Summary:

- Snowflake’s high valuation and decelerating revenue growth has contributed to its underperformance over the past year.

- Management changed its sales practices to emphasize Product revenue growth.

- The company should be a significant beneficiary of Artificial Intelligence adoption.

Sundry Photography

Since I last wrote about the data platform Snowflake (NYSE: SNOW) with a buy recommendation on March 4, 2024, it has been a downhill ride. The stock is down 23.46% compared to the S&P 500 Index (SPX), down 2.86% over the same period. When the company released its first quarter fiscal year (“FY”) 2025 earnings report on May 22, 2024, it mostly added to the sour investor sentiment surrounding the company. The market was disappointed that the company missed analysts’ non-GAAP (Generally Accepted Accounting Principles) earnings estimates and gave disappointing updated guidance for FY 2025. The stock immediately declined 5% the day after it released those earnings.

Despite the company’s near-term uncertainty, Snowflake’s first-quarter performance had some positive aspects. Revenue growth shows signs of reaccelerating, beating analysts’ revenue estimates by $42 million. Product Revenue also surpassed management’s low-ball guidance for the quarter. Management is also optimistic about Artificial Intelligence (“AI”) and other soon-to-be-released products further rejuvenating revenue growth. Wall Street analysts still give the company a Buy rating with a $204.72 price target, signaling that there are still big believers in the stock, regardless of its recent poor performance.

This article will examine the potential impact of management’s recent sales practice changes and the introduction of new AI products on revenue growth. It will also review the company’s first quarter FY 2025 earnings, discuss a few potential risks, evaluate its valuation, and briefly discuss why aggressive growth investors may still find the stock attractive.

Sales team incentive change

First Quarter FY 2025 Earnings Presentation.

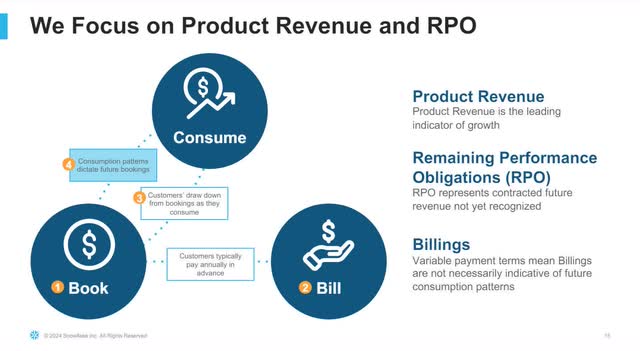

One of the first things an investor in Snowflake needs to know about Snowflake is that it uses a consumption model, which is different from a few other popular cloud platforms like ServiceNow (NOW) and Salesforce (CRM), which use a subscription model. Snowflake’s model allows customers to book a certain amount of consumption capacity on the platform for computing resources, storage, and data transfer usage over a specific period ranging from one to four years. Customers draw down on the booked capacity as they consume services, and Snowflake bills those customers monthly for platform usage in arrears. The company recognizes product revenue as it gets paid. Snowflake records the unused consumption capacity as remaining performance obligations (“RPO”).

Under the old sales model, the company incentivized its sales force to make consumption bookings, and any unused consumption would roll over to future periods. This sales model resulted in a system where salespeople made large commissions by selling customers more capacity than needed. It made bookings and RPO look good, but Snowflake only recognizes product revenue when customers consume the service. Another negative to incentivizing bookings was that sales reps preferred upselling old customers rather than acquiring new customers.

Several years back, Snowflake began a phased transition to a new sales model with a goal of 100% commission on consumption rather than rewarding salespeople for making bookings. The sales model transition, yet to be fully completed, was described by Chief Financial Officer (“CFO”) Mike Scarpelli at the Morgan Stanley Technology, Media and Telecom Conference on March 5, 2024:

So, our comp plan this year is 35% of our reps, their only job is to land new customers, get that initial contract. You sign anything within 12 months after that, you’ll get paid on that, too. And then 55% of the reps are just on revenue only. Their job is to be in the customer, walking the halls, finding new workloads to drive more revenue. That’s how they’re going to make money. And then 10% are what we call hybrid that have a mix of new customers they have to go after, which we’ve identified in our territory, and some small number of existing customers that are driving revenue.

In the new compensation plan, 55% of the sales reps are responsible for finding new use cases for their customer’s data, which drives consumption. This new sales model, emphasizing consumption, drives more customer growth, billings growth, and product revenue growth — a more sustainable model over the long term. Snowflake’s first quarter FY 2025 results are the first quarter under this new sales plan. So far, the new compensation plan and sales structure appear to work. On the first quarter FY 2025 earnings call, CFO Mike Scarpelli said, “In Q1, we exceeded our new customer acquisition and consumption quotas.“

A word of caution. Some analysts may overemphasize Snowflake’s RPO growth. Be aware that if you ever see RPO growth substantially ahead of Product revenue growth, it may mean that customers are failing to consume enough of the platform’s services, which is an unhealthy situation in the long term. Additionally, avoid using RPO to forecast future revenue. The company’s fiscal 2024 10-K states (emphasis added):

When a customer’s consumption during the contract term does not exceed its capacity commitment amount, it may have the option to roll over any unused capacity to future periods, generally upon the purchase of additional capacity. For these reasons, we believe our deferred revenue [RPO] is not a meaningful indicator of future revenue that will be recognized in any given time period.

Generally, a growing RPO is good because it means some future revenue recognition is coming down the pike. However, the exact period when that revenue recognition will occur is unknown and depends more on factors affecting consumption trends.

The company needs its AI initiatives to succeed to reach its goals

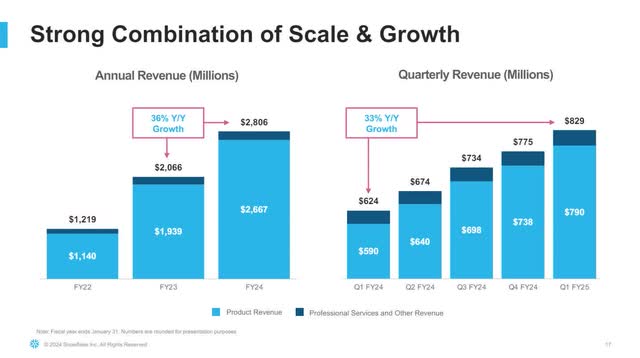

At Snowflake Investor Day 2021, the company forecasted reaching $10 billion in product revenue by the end of 2028 (FY 2029), with a long-term non-GAAP operating margin target of 10% — a very ambitious goal at the time since it had just reported FY 2021 Product revenue of $553.8 million. The company ended FY 2024 with $2,666.8 million in product revenue, meaning it needed a compound annual growth rate of 30.26% between the end of calendar year 2023 and the end of 2028 to achieve its $10 billion Product revenue goal.

Among the reasons that investors were disappointed in the fourth quarter 2024 report was that consumption was not as good as expected. Although the company ended FY 2024 with quarterly Product revenue growth of 33% year-over-year, the original annual FY 2025 guidance given in the fourth quarter called for Product revenue growth of 22%, well under the annual growth rate necessary to achieve its goal. Considering that investors may have awarded the stock with such a lofty valuation in the past based at least partially on its bold 2021 prediction, the stock’s 18% down draft the day after the fourth quarter FY 2024 earnings report makes sense.

Snowflake expects the many new products it will soon bring to the market in FY 2025 to reaccelerate revenue growth. New Snowflake Chief Executive Officer (“CEO”) Sridhar Ramaswamy said at the Morgan Stanley Conference:

We sort of have our work cut out in my mind for, say, the next quarter or two, that really it’s about taking the slew of things that we have in public preview, whether it is transactional tables or interoperable storage or an application platform, all the things that we have announced in AI, getting them into GA [General Availability], getting them into the hands of our customers, that is going to drive momentum for this year.

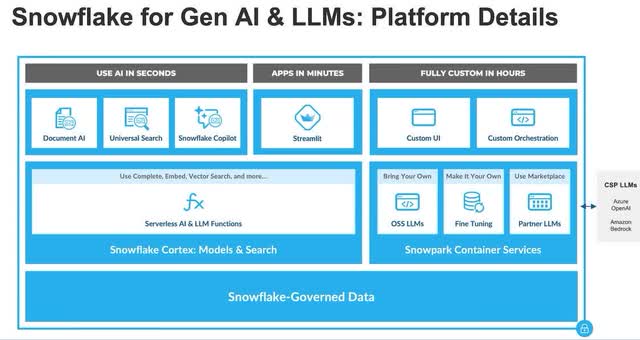

The main AI product that the company will soon release is Snowflake Cortex, which has machine learning capabilities to perform predictive analytics on formatted data and uses large language models (“LLMs”) to understand, query, translate languages, and summarize a customer’s data, and generate text responses. The company designed Cortex for the broadest range of users, including analysts and even those who have little technical background. Cortex is the platform layer that enables several core Snowflake AI functionalities, such as:

- Document AI: Uses an LLM to extract data from documents, including handwritten text and graphics.

- Universal Search: Helps users find data on the Snowflake platform.

- Snowflake Copilot: A chatbot assistant that can translate English text into SQL (Structured Query Language) data queries.

The following image shows the Streamlit functionality in a different box under “Apps in Minutes” because it is an open-source tool that helps users build and share apps. Custom UI and Custom Orchestration are customization options. Snowpark container services help customers use containerized applications on the Snowflake platform. Follow the links I have included to learn more about each of those functionalities.

Explaining the functionality of Cortex and why users might want it is challenging without the discussion getting wonky. However, visiting the company’s website and watching several demonstrations of Cortex and how it works with Streamlit to produce custom apps should make it obvious why Cortex has the potential to become a hit product. Cortex is due to go to GA in June. It’s not yet part of the company’s guidance and represents potential guidance upside. If you are an existing investor in the process of deciding whether or not to sell the stock, understand that the potential benefits from AI adoption for Snowflake have yet to kick in as it has for NVIDIA (NVDA), Microsoft (MSFT), and Alphabet (GOOGL)(GOOG) and even those companies are at the beginning of their AI journey. According to Statista data, the AI market should reach $184 billion by the end of 2024 and grow at a compound annual growth rate of 28.46% between 2024 and 2030 to reach $826.70 billion. Others have forecast an AI market of over $1 trillion. So, Snowflake’s AI products could have massive tailwinds behind them. If Cortex turns out to be a hit product that drives more consumption at Snowflake, selling the stock today may wind up being a mistake. Snowflake has its Data Cloud Summit in San Francisco from June 3 through the 6th, where management will likely release more information about its AI initiatives.

Overview of first quarter FY 2025 earnings report

Snowflake emphasizes Product Revenue rather than Service Revenue, as Product Revenue is the primary growth driver for the business. Product Revenue grew 34% year-over-year, a slight bump up from last year’s 33% growth during the first quarter — signaling product revenue growth may have bottomed out. Product revenue was $790 million, smashing the company’s light guidance of $748 million. Investors should have expected the company to beat that conservative guidance because it provided the new CEO with an easy hurdle to jump over in his first earnings report. The company also grew Total Revenue by 33% year-over-year to $829 million, beating analysts’ estimates of $786 million.

Snowflake First Quarter FY 2025 Earnings Presentation

The company grew first quarter FY 2025 RPO by 46% year-over-year, outpacing Product Revenue growth of 34%. In the previous year’s comparable quarter, Product revenue growth of 50% year-over-year outpaced RPO growth of 31%. Ideally, we would like to see Product revenue growth slightly lag a healthy RPO growth of 35% or more. However, RPO growth numbers can be volatile and depend on many factors, such as seasonality, the dates customers sign contracts, and the size of contracts. Investors should monitor this relationship between the two metrics. Although a small gap between the two numbers over a few quarters may not be concerning, if RPO growth is healthy and the Product revenue growth lags with a persistently widening gap, there could be sales issues with getting customers to consume the capacity they have booked.

Snowflake First Quarter FY 2025 Earnings Presentation

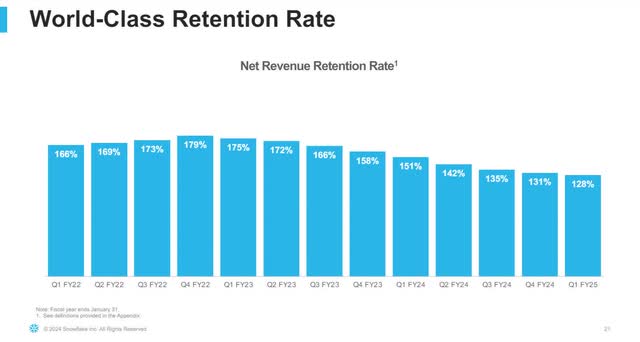

The company had a Net Revenue Retention Rate (“NRR”) of 128% in the first quarter of FY 2025, meaning existing customers under capacity contracts over the first year of the measurement period spent 28% more in Product revenue in the second year of the measurement period. The company defines the measurement period in its first quarter FY 2025 earnings presentation: “We define as our measurement cohort the population of customers under capacity contracts that used our platform at any point in the first month of the first year of the measurement period.“ Although an NRR of 128% is outstanding in absolute terms, the following bar chart shows the number has steadily declined since the fourth quarter of FY 2022. Since Product revenue represents consumption, a declining NRR means the consumption rate among existing customers is declining. It would help investor confidence to see this number stabilize within the next several quarters.

Snowflake First Quarter FY 2025 Earnings Presentation

Management emphasizes non-GAAP numbers in its guidance to highlight the growth of its core business operations. Therefore, I will focus most on its non-GAAP numbers in this analysis. Investors should be aware that Snowflake’s non-GAAP numbers exclude stock-based compensation (“SBC”), a rather sizeable non-cash expense for the company compared to its peers.

| Company name | SBC as % of revenue | |

| Snowflake | 40% | |

| MongoDB (MDB) | 27% | |

| Palantir (PLTR) | 20% | |

| ServiceNow | 16% | |

| Salesforce | 8% |

CFO Scarpelli reported on the earnings call that non-GAAP product gross margins were marginally down from the previous year’s comparable quarter to 76.9% due to GPU-related costs from increased investments in AI. During the fourth quarter FY 2024 earnings call, Scarpelli told investors about these costs when he said, “We expect approximately $50 million of GPU-related costs in fiscal year ’25, approximately $10 million flowing through cost of product revenue.“

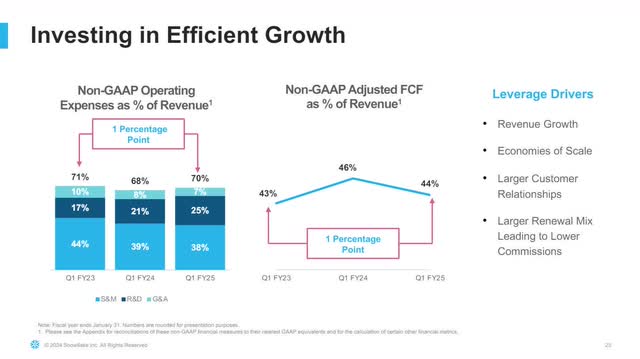

Although the following charts emphasize a reduction in operating costs over two years, investors are more concerned about what has occurred year-over-year. Non-GAAP operating expenses as a percentage of revenue rose two percentage points over the first quarter of FY 2024, with the biggest cost increase coming from research and development (R&D). If you look at the right side of the image, it lists some of the drivers for lower expenses, such as economy of scale. By this stage of the company’s growth, those leverage drivers should already be kicking in and lowering costs. The fact that this is not happening is disconcerting to some investors. However, because of Snowflake’s need to invest heavily in AI, leverage alone has yet to bring down costs as a percentage of revenue. Another consideration is that although AI may reinvigorate revenue growth above the 30% level needed to achieve $10 billion in Product revenue, if AI is too costly, it may threaten the goal of attaining its operating margin target of 10% by the end of the calendar year 2028.

Snowflake First Quarter FY 2025 Investor Presentation.

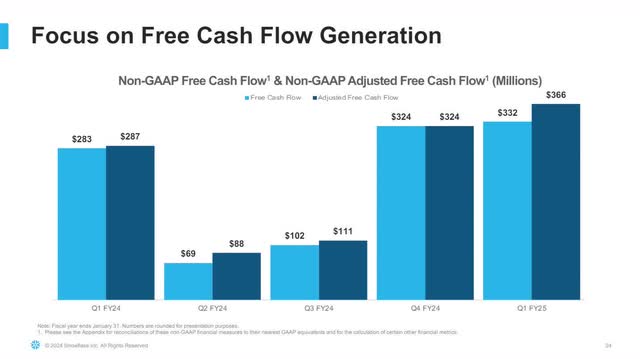

The higher R&D costs negatively impacted non-GAAP operating margins, which dropped from 5.2% in the first quarter of FY 2024 to 4.3% in the first quarter of FY 2025. The image above also shows the quarterly non-GAAP adjusted free cash flow (“FCF”) margin dropped 2% year-over-year to 44%.

The first quarter of FY 2025’s non-GAAP net margin was 6.2%, down 250 basis points from the previous year’s first quarter results. Non-GAAP earnings-per-share (“EPS”) were $0.14, which missed analysts’ expectations of $0.17.

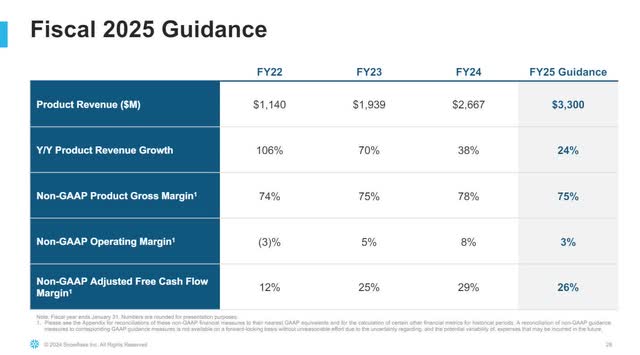

Snowflake First Quarter FY 2025 Investor Presentation.

The table above shows Snowflake’s historical results and updated guidance. Although management raised Product revenue guidance by 2% to 24%, the raise was not enough to excite investors because the company needs to achieve above 30% Product revenue growth to hit its goals. Management also guided to a non-GAAP gross profit margin of 75%, down from a target of 76% previously, and a non-GAAP operating income margin of 3%, down from previous guidance of 6%. The company also forecasts a non-GAAP FCF margin of 26%, down from its earlier estimate of 29%. I interpret those numbers as saying that the company is spending more now on AI and other initiatives for a potential payoff that may come outside of this year.

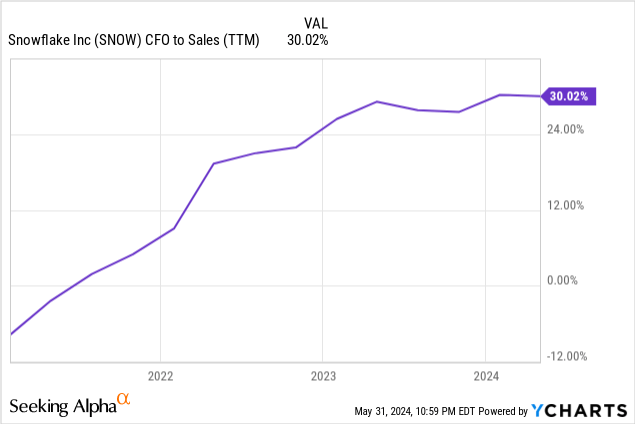

Snowflake has a relatively high cash flow from operations (“CFO”) to sales of 30%, which means the company converts every dollar of sales to $0.30 of CFO. Since purchases of property and equipment and capitalized internal-use software development cost account for around 2% of the difference between CFO margin and FCF margin over a TTM period, we want to eventually see CFO move up to around 37% to enable the FCF margin to reach around 35%.

The light blue bars on the following chart show FCF, and the dark blue bars show adjusted FCF, which excludes the impact of net cash paid on payroll tax for employee stock transactions. SBC is technically a non-cash expense, but it may have some effect on FCF when an employee exercises an option and creates a taxable event. When analyzing Snowflake, it is best to use year-over-year or trailing 12-month (“TTM”) metrics, as the business is seasonal, with most of the FCF occurring in the first and fourth fiscal quarters. The highest orders from new and existing customers and the largest sequential jump in RPO usually happen in the fourth fiscal quarter.

Snowflake First Quarter FY 2025 Investor Presentation.

At the end of the first quarter, Snowflake had $3.53 billion in cash and marketable securities and no long-term debt. Its quick ratio was 1.71, which means it had enough liquid assets to pay its short-term liabilities at the end of the quarter.

Risks

The company built its platform on the three largest public cloud providers: Amazon (AMZN) Web Services (“AWS”), Microsoft Azure, and Alphabet’s Google Cloud Platform (“GCP”). The contracts the company negotiates with these cloud providers can directly impact Snowflake’s gross margins. Failure to negotiate favorable terms to operate on the major cloud providers could result in declining gross margins. Snowflake also has minimum commitments in its cloud infrastructure agreements with these public cloud providers, which, if its customers fail to consume enough, may force the company to pay the difference between the minimum commitment and what its customers used, which would hurt results. These same public cloud providers on which its platform depends offer similar data services and are also its largest competitors.

The company also gave a warning about operating expenses in its 2024 10-K (emphasis added):

We expect our costs and expenses to increase in future periods. In particular, we intend to continue to invest significant resources to further develop our platform, expand our research and development teams, retain our employees, and acquire other businesses, including in the areas of data science, artificial intelligence, and machine learning…Our efforts to grow our business may be costlier than we expect, or our revenue growth rate may be slower than we expect, and we may not be able to increase our revenue enough to offset the increase in operating expenses resulting from these investments. If we are unable to achieve and sustain profitability, or if we are unable to achieve the revenue growth that we expect from these investments, the value of our business and common stock may significantly decrease.

The company faces the above risk today. Management is investing a lot of money into R&D to enable AI and ML capabilities on the platform and produce new data products. If these investments fail to pay off with revenue growth increasing faster than costs, the company may be unable to achieve GAAP profitability. If investors sense that the company is struggling to scale and achieve operating leverage, they may not continue to support the high valuation.

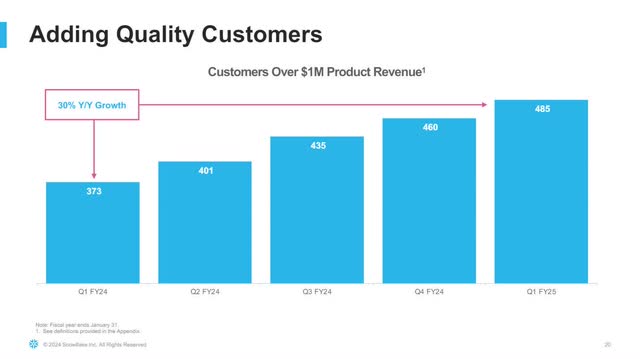

Management’s plan involves onboarding and expanding with larger customers to achieve the needed growth to achieve its goals. Larger customers have the resources for more significant initial consumption commitments and greater capacity to renew consumption contracts at higher levels. In the first quarter of FY 2025, Snowflake grew customers with over $1 million in Product Revenue by 30% over the previous year’s comparable quarter. That’s the good news.

Snowflake First Quarter FY 2025 Investor Presentation.

The risks in this strategy are that larger customers don’t have the same favorable consumption patterns as its early customers, which were venture-backed companies flush with newly raised capital they were ready to spend. These smaller digital native customers would adopt Snowflake’s platform and quickly ramp up consumption in Snowflake’s heydays leading up to its 2020 Initial Public Offering. Venture-back customer growth has slowed considerably recently because the uncertain economy hurt fundraising efforts, and these companies no longer have the cash to spend significantly on the platform.

The disadvantage of massive enterprises is they have a much longer sales process and take longer to ramp up usage compared to smaller digital native customers. Because of this difference, Snowflake’s initial bookings, RPO, and consumption (Product Revenue) could become lumpy, leading to disappointing individual quarterly reports. This company needs to be assessed more over a trailing 12-month basis rather than individual quarters.

To hit its $10 billion in Product revenue target by the end of 2028, the company needs to see massive reacceleration by next year. Some investors have become less confident that Snowflake can hit that target. Until the company restores investor confidence, sentiment around Snowflake may remain muted in the short term.

The company’s AI and other products must successfully reinvigorate its customer’s consumption rates, showing up as Product Revenue growth rebounding to 30% or more. At the same time, management’s plans to reduce costs through “economies of scale, attracting larger customers, and larger renewal mix,“ need to start showing progress in raising non-GAAP operating margins to 10% or above by calendar year 2028. If Snowflake fails to progress in achieving the above, analysts and investors may be disappointed in revenue growth, profitability, or both over the long term.

Valuation

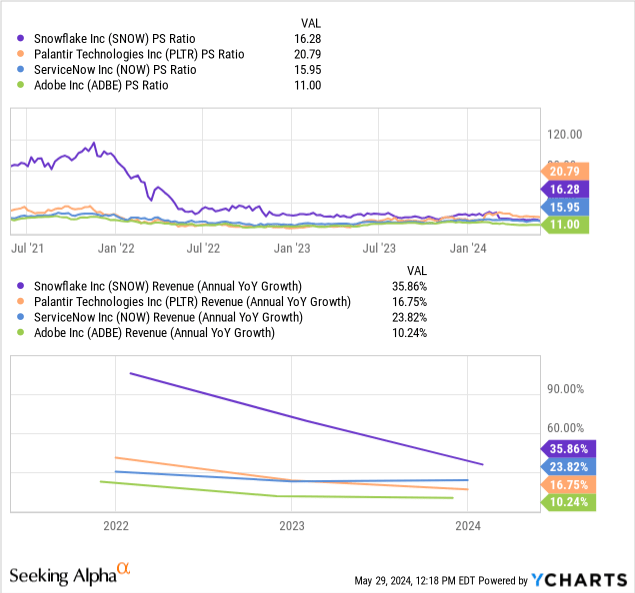

Snowflake has underperformed this year because the stock has a high valuation compared to the results it has put up in the last several quarters. The stock sells at a price-to-sales (P/S) ratio of 16.28, well above the Information Technology (“IT”) sector’s P/S of 3.07. Seeking Alpha Quant rates the stock’s valuation as a D+. The following chart compares Snowflake to several of its large software peers, and the company compares favorably, growing annual year-over-year revenue faster and possibly justifying its valuation. However, the one thing that may concern investors is that revenue growth is decelerating much quicker than its peers and that deceleration may not be over. Remember, the company just guided FY 2025 annual revenue to slow to 24%.

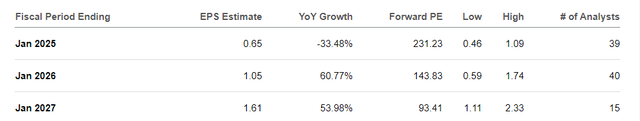

The following image shows the company’s forward EPS estimates, growth rates, and forward P/E. Generally, when the estimated forward EPS growth rate matches the forward P/E, the market considers that stock fairly valued. However, Snowflake sells at a forward fiscal 2026 P/E of 143.83, with the consensus EPS growth rate of 60.77%, indicating that the market may grossly overvalue the company’s estimated fiscal 2026 EPS.

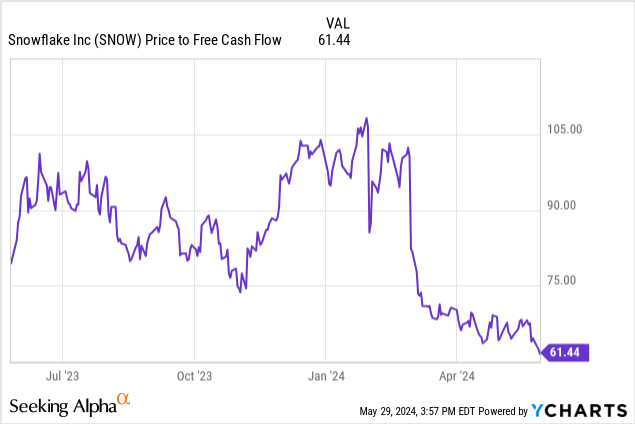

Although Snowflake’s price-to-FCF dropped substantially in 2024, it currently sits at 61.44. The sector median (P/FCF) for the IT sector is 18.76, suggesting overvaluation.

The following reverse Discounted Cash Flow (“DCF”) analysis shows what the closing stock price on May 29, 2024, implied about Snowflake’s FCF growth over the next ten years.

Reverse DCF

|

The first quarter of FY 2025 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$799 |

| Terminal growth rate | 2% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 23.8% |

| Stock Price (May 29, 2024, closing price) | $148.19 |

| Terminal FCF value | $6.892 billion |

| Discounted Terminal Value | $33.215 billion |

| Free Cash Flow margin | 26.52% |

According to the above reverse DCF, Snowflake would have to grow its FCF by 23.8% over the next ten years. According to analysts’ estimates, the company should grow FCF from $813 million at the end of FY 2024 at a CAGR of 28.99% to reach $1.75 billion in FCF by the end of FY 2027.

Another thing to consider is that FCF margins should expand from the current 26.5% to possibly as high as the mid-30s. If Snowflake reaches an FCF margin of 35%, it would only need to grow FCF 20% over the next ten years to justify the May 29 closing price of $148.19. At an FCF margin of only 33%, it would need to grow around 21%. If you factor in that SBC compensation may eat around 2% of that FCF growth annually, the company may need to grow FCF around 22% to 23% over the next ten years to justify the May 29 closing price. The company should accomplish that feat if generative AI lives up to its growth potential. If the company grows FCF at 23% over the next ten years with an FCF margin of 33%, its estimated intrinsic value is $173.73, around 28% above the May 31 closing price of $136.18. If the company grows FCF at 22% over the next ten years with an FCF margin of 35%, its estimated intrinsic value is $171.48, around 26% above the May 31 closing price.

Aggressive growth investors should consider buying the stock

Conservative investors may want to wait on the sidelines. There is some uncertainty around Snowflake’s achieving its revenue and profitability goals, and it may take a year or so to determine whether getting to those goals by 2028 is possible. The company will need to execute, and considering the stock’s high valuation, any bumps along the road will likely result in a sharp decline in stock price.

However, if you are an aggressive growth investor considering the stock’s potential upside, today may be an ideal time to buy shares. This company should be on your watch list if you believe generative AI usage is a massive secular trend. Snowflake can potentially become one of the more prominent beneficiaries of generative AI. Snowflake helps improve a company’s data usage. Since data is the lifeblood of generative AI and other AI forms, the company’s platform can help improve its customer’s AI results. I reiterate my buy recommendation of Snowflake.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN, SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.