Summary:

- Broadcom’s shares have become expensive, and the dividend yield has dropped, making it less appealing as an investment.

- The company’s recent operational performance showed revenue growth, but it is still behind tech companies with more AI exposure.

- Broadcom’s buyback program has not been effective in offsetting share count dilution, and its valuation is higher than the historic norm.

Sundry Photography

Article Thesis

Broadcom Inc. (NASDAQ:AVGO) was a strong performer over the last year, but shares have become quite pricy. The dividend yield also has dropped quite a lot compared to the past, making Broadcom significantly less appealing compared to prior years. At current prices, Broadcom is not a good investment, I believe, despite AI tailwinds.

Past Coverage

I have covered Broadcom here on Seeking Alpha in the past, most recently in 2023. I gave the company a bullish rating in March 2023, with shares rising by 118% since then, including dividends. I downgraded Broadcom to a hold later in 2023, arguing it remained a quality company but that its valuation wasn’t as attractive any longer. In today’s article, we will focus on what has changed since then, looking at Broadcom’s recent operational performance and current valuation.

Broadcom: Recent Performance

During the most recent quarter, Broadcom showed compelling results. The company was able to grow its revenues by 34% compared to the previous year’s period, which is more than the average growth rate over the previous couple of quarters, when Broadcom was able to grow its revenues at an annual pace of 4% to 25%. Broadcom’s revenues surprised to the upside, coming in around 2% higher than what was expected. While that was a good result for sure, Broadcom’s business growth is still far from the growth recorded by tech companies with more AI exposure, such as NVIDIA (NVDA) — which grew its revenues by around 260% during the most recent quarter. We could thus say that Broadcom is feeling some tailwinds from the ongoing AI growth trend, but Broadcom doesn’t belong to the top players or biggest beneficiaries. Others, with larger AI exposure as a percentage of revenues, such as NVIDIA, are more exposed and are seeing a bigger growth boost from AI investments by hyper scalers such as Meta Platforms (META), Microsoft (MSFT), or Alphabet (GOOG)(GOOGL). We should also consider that Broadcom’s above-average revenue growth during the most recent quarter was positively impacted by the acquisition of VMWare, thus the major revenue increase was not entirely the result of organic business growth and market tailwinds.

Broadcom’s profits rose by 17% when adjusted for one-time items, share-based compensation, etc, while GAAP profits were down year-over-year. Even when we go with the more favorable metric, non-GAAP profits, results were not outstanding — profits grew significantly less than revenues, meaning margins declined. This is a stark contrast to NVIDIA, where AI tailwinds and an excellent market position result in significant margin growth and profit growth that is well ahead of revenue growth.

Broadcom: A Buyback Machine?

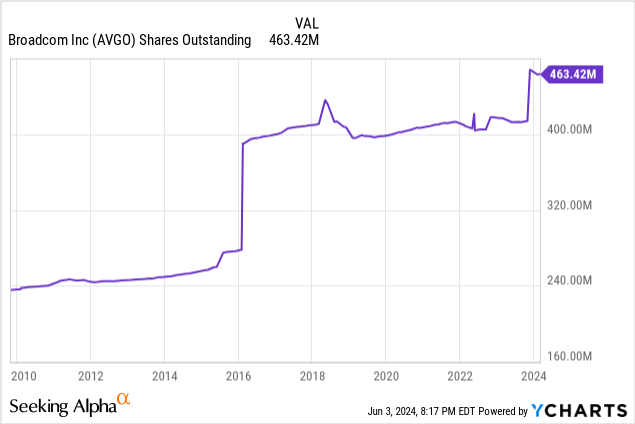

Since Broadcom does not need to invest large sums of cash into its operations due to being a fabless chip player, a large portion of its operating cash flows turns into free cash flows. This has allowed the company to return a lot of cash to its owners in the past. The company did this in two ways, via buybacks and via dividends. When done at the right valuation, buybacks can be very powerful, as shown, for example, by Apple (AAPL) in the past. Of course, share issuance also matters — when companies offer shares to their management team and employees, shareholders get diluted, while acquisitions that are financed via the issuance of new shares also dilute shareholders. When we take a look at Broadcom’s share count, we see the following:

Since 2010, Broadcom’s share count has roughly doubled, while the share count jumped by more than 10% over the last year alone. This is partially due to the takeover of VMWare, which, in turn, was a revenue growth driver during the most recent quarter. But while company-wide revenues were boosted by this takeover, the growing share count has offset this to some degree, which is why per-share revenues did grow significantly less. For reference, Apple’s share count is down by 40% since 2010 — in Broadcom’s case this means that each share’s portion of overall revenues has roughly been cut in half since 2010, while Apple’s shareholders saw their portion of revenues grow by around 67% (1/0.6). This happened despite Broadcom spending significant sums of money on buybacks, as we can see in the following table:

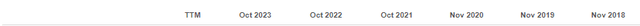

Seeking Alpha Table showing AVGO’s buyback spending (Seeking Alpha)

We see that Broadcom spent dozens of billions of dollars on buybacks over the last couple of years, and yet, its share count kept growing — that’s not a very impressive buyback machine. With Broadcom’s valuation now standing at a level that is substantially higher than in the past, buybacks become even less effective — if the underlying dilution trend continues, this could result in even larger dilution going forward. While Broadcom was able to grow its adjusted net profits by 17% over the last year, as noted above, the company’s growing share count resulted in earnings per share growth being significantly weaker, at just 6%. That is far from disastrous, of course, but a mid-single digits earnings per share growth rate also isn’t especially impressive. Many tech companies offer stronger earnings per share growth, including the aforementioned Meta, Microsoft, and Alphabet, at 114%, 20%, and 62%, respectively, during the most recent quarter.

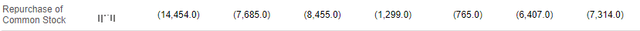

In the past, Broadcom’s investors could offset this dilutive trend, at least to some degree, by reinvesting their dividends. Broadcom used to offer a pretty attractive dividend yield, after all:

Over the last couple of years, Broadcom’s dividend yield oftentimes was in the 3% to 4% range, rising to more than 6% for a short time during the initial phase of the pandemic. When investors put their dividends back into additional shares of Broadcom in the past, their share count rose substantially. But with the dividend yield declining to just 1.5% right now, dividend reinvestment has become a lot less effective and less significant. 10 years of reinvesting dividends at a 3.5% yield make for a 41% share count increase, but a decade of reinvesting a 1.5% yield makes the share count rise by just 16%, for example. So while Broadcom has become less attractive for income investors that need the income now, e.g. retirees that live off their dividends, Broadcom’s currently rather high valuation also negatively impacts investors that are reinvesting their dividends. These investors will see their share count grow at a much slower pace, meaning offsetting the impact of share count dilution by automatically acquiring additional shares via dividend reinvestment has become a lot harder.

Broadcom: Rather Expensive

At first sight, Broadcom looks somewhat pricy in absolute terms. Based on forecasted earnings per share of $47.30 for the current fiscal year, Broadcom is trading at 28x this year’s net profits right now. This makes for an earnings yield of 3.6%, which is considerably less than the rate on basically risk-free treasuries (10 years: 4.4%). But we should also consider Broadcom’s current valuation relative to the historic norm, as this can help us decide whether right now is an opportune time for an investment in Broadcom.

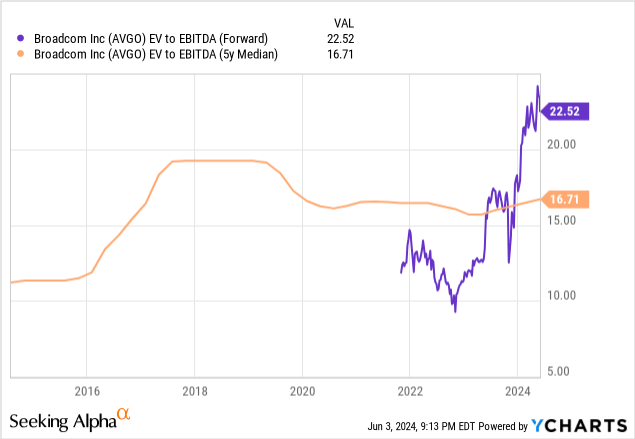

When we look at the company’s current enterprise value to EBITDA ratio relative to the historic norm, we see the following:

The current EV/EBITDA multiple stands at 22.5, which is around 35% higher than the 5-year median. Broadcom’s valuation is thus elevated, relative to the historic trading pattern. I look at the enterprise value to EBITDA ratio as I believe that this could be more telling compared to the earnings multiple, due to the fact that Broadcom has added significant debt in the last couple of years (total liabilities are up more than 300% since 2018), which is reflected in the EV/EBITDA ratio.

Earnings Outlook

Broadcom will report its next quarterly earnings results on June 12. Right now, analysts are forecasting that the company will report earnings per share of $10.84, which would represent growth of 5% versus the previous year’s period. This would be slightly worse than the earnings per share growth rate during the previous quarter. But since Broadcom was able to beat earnings per share estimates in 10 out of the last 10 quarters, I believe that there is a good chance that we will see Broadcom outperform expectations again. Still, even if Broadcom were to beat the analyst consensus, the question would be whether earnings per share growth remains below the previous quarter’s level (e.g. at 6% year over year) or whether Broadcom is able to show accelerating earnings per share growth. The latter would be positive, of course, and could result in positive sentiment, while decelerating earnings per share growth would be, I believe, somewhat bearish. After all, the high valuation and positive sentiment imply that Broadcom is a major AI beneficiary, but declining earnings per share growth would run contrary to that.

Broadcom’s guidance for the following quarter will be important as well, while investors also should look for comments regarding the ongoing integration of VMWare, e.g. when it comes to achieving synergies to bring down expenses. Last but not least, comments regarding Broadcom’s shareholder return program could be of interest, although I do not believe that we will see a dividend increase in the very near term, as Broadcom usually increases its dividend during the fourth quarter.

Is Broadcom A Good Investment Right Now?

Broadcom has a strong dividend growth track record, and the company delivered highly appealing total returns in the past. But the fact that Broadcom was a great investment a decade ago does not automatically mean that it is a great investment right here, either. The company is seeing tailwinds from AI and other tech themes such as cloud computing and digitalization, but growth isn’t excellent — at least on a per-share basis, which is what counts for investors. The current growth rate is not high enough to warrant an earnings multiple in the high-20s, I believe, and the facts that Broadcom’s valuation is well above the historic norm and that the dividend yield is rather low suggest to me that now is not a good time to buy Broadcom. One could argue that it is a solid “Hold”, but some investors may want to lock in some gains by selling some shares. Broadcom traded at just $800 a year ago — should it decline to that level again, it would become quite attractive again.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!