Summary:

- VZ offers a potential capital gain opportunity with a risk to reward ratio of greater than 1:3.

- Technical analysis tools show that VZ is trading above a rising 30-week EMA and has bullish momentum.

- Volume patterns suggest that smart money has been accumulating shares of VZ, while relative strength is neutral.

Kameleon007

Most people know Verizon Communications Inc. (NYSE:VZ) as the wireless service provider that also pays a high yielding dividend of 6.46%. While many people buy VZ for the dividend, I think there is an opportunity for a nice capital gain in VZ. In this article, I will use technical analysis tools such as price action, exponential moving average (EMA), momentum, volume, and relative strength to show why I think VZ offers a risk to reward ratio of greater than 1:3. I will outline a price target and a stop loss in case my analysis is incorrect.

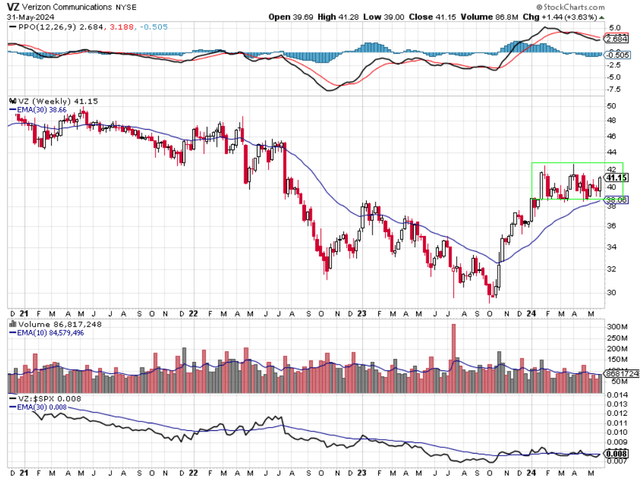

Chart 1 – VZ Weekly with 30-week EMA, Momentum, Volume, and Relative Strength

www.stockcharts.com

When I analyze a potential opportunity, I start with looking at price action and the 30-week EMA. I like the 30-week EMA as a medium to long-term moving average tool. Chart 1 shows the last 3.5 years of trading in VZ. The upper left-hand corner shows the highs of VZ over this period. Back in May 2021 VZ got as high as $50 but then sold off. VZ oscillated above and below its 30-week EMA until VZ had two big one week sell-offs that took place in April 2022 and July 2022. The July 2022 sell off was a clear sign that you didn’t want to be long VZ as the price dropped below the 30-week EMA and the 30-week EMA started to decline along with the stock price. My objective is to own stocks that are above a rising 30-week EMA and not own stocks, or even short stocks, that are below a falling 30-week EMA. VZ sold off until it reached its low in October 2023. You can see that simply observing the fact that VZ was below a downward sloping 30-week EMA would have kept you out of trouble. After the low was set in October 2023 at $29.16, VZ rallied and closed above its 30-week EMA. That was bullish. What was more bullish, was when VZ’s 30-week EMA started to trend higher back in November 2023. That was a clear sign to buy VZ. VZ has continued to rally to a recent high of just shy of $43 in January 2024. Since then, the price action of VZ has been in a consolidation phase. This is not unexpected after rallying 45%. It is this consolidation box outlined in green on Chart 1 where we find ourselves now. I like how VZ has stayed above the bottom of this current consolidation box and above its rising 30-week EMA. I see the price action as bullish, and I believe now is a good time to buy VZ.

Momentum is another tool I use to determine if I want to be long a stock. The upper pane of Chart 1 shows the Percentage Price Oscillator (PPO). This is a momentum oscillator that is easy to read. If offers two ways to view momentum. Short-term momentum is bullish when the black PPO line crosses above the red signal line. Short-term momentum is bearish when the black PPO line is below the red signal line. Right now, VZ is showing short term bearish momentum. But there is hope as the black PPO line looks to be curling back upwards. Long-term momentum is bullish when the black PPO line is trading above the zero or centerline of the chart, as it is now. The black PPO line has a reading of 2.684 which is above zero. Long term bearish momentum is when the black PPO line has a reading of less than zero. Notice how the black PPO line couldn’t stay above zero during the price decline from May 2021 to its low back in October 2023. It pays to pay attention to the long-term momentum, and right now, the long-term momentum is bullish.

Volume is another factor in my analysis of if I should buy the stock. I want to own stocks that the smart money or institutions are buying. One way to find out if smart money is buying stocks is to look at the volume when the stock has big up weeks. Retail traders don’t seem to have enough money to cause the big volume spikes such as the ones seen in July 2023, October 2023, December 2023, January 2024, and April 2024. In each of these weeks, VZ either was up for the week or closed above its lows for the week. That is a sign to me that smart money was accumulating shares that week. Smart money establishes their positions over a period of time because they have so much money to put to work. Last week showed more volume than the previous week, and the price of VZ was up 3.63% for the week. I see the volume picture as bullish for VZ.

The last technical analysis tool that I use for making buying decisions is relative strength. I want to own stocks that are outperforming the SP 500 index. If you want to beat the market, you must own stocks that are outperforming the market, and relative strength helps me determine that. The bottom pane of Chart 1 shows the relative strength of VZ to the SP 500 index. The black line on the chart shows the ratio of VZ to the SP 500 index each week. When VZ outperforms the index, the black line will rise. This was the case last week as VZ gained 3.63% while the SP 500 index lost 0.51% for the week. I like to use relative strength over a longer period of time, not one week. You can see that VZ clearly underperformed the market from July 2022 to VZ’s low in October 2023. Since then, VZ has slightly outperformed as the relative strength line is higher now than it was back in October 2023. The relative strength of VZ is not very bullish. I would say that it is neutral, but it could start moving higher if VZ can break out of the green box consolidation area discussed previously.

If you choose to buy VZ, I see the highs of May 2021 as a realistic price target. That is a 21% gain from here. Now, my analysis could be wrong for any number of reasons. The market could sell off due to a bad economic report, bad earnings, a geopolitical event, etc. Because of this, I always have a stop in loss in place. I would rather take a small loss and re-evaluate the situation, then stay with a stock that rolls over and has a big loss. Right now, I see a close below the bottom of the green box or the 30-week EMA as a sign to cut my losses. Having a stop loss at $38.50 and a price target of $50 gives you a risk of $2.65 with a reward of $8.85. This is a risk to reward ratio of 1:3.

In summary, I think VZ offers a compelling buy at current prices. It is trading above an upward sloping 30-week EMA and is above the bottom of the recent consolidation area. VZ has long term bullish momentum, and the short-term momentum may be turning bullish soon. Volume patterns suggest that smart money has been accumulating shares of VZ since its lows in October 2023. Relative strength is neutral and the least compelling reason to own shares in VZ compared to price action, momentum, and volume. The first price target is $50, and a recommended stop loss is $38.50 which offers a risk to reward ratio of greater than 1:3.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long VZ Jan 2025, 38 Calls

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.