Summary:

- Bank of America is a solid “Hold” but not a “Buy” due to its valuation and dividend yield.

- The bank’s net interest margin has declined due to higher deposit costs, but declining interest rates could be a tailwind in the future.

- Bank of America’s profits declined in the most recent quarter, but analysts forecast an increase in earnings per share for the current and next year.

hapabapa

Article Thesis

Bank of America Corporation (NYSE:BAC) (NEOE:BOFA:CA) is a major bank that operates a high-quality business. But its valuation is not especially attractive at current prices, following strong gains over the last year, and the dividend yield is not much of a total return booster, either. I thus believe that Bank of America is a solid “Hold” but not a “Buy” right here.

Past Coverage

I have covered Bank of America Corporation several times here on Seeking Alpha, most recently in April 2022, or a little more than two years ago. I gave the bank a neutral rating back then, arguing its valuation was not attractive enough for an outright “Buy”. This has played out well so far, as Bank of America has delivered a total return of 7% since then — not bad, but not great, either. My last “Buy” rating for Bank of America Corporation was in 2021, with shares returning around 29% since then, or close to 10% per year. In today’s article, I will focus on what has changed over the last two years and on whether Bank of America is an attractive investment at current prices.

The Macro Environment And Its Impact On Bank of America

Banks borrow and lend money, generating revenue via the difference between the interest they pay and the interest they get paid. This so-called net interest income is partially dependent on broad interest rates. When short-term rates are high, banks oftentimes have to pay more to their customers for the deposits these customers make. On the other hand, when longer-term interest rates are high, then banks tend to generate higher revenues, as they then generate higher interest income when lending money to consumers for automobiles, real estate, and so on. Of course, the interest rate sensitivity of each bank’s customers also plays a role — some customers are more motivated to move their funds to the best-yielding accounts, while others don’t care about that too much and are “stickier”.

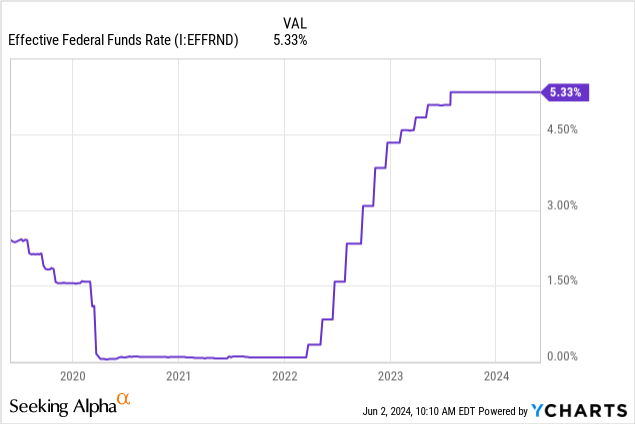

Short-term rates, which are directly controlled by the Federal Reserve, have moved up massively over the last two years, but they have now been stagnating for close to one year, as we see in the following chart:

This has resulted in higher rates on the deposits at banks including Bank of America, which has hurt the net interest margins of some of these banks, including Bank of America. In fact, not only did Bank of America’s net interest margin decline, but the decline was so pronounced that it more than offset net interest income growth tailwinds stemming from growth in the bank’s loan portfolio: In its most recent quarterly earnings results, Bank of America explains (emphasis by author):

NII decreased 3% to $14.0 billion ($14.2 billion FTE), as higher deposit costs more than offset higher asset yields and modest loan growth.

That was not much of a surprise, however, as the market was already expecting headwinds for Bank of America’s net interest margin and its net interest income. In fact, Wall Street analysts were expecting weaker revenues and earnings compared to what Bank of America has actually delivered during the most recent quarter — revenues were down compared to the previous year’s level, but not by as much as what analysts were expecting. Many experts believe that the Fed will start to reduce rates this summer, which could result in declining deposit costs. This could, all else equal, be positive for Bank of America’s net interest margin in the upcoming quarters, although it is not clear whether the bank will be able to lower deposit rates quickly without upsetting its customers.

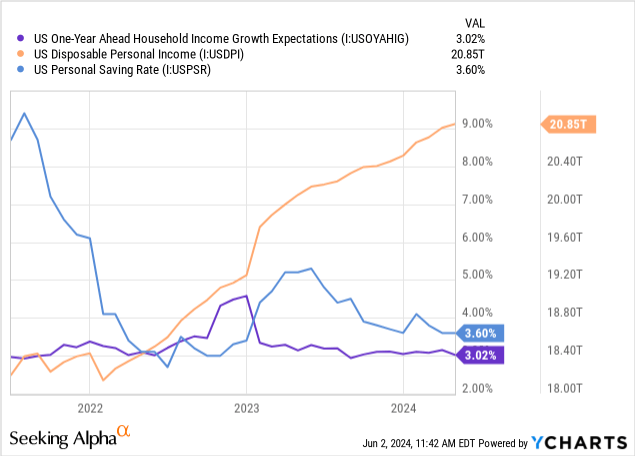

Interest rates are not the only relevant macro factor, of course. Bank of America is also impacted by economic growth, spending power, employment, and consumer sentiment. Higher economic growth reduces the risk of loan defaults, all else equal, and can result in higher consumer spending — Bank of America can benefit from that via higher consumer loans. Spending power, or disposable income, also impacts the likelihood of (consumer) loan defaults. When we take a look at disposable income in the United States, we see the following:

Disposable income grew massively over the last couple of years, but growth over the last year was not as strong as during the year before that. This has made the savings rate decline, relative to one year ago, when consumers were putting more money aside. Household income growth expectations have moderated to 3%. Overall, this does not make for a bad picture, but not for a great picture, either. With the savings rate coming down, income growth expectations at a moderate level, and disposable income growth moderating, loan defaults (on existing loans) will most likely not soar but could increase. Also, consumers will likely be somewhat reluctant to borrow large sums of money, as the macro picture is somewhat cloudy. During the most recent quarter, Bank of America increased its provisions for credit losses to $1.3 billion, relative to $1.1 billion in the previous quarter and $0.9 billion in the year-before quarter. The trends outlined above likely play a role in Bank of America’s decision to increase its credit loss provisions.

Bank of America: A Quality Bank, But Not A Good “Buy”

With the macro picture being neither especially good nor especially bad, let’s take a look at company-specific items. Revenues are important for profit growth, but expenses also play a huge role, of course. While revenues were down slightly during the most recent quarter, Bank of America saw its expenses increase over the same time frame — an unfortunate combination. Non-interest expenses jumped by 6%, but this was partially due to an FDIC special assessment related to uninsured deposits of some failed banks. This is not a recurring item, thus backing that out gives us a better view of forward expenses. Adjusted for the FDIC special assessment, expenses were up 2% year-over-year, which is a lot better compared to the GAAP result, but Bank of America still saw its profits decline due to the combination of lower revenues and higher costs.

Profits declined by 12% from the previous year’s quarter, dropping to $7.2 billion, or $0.83 per share, adjusted for the FDIC-related one-time costs. Generally, we want to see growing profits, of course, but Bank of America’s performance was still better than what analysts were forecasting; thus results weren’t bad in relative terms. The fact that the company is experiencing some macro headwinds right now does not mean that BAC will see its profits drop in the future, too. Once lower Fed rates have made BAC’s funding costs decline, net interest income should grow again, and profits can then improve as well. This could happen during the second half of the year, at least if analysts are correct, as they forecast overall earnings per share increase of 5% for the current year, while earnings per share are forecasted to improve by a nice 9% next year, when further interest rate cuts are expected (although they aren’t guaranteed).

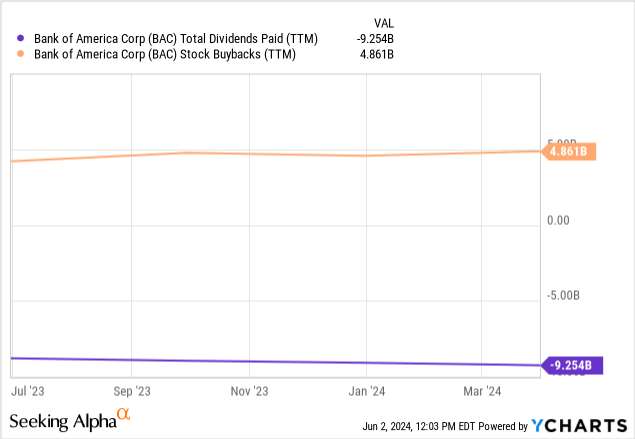

Bank of America’s common equity tier 1 ratio stood at 11.8% at the end of the first quarter, which is well above the 10.0% regulatory minimum. Bank of America thus has ample potential to return capital to its owners via dividends and buybacks. In the recent past, BAC’s focus was on dividends:

Spending on dividends was roughly twice as high compared to buybacks over the last year at Bank of America, possibly due to the fact that Bank of America is trading well above book value, which means that buybacks aren’t increasing the bank’s book value per share. The dividend payments make for a yield of 2.4% at current prices — solid, but not especially attractive.

Today, Bank of America trades at 1.19x book value and at 1.61x tangible book value. The 10-year median book value multiple stands at 1.02, while the 10-year median tangible book value multiple stands at around 1.4. Relative to the 10-year median, Bank of America thus looks overvalued by around 15%. With the forward earnings multiple, using the analyst consensus earnings per share estimate, standing at 12.4 right now, Bank of America trades marginally below the historic median, as the 10-year average earnings multiple is 12.8. Averaging the moderate overvaluation using the book value metric and the marginal undervaluation using the earnings multiple metric, we can assume that Bank of America trades close to fair value right now, possibly a little bit ahead. Buying shares below fair value is ideal; thus I believe that Bank of America is not an especially attractive investment right here. The brand is strong, capital levels are healthy, and ROE is solid at 9%-10%, but neither the bank’s valuation nor its dividend is attractive enough to make BAC a “Buy”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!