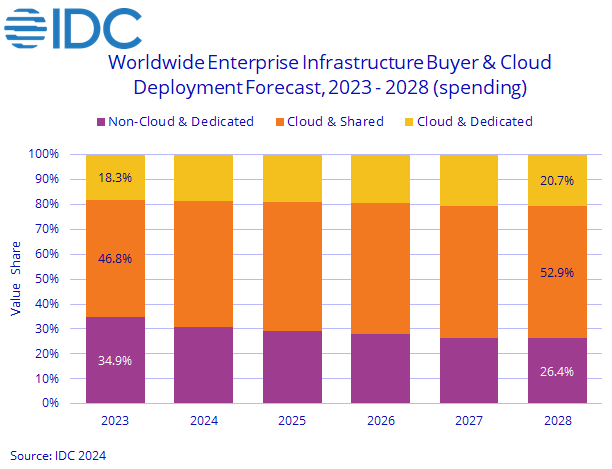

The Q1 2024 financial performance of all three cloud hyperscalers, Amazon (AMZN), Microsoft (MSFT), and Google (GOOG) add a lot of optimism. All three giants demonstrated accelerated cloud revenue growth in Q1 2024, according to crn.com. Moreover, all three cloud and AI giants in recent months announced plans to boost data center spending by tens of billions of dollars. AVGO’s networking business, which is the most exposed to data centers, will certainly benefit from increased CAPEX spending from cloud giants. For the year 2024, IDC forecasts a 19.3% increase in overall cloud infrastructure spending.

IDC

Moreover, Broadcom partners closely with all of these key players. For example, on April 9 Broadcom announced that the company expanded partnership with Google Cloud to add more Broadcom products and services to Google Cloud Marketplace and infusing Google Cloud’s generative AI capabilities. Adding more products and services to a cloud platform that commands an 11% global cloud market share should significantly expand Broadcom’s market reach.

Fresh news also suggests that Broadcom and Microsoft also expanded their partnership, as subscribers to VMware Cloud Foundation [VCF] can now use their licenses on Azure’s VMware Solution. According to the company’s CEO, this portability will help in simplifying VMware’s business. In my opinion, this can ultimately lead to streamlined operations and cost efficiencies.

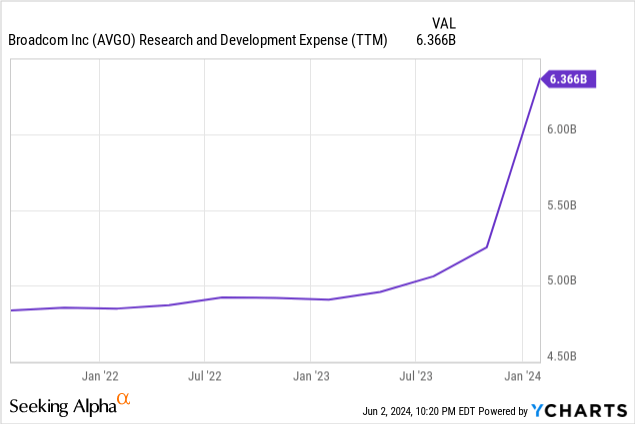

The desire to partner with AVGO from the leading cloud providers is not surprising given the company’s firm commitment to innovation. The R&D spending has grown exponentially in recent quarters, which increases the probability of the company rolling out new cutting-edge products and services. For example, in mid-March, the company delivered industry’s first 51.2 terabits per sec [Tbps] co-packaged optics [CPO] Ethernet switch.

On May 20, Broadcom also unveiled its latest high-performance 5 nm Ethernet Adapter for AI networking. As the AI revolution continues, more energy efficiency with higher performance is required. According to the company’s press-release, the new adapter aligns with these evolving requirements from the industry.

To conclude, there are several reasons to remain bullish. Despite facing the problem of large numbers law, the company continues demonstrating organic growth as it capitalizes on robust AI momentum. The data center spending is highly likely to remain elevated for longer, as major cloud players recently unveiled plans to inject tens of billions of dollars in the industry. With its commitment to innovation and close ties with all cloud giants, AVGO is well-positioned to absorb industry tailwinds.

Valuation update

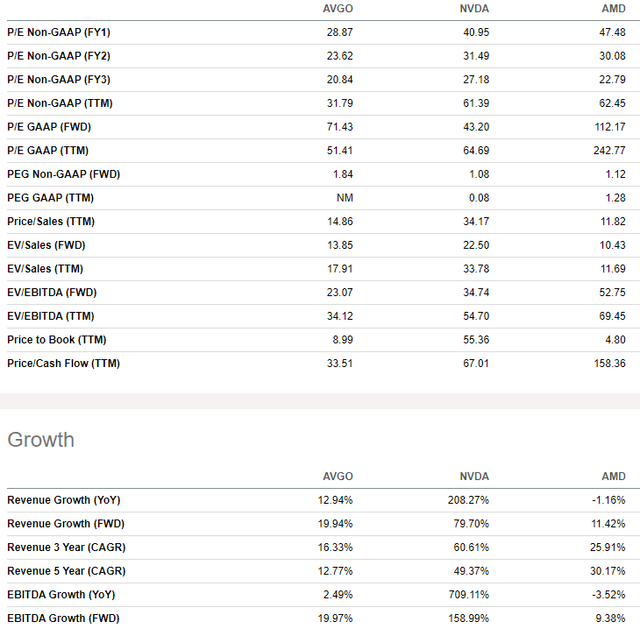

The stock rallied by 64% over the last twelve months and boasts a 19% YTD rally, substantially outperforming the broader U.S. market. Valuation ratios of Broadcom are always high compared to the sector median. On the other hand, since Broadcom is one of the largest and most profitable companies in the industry, I prefer to compare its multiples to two other hot semiconductor stocks: Nvidia (NVDA) and Advanced Micro Devices (AMD).

AVGO’s valuation ratios are lower compared both to NVDA and AMD across the board. NVDA’s much higher multiples are justified by unmatched revenue and EBITDA growth. But AMD is far behind AVGO in terms of both YoY and FWD revenue and EBITDA growth, but its multiples are much higher compared to AVGO. Therefore, the stock looks quite attractive based on peer analysis.

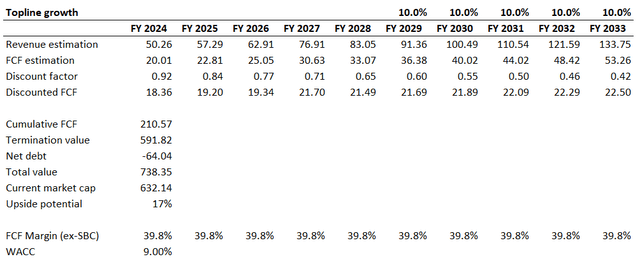

To figure outside the upside potential, a discounted cash flow [DCF] model must be simulated. A 9% WACC is in line with a recommended range from valueinvesting.io, which I consider a reliable source.

The revenue growth trajectory for the next decade is a combination of consensus estimates [FYs 2024-2028] and a 10% revenue CAGR for the years beyond. As a result, we have an 11% CAGR for the entire horizon, approximately in line with long-term growth forecasts for the semiconductor industry. The TTM FCF ex-SBC margin is 39.8%, and it is an exceptional level. Expanding from here will likely be extremely challenging even for AVGO and I prefer to use this level flat for the whole decade.

The business’s fair value is $738 billion, 17% higher than the current market cap. Such a discount for a profitability and growth star like AVGO is a gift, in my opinion.

Risks update

It is a widely known fact that Broadcom’s chips are used in Apple’s (AAPL) flagship product, the iPhone. Therefore, Broadcom’s financial performance also notably depends on the success of this premium smartphone. The iPhone still dominates the smartphone market in the U.S. and its positions are intact in across North America. However, the device has been notably losing its market share in China in recent quarters, a vital market for Apple. In case Apple continues losing its market share in China, this will also adversely affect Broadcom’s financial performance.

In general, high revenue concentration risk is inherent for AVGO as sales to the company’s top-5 end customers accounted for approximately 40% of the total net revenue in Q1 FY 2024.

Thanks to its rapid organic growth and aggressive acquisitions, Broadcom is already a $632 billion worth company. That said, the attention of antitrust bodies will inevitably continue to rise. For example, AVGO is already being questioned by European antitrust regulators regarding VMware’s licensing conditions following complaints from a spate of EU business users and a trade group. Increased antitrust scrutiny likely means increased compliance costs and even potential charges. Moreover, it might mean elevated risks for some of prospective acquisitions to fail getting antitrust approvals. This will limit AVGO’s ability to drive revenue growth.

Bottom line

To conclude, AVGO is still a “Strong Buy”. Industry trends are extremely favorable for the company as data center and AI spending are poised to remain robust for several quarters ahead. Since AVGO has a stellar track record of capitalizing on favorable secular trends, I am highly convinced that the company will demonstrate it in its Q1 performance and guidance boost for the full year 2024. Last but not least, the valuation is very attractive after a recent pullback.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.