Summary:

- Dell Technologies reported mixed results with strength in AI server revenue and servers shipped, but flat growth in storage and decline in consumer PC sales.

- The company is well-positioned for a strengthened end of FY25 and continued strength in FY26 as enterprise customers transition to bringing AI models into production.

- I anticipate that storage, networking equipment, and endpoints will realize significant growth as AI/ML models are brought into production.

Sundry Photography

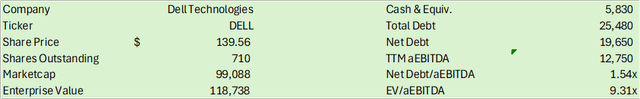

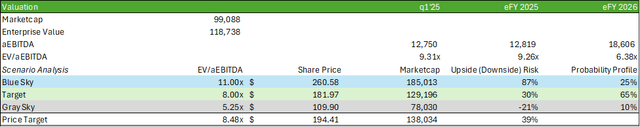

Dell Technologies (NYSE:DELL) reported a relatively mixed Q1’25 with significant strength in AI server revenue, servers shipped, and strength in their growing backlog. Despite this elevated level of demand, other segments remained challenged as storage reported a flat quarter with 3% growth in commercial PC sales paired with a -15% decline in consumer PC and a narrower forecast to operating margins. Though these factors appear disheartening upfront, I believe Dell is well-positioned for a strengthened end of FY25 and continued strength going into FY26 as enterprise customers transition from training AI/LLM models to bringing them into production, which I believe will create a cascading effect across storage, networking, and ultimately, endpoint sales. With this thesis baked into my financial forecast, I reiterate my STRONG BUY recommendation for DELL shares and believe shares should be priced at $194.41/share at 8.48x FY26 EV/EBITDA.

Be sure to review my initial thesis here:

Dell Technologies Operations

Dell Technologies reported mixed results for their Q1’25 earnings in which their growth driver, AI-infrastructure, showed significant strengthening in the quarter paired with lackluster PC growth. Management remained optimistic about the PC recovery coming into play in 2H25; however, I anticipate this to remain relatively flat-to-down despite the nearing refresh cycle as enterprises seek to manage down costs while simultaneously bringing in AI applications. As management discerned on the call, many firms are working through test models and are expected to begin inferencing on-prem applications later in the year. As this plays out, I expect inferencing to be the driver of the refresh, not the 4-year refresh cycle. My expectations are based on PC becoming a bottleneck for speed, rather than upgrading just to upgrade. I believe storage growth will be the leading indicator for PC growth in future periods as investments in storage will likely be the result of transitioning from cloud-based applications to on-prem-based applications and inferencing.

Corporate Reports

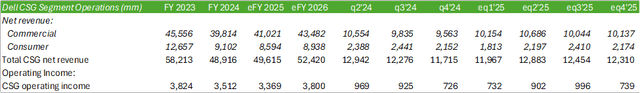

As a result, I forecast relatively flat growth in the CSG segment for Q2’25 and Q3’25 before experiencing strength in Q4’25 and continued strength in FY26. Though I do expect on-prem AI applications to ramp up in the coming year, I do believe much of the testing will occur in the cloud-based environment before moving to private data centers. This thesis is driven by the bottlenecks for H100s experienced in Q4’24 and inventory improvements going into FY25. I also expect growth in AI-PCs to be driven by enterprise-wide adoption of AI applications, which likely will not occur until 2H25 or FY26 as firms continue to undergo data training. Given how fast these applications are evolving, and the inherent security risks involved in applying company data, I expect enterprises to take more conservative steps towards application adoption. My cybersecurity thesis can be found in my recent report covering CrowdStrike (CRWD) who is partnering with Dell for securing AI infrastructure.

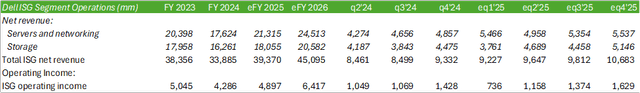

On the ISG side of the business, I anticipate continued strength flowing through as AI infrastructure demand continues to grow. Management mentioned that the supply chain bottlenecks for Nvidia (NVDA) H100 GPUs has loosened up, which in theory should allow for more enterprises to build their AI factories in-house. As for the H200 GPUs, I anticipate much of the demand to be initially driven by hyperscalers as I do not believe enterprises will require such capacity upfront. If this is the case, I believe that this will allow for each customer to acquire the required capacity to build out and run their respective data centers. As a result, as enterprises scale their AI infrastructure, storage should follow suit followed by networking and commercial PCs.

Corporate Reports

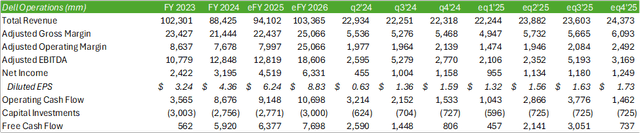

Taking into consideration total firm operations, management did mention that the firm may experience some margin headwinds as a result of inflationary pressures paired with competitive pricing pressures as holiday PC sales deals have continued to roll through Q1’25. Though I do not anticipate this to challenge demand for AI infrastructure and endpoint over time, I do expect Dell will have to remain price-competitive to entice consumers and commercial customers to upgrade to the newer PC models. This may become even more prevalent as AI-PCs become more accessible, especially with the pace of improvement for the technology. Despite this factor, I do anticipate Dell will have the ability to grow their cash flow as demand remains elevated for the next generation of infrastructure, even if traditional servers remain flat for the duration of the year.

Corporate Reports

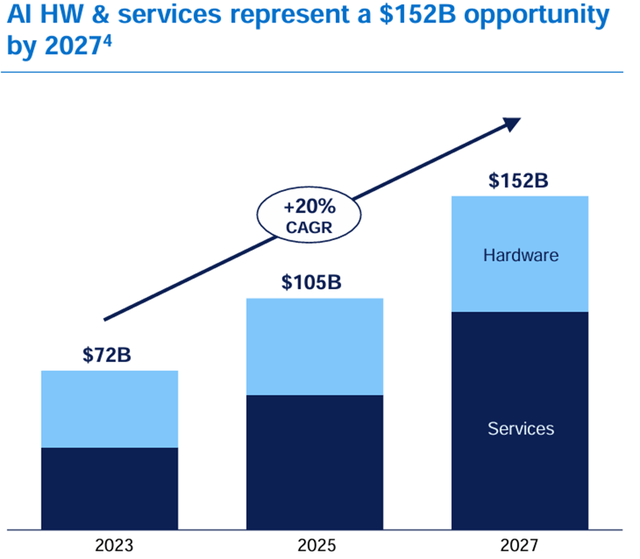

To reiterate my initial thesis for Dell, I expect most of the firm’s growth to derive from server builds with storage and networking lagging behind a few quarters, and finally for endpoints to follow in FY26. Given Palantir’s (PLTR) improved growth forecast for FY24, I would expect some degree of acceleration in 2H25 for enterprises to acquire the needed infrastructure to run these LLM models. I believe the big inflection point for Dell will be driven by the switch from training data to inferencing data. This can be shown in Dell’s $2.6b in orders revenue from AI-infrastructure and the growing backlog that now sits at $3.8b. Given the huge 20% CAGR for AI-related infrastructure and services as forecasted by IDC, Dell should realize significant tailwinds in the space that should cascade across other segments like storage, networking, and endpoints.

Corporate Reports

Valuation & Shareholder Value

Corporate Reports

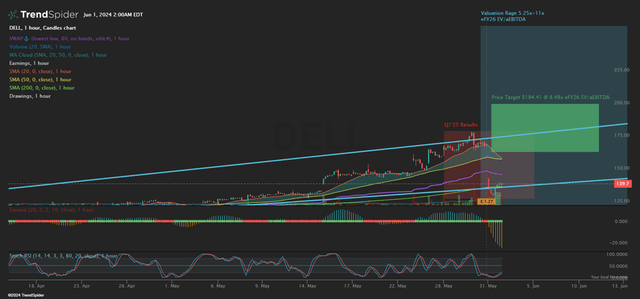

DELL shares took a major hit from their all-time highs, closing down 18% on the day following earnings. I believe much of the price performance was driven by the potential challenge to margin compression in the coming quarters, paired with profit taking as shares experienced a major runup post-FY24 results.

TrendSpider

Looking at the technical chart, it appears that DELL shares were positioned for a selloff. I believe that this event has provided investors room to build their positions within the stock as I anticipate continued growth going into the duration of FY25 and further into FY26.

TrendSpider

Given Dell’s growth trajectory as driven by the growth in AI-infrastructure followed by the cascading effects across other segments, I maintain my STRONG BUY recommendation with a price target of $194.41/share at 8.48x FY26 EV/EBITDA.

Corporate Reports

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.